- Home

- »

- Renewable Energy

- »

-

Underground Hydrogen Storage Market Size Report, 2033GVR Report cover

![Underground Hydrogen Storage Market Size, Share & Trends Report]()

Underground Hydrogen Storage Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Porous Media Storage, Salt Caverns, Engineered Cavities), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-028-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Underground Hydrogen Storage Market Summary

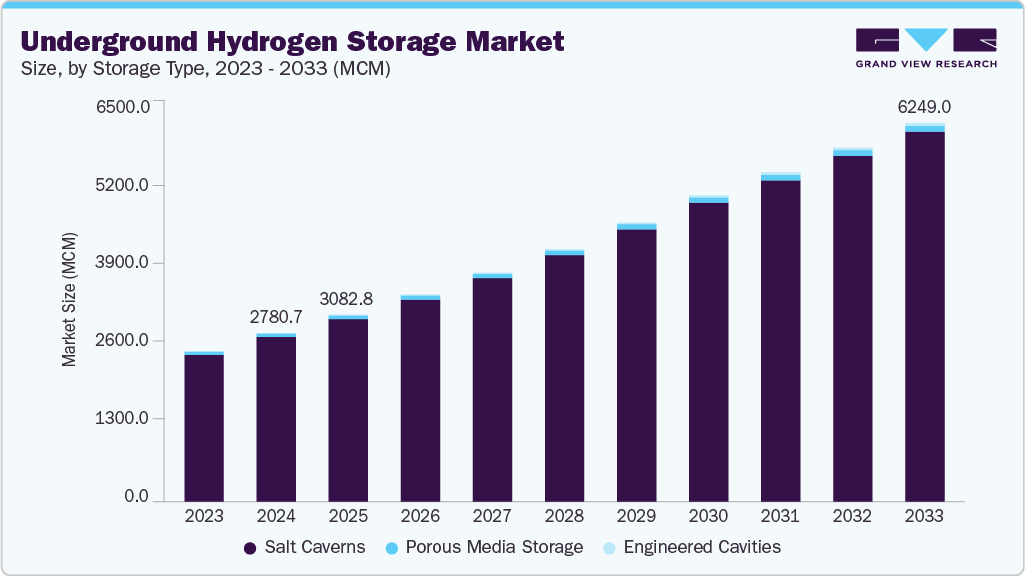

The global underground hydrogen storage market demand was estimated at 2780.67 MCM in 2024 and is projected to reach 6,249.05 MCM by 2033, growing at a CAGR of 9.2% from 2025 to 2033. The market is expected to grow steadily during the forecast period, driven by supportive government policies, increasing net-zero targets, and heightened focus on hydrogen as a clean energy carrier for industry, transport, and power generation sectors.

Key Market Trends & Insights

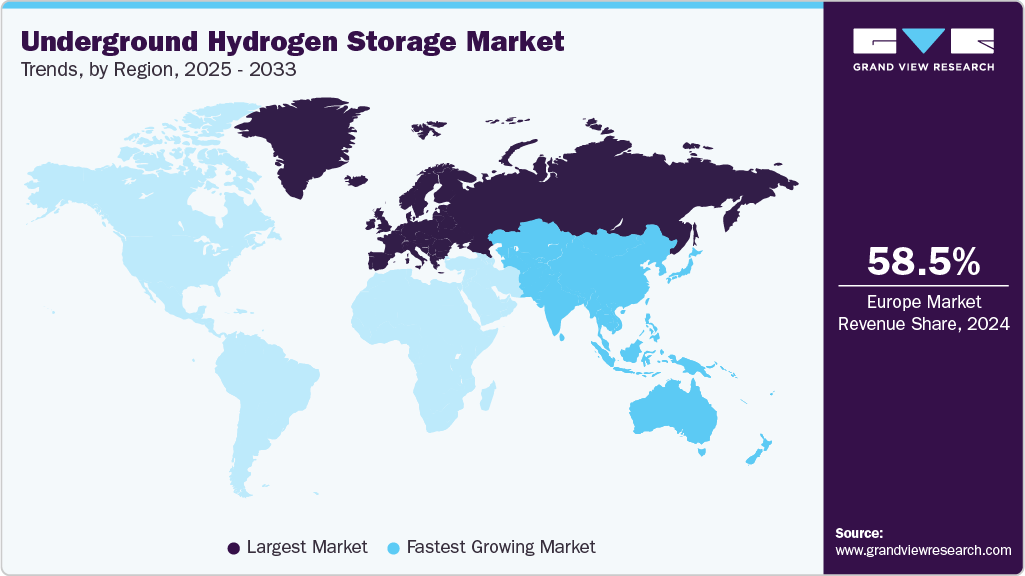

- The Europe underground hydrogen Storage market held the largest global volume share of 58.52 % in 2024.

- The underground hydrogen storage industry in the U.S. is expected to grow significantly over the forecast period.

- By storage type, the salt caverns segment held the highest market share of 97.66% in 2024.

