- Home

- »

- Beauty & Personal Care

- »

-

U.S. Bath Salts Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Bath Salts Market Size, Share & Trends Report]()

U.S. Bath Salts Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Epsom Salt, Dead Sea Salt, Himalayan Salt, Bolivian Salt), By End-use (Residential, Commercial), By Distribution Channel (Offline Channels, Online/ E-commerce), And Segment Forecasts

- Report ID: GVR-4-68040-624-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2025 - 2033

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bath Salts Market Size & Trends

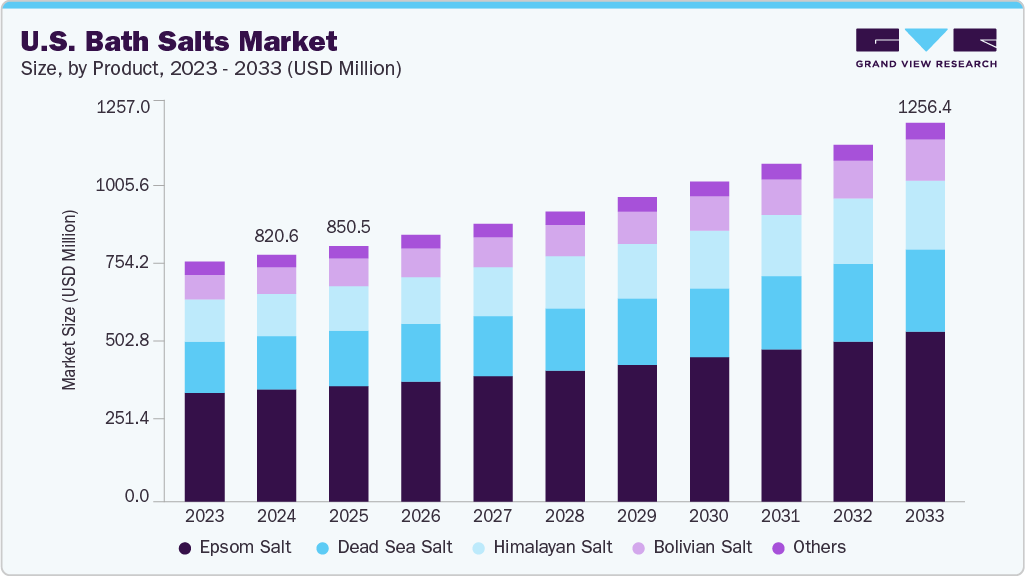

The U.S. bath salts market size was estimated at USD 820.6 million in 2024 and is expected to grow at a CAGR of 5.0% from 2025 to 2033. In today’s marketplace, bath salts are valued not only for their traditional therapeutic benefits, such as muscle relaxation, skin conditioning, and stress relief, but also for elevating at-home rituals. U.S. consumers clearly prefer products that combine efficacy with emotional and sensory appeal, transforming a routine bath into a curated, mindful experience.

This evolution mirrors wider trends across beauty and wellness categories, where consumers seek products that align with their values and lifestyle aspirations. One of the most notable shifts is the rise of premium and artisanal bath salts. Products formulated with natural mineral content, such as Dead Sea salt, Himalayan pink salt, and Epsom salt enriched with botanical oils and aromatherapeutic fragrances, are increasingly sought after. U.S. consumers, particularly younger demographics, gravitate toward bath salts that promise functional results and indulgent experiences. Products priced between USD 12 and USD 25 are gaining traction, signaling a willingness to pay a premium for quality, provenance, and brand storytelling.

Social and cultural trends are accelerating this shift. The growing emphasis on self-care, driven by rising mental health awareness and changing work-life dynamics, has repositioned bath time as a moment of personal restoration. The COVID-19 pandemic further amplified this dynamic as consumers sought to replicate spa-like experiences at home, a behavior that continues to influence purchasing patterns today.

Leading brands are actively responding to this demand. Dr Teal’s remains a dominant player at scale, continuously innovating with new blends that target specific consumer needs such as sleep support, immune boosting, or stress relief by adding essential oils and natural extracts. Meanwhile, boutique and indie brands such as Herbivore Botanicals, Pursoma, and Bathorium are capturing the attention of the premium market with clean formulations, sustainable sourcing, and minimalist, design-forward packaging that appeals to millennial and Gen Z audiences.

E-commerce has emerged as a key market growth driver. Digital channels provide an ideal platform for brands to educate consumers, build brand narratives, and engage wellness communities. Social media platforms, particularly Instagram, TikTok, and Pinterest, play an influential role in shaping trends, with curated bath rituals and aesthetic-driven content inspiring consumers to experiment with new products and formats. As a result, DTC (direct-to-consumer) brands and online-first product launches are becoming increasingly common in this space.

