- Home

- »

- Medical Devices

- »

-

Umbilical Vessel Catheters Market Size, Industry Report 2033GVR Report cover

![Umbilical Vessel Catheters Market Size, Share & Trends Report]()

Umbilical Vessel Catheters Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Umbilical Arterial Catheters, Umbilical Venous Catheters), By Material (Silicone-based Catheters, PVC-coated Catheters), By Channel, By Indication/Use, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-823-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Umbilical Vessel Catheters Market Summary

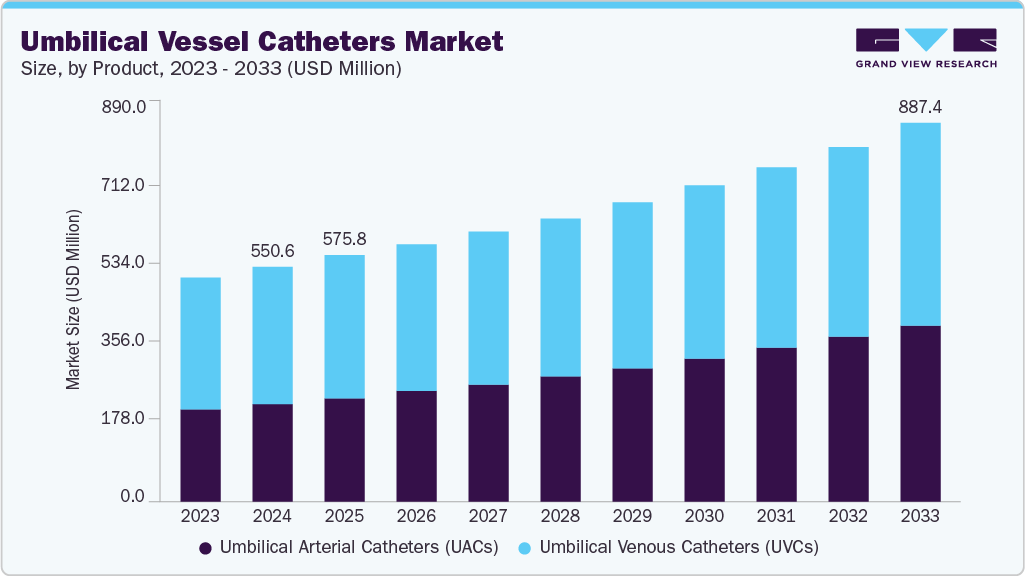

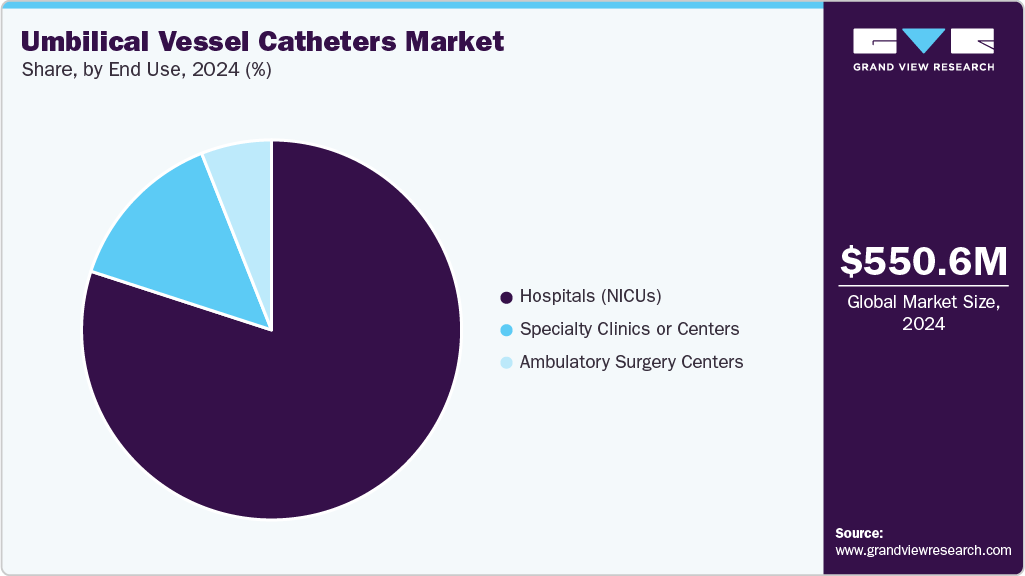

The global umbilical vessel catheters market size was estimated at USD 550.56 million in 2024 and is projected to reach USD 887.45 million by 2033, growing at a CAGR of 5.56% from 2025 to 2033. The industry