- Home

- »

- Medical Imaging

- »

-

U.S. 3D Medical Imaging Devices Market Size Report, 2030GVR Report cover

![U.S. 3D Medical Imaging Devices Market Size, Share, & Trends Report]()

U.S. 3D Medical Imaging Devices Market (2025 - 2030) Size, Share, & Trends Analysis Report By Device Type (Hardware, Software), By Hardware, By Application (Oncology, Cardiology), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-638-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

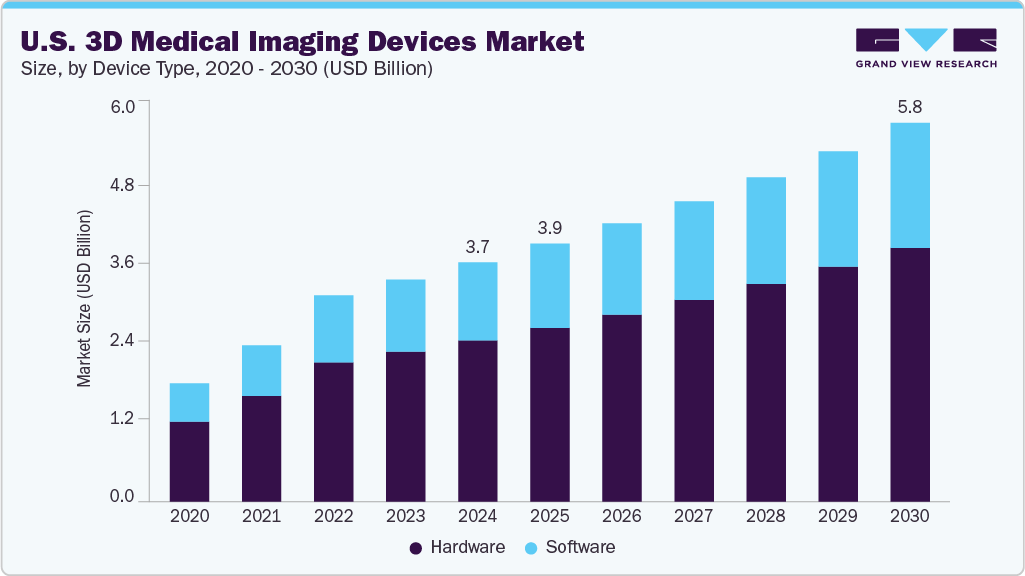

The U.S. 3D medical imaging devices market size was valued at USD 3.69 billion in 2024 and is projected to grow at a CAGR of 8.0% from 2025 to 2030. The rising prevalence of chronic disorders, an increasing preference for minimally invasive procedures, technological advancements, and the growing aging population are the major factors contributing to the growth of the U.S. 3D medical imaging devices industry. The growing prevalence of chronic disorders, such as Cardiovascular Disorders (CVDs), cancer, and neurological conditions, further contributes to market growth. According to data on cancer published by the U.S. Centers for Disease Control and Prevention (CDC), 1,777,566 new invasive cancer cases were reported in 2021, with an age-adjusted rate of 445.8 per 100,000 people. These conditions often require precise and detailed imaging for early detection, diagnosis, and treatment planning. Medical 3D imaging technologies, such as MRI and CT scans, offer healthcare professionals three-dimensional views of anatomical structures and abnormalities, supporting better decision-making and enhancing patient care.

The evolution of 3D medical imaging has improved its efficiency, providing healthcare professionals with better tools for accurate diagnosis and treatment planning. These technologies allow for detailed visualization of anatomical structures, aiding in detecting and managing complex conditions. Furthermore, continuous advancements, such as improved imaging quality, integration of AI, and enhanced device capabilities, further support market growth.

The growing preference for minimally invasive procedures further drives the adoption of 3D imaging technologies in surgical and interventional settings. These advanced imaging devices provide detailed and accurate visualization of complex anatomical structures, enabling surgeons and interventional radiologists to plan procedures more effectively. 3D images enable them to navigate challenging areas more precisely, ensuring that treatment is accurately targeted while minimizing damage to surrounding tissues. This approach helps enhance the safety and efficacy of procedures, enables quicker recovery, reduces risks of complications, and improves overall patient outcomes.

