- Home

- »

- Communications Infrastructure

- »

-

U.S. Distributed Antenna Systems Market Size Report, 2030GVR Report cover

![U.S. Distributed Antenna Systems Market Size, Share & Trends Report]()

U.S. Distributed Antenna Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Coverage, By Ownership (Carrier Ownership, Neutral-Host Ownership), By Signal Source, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-748-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

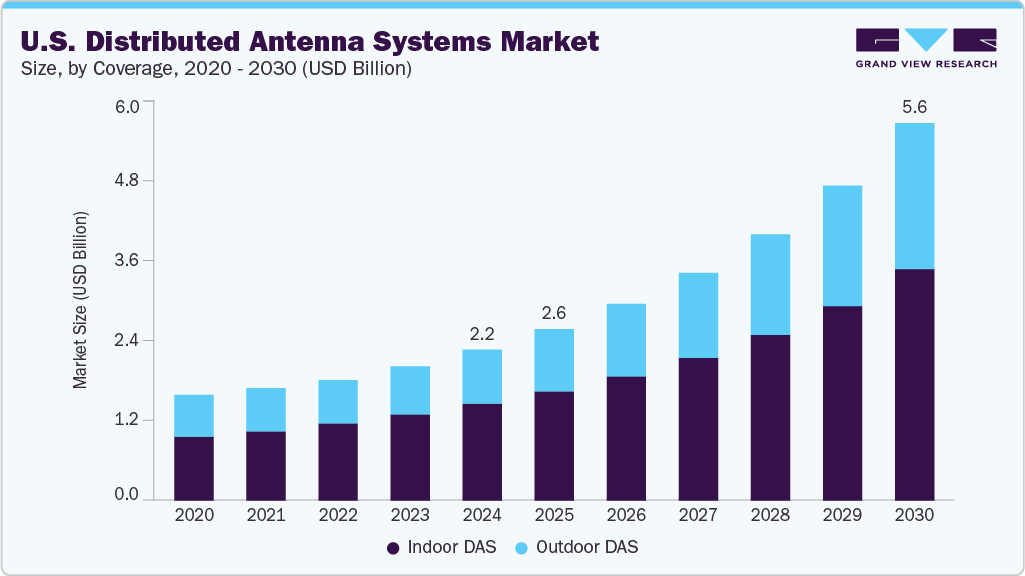

The U.S. distributed antenna systems market size was estimated at USD 2,247.8 million in 2024 and is projected to reach USD 5,622.4 million by 2030, growing at a CAGR of 17.1% from 2025 to 2030. The growth is primarily driven by increasing demand for seamless and high-capacity wireless connectivity and rising adoption of 5G networks. The integration of distributed antenna systems (DAS) with public safety networks and transportation hubs is improving communication resilience. Growing investments in network upgrades, stringent Federal Communications Commission (FCC) regulations, and the need for efficient spectrum utilization are expected to drive the market growth.

The rapid advancement and adoption of Industrial Internet of Things (IIoT) platforms and edge computing technologies have significantly transformed the U.S. distributed antenna systems industry. Enhanced network performance through AI-driven optimization, real-time signal monitoring, and dynamic frequency allocation enables enterprises to improve connectivity. The increasing deployment of 5G networks and private LTE solutions in industrial corridors and urban areas further drives the need for reliable and scalable distributed antenna systems solutions.

Additionally, growing investments in smart infrastructure and next-generation communication networks are fueling the expansion of the U.S. distributed antenna systems market. Government-backed initiatives such as the National Broadband Plan and public-private partnerships are aimed at improving rural connectivity. The increasing adoption of automated manufacturing lines, remote monitoring systems, and connected logistics hubs is creating demand for uninterrupted, low-latency communication networks supported by robust DAS deployments across diverse sectors.

Furthermore, the heightened focus on emergency communication systems and public safety infrastructure is a key driver for the U.S. distributed antenna systems industry. Federal mandates such as the FirstNet initiative, along with state-specific regulatory frameworks, are compelling organizations to upgrade legacy communication networks. The integration of mission-critical voice, video, and data services over secure, resilient DAS platforms is helping first responders, hospitals, and municipal authorities enhance situational awareness and coordinate responses.