is driven by several key factors, including the rising incidence of preterm births and the growing need for advanced neonatal intensive care worldwide. Increasing investments in healthcare infrastructure and NICU capacity have enhanced access to specialized vascular access devices for newborns.

Key Market Trends & Insights

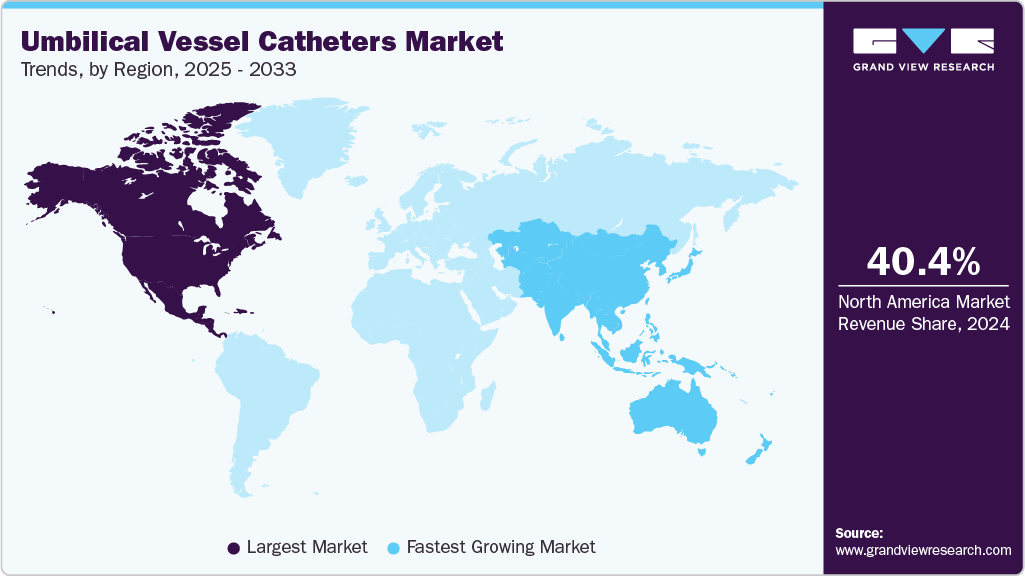

- North America dominated the umbilical vessel catheters market with the largest share of 40.36% in 2024.

- The umbilical vessel catheters market in the U.S. accounted for the largest market revenue share of 74.42% in North America in 2024.

- By product, the umbilical venous catheters (UVCs) segment led the market with the largest revenue share of 58.00% in 2024.

- By material, the polyurethane-based catheters segment led the market with the largest revenue share of 52.90% in 2024.

