UK Draught Beer Market Summary

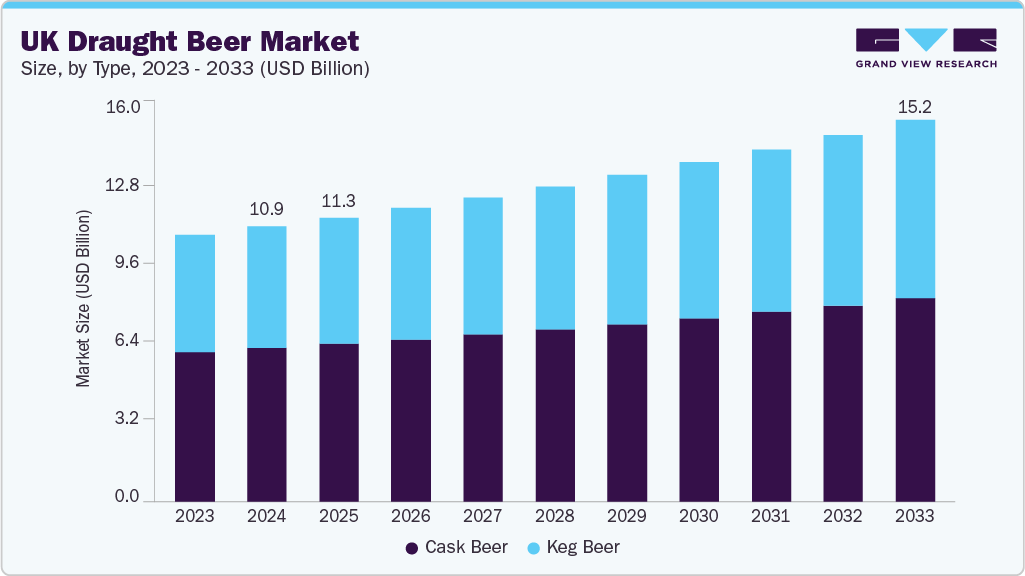

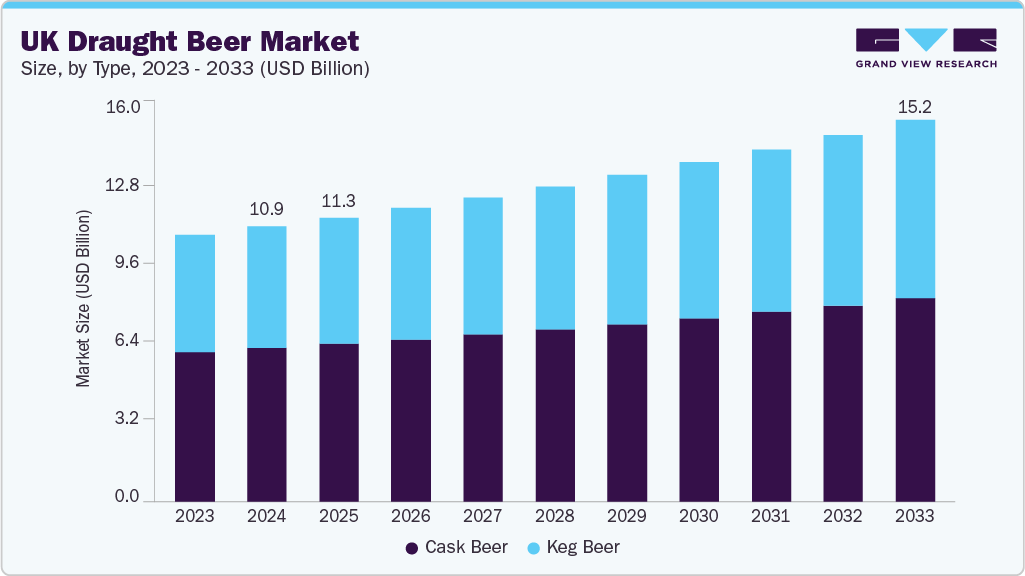

The UK draught beer market size was estimated at USD 10.94 billion in 2024 and is projected to reach USD 15.18 billion by 2033, growing at a CAGR of 3.8% from 2025 to 2033. Factors such as the popularity of craft beer, local breweries, and experimental drinking are expected to increase the demand for draught beer in the market.

