- Home

- »

- Distribution & Utilities

- »

-

U.S. Flexible AC Transmission Systems Market Report, 2033GVR Report cover

![U.S. Flexible AC Transmission Systems Market Size, Share & Trends Report]()

U.S. Flexible AC Transmission Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Series, Shunt), By End Use (Transmission Lines, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-820-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Flexible AC Transmission Systems Market Summary

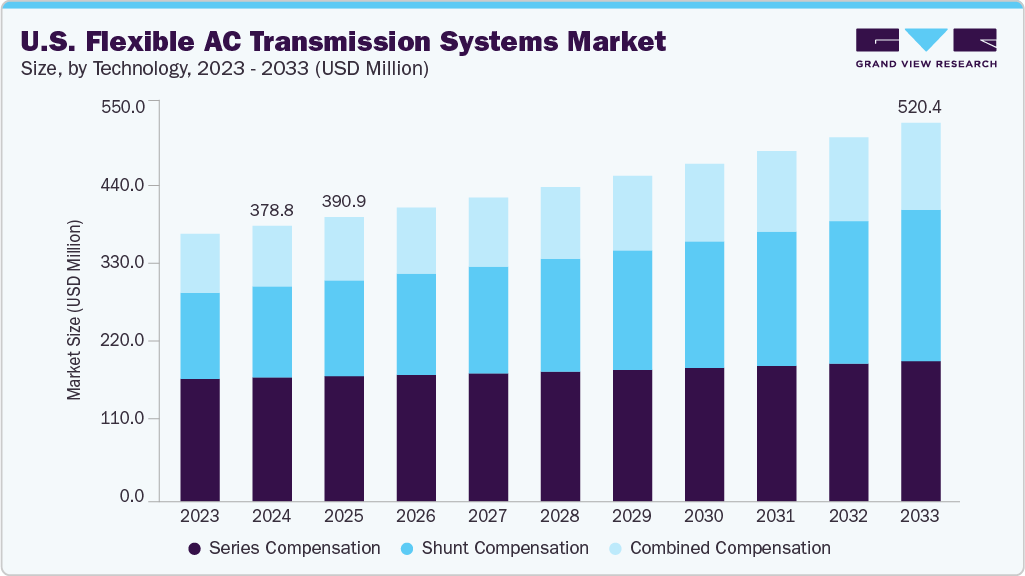

The U.S. flexible AC transmission systems market size was estimated at USD 378.8 million in 2024 and is projected to reach USD 520.4 million by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The market is expanding steadily, supported by rising investments in grid modernization, increasing penetration of renewable energy, and the need to improve transmission efficiency across aging infrastructure.

Key Market Trends & Insights

- By technology, series compensation held the highest market share of 45% in 2024.