- Based on channel, the single lumen segment led the market with the largest revenue share of 67.05% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 550.56 Million

- 2033 Projected Market Size: USD 887.45 Million

- CAGR (2025-2033): 5.56%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

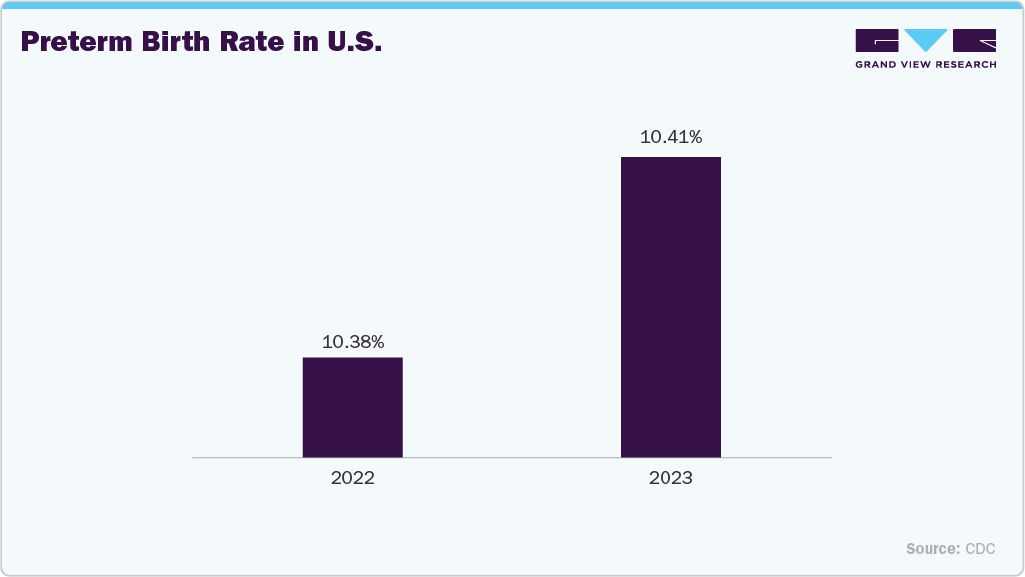

The rising incidence of preterm births is a primary factor driving the growth of the umbilical vessel catheters industry. Preterm infants often require immediate and reliable vascular access for administering fluids, medications, and parenteral nutrition in neonatal intensive care units (NICUs). Umbilical vessel catheters (UVCs and UACs) play a crucial role in stabilizing these infants during the critical early stages of life. With increasing global preterm birth rates and improved survival outcomes, the demand for advanced, safe, and infection-resistant catheters continues to rise. Moreover, growing awareness among healthcare professionals and the expansion of neonatal care infrastructure further reinforce market growth worldwide. According to the Reproductive Health Journal, the number of preterm births remained high globally, with an estimated 13.4 million cases in 2020. According to the Centers for Disease Control and Prevention (CDC), both early and late preterm birth rates increased by 4% from 2020 to 2021 but later declined by 1%-2% from 2021 to 2022.