Key Market Trends & Insights

- By type, the cask beer segment held the largest market share of 55.8% in 2024.

- Based on category, the regular segment held the largest market share in 2024.

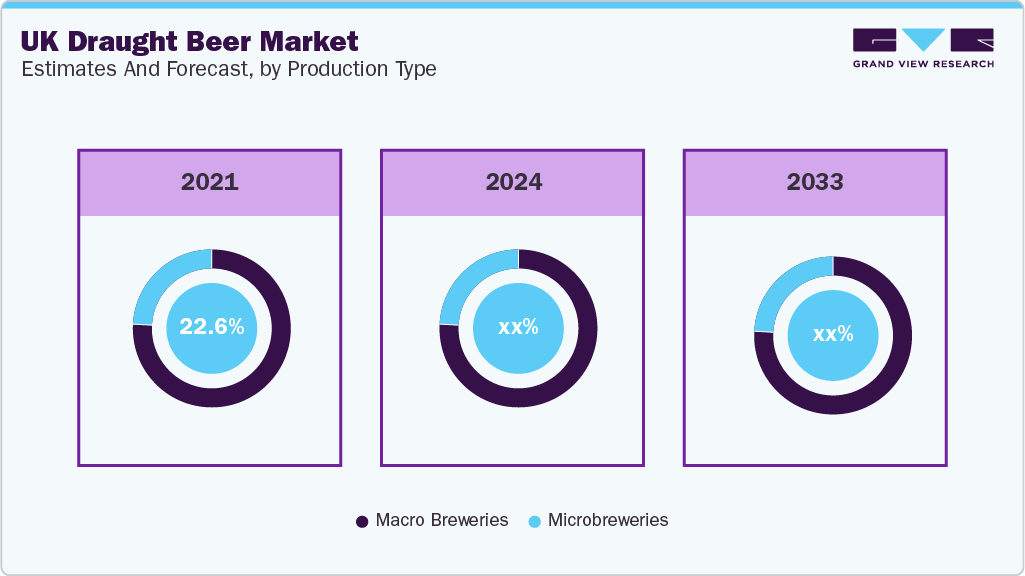

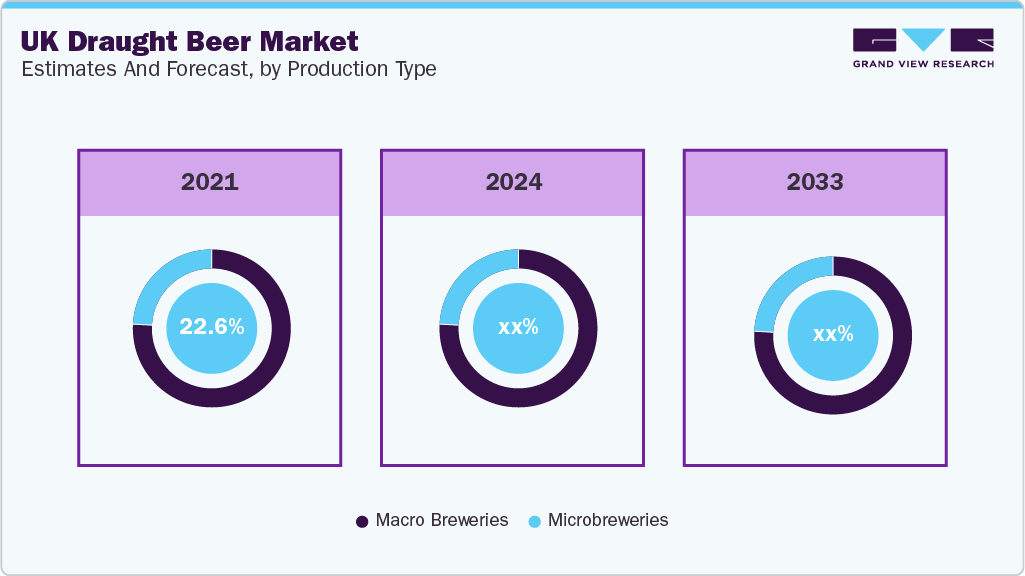

- By production type, the macro breweries segment held the largest market share of 76.7% in 2024.