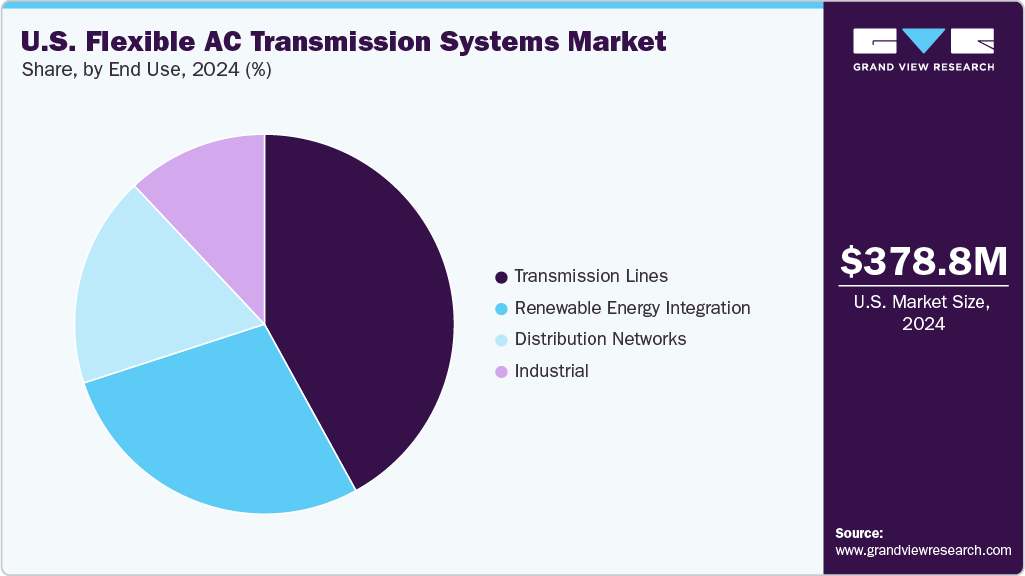

- Based on the end use, the transmission lines segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 378.8 Million

- 2033 Projected Market Size: USD 520.4 Million

- CAGR (2025-2033): 3.6%

As utilities manage greater variability from solar, wind, and distributed energy resources, FACTS technologies play a critical role in dynamic voltage regulation, power quality enhancement, and boosting transmission capacity without requiring substantial new line construction. Advancements in power electronics, particularly VSC-based STATCOM and hybrid systems, are enhancing responsiveness, reducing operational costs, and promoting the adoption of FACTS across major transmission corridors. Federal and state-level initiatives aimed at renewable energy integration, grid resilience, and smart grid development continue to accelerate market deployment. Regulatory measures, such as FERC orders supporting transmission upgrades, combined with interconnection reforms, are driving the wider adoption of FACTS by utilities and transmission operators. Regional transmission organizations (RTOs) and independent system operators (ISOs), including PJM, CAISO, ERCOT, and MISO, are increasingly integrating FACTS devices to address congestion, voltage instability, and dynamic power flow challenges.

In addition, the growing involvement of private engineering firms and technology providers is fostering innovation and expanding competition in the U.S. market. As the country transitions toward a more decentralized and decarbonized power ecosystem, FACTS technologies are expected to play a crucial role in ensuring system reliability, operational flexibility, and efficient integration of renewable energy.

Drivers, Opportunities & Restraints

The U.S. flexible AC transmission systems (FACTS) industry is primarily driven by the growing need to enhance grid reliability, increase power transfer capability, and support the integration of large-scale renewable energy projects. As wind, solar, and distributed energy resources continue expanding across regions such as the Midwest, Texas, and California, utilities increasingly face challenges related to voltage instability, reactive power imbalance, and grid congestion. FACTS technologies provide dynamic power flow control and fast-acting voltage regulation, enabling system operators to stabilize the grid and improve the utilization of existing transmission infrastructure without undertaking large-scale line expansions. Rising federal and state investments in grid modernization, supported by policies promoting resilience, smart grid deployment, and renewable energy integration, further strengthen demand for FACTS solutions across the U.S. transmission network.

Opportunities in the U.S. FACTS market are growing in tandem with advancements in power electronics, VSC-based STATCOM systems, and real-time digital grid monitoring platforms. The increasing adoption of utility-scale battery storage, electrification of transportation, and expansion of high-voltage transmission corridors create a demand for flexible, controllable compensation systems. Grid operators, such as PJM, CAISO, MISO, and ERCOT, are accelerating upgrades to manage congestion and integrate new renewable capacity, creating significant opportunities for manufacturers, engineering firms, and service providers. In addition, ongoing investments in interconnection queue reforms, transmission permitting acceleration, and expansion of cross-state transmission projects are increasing the need for FACTS installations to support stability and operational efficiency. Private utilities, independent power producers, and regional transmission organizations are also prioritizing FACTS to enhance grid flexibility and meet evolving NERC reliability standards.

However, the U.S. market faces several restraints, including high initial capital costs, complex system design requirements, and challenges associated with integrating advanced FACTS devices into aging legacy grids. Installation, commissioning, and maintenance require specialized technical expertise, which can extend project timelines and increase implementation risks for utilities. Regulatory uncertainty, lengthy permitting processes, and slow progress on transmission infrastructure upgrades may also hinder widespread adoption. Furthermore, competition from alternative solutions, such as traditional capacitor banks, synchronous condensers, and HVDC transmission systems, can limit market penetration in specific use cases. Addressing these barriers through streamlined regulatory processes, expanded workforce training, and collaborative R&D initiatives will be essential for accelerating FACTS deployment and fully realizing its benefits for the U.S. power grid.