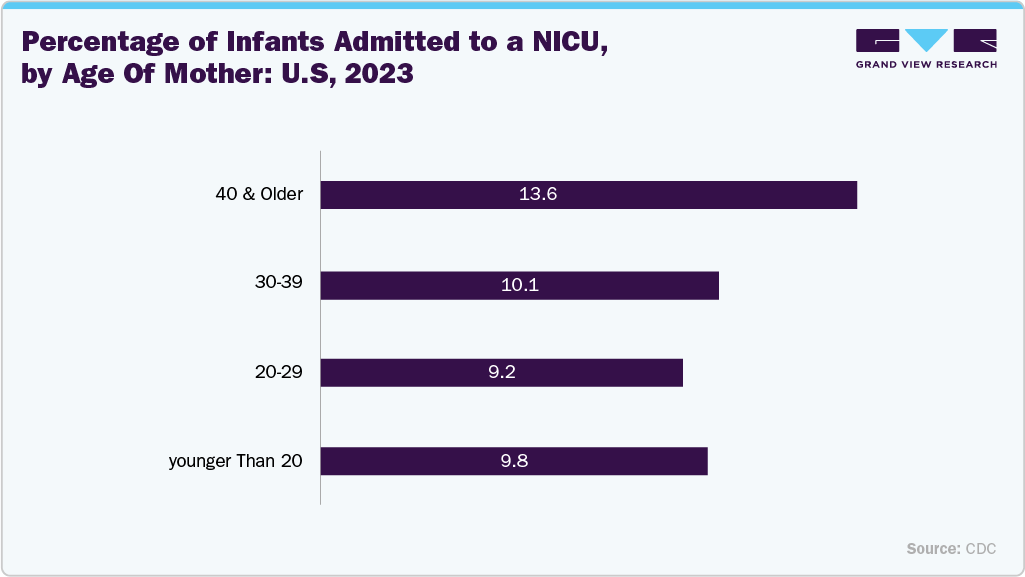

The growing need for advanced neonatal intensive care is a major factor driving the umbilical vessel catheters market. As the number of preterm and low-birth-weight infants continues to rise, the demand for reliable and safe vascular access solutions has increased significantly. Umbilical vessel catheters play a crucial role in delivering essential medications, fluids, and nutrition while allowing continuous monitoring of critically ill newborns. The expansion of neonatal intensive care units (NICUs) and the adoption of advanced medical technologies are further enhancing their use. In addition, the focus on improving neonatal survival rates and reducing complications is accelerating the adoption of high-performance, infection-resistant catheters across hospitals worldwide.

Technological innovations, like antimicrobial-coated catheters, are further enhancing adoption by reducing infection risks and improving patient safety. Furthermore, the growing awareness among healthcare professionals of early neonatal interventions and infection control practices continues to drive global market growth. The integration of imaging-guided insertion techniques and real-time monitoring systems is enhancing precision and reducing procedural complications. Moreover, ongoing product development by key manufacturers is expanding the availability of advanced, cost-effective solutions for neonatal care worldwide.

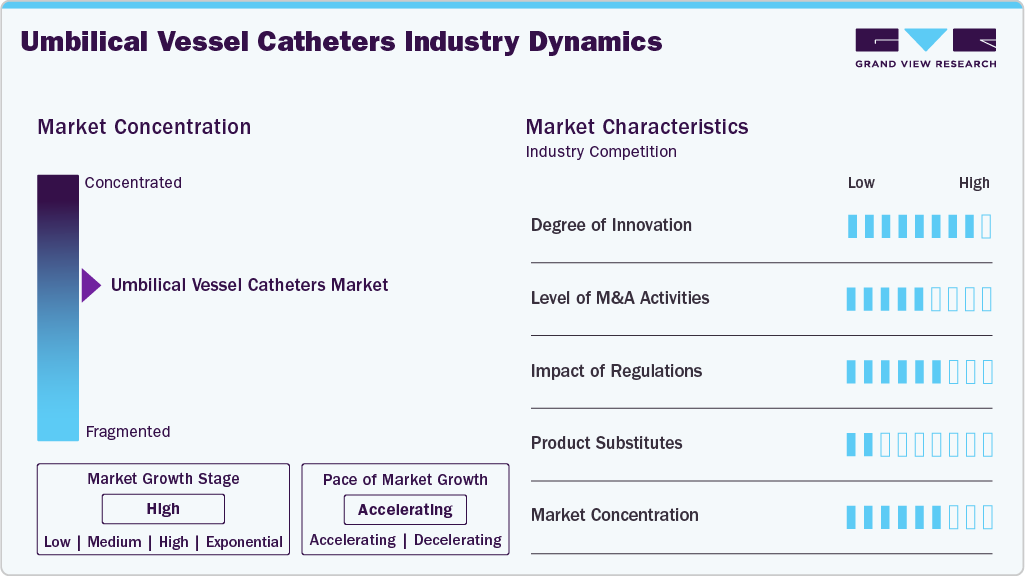

Market Concentration & Characteristics

The umbilical vessel catheters industry is characterized by its focus on neonatal intensive care, with demand driven by rising preterm birth rates and advancements in catheter technology. The market emphasizes infection prevention, biocompatibility, and safety, supported by increasing healthcare investments and the modernization of neonatal care facilities worldwide.