Market Concentration & Characteristics

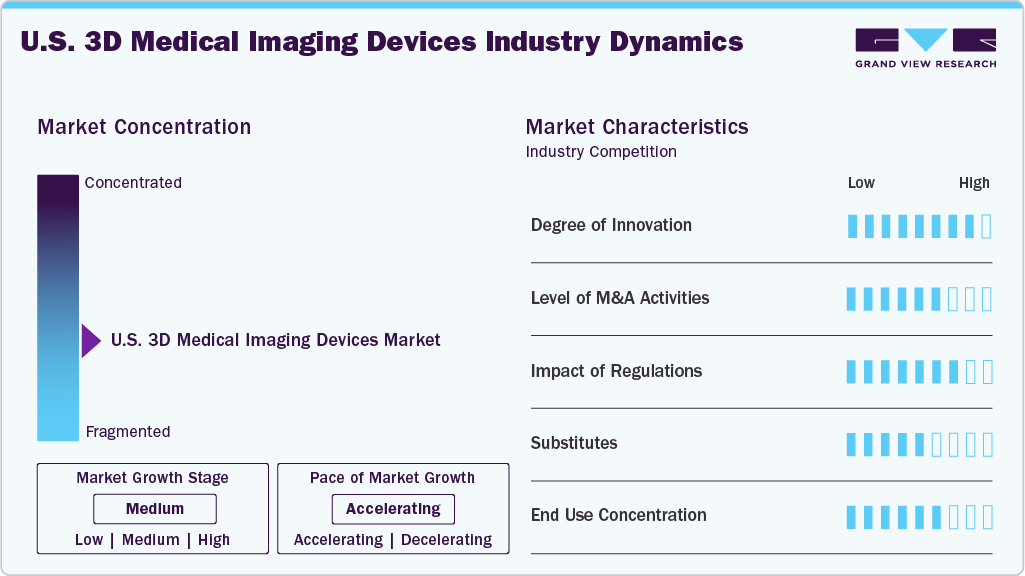

The market growth stage is medium, and the pace of growth is accelerating. The U.S. 3D medical imaging devices market exhibits a high degree of innovation, driven by continuous advancements in imaging technologies such as AI integration, enhanced image resolution, and portable imaging solutions. Companies invest heavily in R&D to develop more accurate, faster, and less invasive imaging devices. For example, in December 2024, Canon Medical Systems USA expanded its AI-powered CT imaging solutions, including remote assistance and workflow automation tools.

Merger & Acquisition (M&A) in this market is moderate, with key players acquiring niche technology firms or startups to expand their product portfolios and technological capabilities. In July 2024, GE HealthCare agreed to acquire Intelligent Ultrasound’s AI software business for USD 51 million. The acquisition enhanced GE’s ultrasound portfolio with real-time AI technology to improve scan accuracy and workflow.

Regulatory impact is considerable, given the stringent FDA approvals and compliance requirements for medical devices in the U.S. These regulations ensure patient safety and efficacy but can also slow down product launches and increase development costs.

Device Type Insights

The hardware segment dominated the market with a 67.4% share in 2024. Hardware components are essential to any medical imaging device, serving as the foundation for technologies like MRI machines, CT scanners, and ultrasound devices. These essential components play a significant role in medical imaging, and healthcare institutions invest in hardware to ensure optimal patient outcomes.

The software segment is expected to grow at the fastest CAGR of 8.2% over the forecast period. Software improves the quality and functionality of images produced by hardware devices such as MRI, CT scanners, and ultrasound machines. These software solutions utilize advanced algorithms and image processing techniques to create detailed 3D reconstructions, enhance image contrast, and eliminate noise. In December 2024, GE HealthCare launched Sonic DL for 3D, a technology that accelerates MRI scans by up to 86% and improves image resolution. This technology aims to enhance diagnostics and reduce clinician workload.