Moreover, the growing emphasis on energy efficiency and sustainable communication infrastructure is crucial in supporting the expansion of the market. Facility operators, technology providers, and government agencies promote smart power management systems and passive antenna designs. Incentives, tax credits, and grant programs encourage investments in energy-efficient network solutions. Corporate sustainability initiatives and consumer demand for eco-friendly technologies drive adoption across the U.S. distributed antenna systems industry.

Coverage Insights

The indoor segment dominated the U.S. distributed antenna systems with the largest share of over 64% in 2024. The increasing reliance on enhanced in-building wireless connectivity has significantly influenced the growth of this segment. Many building owners and facility managers prefer indoor DAS solutions due to their ability to ensure seamless coverage, support high-bandwidth services, and maintain uninterrupted communication. The growing adoption of smart building technologies, IoT devices, and connected services further drives demand for robust indoor connectivity solutions in the U.S. distributed antenna systems market.

The outdoor segment is expected to witness the fastest CAGR of over 18% from 2025 to 2030. This segment includes outdoor DAS solutions such as high-gain antennas, signal repeaters, and weather-resistant and transportation hubs. The growing need for reliable communication, data transmission, and public safety networks in outdoor environments has increased demand. Municipalities, event organizers, and infrastructure providers are investing in robust wireless systems. These systems support seamless and ubiquitous connectivity across extensive outdoor spaces.

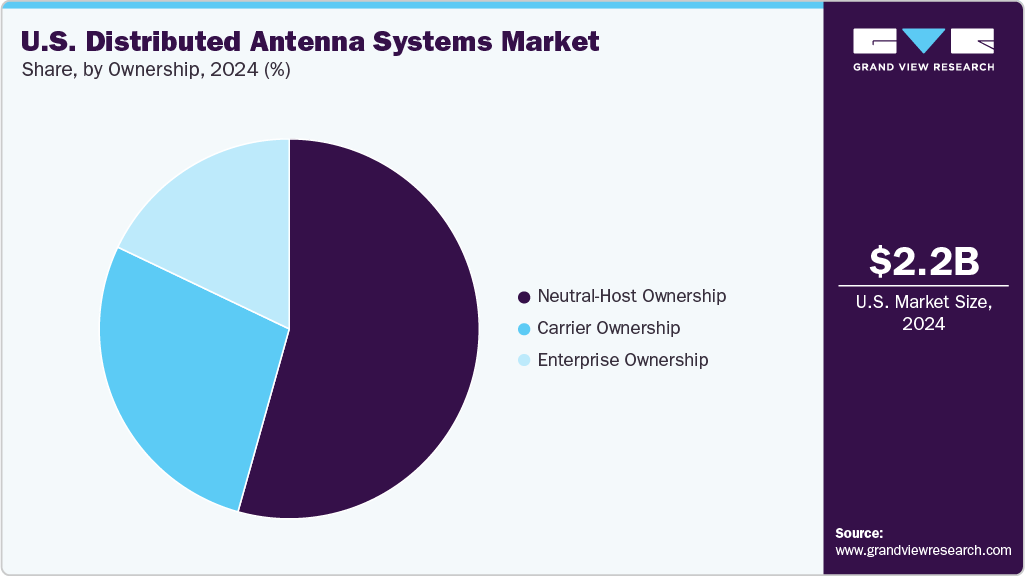

Ownership Insights

The neutral host ownership segment accounted for the largest share of the U.S. distributed antenna systems industry in 2024, driven by its ability to provide seamless connectivity across multiple service providers. The neutral host model offers shared infrastructure solutions that reduce capital expenditures while improving network coverage and capacity in high-traffic areas. The flexibility, cost-effectiveness, and scalability of neutral host deployments continue to strengthen their role and support growth in the U.S. market for distributed antenna systems.