The market demonstrates a high degree of innovation, driven by the introduction of antimicrobial, silicone-based catheters that enhance safety and reduce infection risks. Continuous advancements in biocompatible materials and design are improving catheter performance and extending their clinical usability in neonatal care. For instance, in 2022, Frontiers in Pediatrics highlighted that Polyurethane catheters, preferred over polyethylene and polyvinyl types due to lower bacterial colonization, have evolved with the introduction of silver ion-releasing UVCs. These antimicrobial catheters reduce both internal and external bacterial growth, effectively lowering the risk of catheter-related bloodstream infections (CRBSI) in preterm infants. Supported by clinical evidence and SHEA guidelines, such advancements reflect the market’s growing focus on infection prevention, material innovation, and extended catheter safety for neonatal care.

Regulations have a significant impact on the industry, as stringent safety and quality standards govern the design, testing, and approval of neonatal medical devices. Compliance with guidelines from agencies such as the U.S. FDA and European Medicines Agency (EMA) ensures product reliability and patient safety. However, these strict regulatory requirements can also increase development costs and lengthen approval timelines, thereby influencing market entry and the pace of innovation.

The market for umbilical vessel catheters has witnessed a moderate level of mergers and acquisitions, primarily aimed at expanding product portfolios and enhancing neonatal care technologies. Strategic acquisitions, like larger medical device companies acquiring innovative startups, have focused on integrating advanced catheter protection and infection prevention solutions. These collaborations are strengthening market presence and accelerating innovation in neonatal vascular access devices.

Product substitutes in industry include peripheral intravenous (IV) lines, peripherally inserted central catheters (PICCs), and intraosseous access devices, which can serve as alternatives for neonatal vascular access. These substitutes are often used when umbilical access is not feasible or for administering fluids and medications on a short-term basis. However, they may pose limitations in terms of durability, infection risk, or suitability for critically ill preterm infants, making UVCs the preferred choice in many neonatal intensive care settings.

Product Insights

The umbilical venous catheters (UVCs) segment dominated the market in 2024, driven by their widespread use in administering fluids, medications, and parenteral nutrition to critically ill and preterm infants. Their ability to provide reliable central venous access with minimal invasiveness made them the preferred choice in neonatal intensive care units (NICUs). The increasing focus on infection prevention and the availability of advanced, biocompatible UVC designs further strengthened their market growth. For instance, in October 2025, an article published in Frontiers in Pediatrics reported that the use of real-time ultrasound guidance significantly improves the accuracy and efficiency of umbilical venous catheter placement in neonates, while also reducing the risk of liver complications.

The umbilical arterial catheters (UACs) segment is projected to witness the fastest CAGR from 2025 to 2033, driven by their increasing use in continuous blood pressure monitoring and blood gas analysis in critically ill neonates. Advancements in catheter design and infection control technologies are enhancing their safety and clinical efficiency. The expansion of neonatal intensive care units (NICUs) and growing emphasis on real-time hemodynamic monitoring are expected to further accelerate segment growth during the forecast period.

Material Insights

The polyurethane-based catheters segment dominated the market for umbilical vessel catheters in 2024, and it is projected to exhibit the fastest growth from 2025 to 2033, driven by their superior material properties and clinical advantages. These catheters offer greater biocompatibility, flexibility, and resistance to kinking compared to PVC, ensuring safer and more comfortable use in neonates. Their smoother surface minimizes the risk of thrombosis and infection, leading to improved patient outcomes. In addition, growing preference for advanced, non-toxic, and DEHP-free materials aligns with stricter regulatory and hospital standards. As healthcare providers shift toward high-performance and patient-safe catheter solutions, polyurethane-based products are expected to witness robust adoption and market expansion.

