- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Fortified Dairy Products Market, Industry Report, 2033GVR Report cover

![U.S. Fortified Dairy Products Market Size, Share & Trends Report]()

U.S. Fortified Dairy Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Milk, Yogurt, Cheese), By Ingredient (Probiotic & Prebiotic, Protein, Vitamins & Minerals), By Distribution Channel (Hypermarket/Supermarket, Convenience Stores), And Segment Forecasts

- Report ID: GVR-4-68040-819-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Fortified Dairy Products Market Summary

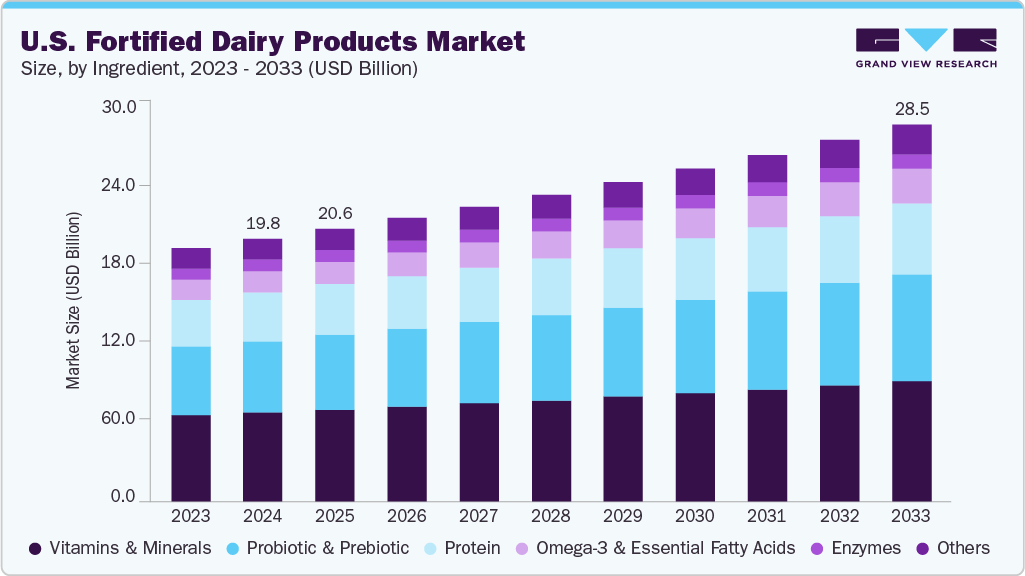

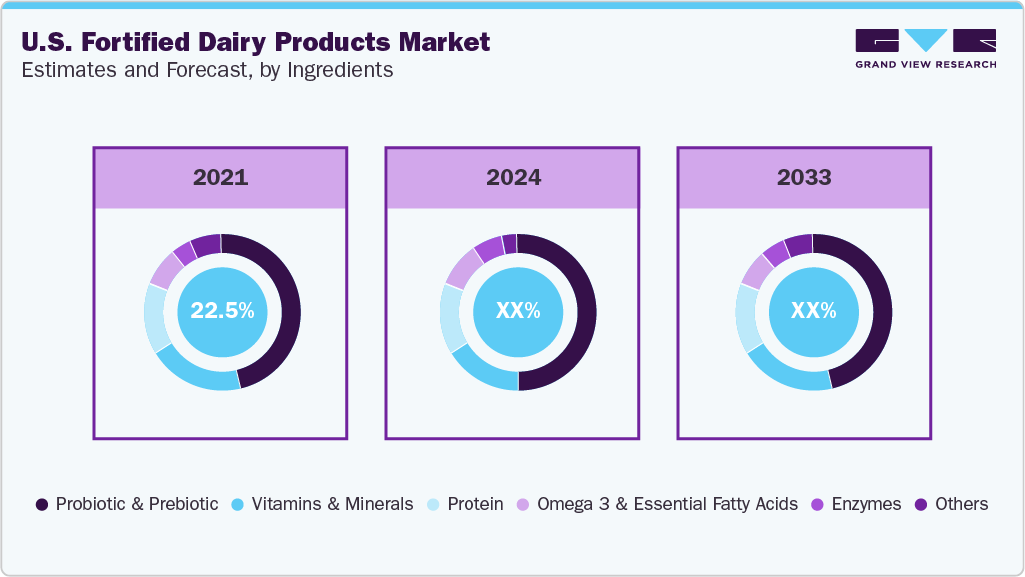

The U.S. fortified dairy products market size was estimated at USD 19.82 billion in 2024 and is projected to reach USD 28.41 billion in 2033, growing at a CAGR of 4.1% from 2025 to 2033. The increasing health-conscious consumer base drives market growth.

