- Home

- »

- Consumer F&B

- »

-

U.S. Brain Health Supplements Market Size Report, 2030GVR Report cover

![U.S. Brain Health Supplements Market Size, Share & Trends Report]()

U.S. Brain Health Supplements Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Natural Molecules, Herbal Extract, Vitamins & Minerals), By Form (Capsules, Tablets, Softgels, Powders, Gummies), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-203-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Brain Health Supplements Market Summary

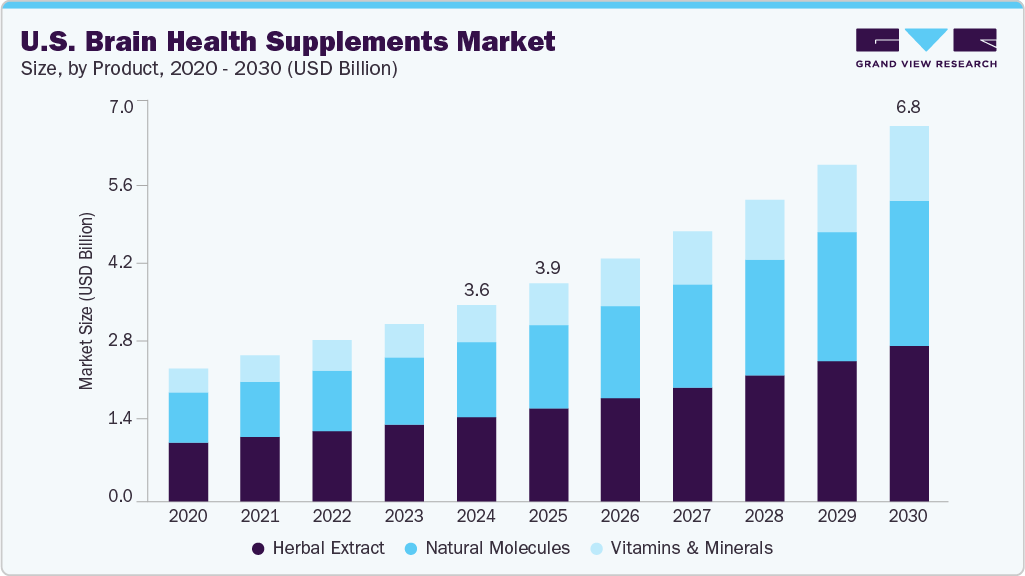

The U.S. brain health supplements market size was valued at USD 3.56 billion in 2024 and is projected to reach USD 6.80 billion by 2030, growing at a CAGR of 11.5% from 2025 to 2030. The growth is driven by rising concern about maintaining cognitive performance over time.

Key Market Trends & Insights

- By product, the herbal extract segment accounted for a market share of 43.0% in 2024.

- By form, the capsules segment accounted for a market share of 34.4% in 2024.

- By application, the memory enhancement segment dominated the market with a revenue share of 24.9% in 2024.