The PVC-coated catheters segment is growing significantly, driven by a blend of clinical familiarity, cost-effectiveness, and reliable performance. PVC coatings offer a favorable balance of flexibility and tensile strength that clinicians prefer for secure placement in fragile neonatal vessels, reducing procedural complications. Broad availability and well-established manufacturing processes kept unit costs lower than those of many alternative materials, supporting widespread adoption across hospitals and NICUs. A strong regulatory track record and plentiful clinical data also reassured purchasers and clinicians about safety and biocompatibility.

Channel Insights

The single lumen segment dominates the umbilical vessel catheters industry, driven by its widespread use in routine neonatal care and ease of insertion. Single-lumen catheters are preferred for short-term vascular access, fluid administration, and blood sampling in preterm and critically ill infants. Their simple design minimizes the risk of infection and mechanical complications, making them highly reliable in neonatal intensive care settings. The lower costs and broad availability across healthcare facilities have further strengthened their market position. The continued reliance on these catheters for essential neonatal procedures ensured their dominance in the umbilical vessel catheter market.

The triple lumen segment is projected to depict the fastest CAGR from 2025 to 2033. Driven by the increasing demand for multifunctional vascular access in critically ill neonates. These catheters enable simultaneous administration of medications, parenteral nutrition, and blood sampling, improving treatment efficiency and reducing the need for multiple insertions. Advances in design and material technology have enhanced their flexibility and reduced the risk of complications, such as thrombosis or infection. Moreover, the growing preference for advanced neonatal intensive care procedures is accelerating their adoption. As healthcare providers emphasize the importance of comprehensive and continuous monitoring, triple-lumen catheters are expected to experience strong market growth.

Indication/Use Insights

The parenteral nutrition segment dominated the market in 2024, driven by the increasing demand for nutritional support in preterm and critically ill neonates. Umbilical catheters are essential for delivering vital nutrients directly into the bloodstream when enteral feeding is not feasible. The rise in premature births and low birth weight infants has increased the demand for reliable vascular access for sustained parenteral nutrition. Clinicians prefer umbilical venous catheters for their safety, stability, and ability to deliver balanced nutrient solutions efficiently. This widespread clinical application and necessity for neonatal survival firmly established the parenteral nutrition segment as the leading category in the market.

The neonates with difficult venous access (DVA) for emergency resuscitationsegment is projected to witness the fastest CAGR from 2025 to 2033. This growth is driven by the increasing recognition of umbilical catheterization as a rapid and reliable method for vascular access in critical emergencies. In neonates where peripheral veins are hard to locate or access, umbilical catheters provide immediate routes for fluid resuscitation, medication delivery, and blood sampling. Advances in neonatal care protocols and training have improved the success rates and safety of these procedures. As emergency response in neonatal intensive care becomes more protocol-driven, the adoption of umbilical catheters for DVA management is projected to rise significantly.

End Use Insights

The hospitals (NICUs) segment dominated the market for umbilical vessel catheters in 2024, capturing the largest share. This leadership was attributed to the high volume of neonatal admissions and the advanced clinical infrastructure available in these settings. Neonatal Intensive Care Units (NICUs) are the primary sites for managing preterm and critically ill infants requiring umbilical catheterization for fluid therapy, medication delivery, and monitoring. The presence of skilled healthcare professionals and adherence to standardized neonatal care protocols enhance the safe and effective use of these catheters. In addition, hospitals are often equipped with advanced imaging and monitoring systems that support precise catheter placement. This combination of specialized care, technology, and patient volume solidified hospitals’ leading position in the market.

The specialty clinics or centers segment is expected to exhibit the fastest CAGR during the forecast period. This growth is driven by the expansion of neonatal care facilities and advanced pediatric units. These centers increasingly adopt umbilical catheters for precise monitoring, medication administration, and nutritional support in preterm and critically ill infants. The growing availability of specialized neonatal professionals and advanced infrastructure supports higher procedural efficiency and better outcomes. In addition, increasing awareness of early intervention and improved neonatal survival rates is fueling demand for catheter-based care in these settings.