The carrier ownership segment is expected to witness a significant CAGR from 2025 to 2030. This growth is driven by the increasing demand for carrier-owned infrastructure that allows service providers to maintain full control over network performance and customer experience. The surge in mobile data traffic and IoT deployments encourages carriers to invest in proprietary DAS solutions. Competitive pressures among telecom operators are accelerating investments in carrier-owned DAS networks, making this segment one of the fastest-growing market segments.

Signal Source Insights

The on-site base transceiver station segment accounted for the largest market share in 2024. The compact footprint, ease of installation, and ability to be integrated into existing infrastructure make on-site stations a preferred choice for service providers. Government initiatives to expand broadband access and rising investments from telecom operators to optimize network performance and user experience reinforce the dominance of on-site base transceiver stations in the U.S. distributed antenna systems market.

The off-air antenna solution segment is expected to witness the fastest CAGR from 2025 to 2030. These solutions are increasingly deployed across commercial complexes, healthcare facilities, educational institutions, and transportation hubs, with their demand rising due to the growing need for cost-effective connectivity solutions. These factors contribute to the swift growth of the U.S. distributed antenna systems industry, with off-air antenna solutions emerging as a leading technology.

Application Insights

The indoor segment accounted for the largest market share in 2024, driven by its ability to deliver enhanced wireless connectivity within buildings. Indoor DAS solutions provide consistent signal strength in complex structures such as offices, hospitals, and shopping centers, supporting data-intensive applications and improving user experience. The demand for reliable indoor coverage, which promotes high bandwidth requirements, is strengthening the role of indoor DAS deployments and fueling growth in the U.S. distributed antenna systems market.

The outdoor segment is expected to witness the fastest CAGR from 2025 to 2030. The increasing demand for robust outdoor wireless infrastructure and municipalities in the U.S drives this growth. The rising deployment of 5G networks and IoT applications encourages enterprises to invest in outdoor DAS solutions to enhance coverage and capacity. Government initiatives promoting smart city development and competitive pressures among network operators are accelerating investments in outdoor DAS systems, making this one of the fastest-growing segments.

Key U.S. Distributed Antenna Systems Company Insights

Some of the key players operating in the market include American Tower Corporation and CommScope Holdings Company Inc.

-

American Tower Corporation is a leading provider of advanced wireless infrastructure solutions in the U.S. distributed antenna systems market. It operates a vast network of DAS sites across urban, suburban, and rural areas, supporting seamless mobile connectivity for enterprises. Its partnerships with telecom operators and focus on expanding 5G-ready DAS solutions have strengthened its position as a dominant player across the U.S market.

-

CommScope Holdings Company Inc. delivers innovative DAS solutions that enhance wireless communication performance in complex environments. The company’s expertise in active and passive DAS technologies and its collaborations with major service providers enable it to provide scalable, high-performance connectivity solutions. Its continued investments in next-generation network infrastructure and recent strategic partnerships have reinforced its leadership in the U.S. distributed antenna systems industry.

JMA Wireless and BTI Wireless are some of the emerging participants in the U.S. distributed antenna systems market.

-

JMA Wireless is emerging as a key player in the market by offering flexible, software-defined DAS solutions that meet the growing demand for scalable and cost-effective wireless infrastructure. The company’s focus on open-architecture designs and cloud-based management platforms allows enterprises and service providers to deploy connectivity solutions tailored to specific environments, reinforcing its position in distributed antenna systems.

-

BTI Wireless is gaining traction in the U.S. distributed antenna systems industry with its innovative approach to providing integrated wireless solutions for enterprise, healthcare, and public venues. Its emphasis on hybrid DAS networks, modular designs, and advanced monitoring capabilities is helping organizations overcome deployment challenges while improving network performance. Strategic partnerships with technology integrators and telecom providers further accelerate its expansion in underserved and complex wireless environments.

Key U.S. Distributed Antenna System Companies:

- American Tower Corporation

- Boingo Wireless, Inc.

- BTI Wireless

- CommScope Holdings Company Inc.

- Corning Incorporated

- Crown Castle

- Comba Telecom Systems Holdings Ltd.

- JMA Wireless.