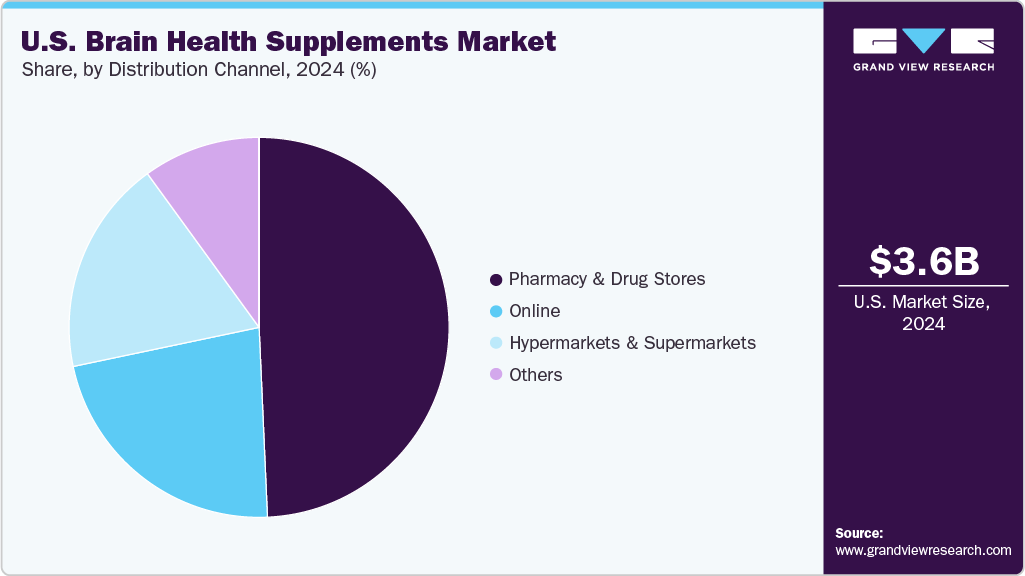

- By distribution channel, the pharmacy & drug stores segment dominated the market with a market share of 49.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.56 Billion

- 2030 Projected Market Size: USD 6.80 Billion

- CAGR (2025-2030): 11.5%

The increasing demand for the product among younger consumers, who seek supplements that enhance focus, concentration, and cognitive performance to support productivity, is expected to drive market demand. The rising prevalence of mental illness and increasing awareness of wellness are driving the growth of the U.S. brain health supplements industry. For instance, according to a report published by NAMI, in 2024, nearly 1 in 5 U.S. adults, about 61.5 million people, experienced some form of mental illness. Among them, around 14.6 million adults, or 5.6%, faced serious mental illness, equivalent to 1 in 20 adults. With mental health receiving greater attention both from consumers and health professionals, people are more likely to look for non-prescription, preventive options such as health supplements. Stress, fatigue, and cognitive load from work, digital lifestyles, and daily pressures push people toward products that promise mood support, memory enhancement, or improved concentration.Innovation in product formulations and delivery methods is also a key market driver. Companies invest in advanced combinations of vitamins, minerals, herbal extracts, and nootropics to differentiate their products. Convenient formats such as gummies, powders, and ready-to-drink beverages cater to busy lifestyles, making supplementation easier to incorporate into daily routines. Product innovation enhances perceived efficacy and consumer appeal, boosting market adoption.

Marketing and awareness campaigns play a pivotal role in shaping consumer behavior. Educational content, social media influence, and partnerships with health professionals help raise awareness of the benefits of brain health supplements. Messaging that emphasizes mental clarity, focus, and memory preservation resonates with consumers navigating demanding work schedules, academic commitments, and digitally connected lifestyles.