Regional Insights

The North America umbilical vessel catheters industry held the largest revenue share in 2024. The growth is driven by the rising number of preterm births and the presence of well-established neonatal intensive care facilities. The region benefits from advanced healthcare infrastructure, strong regulatory standards, and ongoing technological innovations in catheter materials and design. Increasing adoption of antimicrobial and polyurethane catheters to reduce infection risks further supports market expansion. In addition, growing investments in neonatal care programs and hospital modernization continue to strengthen the market outlook across the region.

U.S. Umbilical Vessel Catheters Market Trends

The U.S. umbilical vessel catheters industry is primarily driven by the increasing incidence of preterm births and the availability of advanced neonatal intensive care units (NICUs). Increasing adoption of antimicrobial-coated and biocompatible catheters is enhancing patient safety and reducing infection rates in newborns. Strong government initiatives to improve neonatal health outcomes, along with continuous technological innovation by key manufacturers, are further driving market expansion. The growing investments in healthcare and an emphasis on quality neonatal care continue to reinforce the market’s positive trajectory. According to the Centers for Disease Control and Prevention (CDC), both early and late preterm birth rates increased by 4% from 2020 to 2021 but later declined by 1%-2% from 2021 to 2022.

Europe Umbilical Vessel Catheters Market Trends

The umbilical vessel catheters industry in Europe is witnessing significant growth, driven by the region’s strong focus on neonatal care and infection prevention. The increasing prevalence of preterm births and the presence of well-established healthcare systems are fueling the adoption of advanced catheter technologies. European countries are also investing in modern NICU infrastructure and promoting the use of antimicrobial and biocompatible materials to enhance patient safety and well-being. Furthermore, supportive government policies and continuous innovation by medical device manufacturers are strengthening market growth across the region.

The UK umbilical vessel catheters industry is largely driven, supported by an increasing focus on neonatal care quality and the management of preterm births, which account for approximately 8% of all deliveries. The expansion of investments in neonatal intensive care units (NICUs) and the adoption of advanced catheter technologies are driving market demand. The emphasis on infection prevention and clinical safety standards has accelerated the use of antimicrobial and biocompatible catheters. Moreover, government initiatives aimed at improving maternal and infant health outcomes continue to bolster market growth nationwide. According to data from the UK government, in England, 8.1% of all births in 2023 were preterm (between 24 and 36 weeks of gestation). While the global average preterm birth rate stands at around 10%, England’s rate is lower than that of some comparable nations, such as the U.S., but higher than in others, including France and several Scandinavian countries.

Asia Pacific Umbilical Vessel Catheters Market Trends

The Asia Pacific umbilical vessel catheters industry is expected to experience the fastest CAGR from 2025 to 2033. Fueled by a high number of preterm births and expanding investments in neonatal healthcare infrastructure. Countries such as China, India, and Japan are focusing on strengthening neonatal intensive care units (NICUs) and improving access to advanced medical devices. Rising awareness of neonatal infection control and the adoption of antimicrobial-coated catheters are further supporting market expansion. Additionally, growing government initiatives aimed at reducing infant mortality and improving maternal health are creating favorable conditions for market growth across the region.

The umbilical vessel catheters industry in China is witnessing significant growth, driven by the increasing number of preterm births and ongoing improvements in neonatal healthcare infrastructure. Expanding investments in hospital modernization and the establishment of advanced neonatal intensive care units (NICUs) are boosting the adoption of umbilical vessel catheters. Increasing emphasis on infection prevention and the use of biocompatible, antimicrobial-coated catheters is enhancing patient safety. Furthermore, government initiatives focused on maternal and infant health are supporting sustained market growth nationwide.