Technology Insights

The series compensation segment held the largest revenue share, over 45%, in the U.S. FACTS market in 2024, maintaining a strong lead due to its essential role in strengthening transmission capacity and improving system stability across long-distance and high-voltage corridors. In the U.S., where transmission expansion is often constrained by permitting challenges and aging infrastructure, series compensation enables utilities to enhance power transfer capability without the need to construct new lines. By improving voltage regulation, minimizing line reactance, and reducing transmission losses, series compensation solutions help optimize existing grid assets and ensure reliable power delivery during periods of peak demand. Technologies such as Fixed Series Capacitors (FSC) and Thyristor-Controlled Series Capacitors (TCSC) remain widely deployed across major transmission networks operated by entities like ERCOT, CAISO, MISO, and SPP, where they support long-distance power flows and mitigate congestion on heavily loaded lines. The increasing penetration of utility-scale wind and solar generation further reinforces the importance of series compensation in maintaining stability and managing dynamic grid conditions.

The shunt compensation segment is projected to register the fastest CAGR of 5.8% during the forecast period, driven by its growing adoption for voltage support, reactive power management, and flexible grid stabilization across diverse operating conditions. As the U.S. grid integrates higher levels of inverter-based resources, such as solar PV, wind power, and battery storage, utilities are increasingly deploying Shunt-based technologies, including Statcoms and SVCs, to mitigate voltage fluctuations, manage power quality, and provide fast reactive power compensation. Their rapid response capability, compatibility with modern control systems, and effectiveness in addressing both local and wide-area stability issues make them highly attractive for transmission operators and regional grids. Advancements in VSC-based Statcom architectures, real-time digital monitoring, and modular designs also reduce operational costs and improve reliability, boosting adoption across the Western and Eastern Interconnections. With continued renewable capacity additions, increasing electrification, and growing demand for dynamic grid support, Shunt Compensation is expected to emerge as one of the most strategically important technology segments in the U.S. FACTS market.

End Use Insights

Based on end use, the transmission lines segment held the largest revenue share of over 42% in 2024. This dominance is driven by the country’s reliance on long-distance, high-voltage transmission corridors that require advanced compensation systems to maintain stability and efficiency. With rising electricity demand and growing constraints on new transmission line construction, utilities are increasingly adopting FACTS solutions to enhance power transfer capacity, reduce line reactance, and mitigate congestion across heavily loaded networks. FACTS technologies help improve voltage regulation and ensure reliable power delivery, particularly in regions experiencing rapid growth in renewable energy. Large transmission operators, such as PJM, ERCOT, MISO, and CAISO, continue to invest in modernizing their grid infrastructure, further supporting the strong adoption of FACTS devices in transmission applications.

The renewable energy integration segment is projected to record the fastest CAGR of 7.8% during the forecast period, driven by the accelerating deployment of utility-scale solar, wind, and hybrid renewable energy projects across the United States. As renewable penetration increases, the grid faces more frequent voltage fluctuations, intermittent generation, and reactive power imbalances, challenges that FACTS technologies are designed to address. Devices such as STATCOMs and SVCs are being widely deployed to provide fast voltage support, enhance dynamic stability, and facilitate the smooth integration of inverter-based resources into the transmission system. Federal and state renewable energy policies, coupled with the expansion of interconnection queues and the need for flexible grid solutions to accommodate variable generation, are creating significant opportunities for FACTS deployment. As utilities and ISOs implement grid modernization and resilience programs, the Renewable Energy Integration segment is expected to remain a critical driver of U.S. FACTS market growth.

Key U.S. Flexible AC Transmission Systems (FACTS) Company Insights

Some of the key players operating in the U.S. market include Siemens Energy and Hitachi Energy, among others.