Product Insights

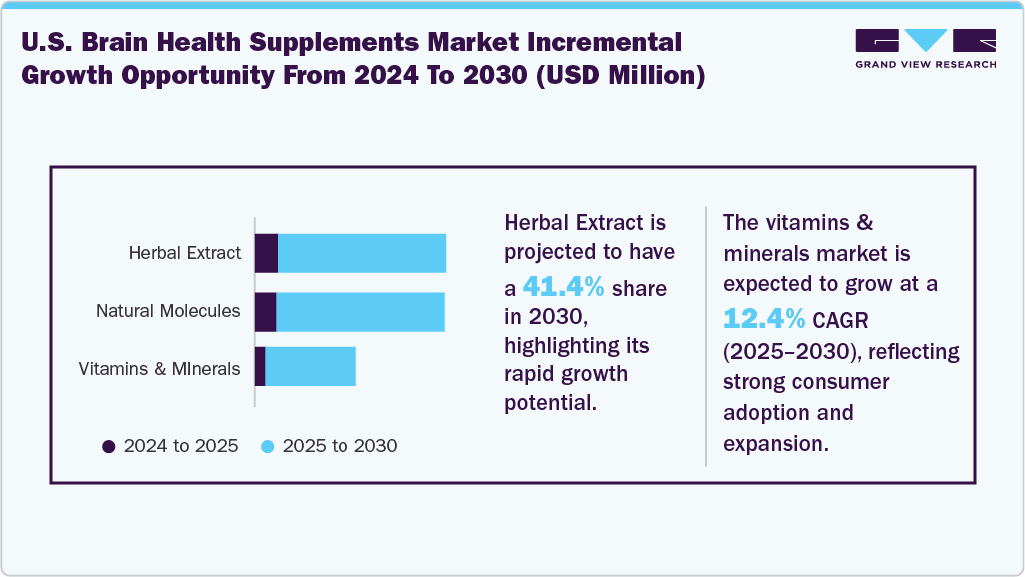

The herbal extract segment accounted for the largest market share of 43.0% in 2024. The demand for the segment is driven by growing consumer preference for natural and clean-label products. In addition, product innovation, convenient formats, and clear scientific or traditional backing for herbal ingredients boost consumer confidence and adoption, making herbal extracts a preferred choice in health supplements. According to a report published by NIH in February 2024, Ginseng, a traditional herbal remedy, is increasingly recognized for its potential to support cognitive health and slow age-related memory decline. Research shows that long-term ginseng consumption may reduce mortality and improve cognitive function, including in individuals with mild cognitive impairment, early Alzheimer’s disease, or subjective memory issues. Clinical studies suggest that ginseng extracts can improve working memory and overall brain function, and may also enhance the effectiveness of existing Alzheimer’s medications.

The vitamins & minerals segment is projected to grow at the fastest CAGR of 12.4% from 2025 to 2030. The market is driven by trends in personalized nutrition, as consumers seek specific nutrients to support focus, memory, and mood. Rising health consciousness among consumers is pushing demand for these supplements as people increasingly seek to support their immune health, energy levels, and overall wellness. The increasing aging population with age-related health needs is expected to drive the demand for the segment.

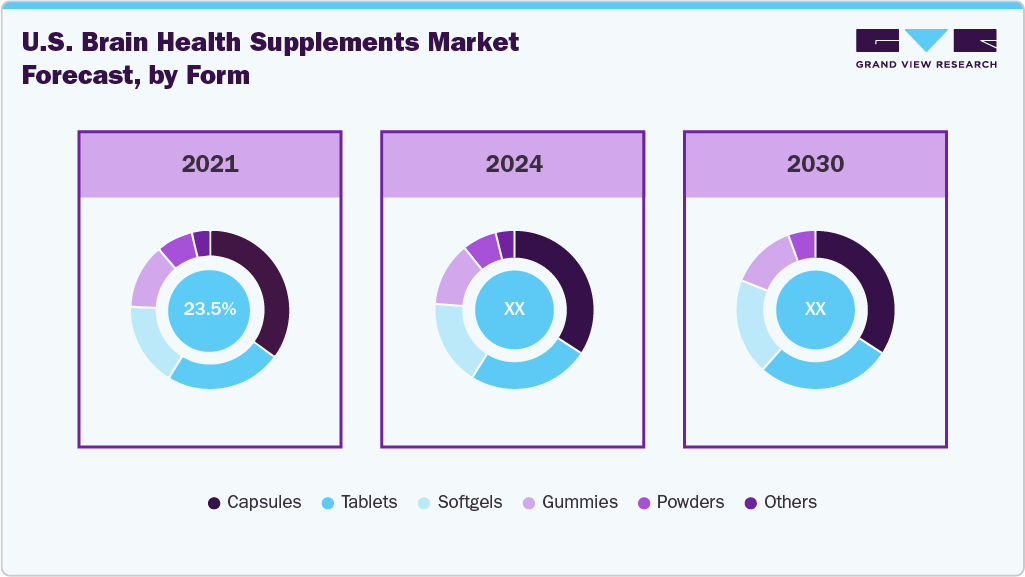

Form Insights

The capsules segment accounted for the largest share, 34.4% of the revenue, in 2024. The consumer preference for convenience, precise dosing, and ease of consumption is driving the demand for the product in the market. Capsules are portable, travel-friendly, and allow for consistent intake of active ingredients, which appeals to busy professionals and health-conscious individuals. In addition, capsules can mask the taste of strong or bitter ingredients, thereby improving the user experience, while manufacturers benefit from lower production costs and a longer shelf life. These factors collectively make capsules the preferred format in the industry.