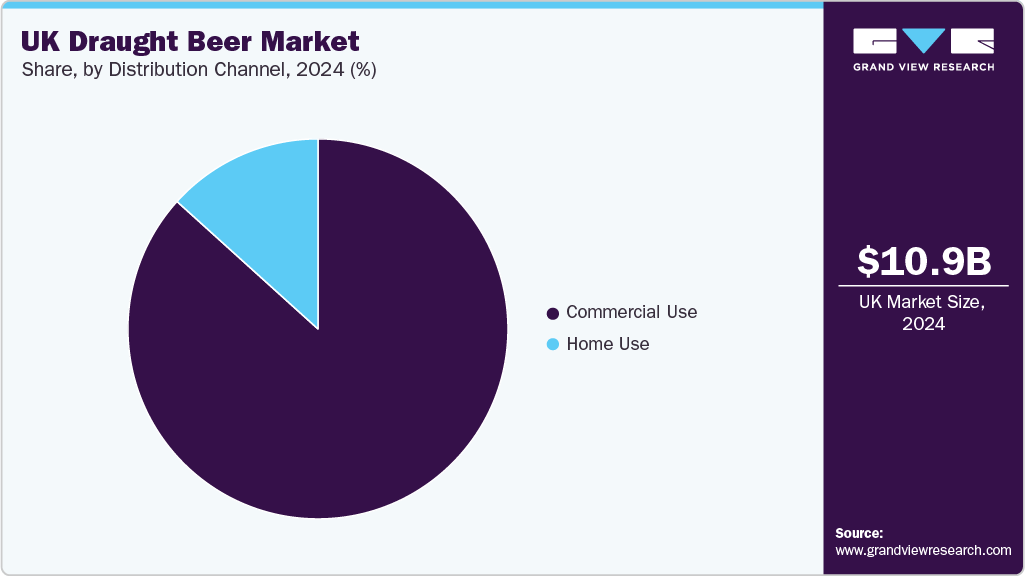

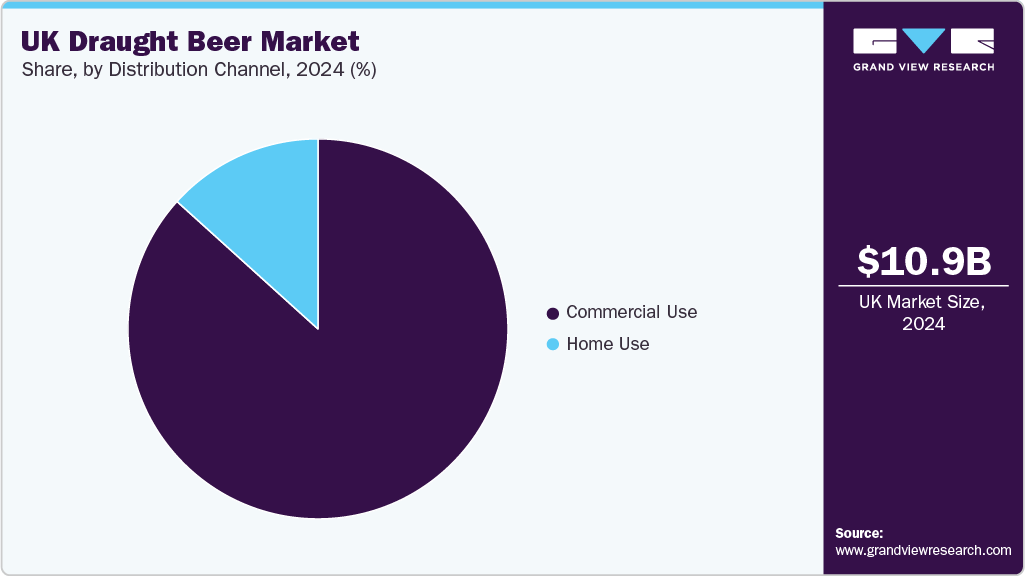

- By end use, the commercial use segment held the highest market share of 86.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.94 Billion

- 2033 Projected Market Size: USD 15.18 Billion

- CAGR (2025-2033): 3.8%

This trend is further supported by the expanding on-trade sector, including bars, restaurants, and pubs, which offer various draught beers on tap to attract customers. A growing number of consumers are looking for distinctive, small-batch beers, leading to a surge in demand for craft draught options such as cask ales and specialty brews. This helps smaller brewers gain a strong foothold in the market.