Key Market Trends & Insights

- By product, the milk segment accounted for a market share of 65.66% in 2024.

- By ingredient, the vitamins & minerals segment held a market share of 33.85% in 2024.

- By distribution channel, the hypermarket/supermarkets segment dominated the market with a revenue share of 41.55% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.82 Billion

- 2033 Projected Market Size: USD 28.41 Billion

- CAGR (2025-2033): 4.1%

With an increasing focus on health and wellness, consumers are becoming more inclined toward dairy products that offer additional benefits such as improved digestion, immunity, and heart health. The demand for plant-based dairy alternatives, enriched with nutrients such as calcium, vitamins, and probiotics, has gained significant traction, driven by the rise in vegan and lactose-intolerant populations. Additionally, an increase in lactose intolerance and the growing preference for dairy alternatives have created opportunities for plant-based fortified dairy options, such as almond and soy milk, further expanding the market. For instance, according to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) data, about 36% of Americans have lactose malabsorption.

According to the data published by Boston Children's Hospital Services, about 30 to 50 million people in the U.S. are lactose intolerant. Moreover, fortified dairy products, such as milk and yogurt, enriched with calcium, protein, and probiotics, are increasingly popular as Americans seek convenient options to enhance bone health, digestive health, and overall nutrition. This has urged key players to introduce new products to cater to the changing consumer preferences. For instance, in February 2023, Dairy Farmers of America, Inc., collaborated with Good Culture to produce a new probiotic milk free from lactose. The new product is available in two variants: whole milk and 2% reduced-fat options. It is formulated with 1 billion probiotic cultures per 12-oz serving to support digestive and immune health. The U.S. market for fortified dairy products is booming due to a high level of health consciousness among consumers, driven by a focus on disease prevention, fitness, and overall well-being.