The softgels segment is anticipated to grow at the fastest CAGR of 13.4% from 2025 to 2030. The demand for the segment is expected to rise due to its rapid absorption and smoother swallowing experience compared with tablets or capsules. Consumers perceive soft gels as more convenient and easier to digest, particularly for busy adults and older individuals. The growing demand for convenient, safe, and science-backed softgel supplements to support memory and focus is attracting manufacturers to invest in such products. In October 2025, HelthJin Biotech launched JOURTHON Brain Health Softgel in the U.S., targeting professionals, entrepreneurs, and parents experiencing memory lapses, poor concentration, and mental fatigue. The supplement is designed to support memory, focus, and long-term brain health, using ingredients recognized as safe by the U.S. FDA, combining proven effectiveness with daily safety.

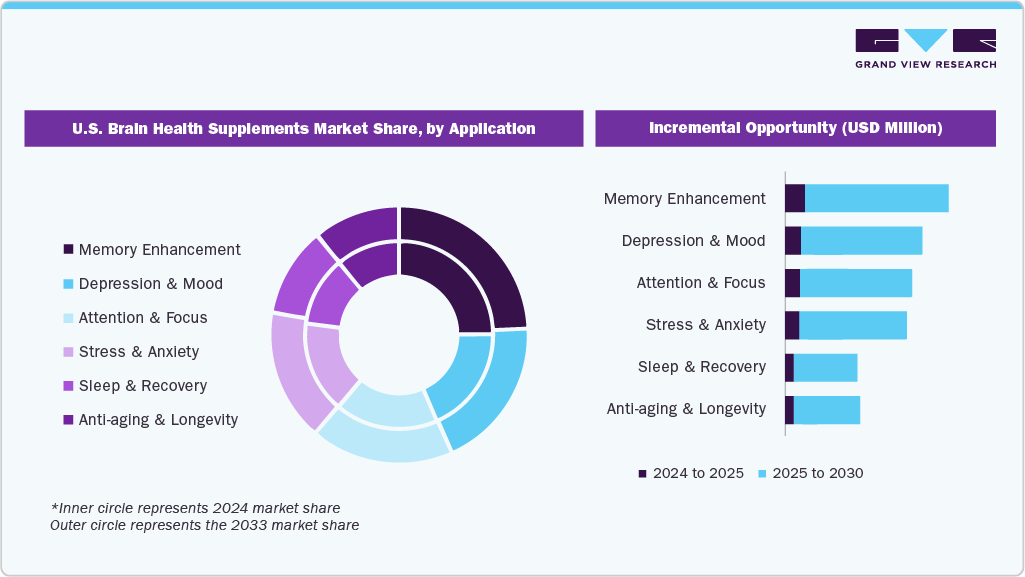

Application Insights

The memory enhancement segment accounted for the largest share, 24.9%, in 2024. The growth of the segment is driven by increasing cognitive demands from work, study, and digitally connected lifestyles. Consumers seek solutions to improve focus, recall, and overall mental performance, particularly among busy professionals, students, and older adults concerned about age-related cognitive decline. Growing awareness of mental wellness, preventive healthcare, and scientifically backed ingredients further drives the growth of the market. In addition, the trend toward proactive self-care and the desire for convenient, effective supplements have made memory enhancement products a key growth segment in the market. In September 2025, Apex Performance Life launched LucidFlow, a science-backed cognitive supplement to reduce brain fog and enhance mental clarity. Designed for knowledge workers, academics, and professionals, LucidFlow supports peak cognitive performance, reflecting the company’s focus on providing tools and nutrition to improve daily mental productivity.