Hardware Insights

The ultrasound systems segment dominated the market in 2024. This growth is driven by several factors, such as advancements in imaging technology, which have enhanced the quality and accuracy of diagnostic images, making ultrasound devices a preferred choice for many healthcare providers. Due to their safety, portability, and real-time imaging capabilities, ultrasound systems are widely used for various applications, including cardiology, musculoskeletal imaging, obstetrics and gynecology, and emergency care, especially for women. In November 2023, Boston Imaging, the U.S. headquarters of Samsung’s digital radiography and ultrasound division, launched the V6 ultrasound system. The FDA-cleared device delivers advanced 2D, 3D, and color imaging specifically designed for Women’s Health and Urology.

X-ray devices segment is projected to grow at the fastest CAGR over the forecast period. X-ray technology remains essential for various clinical applications, including image-guided surgical procedures, especially with interventional systems like C-arms that provide real-time imaging during operations. The rising incidence of chronic diseases such as cancer, CVDs, and orthopedic injuries also increases the demand for precise and timely diagnostic imaging. In addition, technological advancements such as digital radiography, flat panel detectors, and mini C-arms have improved image quality and usability, making X-ray devices more effective and accessible, even in rural healthcare settings.

Application Insights

The oncology segment dominated the U.S. 3D medical imaging devices industry in 2024. The rising incidence of cancer in the U.S. has increased the demand for advanced diagnostic and treatment tools. 3D medical imaging devices such as CT, MRI, and PET-CT scanners play a vital role in oncology by providing detailed and accurate images of tumors and surrounding tissues. These technologies are essential for cancer diagnosis, staging, treatment planning, and ongoing monitoring, making them crucial for effective cancer patient management.

The cardiology segment is expected to experience the fastest CAGR of 8.3% during the forecast period. As cardiac interventions, including catheter-based procedures, minimally invasive surgeries, and structural heart treatments, become more complex, cardiologists need detailed 3D images of the heart and its blood vessels to plan and guide these procedures effectively.

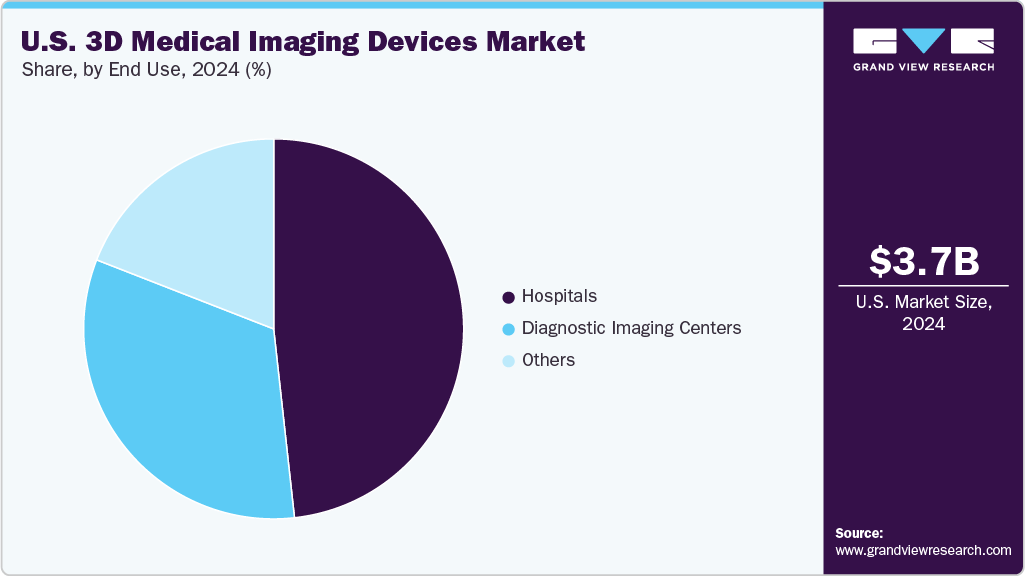

End Use Insights

Hospitals dominated the market in 2024. Hospitals are major end users of 3D medical imaging devices and offer various diagnostic, therapeutic, and surgical services. These devices are crucial for diagnosing and monitoring multiple medical conditions, including cancer, cardiovascular, orthopedic, and neurological disorders, enabling hospitals to provide comprehensive healthcare services. Strategic partnerships between hospitals and health technology companies drive this growth by enabling the adoption of innovative imaging solutions, optimizing clinical workflows, and enhancing cost-effectiveness, as seen in collaborations involving major players like GE HealthCare and Siemens Healthineers. For instance, in September 2023, Mayo Clinic and GE HealthCare formed a strategic partnership to advance medical imaging and theranostics using AI and innovative technologies to improve patient care.

