- Home

- »

- Beauty & Personal Care

- »

-

UK Sun Care Cosmetics Market Size, Industry Report, 2033GVR Report cover

![UK Sun Care Cosmetics Market Size, Share & Trends Report]()

UK Sun Care Cosmetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tinted Moisturizers, SPF Foundation, SPF Sunscreen), By Type (Conventional, Organic), By Distribution Channel (Hypermarkets & Supermarkets, E-commerce), And Segment Forecasts

- Report ID: GVR-4-68040-663-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Sun Care Cosmetics Market Trends

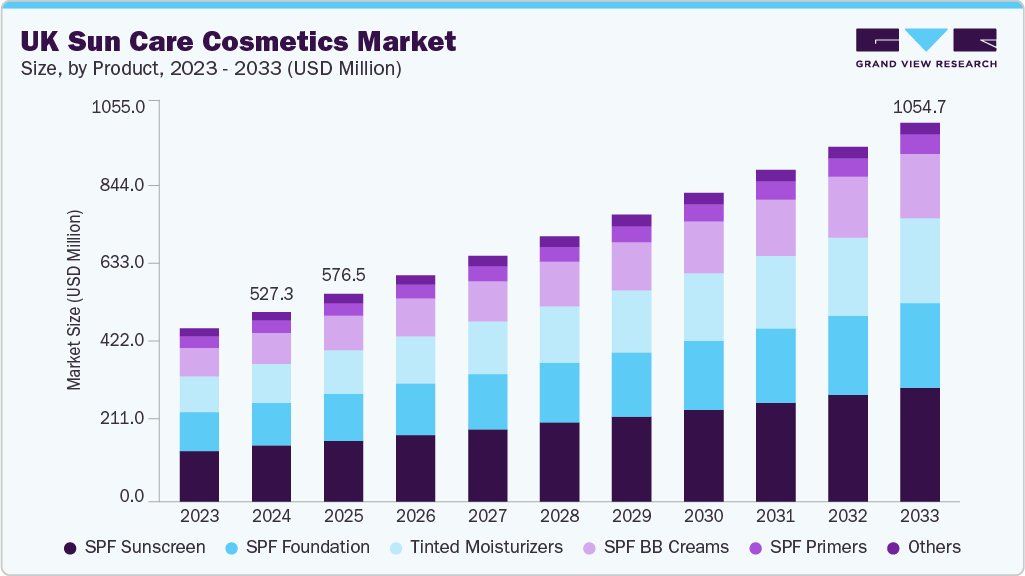

The UK sun care cosmetics market size was estimated to reach USD 527.3 million in 2024 and is projected to grow at a CAGR of 7.8% from 2025 to 2033. The UK sun care cosmetics industry is driven by increasing awareness of skin health and the long-term risks of sun exposure, such as premature aging and skin cancer.

Rising consumer preference for multifunctional skincare products, combining sun protection with moisturizing, anti-aging, or tinted formulas, is fueling demand. The UK’s growing interest in dermatologically tested, sensitive-skin-friendly formulations and reef-safe or eco-certified products contributes to market growth.

European sunscreen products are regulated under the EU Cosmetic Regulation (EC) No 1223/200. These regulations mandate strict safety, efficacy, and labeling standards. Sunscreens must provide both UVB and UVA protection (with UVA coverage of at least one-third of the SPF), undergo standardized testing (e.g., ISO 24444 for SPF, ISO 24443 for in vitro UVA), and display clear SPF levels, UVA logos, usage instructions, reapplication advice, and precautionary statements. Product claims are tightly controlled: terms like “sunblock,” “100% protection,” or “all‑day protection” are prohibited, and maximum SPF is capped at “50+.”