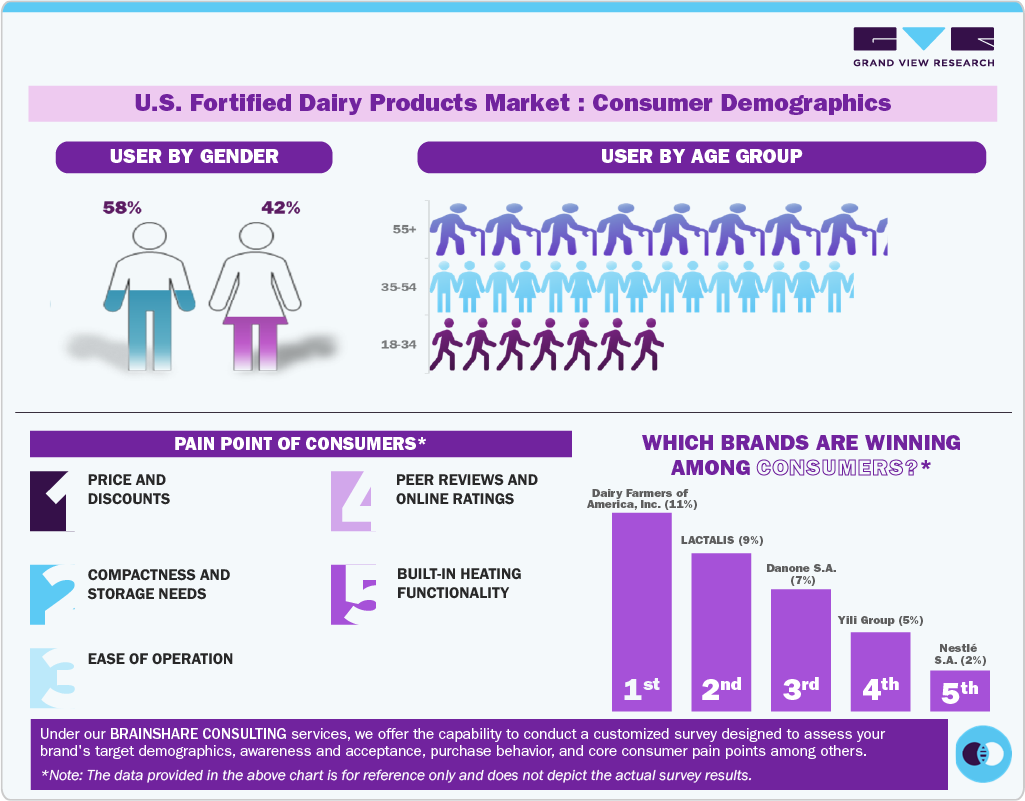

Consumer Insights for the Fortified Dairy Products Market

The expansion of protein fortification beyond traditional sports nutrition to cater to a broader demographic has opened up new opportunities for brands in the market. Men consume more fortified dairy products than women, primarily for muscle-building and fitness purposes, as protein supports muscle repair and growth. Their higher caloric and protein needs also drive this trend. Women, on the other hand, prioritize fortified dairy for weight management, bone health, and overall nutrition. Fortified dairy provides a convenient way for both men and women to meet their dietary needs while maintaining a balanced diet.

According to GVR analysis, the percentage of adults consuming fortified dairy products increased with age, peaking at 41% among those aged 55 years and above, compared to 21% among individuals aged 18-34 years.

Consumer perception plays a crucial role in shaping the U.S. fortified dairy products industry. The way consumers perceive these products directly influences their acceptance, demand, and, ultimately, the success of such items in the market. Older adults may have different sensory sensitivities, oral health issues, and preferences compared to younger demographics. According to a Multidisciplinary Digital Publishing Institute (MDPI) report published in November 2022, protein fortification is crucial for older adults to address malnutrition and combat sarcopenia, which is characterized by age-related loss of muscle mass and strength.

Product Insights

The milk segment led the U.S. fortified dairy products market with the largest share of 65.66% in 2024. With modern lifestyles limiting sun exposure and dietary diversity, deficiencies in essential nutrients, particularly vitamin D and calcium, have become widespread. Fortified milk serves as an effective dietary solution to combat these deficiencies, particularly for vulnerable populations, including children, pregnant women, and the elderly. Moreover, the expansion of plant-based fortified milk alternatives has broadened the market. As lactose intolerance and plant-based diets gain popularity, fortified almond, soy, and oat milk variants have seen increased adoption. These products are enriched with the same essential nutrients as traditional dairy, making them an attractive choice for consumers seeking non-dairy options that do not compromise on nutrition.

The frozen desserts segment is anticipated to grow at a CAGR of 5.7% from 2025 to 2033. The availability of fortified desserts in supermarkets, health food stores, and online platforms has made these products more accessible to a wider consumer base. E-commerce and direct-to-consumer brands are playing a crucial role in introducing innovative and niche-fortified dessert options. In September 2024, Müller and Myprotein partnered to launch a new range of high-protein yogurts and desserts. This collaboration aims to meet the growing demand for protein-rich dairy products, targeting health-conscious consumers and fitness enthusiasts. The range will feature a variety of flavors and formats, emphasizing taste alongside nutritional benefits. The partnership combines Müller's expertise in dairy with Myprotein’s strong presence in the fitness nutrition sector. This launch aligns with the increasing trend of functional foods in the dairy market.

Ingredient Insights

The vitamins & minerals segment held a 33.85% share of the U.S. fortified dairy products industry in 2024. Vitamins and minerals play a crucial role in enhancing the nutritional value of fortified dairy products, making them more beneficial for consumers. Fortification helps address nutrient deficiencies, particularly in essential areas like bone health, immune support, and energy metabolism. Vitamin D is commonly added to enhance calcium absorption, thereby reducing the risk of osteoporosis. Meanwhile, B vitamins support energy production and cognitive function. Additionally, iron fortification helps prevent anemia, and nutrients like vitamin A, vitamin C, and zinc strengthen the immune system, making fortified dairy a more functional dietary choice.