Innovation in product delivery and consumption is also expected to influence market growth in the coming years positively. Growth in home draught beer systems and subscription or delivery models has expanded consumer access to tap-quality beer outside pubs. Meanwhile, changing regulatory and economic factors, including alcohol duty adjustments and relief schemes, affect pricing and consumption. Rising energy and labor costs pose challenges for the on-trade sector, but strategic responses such as new serving sizes and promotions help maintain consumer interest.

Sustainability has become an increasingly important consideration for both producers and consumers. Breweries are adopting eco-friendly practices such as reusable kegs and reducing carbon footprint to meet growing environmental expectations. Social habits, evolving tastes, innovation, economic influences, and sustainability shape the UK draught beer market, supporting steady growth and adaptation to changing consumer preferences.

Consumer Insights

In the UK draught beer market, consumers are showing a clear shift toward premium, craft-style, and international lagers. Younger drinkers, especially those aged 25-44, increasingly seek quality over quantity, favoring beers with distinctive flavors and brand stories. At the same time, health-conscious behavior is shaping preferences, and many consumers now look for lower-alcohol or alcohol-free options when drinking out. Traditional older male consumers still represent a large market share, while engagement of women and younger, more diverse audiences who value variety and brand authenticity is also growing.

The main drivers of draught beer sales in the UK include experience-led consumption, the revival of pub culture, and the growing popularity of premium imports. Economic pressures have made price more relevant, but many consumers are still willing to pay more for beers perceived as higher quality. Seasonal demand, sports events, and promotional tie-ins also boost the demand. Macro breweries are responding to these trends by expanding their craft-style portfolios and investing in branding, taproom experiences, and sustainable practices. In parallel, pub operators and retailers are increasing their focus on range rotation and local appeal to stay competitive.

Type Insights

The cask beer segment dominated the market with a revenue share of 55.8% in 2024. The market is driven by shifting consumer preferences, a renewed interest in traditional brewing methods, and a growing desire for authenticity and locally produced products. While cask ale has faced challenges in recent years, driven by changing drinking habits and pub closures, emerging trends indicate that younger and older drinkers are rediscovering its appeal. This is especially true among independent breweries modernizing their cask offerings while maintaining the craftsmanship that defines the category. As per the article of February 2025, Strongbow introduced Strongbow Strawberry, which is available in a 500 ml bottle and on draught. The variant was launched first in August last year in the off-trade with rollout across the Tesco Group.

The keg beer segment is projected to experience the fastest CAGR of 4.4% from 2025 to 2033. The growing need for operational efficiency and flexibility in brewery supply chains is expected to drive the growth of this segment.