In the UK, mineral and hybrid sunscreens are gaining momentum, particularly among eco-conscious consumers and those with sensitive skin. The market prefers reef-safe formulations featuring non-nano zinc oxide and titanium dioxide, with advancements in dispersion technology enhancing their cosmetic elegance. Brands like Green People, REN Clean Skincare, and Pai Skincare are widely recognized for their transparency, certified organic ingredients, and skin-friendly formulations, aligning with the growing demand for clean, sustainable sun protection.

Personalization is becoming a key trend in the sun care industry, driven by advancements in AI and digital diagnostics. Modern beauty tech enables consumers to receive tailored product recommendations based on skin tone, type, lifestyle, and even the local UV index. This focus on hyper-personalization is making sun protection more accessible and inclusive, catering to diverse skin tones, texture preferences, and individual SPF requirements. For example, UK-based brand No7 (by Boots) leverages skin analysis tools to offer personalized skincare and sun protection solutions, enhancing user experience and daily SPF compliance.

Consumer Insights & Surveys

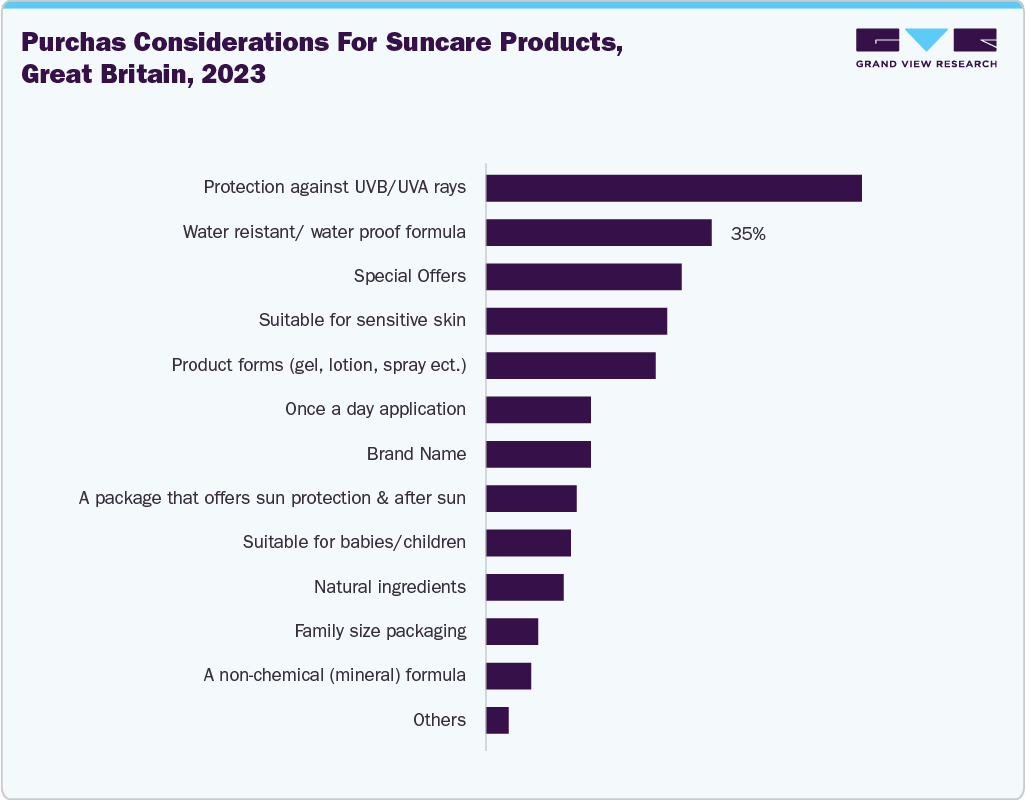

British sunscreen consumers prioritize strong protection against UVA and UVB rays, valuing effective sun defense. Water-resistant formulas are important to 35%, particularly for active lifestyles or water-based activities. Application preferences also play a role in choosing specific formats like gels, lotions, or sprays. Skin sensitivity influences users' choices, while many consider special offers and discounts when purchasing.