-

Siemens Energy is one of the leading providers of FACTS solutions in the United States, offering a wide range of technologies such as Static VAR Compensators (SVCs), Static Synchronous Compensators (STATCOMs), and Series Compensation systems. Based out of its U.S. headquarters in Orlando, Florida, the company maintains a strong national presence with advanced engineering centers, manufacturing sites, and service hubs that support major transmission enhancement projects. Siemens Energy emphasizes system reliability, grid stability, and compliance with U.S. grid standards while delivering high-performance power electronics that strengthen voltage regulation and increase transfer capability. The company is actively investing in digital FACTS control platforms, predictive maintenance solutions, and real-time grid monitoring tools aimed at improving equipment performance and reducing operational costs for utilities across the country.

-

Hitachi Energy (formerly ABB Power Grids) is another major player in the U.S. FACTS market, delivering a comprehensive portfolio of transmission stabilization technologies, including STATCOM, SVC, and Series Compensation systems. The company operates multiple engineering centers and service facilities across the United States, supporting utilities and transmission operators with high-performance FACTS products tailored to enhance power flow, mitigate congestion, and maintain system voltage under varying load and renewable generation conditions. Hitachi Energy focuses on delivering solutions that integrate seamlessly with digital substations, advanced control systems, and modern grid monitoring technologies. Its strong emphasis on reliability, grid compliance, and long-term service capabilities has made it a preferred partner for major grid enhancement and interconnection projects nationwide.

Key U.S. Flexible AC Transmission Systems (FACTS) Companies:

- General Electric (GE Grid Solutions)

- Hitachi Energy (ABB Power Grids)

- Siemens Energy

- American Superconductor Corporation (AMSC)

- Eaton Corporation

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- NR Electric Co., Ltd.

- Toshiba Energy Systems & Solutions

- Alstom Grid

Recent Developments

-

In March 2025, Hitachi Energy announced the commissioning of a major Flexible AC Transmission Systems (FACTS) installation in Texas, designed to support the state’s rapidly expanding renewable energy network. The project features the deployment of a high-capacity STATCOM system integrated with advanced digital control platforms to stabilize voltage fluctuations caused by large-scale wind and solar generation. The installation enhances grid resilience, improves reactive power management, and increases the transfer capability of existing transmission corridors, all of which are crucial for managing Texas’s rapidly growing clean energy load.

U.S. Flexible AC Transmission Systems (FACTS) Market Report Scope

Report Attribute

Details

Market Definition

The U.S. FACTS market estimate includes the total revenues generated from the deployment of FACTS technologies such as STATCOMs, SVCs, and Series Compensation systems across all end-use transmission applications.

Market size value in 2025

USD 390.9 million

Revenue forecast in 2033

USD 520.4 million

Growth rate

CAGR of 3.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, end use

Country scope

U.S.

Key companies profiled

General Electric (GE Grid Solutions); Hitachi Energy (ABB Power Grids); Siemens Energy; American Superconductor Corporation (AMSC); Eaton Corporation; Mitsubishi Electric Corporation; Hyosung Heavy Industries; NR Electric Co., Ltd.; Toshiba Energy Systems & Solutions; Alstom Grid

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flexible AC Transmission Systems (FACTS) Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. flexible ac transmission systems (FACTS) market report based on technology, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Series Compensation

-

Shunt Compensation

-

Combined Compensation

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Transmission Lines

-

Distribution Networks

-

Industrial

-

Renewable Energy Integration

-

Frequently Asked Questions About This Report

b. The U.S. flexible AC transmission systems market size was estimated at USD 378.8 million in 2024 and is expected to reach USD 390.9 million in 2025.

b. The U.S. flexible AC transmission systems market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach USD 520.4 million by 2033.

b. Based on the technology segment, Series Compensation held the largest revenue share of more than 45% in 2024.

b. Some of the key players operating in the U.S. FACTS market include General Electric (GE) Grid Solutions; Hitachi Energy (formerly ABB Power Grids); Siemens Energy; American Superconductor Corporation (AMSC); Eaton Corporation; Mitsubishi Electric Corporation; Hyosung Heavy Industries; NR Electric Co., Ltd.; Toshiba Energy Systems & Solutions; and Alstom Grid.

b. The key factors driving the U.S. flexible AC transmission systems market include the increasing need to strengthen grid stability, enhance power quality, and support the rapid integration of renewable energy sources such as wind and solar across the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.