Furthermore, offline retail channels continue to evolve. Specialty beauty retailers, such as Sephora and Ulta Beauty, are expanding their bath and body assortments to cater to wellness-driven consumers. Premium bath salts are also finding new entry points through gift shops, boutique wellness stores, and curated lifestyle retailers, where they are positioned as everyday indulgences and thoughtful gifts.

In addition, many consumers view bath salts as a desirable and affordable luxury that lends itself well to occasions such as birthdays, holidays, and corporate wellness programs. Brands are capitalizing on this trend by offering elegant gift packaging and curated sets that elevate bath salts from personal care products to premium lifestyle accessories.

Sustainability is also shaping market dynamics. U.S. consumers are increasingly conscious of packaging, ingredient sourcing, and ethical production. Brands that communicate strong sustainability credentials through biodegradable packaging, transparent supply chains, and cruelty-free claims are gaining a competitive advantage, particularly among younger, values-driven buyers.

Consumer Insights

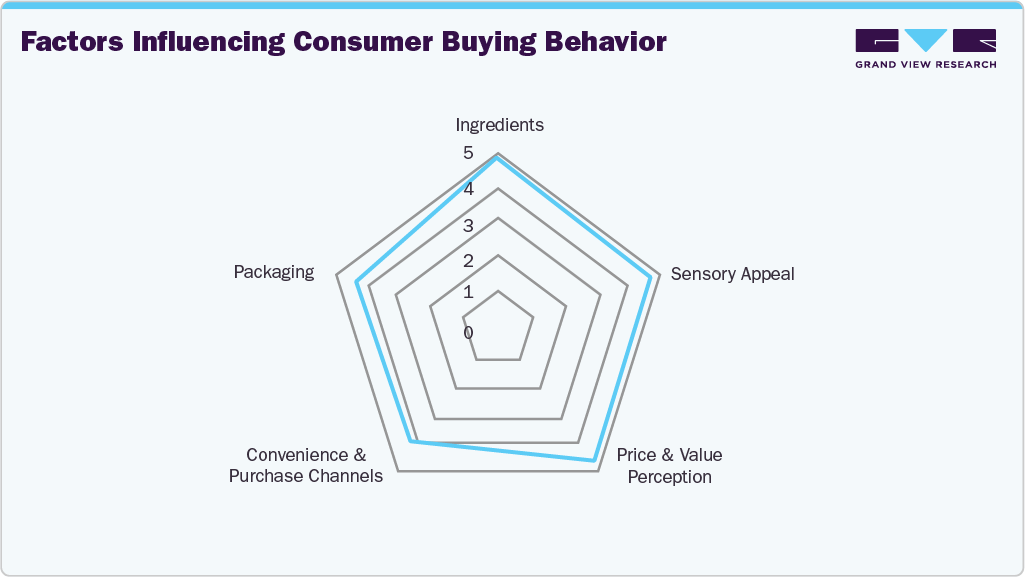

Consumer trends within the U.S. market reveal a strong demand for natural, clean-label, and functional products. Shoppers are becoming more ingredient-conscious, favoring bath salts free from parabens, sulfates, artificial colors, and synthetic fragrances. Epsom salt remains widely favored due to its recognized muscle relaxation and stress reduction benefits. In contrast, Dead Sea salts are prized for their mineral content and skincare advantages. In addition, the market is seeing increased interest in infused bath salts products enriched with essential oils, botanical extracts, or cannabidiol (CBD) that promise enhanced aromatherapy effects and holistic well-being. The trend toward sustainability and ethical sourcing also shapes buying preferences; consumers are drawn to brands offering eco-friendly packaging, cruelty-free certifications, and transparent supply chains. Furthermore, the rise of premiumization is notable: a growing segment of consumers is willing to invest in higher-end bath salts that deliver a luxurious, spa-like experience at home.

Consumers expect bath salts to deliver tangible outcomes, such as relieving muscle tension, soothing skin, improving sleep, and reducing stress levels. Sensory appeal also plays a critical role; pleasant scents and visually appealing packaging often serve as emotional triggers that drive impulse purchases, especially in online retail environments. Brand trust and transparency have become increasingly important, with shoppers favoring companies communicate ingredient sourcing, product benefits, and sustainability commitments. The power of social proof via customer reviews, ratings, and social media endorsements is another influential factor, as many consumers rely on digital communities to validate their product choices.

