- Home

- »

- Distribution & Utilities

- »

-

U.S. Current Transformer Market Size, Industry Report, 2030GVR Report cover

![U.S. Current Transformer Market Size, Share & Trends Report]()

U.S. Current Transformer Market (2025 - 2030) Size, Share & Trends Analysis Report By Voltage (Low Voltage, Medium Voltage, High Voltage), By Application (Power Distribution, Manufacturing), And Segment Forecasts

- Report ID: GVR-4-68040-712-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Current Transformer Market Summary

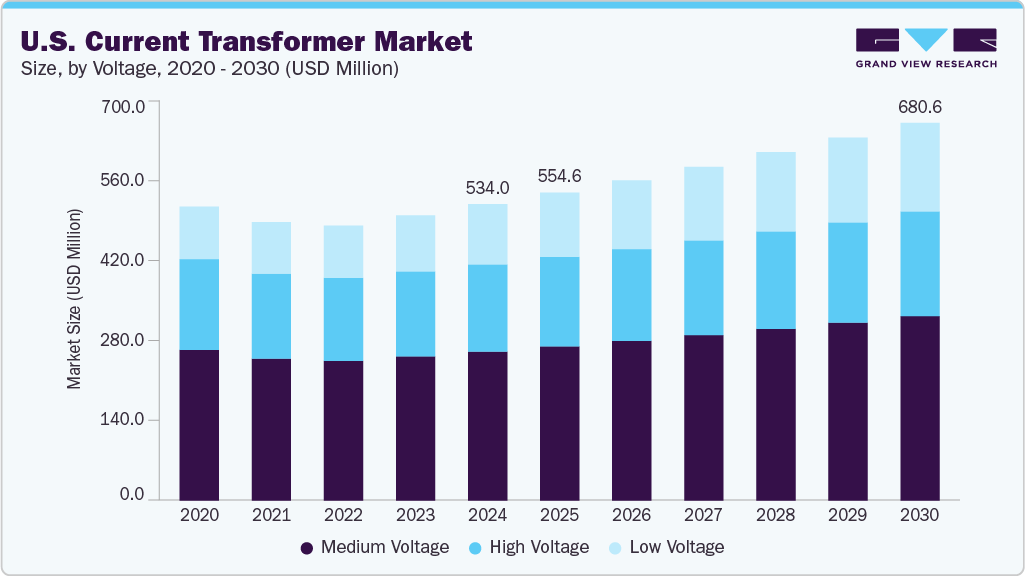

The U.S. current transformer market size was valued at USD 534.0 million in 2024 and is projected to reach USD 680.6 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The industry is expected to grow due to rising demand for efficient energy monitoring and control across the industrial, utility, and commercial sectors.

Key Market Trends & Insights

- By voltage, medium voltage held the largest market share of over 50.3% in 2024.

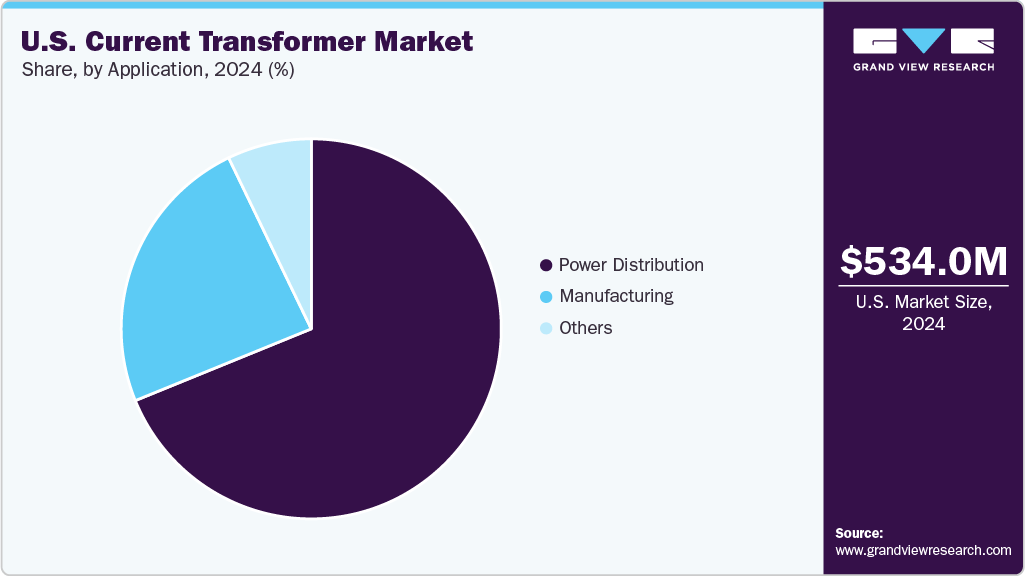

- By application, the power distribution segment held the largest market share of 68.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 534.0 Million

- 2030 Projected Market Size: USD 680.6 Million

- CAGR (2025-2030): 4.2%

The current transformer industry in the U.S. is primarily driven by the increasing demand for electricity due to rapid urbanization, industrialization, and the ongoing modernization of aging power infrastructure. In alignment with this growing need, in March 2024, the U.S. Department of Energy announced a USD 18 million funding opportunity under the Flexible Innovative Transformer Technologies (FITT) program. Technological advancements are profoundly reshaping the U.S. current transformer market, with a notable shift towards smart digital transformers that offer advanced real-time monitoring, predictive maintenance, and automated energy optimization, leading to reductions in downtime.