Market Size & Forecast

- 2024 Market Demand: 2,780.67 MCM

- 2033 Projected Market Demand: 6,249.05 MCM

- CAGR (2025-2033): 9.2%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing investments in green hydrogen infrastructure and rising adoption of renewable energy sources are accelerating the demand for safe and scalable hydrogen storage technologies. Underground hydrogen storage involves storing hydrogen gas in large geological formations such as salt caverns, depleted oil and gas fields, or aquifers, enabling the buffering of supply and demand in large-scale hydrogen energy systems. This method stabilizes hydrogen supply chains by offering long-duration energy storage solutions essential for decarbonized energy grids. Advancements in subsurface engineering and the repurposing of existing gas storage facilities further enhance underground hydrogen storage's commercial viability.

Underground hydrogen storage is primarily used to balance supply and demand in hydrogen energy systems and support large-scale hydrogen deployment. While smaller above-ground storage solutions exist, they are not economically viable for handling seasonal fluctuations or industrial-scale volumes. Therefore, geological formations like salt caverns, depleted oil and gas fields, and aquifers are increasingly utilized due to their high capacity and long-duration storage capabilities. Projects integrating underground hydrogen storage with green hydrogen production and fuel cell deployment, particularly in Europe, the United States, and Asia-Pacific countries like Japan and Australia, are gaining momentum. Supportive regulatory frameworks, national hydrogen strategies, and investment in hydrogen hubs are key factors driving the development of underground hydrogen storage infrastructure.

Drivers, Opportunities & Restraints

The global underground hydrogen storage market’s growth is driven by the accelerating adoption of hydrogen as a clean energy carrier and the urgent need for large-scale, long-duration energy storage solutions. As countries decarbonize their power, industrial, and transport sectors, underground storage offers a scalable way to manage seasonal imbalances in renewable energy supply. Its ability to safely and cost-effectively store vast volumes of hydrogen supports grid stability, industrial decarbonization, and energy security. Government-backed hydrogen roadmaps, net-zero targets, and funding initiatives across the U.S., Europe, and Asia Pacific further strengthen the business case for developing underground hydrogen infrastructure.

Emerging opportunities in the underground hydrogen storage industry include integrating underground storage into green hydrogen hubs, enabling centralized production, storage, and distribution. Advancements in subsurface engineering, monitoring technologies, and material science are improving the feasibility of using diverse geological formations like salt caverns, aquifers, and depleted gas fields. As hydrogen demand rises in mobility, steel, and ammonia production, underground storage becomes critical in ensuring a reliable supply chain. However, the market faces restraints such as high upfront costs, technical complexity in assessing suitable geological sites, and limited existing infrastructure. Regulatory uncertainties and the need for robust safety standards also present challenges, especially in early-adopter and emerging regions.

Storage Type Insights

Salt caverns emerged as a significant storage type segment in the underground hydrogen storage market with a volume share of more than 97.66% in 2024. It is further projected to be the fastest-growing segment during the assessment period. Salt caverns are preferred due to their excellent sealing capabilities, high cycling rates, and suitability for storing hydrogen at high pressures. The growing need for grid-scale energy storage to support renewable energy integration, combined with increasing hydrogen demand from sectors such as steel, mobility, and chemical processing, is driving the adoption of salt cavern storage. Countries like Germany, the U.S., and the Netherlands are actively developing pilot and commercial-scale projects using salt formations to create large, secure, and flexible hydrogen reserves.

The natural structure of salt caverns allows for relatively low-cost development compared to other geological formations and offers enhanced operational responsiveness. These caverns are particularly well-suited for seasonal or high-frequency cycling applications, making them ideal for balancing variable renewable energy sources like solar and wind. As green hydrogen production scales up, salt caverns will play a central role in enabling stable hydrogen supply chains for energy and industrial users. However, the global availability of suitable salt formations is limited, and site-specific geological assessments are essential. Despite this, their technical advantages and growing policy support make salt caverns the dominant and most promising segment in underground hydrogen storage.

Regional Insights

North America Underground hydrogen storage market is gaining momentum due to clean energy transition efforts and increasing investments in hydrogen production, especially in the United States and Canada. The U.S. Department of Energy's hydrogen hub program and Canada's national hydrogen strategy are driving the development of large-scale geological storage to support decarbonized industrial, transport, and power sectors. Repurposing existing gas storage infrastructure and abundant natural formations, such as salt domes in Texas and the Gulf states, provides technical and economic advantages. As hydrogen adoption scales, North America is poised to expand its underground storage capacity to meet growing regional demand.

Europe Underground Hydrogen Storage Market Trends

Europe held over 58.52% share of the global underground hydrogen storage market in 2024. The region leads underground hydrogen development, backed by ambitious decarbonization goals under the EU Green Deal and REPowerEU. Countries such as Germany, the Netherlands, France, and the UK are actively developing hydrogen valleys and pilot-scale salt cavern projects to create a resilient hydrogen backbone for industrial and energy use. Regulatory clarity, public-private partnerships, and funding from EU initiatives are accelerating underground storage deployment. Europe also benefits from mature gas infrastructure, advanced geological mapping, and strong OEM presence, reinforcing its role as a frontrunner in scaling and commercializing hydrogen storage technologies.