Category Insights

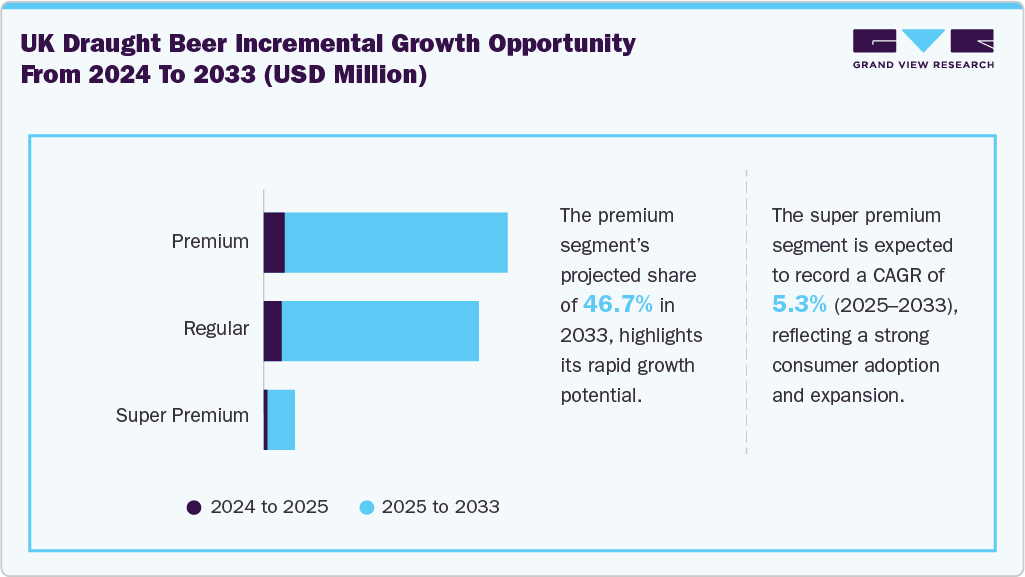

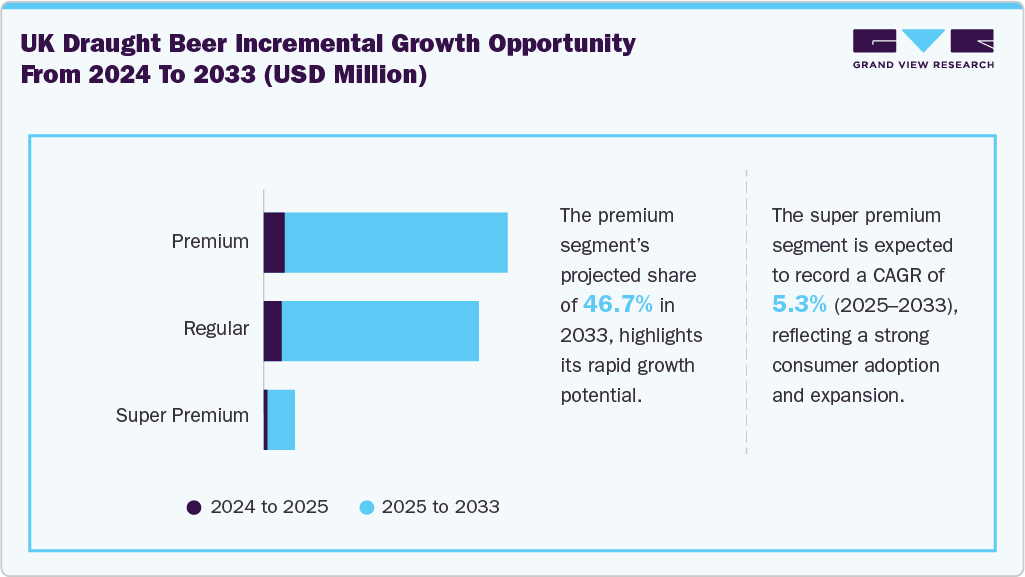

The regular segment held the largest revenue share of the UK draught beer market in 2024. Freshness and superior taste of the beer are expected to increase the demand for the segment in the UK draught beer industry. Draught beer is perceived as fresher and often superior in taste to bottled or canned alternatives because it is poured directly from kegs or casks. In addition, thriving pub culture and social experience are boosting the growth of this segment.

The super-premium segment is projected to experience the fastest CAGR from 2025 to 2033. The market is driven by rising premiumization in pubs, dining culture, and the desire for quality, uniqueness, and craftsmanship. Super premium draught beers often feature unfiltered, artisan brewing techniques and bold, diverse flavors. In October,

2022, Budweiser Brewing Group UK&I launched Stella Artois Unfiltered in both

draught and packaged formats for pubs and bars.

Production Type Insights

The macro breweries segment dominated the UK draught beer market in 2024. The breweries in this segment offer massive production capacity, strong brand presence, and widespread distribution networks. Large-scale brewers such as Heineken, AB InBev, and Diageo capitalize on economies of scale to offer consistent products at competitive prices across thousands of pubs and retail outlets.