The stress & anxiety segment is projected to grow at the fastest CAGR of 12.4% from 2025 to 2030. The rising prevalence of stress and anxiety is driving the demand for brain health supplements in the U.S. market. For instance, the annual mental health poll of the American Psychiatric Association in 2024 found that 43% of adults in the U.S. felt more anxious in comparison to the previous year, with many attributing this rise in anxiety to increased stress. Increasing work pressure, fast-paced lifestyles, and digital overload, which contribute to mental fatigue and emotional strain, are expected to drive the market's growth. In addition, growing demand for natural and convenient supplements to manage stress further drives the market’s growth.

Distribution Channel Insights

The pharmacy & drug stores segment accounted for the largest market share of 49.3% in 2024. The demand is rising due to their convenience, accessibility, and consumer trust in these retail channels. Pharmacies offer a one-stop solution where customers can easily find scientifically backed, regulated, and quality-assured products. In addition, the presence of trained pharmacists provides guidance and reassurance, particularly for older adults and health-conscious consumers seeking cognitive support. Growing awareness of preventive health, coupled with the preference for over-the-counter supplements, is expected to drive the growth of the industry.

The online segment is projected to grow at the fastest CAGR of 12.3% from 2025 to 2030. The convenience, variety, and competitive pricing offered by e-commerce platforms are expected to drive the demand for the segment. Consumers increasingly prefer digital channels for easy home delivery, subscription options, and access to detailed product information, including reviews and clinical evidence. The growth of mobile commerce, social media influence, and targeted digital marketing campaigns further drives the market's expansion. Some online platforms providing supplements in the U.S. include Amazon, CVS Pharmacy, iHerb, Vitacost, and BrainMD.

Key U.S. Brain Health Supplements Companies Insights

Key players operating in the U.S. brain health supplements market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Brain Health Supplements Companies:

- Natural Factors USA

- Onnit Labs, Inc.

- Intelligent Labs

- Accelerated Intelligence, Inc.

- NOW Foods

- Health Via Modern Nutrition Inc.

Recent Developments

-

In September 2025, Neuriva, a top brain health supplement brand by Reckitt, launched Neuriva Memory 3D, a new formula designed to support long-term, short-term, and working memory

-

In June 2023, USA Track & Field partnered with Prevagen as its official brain health supplement. Prevagen, an over-the-counter memory supplement, supports cognitive function and is used by over a million U.S. consumers.

U.S. Brain Health Supplements Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 3.95 billion

Revenue Forecast in 2030

USD 6.80 billion

Growth rate

CAGR of 11.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative (revenue) units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application, distribution channel

Country scope

U.S

Key companies profiled

Natural Factors USA; Onnit Labs, Inc.; Intelligent Labs; Accelerated Intelligence, Inc.; NOW Foods; Health Via Modern Nutrition Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Brain Health Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. brain health supplements market report on the basis of product, form, application, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Molecules

-

Acetyl-L-Carnitine

-

Alpha-GPC

-

Citicoline

-

DHA

-

Pre/Pro/Postbiotics

-

Others (EPA, Conezyme q10, MCT, Resveratrol, Phosphatidylserine, etc.)

-

-

Herbal Extract

-

Ginseng

-

Gingko Biloba

-

Curcumin

-

Others (Bacopa, Ashwagandha, Gotu Kola, Lemon Balm, etc.)

-

-

Vitamins & Minerals

-

Vitamin B

-

Vitamin C & E

-

Others (Magnesium, Zinc, etc.)

-

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Tablets

-

Softgels

-

Powders

-

Gummies

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Memory Enhancement

-

Attention & Focus

-

Depression & Mood

-

Sleep & Recovery

-

Anti-aging & Longevity

-

Stress & Anxiety

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drug Stores

-

Online

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.