The diagnostic imaging centers segment is projected to witness the fastest CAGR during the forecast period. Diagnostic imaging centers offer faster appointments and shorter wait times than hospitals, making them especially appealing for patients requiring non-emergency imaging, such as routine screenings, preventive check-ups, and follow-up exams. With healthcare increasingly emphasizing efficiency and convenience, these centers are well-positioned to meet patient needs. Often serving as disease detection hubs, they provide physicians with timely results that aid diagnosis and treatment. As awareness increases and technology advances, this segment is expected to grow significantly.

Key U.S. 3D Medical Imaging Devices Market Company Insights:

Some key companies in the U.S. 3D medical imaging devices industry include Siemens Healthineers AG, Esaote SPA, Koninklijke Philips N.V., and GE Healthcare. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are undertaking several strategic initiatives, such as mergers & acquisitions and partnerships with other major companies.

-

Siemens Healthineers AG is a global healthcare technology company specializing in innovative medical solutions. It is a major provider of 3D medical imaging devices and offers a range of advanced solutions for hospitals and clinics, such as CT, MRI, and others.

-

GE HealthCare is a global health technology company that focuses on delivering advanced medical technology, digital solutions, and pharmaceutical diagnostics. It is also a provider of 3D medical imaging devices, offering a wide range of products and solutions such as 3D Imaging (OEC 3D C-arm), MRI, CT, and more.

Key U.S. 3D Medical Imaging Devices Companies:

- Siemens Healthineers AG

- Esaote SPA

- Koninklijke Philips N.V.

- GE Healthcare

- CANON MEDICAL SYSTEMS CORPORATION

- Hitachi High-Tech Corporation

- Shimadzu Corporation

- DigiRad Corporation

- UMG/DEL MEDICAL

Recent Developments

-

In May 2025, GE HealthCare launched CleaRecon DL, an AI-powered deep-learning technology designed to improve Cone-Beam CT (CBCT) image quality by removing streak artifacts caused by blood flow pulsatility. The solution received U.S. FDA 510(k) clearance and CE marking and is available on the Allia platform.

-

In March 2025, GE HealthCare announced expanding its collaboration with NVIDIA at the GTC conference in San Jose, California, focusing on autonomous X‑ray and ultrasound systems. The partnership aimed to address radiology staff shortages by using NVIDIA’s Isaac platform for virtual training and testing.

-

In February 2025, Stratasys and Siemens Healthineers introduced patient-specific 3D-printed phantoms to improve CT imaging and AI training, enhancing diagnostic accuracy and surgical planning. The partnership integrates Stratasys’ RadioMatrix materials and Digital Anatomy 3D‑printing technology with Siemens Healthineers’ CT imaging algorithms to create anatomically accurate, patient-specific phantoms

-

In January 2025, Siemens Healthineers announced the first U.S. installation of the Mammomat B. brilliant mammography system at GRACE Breast Imaging & Medical Spa in Iowa. The system features advanced 3D image acquisition and the fastest 50-degree tomosynthesis scan in under 5 seconds.

U.S. 3D Medical Imaging Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.97 billion

Revenue forecast in 2030

USD 5.84 billion

Growth Rate

CAGR of 8.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, hardware, application, and end use

Key companies profiled

Siemens Healthineers AG; Esaote SPA; Koninklijke Philips N.V.; GE Healthcare; CANON MEDICAL SYSTEMS CORPORATION; Hitachi High-Tech Corporation; Shimadzu Corporation; DigiRad Corporation; UMG/DEL MEDICAL.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. 3D Medical Imaging Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. 3D medical imaging devices market report based on device type, hardware, application, and end use.

-

Device Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

-

Hardware Outlook (Revenue, USD Billion, 2018 - 2030)

-

X-ray Devices

-

CT Devices

-

Ultrasound Systems

-

MRI Equipment

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Cardiology

-

Orthopedic

-

Gynaecology

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.