Convenience and availability continue to shape the journey of purchasing bath salts. Online channels, particularly e-commerce platforms such as Amazon, Walmart.com, and specialty beauty retailers, are gaining ground as preferred shopping destinations. The online space offers broader product variety, competitive pricing, and the convenience of home delivery, which today’s time-conscious consumers highly value. At the same time, brick-and-mortar retail remains important, especially in specialty beauty and wellness stores, where consumers can engage in sensory testing of fragrances and textures before making a purchase.

Product Insights

Epsom salt accounted for a revenue share of 45.27% in the year 2024 in the U.S. bath salts industry, due to its widespread recognition as a natural remedy for muscle aches and overall relaxation. Its proven effectiveness in aiding recovery after physical activity has made it a go-to product for athletes and everyday consumers alike. Moreover, its cost-effectiveness and ease of use have contributed to strong consumer preference. The growing trend towards wellness and self-care has further boosted demand, as more people incorporate Epsom salt baths into their routines to relieve stress and improve skin health, solidifying its leading position in the industry.

Himalayan salts are projected to grow at a CAGR of 5.5% over the forecast period of 2025-2033. Known for their distinctive pink hue and rich mineral content, these salts are perceived as a healthier and more luxurious alternative to conventional bath salts. The rising popularity of holistic health practices and the expanding spa and beauty industries drive interest in Himalayan salt products for their exfoliating, detoxifying, and therapeutic properties.

Distribution Channel Insights

Offline sales for bath salts in the U.S. accounted for a revenue share of 64.18% in 2024. Many buyers value the ability to see, touch, and smell products before purchase, which is especially important for bath salts, which often come with unique scents and textures. Furthermore, established retail channels such as supermarkets, specialty beauty stores, and pharmacies provide convenient access and trusted environments, encouraging repeat purchases.

Online sales for bath salts in the U.S. are projected to grow at a CAGR of 5.3% over the forecast period of 2025-2033. Consumers are increasingly turning to online platforms to access a broader selection of bath salts, including specialty and organic options that may not be readily available in physical stores. The ability to easily compare brands, read user reviews, and take advantage of discounts and fast home delivery has made e-commerce particularly appealing. Furthermore, the growth of online health and wellness communities, alongside influencer endorsements, drives consumer interest and boosts online purchases in this category across the country.

End-use Insights

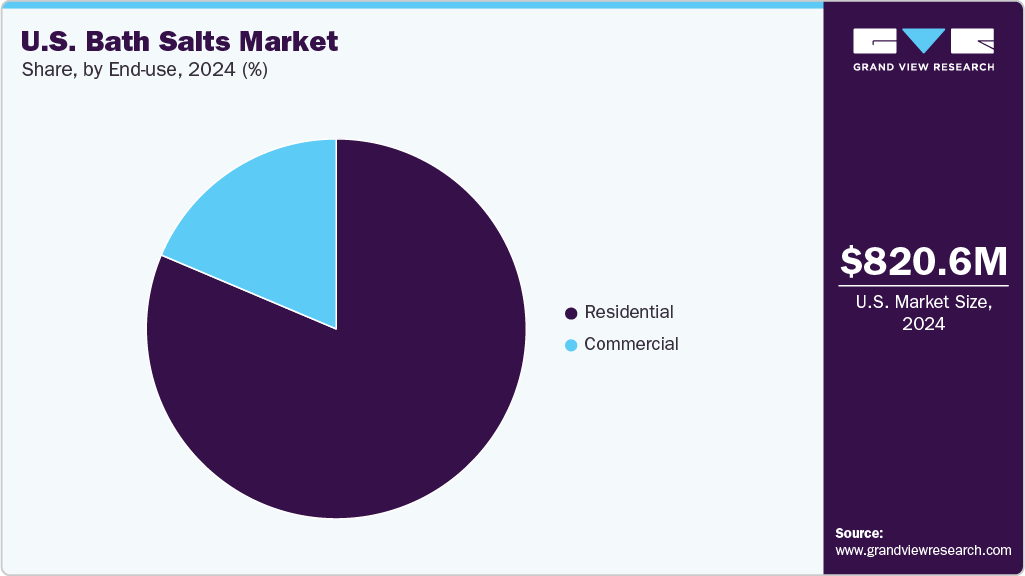

Residential end use of bath salts in the U.S. accounted for a revenue share of 81.36% in the year 2024. Bath salts are widely used by individuals seeking relaxation, stress relief, and skin care within the comfort of their own homes. The rise in awareness about mental health and holistic well-being has encouraged more people to incorporate bath salts into their daily or weekly rituals. In addition, the convenience and privacy offered by home use and the growing popularity of DIY spa treatments have significantly contributed to the industry's dominance of the residential end-use category.

