- Home

- »

- Renewable Energy

- »

-

U.S. Bunker Fuel Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Bunker Fuel Market Size, Share & Trends Report]()

U.S. Bunker Fuel Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Very Low Sulfur Fuel Oil (VLSFO), High Sulfur Fuel Oil (HSFO), Marine Gas Oil (MGO)), By Application (Bulk Carrier, Oil Tanker, Container, General Cargo), And Segment Forecasts

- Report ID: GVR-4-68040-745-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bunker Fuel Market Summary

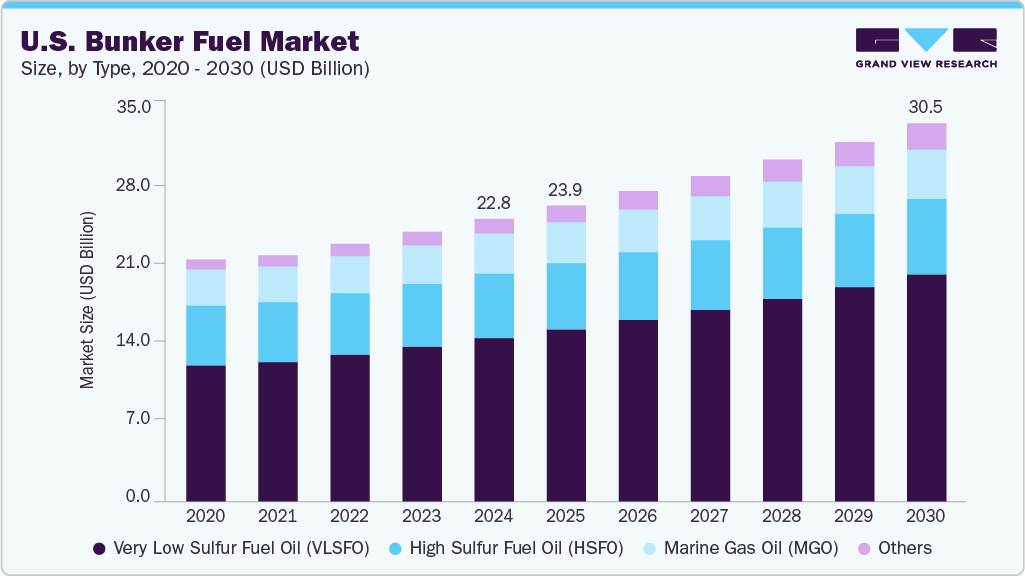

The U.S. bunker fuel market size was estimated at USD 22.80 billion in 2024 and is projected to reach USD 30.51 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. The market is witnessing steady growth, driven by the expansion of global maritime trade and the demand for reliable marine fuel solutions.

Key Market Trends & Insights

- By fuel type, very low sulfur fuel oil (VLSFO) dominated the bunker fuel market with a revenue share of 57.7% in 2024.

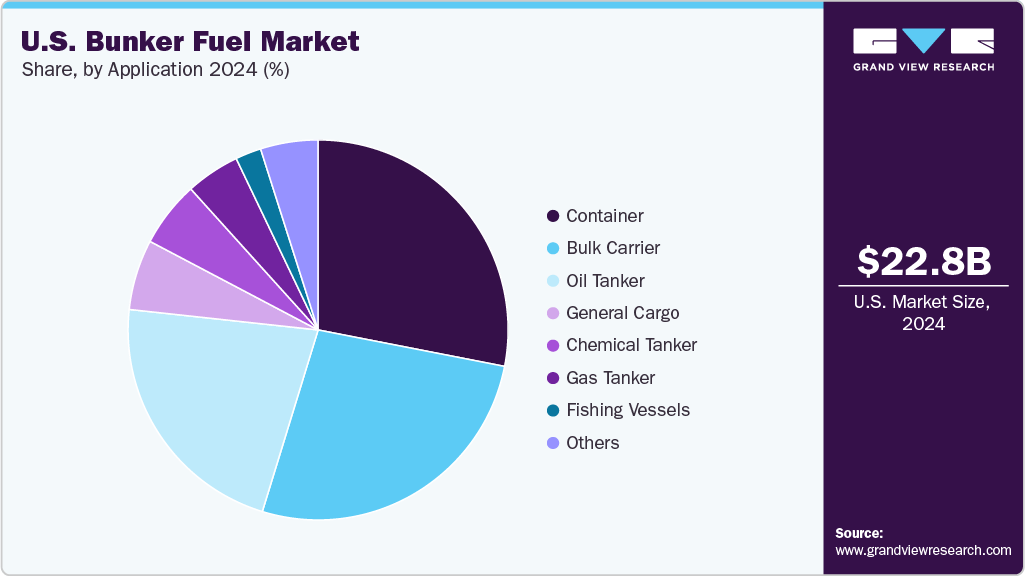

- By application, container segment dominated the U.S. bunker fuel industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.80 Billion

- 2030 Projected Market Size: USD 30.51 Billion

- CAGR (2025-2030): 5.0%

Key drivers of the U.S. bunker fuel industry include container traffic growth at major ports, rising coastal and international trade activity, and increasing energy demand from maritime transport. In addition, the enforcement of IMO 2020 sulfur regulations and the U.S. environmental policies are pushing a shift toward cleaner marine fuels such as VLSFO, MGO, and LNG.