The microbreweries segment is anticipated to record the fastest CAGR from 2025 to 2033. Rising consumer demand for local, artisanal, and flavor-forward beers drives the segment's growth. The small-scale producers focus on creativity, community engagement, and limited-batch brewing, offering alternatives to mass-market lagers.

End-use Insights

The commercial use segment dominated the UK draught beer market in 2024. Factors such as strong growth in the hospitality sector, including pubs, bars, restaurants, hotels, and catering services, contribute to the segment's growth. Consumer preferences have shifted toward unique, authentic, and personalized experiences, pushed by younger demographics, including millennials and Gen Z, who prioritize variety and quality when visiting commercial venues. This has led commercial businesses to diversify their offerings, stocking a wider range of draught beers, including craft and specialty varieties from microbreweries, alongside established macro brewery products.

The home end-use segment is anticipated to experience the fastest CAGR from 2025 to 2033. The rise of compact draught systems, mini kegs, and home beer taps has made it easier and more appealing for consumers to enjoy draught-quality beer at home. In addition, the expansion of e-commerce and online retail is expected to drive the growth of the segment in the UK draught beer industry.

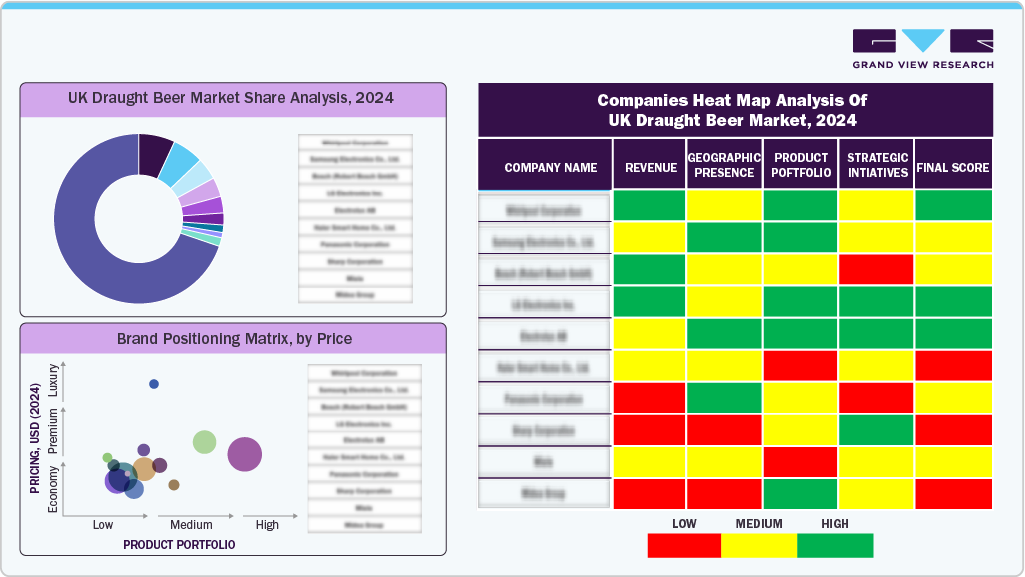

Key UK Draught Beer Company Insights

Some of the key players in the UK draught beer market include Heineken N.V.; Molson Coors Beverage Company; and others.

Key UK Draught Beer Companies:

- Heineken N.V.

- Molson Coors Beverage Company

- Carlsberg Breweries A/S

Recent Developments

- In July 2024, Lucky Buddha Beer, known for its iconic green bottle, launched a draught version in the UK to meet growing demand from Asian and Southeast Asian restaurants.

UK Draught Beer Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 11.30 billion

|

|

Revenue forecast in 2033

|

USD 15.18 billion

|

|

Growth rate

|

CAGR of 3.8% from 2025 to 2033

|

|

Actual data

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Type, category, production type, end-use

|

|

Key companies profiled

|

Heineken N.V.; Molson Coors Beverage Company; Carlsberg Breweries A/S

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

UK Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UK draught beer market report based on type, category, production type, and end-use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

Production Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Micro Breweries

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)