Commercial end use of bath salts in the U.S. is projected to grow at a CAGR of 5.8% over the forecast period of 2025-2033. Spas, hotels, and wellness centers increasingly incorporate bath salts into their services to enhance customer experience through relaxation and treatments. Rising consumer demand for premium self-care experiences has encouraged businesses to offer specialized bath salt products as part of their packages. Furthermore, growing investments in luxury wellness facilities and the trend toward holistic health practices fuel demand in commercial settings, making this segment one of the fastest-growing areas within the bath salts industry.

Key U.S. Bath Salts Company Insights

The U.S. bath salts industry is driven by a combination of well-established brands and innovative newcomers, creating a vibrant and competitive environment. Leading companies prioritize product quality, unique formulations, and natural ingredients to meet growing consumer demand for wellness, relaxation, and skin care benefits. These brands cultivate strong partnerships with major retail outlets and specialty stores and expand online platforms to maximize product availability and consumer engagement. Many U.S. bath salt manufacturers also embrace sustainable sourcing, eco-friendly packaging, and customizable blends to appeal to health-conscious and environmentally aware buyers. This focus on innovation and adaptability allows them to cater to both broad consumer bases and niche segments while staying responsive to emerging self-care and holistic wellness trends across domestic and global markets.

Key U.S. Bath Salts Companies:

- Basin

- The Seaweed Bath Co.

- Parfums de Coeur, Ltd.

- SAN FRANCISCO SALT CO

- Enviromedica.

- Bathorium.

- The Midwest Sea Salt Company Inc.

- Better Bath Better Body LLC

- Yareli Bath & Beauty.

- SaltWorks

Recent Developments

-

In January 2024, White Egret Personal Care expanded its product range by introducing two new Epsom salt varieties. The Recovery Epsom Salt blend features organic peppermint and eucalyptus oils designed to ease muscle tension and refresh the skin. At the same time, the Skin Therapy Epsom Salt combines coconut oil and lime essential oil to promote hydration and a more radiant complexion. Both products use high-quality magnesium sulfate sourced from ancient Utah salt deposits, reflecting the brand’s focus on natural, mineral-rich formulations that support overall wellness.

-

In May 2023, Natural Grocers added four new scented options to its Epsom salt baths and foot soaks, enhancing its in-house wellness offerings. The new Peppermint, Lavender, Tea Tree, and Eucalyptus varieties are crafted with premium magnesium sulfate and pure essential oils. They are cruelty-free and are formulated without synthetic fragrances, artificial dyes, parabens, or phthalates. Available in convenient 64-ounce resealable pouches, these additions reflect the company’s commitment to providing natural and affordable self-care products.

U.S. Bath Salts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 850.5 million

Revenue forecast in 2033

USD 1,256.4 million

Growth rate

CAGR of 5.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end-use

Country scope

U.S.

Key companies profiled

Basin; The Seaweed Bath Co.; Parfums de Coeur, Ltd.; SAN FRANCISCO SALT CO; Enviromedica.; Bathorium.; The Midwest Sea Salt Company Inc.; Better Bath Better Body LLC; Yareli Bath & Beauty.; SaltWorks

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bath Salts Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. bath salts market report based on product, distribution channel, and end-use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Epsom Salt

-

Dead Sea Salt

-

Himalayan Salt

-

Bolivian Salt

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline Channels

-

Supermarkets/Hypermarkets

-

Specialty Stores (beauty/wellness shops)

-

Pharmacies/Drug Stores

-

-

Online/ E-commerce

-

- End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. bath salts market was estimated at USD 820.6 million in 2024 and is expected to reach USD 850.5 million in 2025.

b. The U.S. bath salts market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 1256.4 million by 2033.

b. Epsom salt accounted for a revenue share of 45.27% in the year 2024 in the U.S. bath salts industry. This dominance is attributed to its widespread use for muscle relaxation and therapeutic bathing.

b. Some of the key players operating in the U.S. bath salts market include Basin, The Seaweed Bath Co., Parfums de Coeur, Ltd., SAN FRANCISCO SALT CO, Enviromedica., Bathorium. , The Midwest Sea Salt Company Inc., Better Bath Better Body LLC, Yareli Bath & Beauty., SaltWorks

b. Growth of the U.S. bath salts market is primarily driven by a surging demand for relaxation and wellness products as consumers increasingly embrace at-home self-care routines and seek stress relief through aromatherapy and therapeutic bathing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.