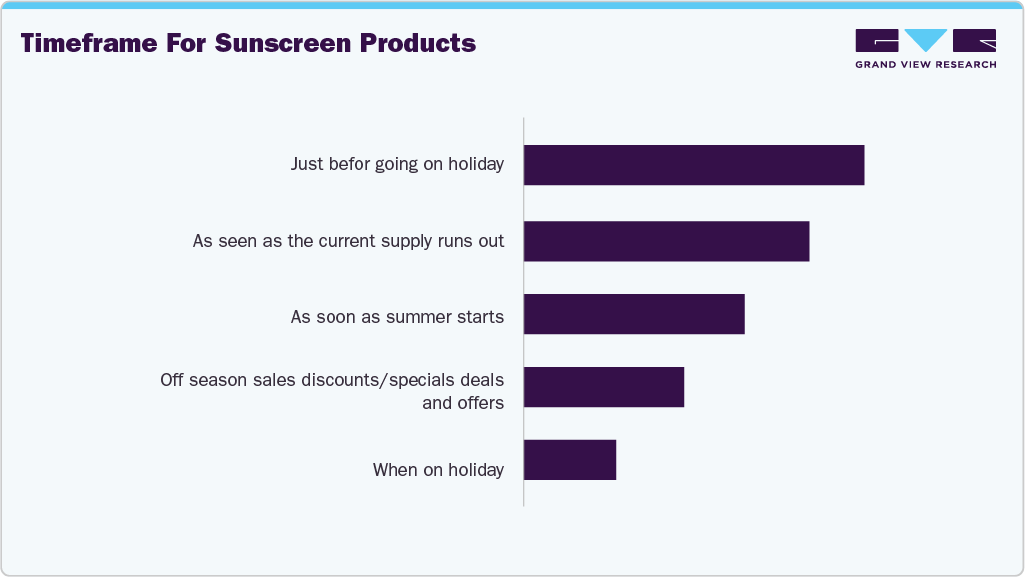

According to the survey conducted by YouGov, in 2023, travel plans and practical needs shape sunscreen purchasing habits among UK consumers. Many buy sunscreen before going on holiday, while others make purchases during their trip, such as at airports or vacation destinations. Some consumers shop for sun protection products as their current supply runs out, ensuring continuous yearly coverage. Others take a cost-conscious approach by stocking up during off-season periods when discounts and promotional offers are more readily available.

Product Insights

The sunscreen segment led the market with the largest revenue share of 29.27% in 2024. The trend toward daily wear of sun protection, even on cloudy or mild days, is gaining traction thanks to dermatologists, health campaigns, and beauty influencers emphasizing that UVA rays cause aging and penetrate clouds. Modern formulas now include hydrating ingredients to support the skin barrier and overall health. Innovative formats like sticks, mists, and capsules make SPF easier to use and more convenient for busy lifestyles. UK brand REN Clean Skincare offers lightweight, skin-friendly sunscreens that align with these trends, combining effective protection with ease of use and skin-nourishing benefits.

The tinted moisturizers segment is projected to rise at the fastest CAGR of 8.7% from 2025 to 2033, driven by consumers' preference for multifunctional products that streamline beauty routines. These moisturizers offer sun protection, hydration, and light coverage in a single step, perfect for those embracing the consumer who prefer simpler routines with fewer, high-performing products. They also cater to the growing awareness of the need for daily sun protection, even on cloudy days, and align with the shift toward natural, minimal makeup looks. For instance, BareMinerals Tinted Hydrating Gel Cream combines SPF 30, skincare, and sheer coverage for a healthy, radiant finish.

Type Insights

The conventional segment led the market with the largest revenue share of 81.93% in 2024. Conventional types often contain chemical filters like oxybenzone, avobenzone, octinoxate, synthetic preservatives, fragrances, and silicones to improve texture and shelf life. Brands like Neutrogena and Nivea Sun offer many products, including lotions, sprays, and SPF moisturizers. For example, Nivea Sun’s Protect & Moisture range combines chemical UV filters with hydrating ingredients for reliable, broad-spectrum protection.