Technological progress is also vital, with innovations such as advanced fuel blending methods and digital fuel monitoring systems enhancing both efficiency and regulatory compliance. These technologies support improved fuel quality management, real-time fuel consumption tracking, and more efficient logistics resulting in lower emissions and operational cost savings. The shift toward low-sulfur and alternative marine fuels reflects a broader industry commitment to sustainable and environmentally responsible shipping practices. The U.S. bunker fuel market is experiencing a phase of dynamic transformation, driven by evolving regulatory landscapes, cleaner fuel demand, and operational innovations.

Type Insights

The very low sulfur fuel oil (VLSFO) type segment held the largest share of 57.8% in 2024. Very low sulfur fuel oil has emerged as the standard fuel at major U.S. ports, largely due to its ability to meet stringent emissions regulations, particularly within Emission Control Areas, while remaining compatible with existing ship engines. Its strong balance between environmental compliance and operational efficiency has made it the preferred choice for commercial shipping fleets globally. As more ports and fuel suppliers invest in infrastructure to ensure reliable VLSFO availability, the fuel's dominance in the maritime market continues to strengthen.

The marine gas oil (MGO) segment is expected to grow at a significant CAGR of 3.7% over the forecast period. MGO is a high-quality distillate marine fuel with low sulfur content, commonly used in medium-speed marine diesel engines and auxiliary engines operating in Emission Control Areas (ECAs).

Application Insights

The container segment dominated the U.S. bunker fuel industry in 2024. Container vessels, which transport manufactured goods across global trade routes, require significant volumes of bunker fuel, such as marine gas oil (MGO) and very low sulfur fuel oil (VLSFO), to power their long-distance voyages. The U.S., with major ports such as Los Angeles, Long Beach, New York/New Jersey, and Savannah, is a key hub for container traffic, influencing bunker fuel consumption patterns.

The general cargo segment is projected to grow at the fastest CAGR over the forecast period, driven by the surge in global trade, e-commerce, and transpacific shipping volumes. The oil tanker is another key segment in the bunker fuel market due to the critical need for reliable marine fuels to transport chemicals, oil, and liquefied natural gas (LNG). Tankers often operate in heavily regulated and sensitive environments, requiring compliance with stringent fuel sulfur limits and environmental standards.

Key U.S. Bunker Fuel Company Insights

Some of the key companies in the U.S. bunker fuel industry include ExxonMobil Corporation, Chevron Corporation, and BP plc.

-

PBF Energy Inc. is a major independent petroleum refiner and supplier in the U.S., with operations supporting marine fuel production and distribution. The company plays a key role in the U.S. bunker fuel industry through its refining assets, which produce compliant marine fuels such as VLSFO and MGO to meet IMO regulations.

Key U.S. Bunker Fuel Companies:

- ExxonMobil Corporation

- Chevron Corporation

- BP plc

- World Kinect Corporation (formerly World Fuel Services)

- Clipper Oil Company

- NuStar Energy L.P.

- Sprague Energy

- Chemoil Energy Limited

- PBF Energy Inc.

- GAC North America

U.S. Bunker Fuel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.87 billion

Revenue forecast in 2030

USD 30.51 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Type, application

Key companies profiled

ExxonMobil Corporation; Chevron Corporation; BP plc; World Kinect Corporation (formerly World Fuel Services); Clipper Oil Company; NuStar Energy L.P.; Sprague Energy; Chemoil Energy Limited; PBF Energy Inc.; GAC North America

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bunker Fuel Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bunker fuel market report based on type and application:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Very Low Sulfur Fuel Oil (VLSFO)

-

High Sulfur Fuel Oil (HSFO)

-

Marine Gas Oil (MGO)

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bulk Carrier

-

Oil Tanker

-

Container

-

General Cargo

-

Chemical Tanker

-

Fishing Vessels

-

Gas Tanker

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. bunker fuel market size was estimated at USD 22.81 billion in 2024 and is expected to reach USD 23.87 billion in 2025.

b. The U.S. bunker fuel market is expected to grow at a compound annual growth rate of 5% from 2025 to 2030 to reach USD 30.51 billion by 2030.

b. Based on fuel type, very low sulfur fuel oil (VLSFO) dominated the U.S. bunker fuel market with a revenue share of 57.7% in 2024.

b. Some of the key vendors operating in the U.S. bunker fuel market include ExxonMobil Corporation, Chevron Corporation, BP plc, World Kinect Corporation (formerly World Fuel Services), Clipper Oil Company, NuStar Energy L.P., Sprague Energy, Chemoil Energy Limited, PBF Energy Inc., and GAC North America, among others.

b. The key factors driving the U.S. bunker fuel market include the steady growth of international and domestic maritime trade and increasing fuel demand from shipping fleets operating across the Gulf Coast, Pacific, and Atlantic ports.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.