- TE Connectivity

- Westell Technologies, Inc.

Recent Developments

-

In September 2025, Boingo Wireless, Inc. announced that its Boingo Innovation Center will host DASpedia. This will highlight advancements in in-building wireless technologies, including distributed antenna systems (DAS), private 5G, and Wi-Fi 7. This initiative reinforces Boingo’s leadership in delivering cutting-edge wireless connectivity solutions that enhance indoor network performance across key U.S. markets.

-

In August 2025, JMA Wireless launched its Power of One Driving Across America roadshow to showcase the latest advancements in distributed antenna systems (DAS) and antenna technologies. JMA’s new sustainable DAS platform features a software-defined approach, a pay-as-you-grow model, and a 60% reduction in hardware footprint, reinforcing JMA's leadership as the most sustainable DAS provider in the U.S. market.

-

In March 2025, Comba Telecom Systems Holdings Ltd. advanced the U.S. distributed antenna systems industry with its flagship ComFlex MAX solution. This cutting-edge, multi-band, multi-operator DAS platform supports 3G, 4G, and 5G networks with open interfaces and DAS slicing, enabling flexible, scalable, and sustainable indoor connectivity. ComFlex MAX’s innovative design reduces power consumption and equipment space while enhancing network performance, positioning Comba as a leader in next-generation indoor wireless solutions.

U.S. Distributed Antenna Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,554.2 million

Revenue forecast in 2030

USD 5,622.4 million

Growth rate

CAGR of 17.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage, ownership, signal source, application

Country scope

U.S.

Key companies profiled

American Tower Corporation; Boingo Wireless, Inc.; BTI Wireless; CommScope Holdings Company Inc.; Corning Incorporated; Crown Castle; Comba Telecom Systems Holdings Ltd.; JMA Wireless; TE Connectivity; Westell Technologies, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Distributed Antenna Systems Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. distributed antenna systems market report based on coverage, ownership, signal source, and application:

-

Coverage Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor DAS

-

Active DAS

-

Amplifiers (Remote Units)

-

Master Units

-

Cables

-

Others

-

-

Passive DAS

-

Antennas

-

Signal Boosters

-

Splitters and Combiners

-

Cables

-

Others

-

-

Hybrid DAS

-

-

Outdoor DAS

-

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Carrier Ownership

-

Neutral-Host Ownership

-

Enterprise Ownership

-

-

Signal Source Outlook (Revenue, USD Million, 2018 - 2030)

-

On-site Base Transceiver Station

-

Off-Air Antennas

-

Small Cell

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor DAS

-

Public Venue & Safety

-

Hospitality

-

Airport & Transportation

-

Healthcare

-

Education Sector & Corporate Offices

-

Industrial

-

Others

-

-

Outdoor DAS

-

Public Venue & Safety

-

Hospitality

-

Airport & Transportation

-

Healthcare

-

Education Sector & Corporate Offices

-

Industrial

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. distributed antenna systems market was estimated at USD 2,247.8 million in 2024 and is expected to reach USD 2,554.2 million in 2025.

b. The U.S. distributed antenna systems market is expected to grow at a compound annual growth rate of 17.1% from 2025 to 2030, reaching USD 5,622.4 million by 2030.

b. The indoor segment dominated the market and accounted for the largest market share, over 64%, in 2024. The increasing reliance on enhanced in-building wireless connectivity has driven the market growth.

b. The key players in the U.S. distributed antenna systems market are American Tower Corporation, Boingo Wireless, Inc., BTI Wireless, CommScope Holdings Company Inc., Corning Incorporated, Crown Castle, Comba Telecom Systems Holdings Ltd., JMA Wireless., TE Connectivity, Westell Technologies, Inc.

b. Key drivers of the U.S. distributed antenna systems market include the increasing demand for seamless and high-capacity wireless connectivity and the rising adoption of 5G networks. Integrating distributed antenna systems (DAS) with public safety networks and transportation hubs improves communication resilience. Growing investments in network upgrades, stringent Federal Communications Commission (FCC) regulations, and the need for efficient spectrum utilization are expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.