Asia Pacific Underground Hydrogen Storage Market Trends

Rising hydrogen demand from industrial decarbonization, mobility sectors, and national hydrogen strategies in China, Japan, Australia, and India is a major growth driver for the underground hydrogen storage industry. Regional governments prioritize clean hydrogen infrastructure to support energy security and climate goals, with salt caverns and depleted field projects under active exploration. Investments in renewable energy, coupled with favorable policies encouraging hydrogen storage and transport, further strengthen market growth. APAC's strong manufacturing ecosystem and growing pipeline of hydrogen production hubs position the region as a key player in global underground hydrogen infrastructure development.

Latin America Underground Hydrogen Storage Market Trends

The Latin American underground hydrogen storage industry is in early development, but growing momentum around renewable hydrogen production and regional energy diversification efforts is fueling interest. Countries like Chile and Brazil are exploring geological storage potential to complement large-scale green hydrogen projects driven by strong solar and wind resources. Underground storage is a key enabler to ensure a continuous hydrogen supply for export and domestic use. Though challenges such as infrastructure gaps and regulatory frameworks persist, supportive government policies and international collaboration are laying the groundwork for future growth in the region.

Middle East & Africa Underground Hydrogen Storage Market Trends

The Middle East and Africa (MEA) underground hydrogen storage industry is emerging as countries look to leverage their vast renewable and natural gas resources to build global-scale hydrogen economies. Nations like Algeria, the UAE, Oman, and South Africa are investing in green and blue hydrogen production, with underground storage identified as critical for supply reliability and export readiness. While geological assessment is ongoing, initial feasibility studies in salt formations and depleted fields offer promise. Government-backed energy diversification strategies, coupled with interest from international investors, are likely to drive underground hydrogen storage development across MEA in the coming years.

Key Underground Hydrogen Storage Company Insights

Some of the key players operating in the underground hydrogen storage industry include Air Liquide; Air Products and Chemicals, Inc.; Engie, Linde plc; and Texas Brine Company, LLC. These companies are actively engaged in developing large-scale underground hydrogen storage projects, particularly in salt caverns and depleted gas fields, to support the transition toward low-carbon energy systems.

Key Underground Hydrogen Storage Companies:

The following are the leading companies in the underground hydrogen storage market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide

- Air Products and Chemicals, Inc.

- Engie

- Linde plc

- Texas Brine Company, LLC

- Uniper SE

- WSP

Recent Developments

- In March 2025, Air Liquide announced a partnership with a European energy consortium to develop one of the continent’s largest underground hydrogen storage facilities in a salt cavern located in northern Germany. The project aims to secure renewable hydrogen supply for industrial users and mobility applications, supporting the region’s energy independence goals. This development highlights Air Liquide’s strategic commitment to scaling infrastructure along the hydrogen value chain and reinforces its role in enabling long-duration, low-carbon storage solutions in Europe.

Underground Hydrogen Storage Market Report Scope

Report Attribute

Details

Market demand volume in 2025

3,082.78 MCM

Volume forecast in 2033

6,249.05 MCM

Growth rate

CAGR of 9.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in MCM, and CAGR from 2025 to 2033

Report coverage

Volume forecast, competitive landscape, growth factors, and trends

Segments covered

Storage type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; Brazil; Mexico; Algeria; Egypt; Libya; UAE

Key companies profiled

Air Liquide; Air Products and Chemicals, Inc.; Engie; Linde plc; Texas Brine Company, LLC; Uniper SE; WSP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Underground Hydrogen Storage Market Report Segmentation

This report forecasts volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global underground hydrogen storage market report based on storage type, and region:

-

Storage Type Outlook (Volume, MCM, 2021 - 2033)

-

Porous Media Storage

-

Salt Caverns

-

Engineered Cavities

-

-

Regional Outlook (Volume, MCM, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Algeria

-

Egypt

-

Libya

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global Underground Hydrogen Storage market size was estimated at 2780.67 MCM in 2024 and is expected to reach 3082.78 MCM in 2025.

b. The global Underground Hydrogen Storage market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2033 to reach 6249.05 MCM by 2033.

b. Based on the Storage Type segment, Salt Caverns held the largest share of more than 97.66% in 2024, owing to their superior geological properties, cost-effectiveness, and proven performance in high-pressure gas storage applications.

b. Some of the key vendors of the global Underground Hydrogen Storage market include Air Liquide, Air Products and Chemicals, Inc., Engie, Linde plc, and Texas Brine Company, LLC, among others.

b. The key factors driving the underground hydrogen storage market include the accelerating shift toward low-carbon energy systems and the increasing adoption of green hydrogen. As countries expand solar and wind power capacity, the need for large-scale, long-duration energy storage is growing to balance supply and demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.