The organic segment is estimated to grow at the fastest CAGR of 7.9% over the forecast period, driven by a shift toward health-conscious, eco-friendly, and wellness-oriented lifestyles. Consumers are increasingly concerned about the potential risks of synthetic ingredients and are opting for cleaner, skin-friendly alternatives, especially for sensitive skin. At the same time, rising environmental awareness is fueling interest in reef-safe, biodegradable, and sustainably packaged products. For instance, Green People exemplifies certified organic sun care products that combine effective mineral protection with natural, skin-soothing ingredients.

Distribution Channel Insights

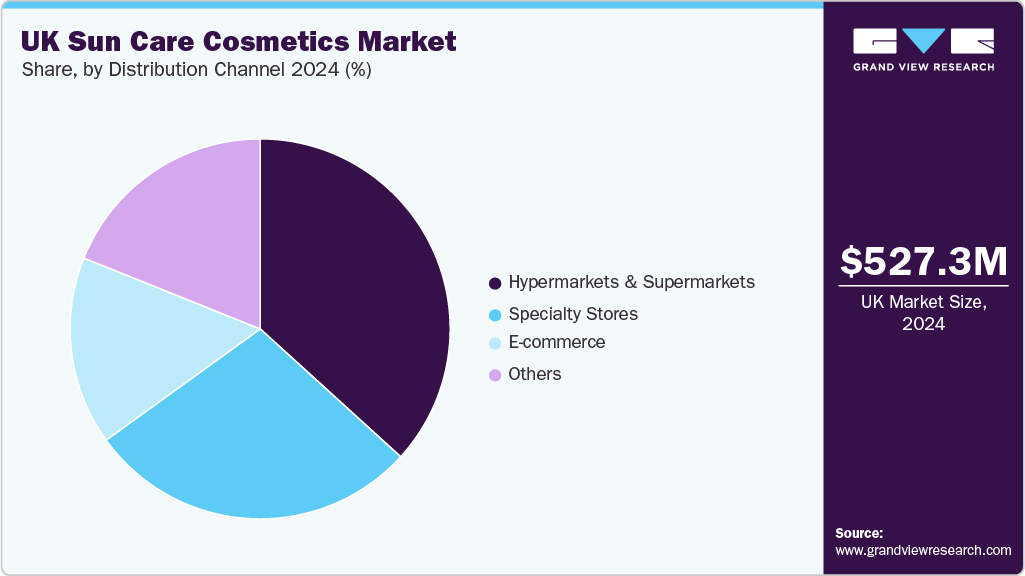

The hypermarkets and supermarkets segment led the market with the largest revenue share of 36.75% in 2024, due to their convenience, affordability, and wide product range. Consumers appreciate the ability to compare various brands, formats, and SPF levels in one location while completing regular shopping. Retailers like Tesco, Sainsbury’s, and Boots also offer seasonal promotions, multi-buy deals, and loyalty rewards, making them attractive to cost-conscious shoppers.

The e-commerce segment is anticipated to grow at the fastest CAGR of 8.0% from 2025 to 2033, due to the ease of browsing and purchasing products online. They can access a wider range of brands, including organic and niche options, along with detailed reviews and ingredient information. Features like fast delivery, exclusive discounts, and personalized recommendations enhance the shopping experience. The influence of social media and beauty influencers also plays a key role, making online platforms a preferred and trusted source for products.

Key UK Sun Care Cosmetics Company Insights

The market comprises both well-established companies and new entrants. Leading players are actively responding to evolving sun care cosmetics trends and broadening their services to sustain and enhance their market share.

-

Beiersdorf AG is a global personal care company headquartered in Hamburg, Germany, renowned for its strong portfolio of skincare and cosmetics brands. The company operates through two main business segments: Consumer and Tesa. The Consumer segment includes iconic brands such as NIVEA, Eucerin, La Prairie, and Hansaplast, covering categories like skincare, body care, wound care, and sun protection.