Latin America Umbilical Vessel Catheters Market Trends

The umbilical vessel catheters industry in Latin America is growing moderately, supported by the rising incidence of preterm births and improving access to neonatal intensive care services. Countries such as Brazil, Mexico, and Argentina are investing in healthcare infrastructure upgrades and expanding NICU capacity to enhance newborn survival rates. Increasing awareness of neonatal infection prevention and the availability of advanced catheter technologies are further driving market adoption. In addition, growing government support for maternal and infant health programs continues to strengthen the market outlook across the region.

Middle East and Africa Umbilical Vessel Catheters Market Trends

The umbilical vessel catheters industry in the Middle East and Africa is witnessing significant growth driven by increasing efforts to improve maternal and neonatal healthcare infrastructure. Rising awareness of the importance of early neonatal intervention and the growing number of premature births are boosting demand for umbilical vessel catheters across hospitals and specialized care centers. Governments in the region are investing in healthcare modernization and expanding NICU facilities, particularly in Gulf Cooperation Council (GCC) countries. Additionally, international collaborations and training programs are enhancing clinical expertise, further supporting market growth.

Key Umbilical Vessel Catheters Company Insights

The market is characterized by the presence of several key players focusing on product innovation, quality improvement, and expanded distribution networks. Leading companies emphasize advanced material technologies and improved safety designs to enhance neonatal outcomes. Strategic collaborations, product launches, and regulatory approvals continue to strengthen their market share and global presence.

Key Umbilical Vessel Catheters Companies:

The following are the leading companies in the umbilical vessel catheters market. These companies collectively hold the largest market share and dictate industry trends.

- Vygon

- Utah Medical Products, Inc.

- Cardinal Health

- Haolang Technology (Foshan) Limited Co., Ltd

- Polymed

- Sterimed Group

- ANGIPLAST PRIVATE LIMITED

- Romsons

- Laborie

- AMECATH

Recent Developments

-

In July 2025, Haolang Technology (Foshan) Limited Co., Ltd. introduced its advanced Umbilical Venous Catheterization (UVC) system, designed to establish a critical lifeline for preterm and critically ill newborns. This innovation enables efficient vascular access for administering essential medications, fluids, and nutrition, ensuring stable and precise neonatal care. With a focus on safety, biocompatibility, and ease of insertion, Haolang Technology’s UVC solution reflects its commitment to improving neonatal outcomes and advancing standards in infant healthcare technology.

-

In February 2023, Laborie Medical Technologies Corp., a leading diagnostic and therapeutic medical technology company, announced the acquisition of Novonate, Inc. and its innovative LifeBubble technology. This device is designed to transform umbilical catheter protection and security, enhancing safety and reducing complications for neonates in intensive care environments.

Umbilical Vessel Catheters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 575.83 million

Revenue forecast in 2033

USD 887.45 million

Growth rate

CAGR of 5.56% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, channel, indication/use, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Vygon; Utah Medical Products, Inc.; Cardinal Health; Haolang Technology (Foshan) Limited Co. Ltd; Polymed; Sterimed Group; ANGIPLAST PRIVATE LIMITED; Romsons; Laborie; AMECATH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Umbilical Vessel Catheters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global umbilical vessel catheters market report based on product, material, channel, indication/use, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Umbilical Arterial Catheters (UACs)

-

Umbilical Venous Catheters (UVCs)

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Polyurethane-based Catheters

-

Silicone-based Catheters

-

PVC-coated Catheters

-

Others

-

-

Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Lumen

-

Double Lumen

-

Triple Lumen

-

-

Indication/Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Neonates with Difficult Venous Access (DVA) for Emergency Resuscitation

-

Exchange Blood Transfusion

-

Cardiac Catheterisation

-

Parenteral Nutrition

-

Drug Administration

-

Frequent Blood Sampling/Arterial Blood Gas Monitoring

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals (NICUs)

-

Specialty Clinics or Centers

-

Ambulatory Surgery Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.