Innovations include integrating IoT-enabled sensors and digital signal processing for enhanced accuracy and reliability, especially for smart grid deployments. Manufacturers also focus on miniaturization and lightweight designs to facilitate easier installation and improve performance in space-constrained areas, particularly for industrial automation and building energy management systems.

Key players often engage in strategic acquisitions to expand their product portfolios, gain access to new technologies, enhance market share, and consolidate their presence in specific regions or end-use segments. In October 2024, Standex International Corporation acquired U.S.-based Amran Instrument Transformers and Narayan Powertech Pvt. Ltd. (India-based). This is expected to expand presence in the high-margin, fast-growing electrical grid end market, and benefit from capacity expansion, infrastructure upgrades, and data center demand.

Voltage Insights

The medium voltage segment dominated the industry with a 50.3% revenue share in 2024. This dominance is primarily attributed to their essential role in monitoring and protecting power systems, which form the backbone of power distribution networks, industrial facilities, and commercial buildings across the nation. Medium voltage current transformers are crucial for ensuring electrical safety, enabling accurate fault detection, and enhancing system efficiency in these critical infrastructure areas.

The low voltage segment is projected to grow at the fastest CAGR from 2025 to 2030. This accelerated growth is driven by the increasing need for precise and reliable current measurements in diverse low-voltage applications, including industrial automation, residential and commercial building energy management systems, and the burgeoning electric vehicle (EV) charging infrastructure. The rising demand for energy-efficient solutions across various industrial sectors, continuous technological innovations, and a shift towards optimized electrical systems are fueling this expansion.

Application Insights

The power distribution segment dominated the market with the highest revenue share in 2024, driven by the ongoing modernization of the electrical grid and increasing demand for a reliable energy supply. Utilities and power companies actively deploy current transformers in substations and transmission networks to enhance monitoring, protection, and control functions.

The manufacturing segment is projected to grow significantly from 2025 to 2030. The increasing reliance of manufacturing facilities on advanced electrical systems for process automation, energy management, and equipment protection primarily fuels this accelerated growth. Current transformers are essential in manufacturing applications such as load monitoring, power quality analysis, and safeguarding machinery from overloads or faults, all contributing to enhanced operational efficiency and safety.

Key U.S. Current Transformer Company Insights

Some of the key players operating in the current transformer market include Triad Magnetics, Stangenes Industries, Inc., and MPS Industries, Inc.

-

Triad Magnetics is a U.S.-based manufacturer of custom and standard current sense transformers, serving various industries, including power distribution, industrial automation, and renewable energy.

Key U.S. Current Transformer Companies:

- Triad Magnetics

- Stangenes Industries, Inc.

- MPS Industries, Inc.

- Coilcraft, Inc.

- Continental Control Systems, LLC

- Amran Instrument Transformers

- Dongan Electric Manufacturing Company

- V & F Transformer Corporation

- Midwest Current Transformer

U.S. Current Transformer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 554.6 million

Revenue forecast in 2030

USD 680.6 million

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage, application

Key companies profiled

Triad Magnetics; Stangenes Industries, Inc.; MPS Industries, Inc.; Coilcraft, Inc.; Continental Control Systems, LLC; Amran Instrument Transformers; Dongan Electric Manufacturing Company; V & F Transformer Corporation; Midwest Current Transformer

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to the country, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Current Transformer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. current transformer market report based on voltage, and application:

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Distribution

-

Manufacturing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. current transformer market size was estimated at USD 0.53 billion in 2024 and is expected to reach USD 0.55 billion in 2025.

b. The U.S. current transformer market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 0.68 billion by 2030.

b. Based on the application segment, Power Distribution held the largest revenue share of more than 68.84% in 2024.

b. Some of the key players in the U.S. current transformer market include Triad Magnetics, Stangenes Industries, Inc., MPS Industries, Inc., Coilcraft, Inc., Continental Control Systems, LLC, Amran Instrument Transformers, Dongan Electric Manufacturing Company, V & F Transformer Corporation, and Midwest Current Transformer, among others.

b. The key factors driving the U.S. current transformer market include the modernization of power infrastructure, rising adoption of renewable energy, and increasing industrial electrification. The expansion of smart grids and advanced metering systems is prompting utilities and industries to deploy high-accuracy current transformers for reliable monitoring, protection, and energy management across residential, commercial, and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.