-

Boots is the UK’s leading health and beauty retailer and pharmacy chain, founded in 1849 by John Boot. Headquartered in Beeston, Nottinghamshire, it now operates around 1,900-2,200 stores in the UK and Ireland, offering a comprehensive mix of prescription medicines, over-the-counter healthcare, personal care, beauty, optician services, and hearing care.

Key UK Sun Care Cosmetics Companies:

- Unilever PLC

- Procter & Gamble

- The Estée Lauder Companies Inc.

- The Boots Company PLC.

- Groupe Clarins

- L'Oréal Groupe

- Coty Inc.

- Kenvue Brands LLC

- Beiersdorf AG

- Supergoop!

Recent Developments

-

In April 2025, Clinique introduced its new Even Better Clinical Vitamin Makeup SPF 45, a lightweight foundation designed to provide a luminous finish while protecting the skin. The formula combines sun protection with skincare, featuring ingredients like five types of vitamin C, along with vitamins E and B3, plus hyaluronic acid for hydration. It offers buildable light-to-medium coverage and helps defend against UV rays, pollution, and blue light.

-

In September 2024, Kenvue expanded its Aveeno brand into 12 Central European countries, marking the brand’s first entry into this region through pharmacy channels. Known for its oat-based skincare solutions tailored to sensitive and eczema-prone skin, Aveeno will now be accessible to European consumers with the added benefit of expert pharmacy advice. This strategic move aligns with Kenvue’s vision to establish Aveeno as a major player in the European dermo-cosmetic market, supported by professional endorsements and upcoming showcases at key industry events in cities like Amsterdam and Munich.

-

In July 2024, Beiersdorf AG introduced a cutting-edge, AI-enhanced skincare offering with highly personalized sun care recommendations. Through its extensive SKINLY skin study, which captures daily user data like skin hydration, tone, and wrinkle depth, Beiersdorf leverages AI and IoT-powered diagnostics to generate consumer-specific skincare insights. This initiative is part of Beiersdorf’s broader strategy to integrate digitalization and AI across its research process.

UK Sun Care Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 576.5 million

Revenue forecast in 2033

USD 1,054.7 million

Growth rate

CAGR of 7.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel

Country scope

UK

Key companies profiled

Unilever PLC; Procter & Gamble; The Estée Lauder Companies Inc.; The Boots Company PLC.; Groupe Clarins; L'Oréal Groupe; Coty Inc.; Kenvue Brands LLC; Beiersdorf AG; Supergoop

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Sun Care Cosmetics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UK sun care cosmetics market report based on product, type, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tinted Moisturizers

-

SPF Foundation

-

SPF BB Creams

-

SPF primers

-

SPF Sunscreen

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

E-Commerce

-

Others

-

Frequently Asked Questions About This Report

b. The UK sun care cosmetics market was estimated at USD 527.3 million in 2024 and is expected to reach USD 576.5 million in 2025.

b. The UK sun care cosmetics market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 1,054.7 million by 2033.

b. Sunscreen accounted for the largest share of about 29.27% of the U.K. sun care cosmetics market in 2024. The trend toward daily wear of sun protection, even on cloudy or mild days, is gaining traction thanks to dermatologists, health campaigns, and beauty influencers emphasizing that UVA rays cause aging and penetrate clouds.

b. Some of the key players in the UK sun care cosmetics market is - Unilever PLC; Procter & Gamble; The Estée Lauder Companies Inc.; The Boots Company PLC.; Groupe Clarins; L'Oréal Groupe; Coty Inc.; Kenvue Brands LLC; Beiersdorf AG; Supergoop!

b. The UK sun care cosmetics market is growing due to rising awareness of skin health and the dangers of sun exposure, such as aging and skin cancer. Consumers are increasingly drawn to multifunctional products that combine SPF with hydration, anti-aging, or tinting benefits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.