The omega-3 & essential fatty acids segment is anticipated to grow at a CAGR of 5.7% during the forecast period. Fortifying dairy products with omega-3 and essential fatty acids significantly enhances their nutritional value, offering consumers additional health benefits. These polyunsaturated fats are vital for maintaining optimal health, supporting heart function, brain development, and even skin health. However, the human body cannot synthesize them, necessitating their inclusion through diet. By enriching commonly consumed dairy items like milk, yogurt, and cheese with these essential nutrients, manufacturers provide an accessible means for individuals to meet their dietary requirements. Incorporating omega-3 and essential fatty acids into dairy products not only meets consumer demand for functional foods but also addresses dietary deficiencies prevalent in modern diets. This fortification approach offers a practical solution to enhance public health by providing essential nutrients through familiar and widely consumed food items.

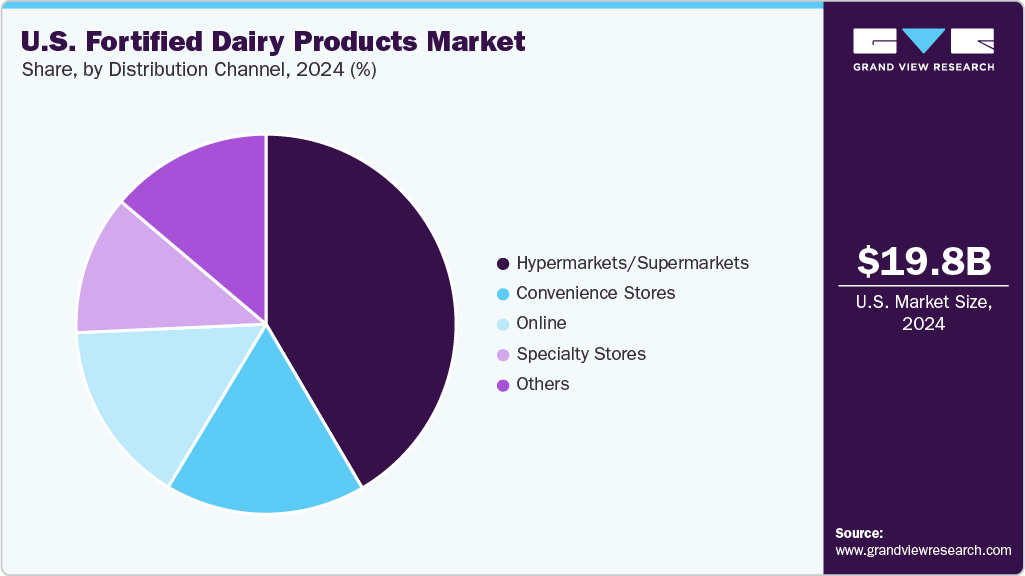

Distribution Channel Insights

The sale of fortified dairy products through the hypermarkets/supermarkets accounted for a 44.55% share of the U.S. fortified dairy product market in 2024. Supermarkets and hypermarkets are gaining popularity due to their wide range of options and the convenience of purchasing everything in one location. The availability of various products also enables customers to choose from multiple options according to their preferences, dietary requirements, and budget. Moreover, consumers are likely to trust the quality of products available at well-established hypermarkets and supermarkets, and therefore prefer to buy from them. This makes supermarkets a convenient and preferable distribution channel for fortified dairy products.

Sales of fortified dairy products through online channels are anticipated to grow at a CAGR of 5.3% from 2025 to 2033. The increasing digitization and rising e-commerce are expected to further contribute to the market growth. According to the Food and Agriculture Organization of the United Nations (FAO), the rising emphasis on healthy living, the increased expectation for personalization, and the rapid integration of technological innovations are driving the growth of the customized nutrition sector and affecting the consumption habits of the customers, which is expected to drive market growth.

Moreover, online channels offer advantages to both brands and customers, as they eliminate mediators and storage costs, while also providing a personalized shopping experience. These also provide brands with insights into consumer preferences through the integration of big data analytics and help improve their product portfolios. Key players in the fortified dairy products market are shifting to online sales channels to expand their customer base and sales.

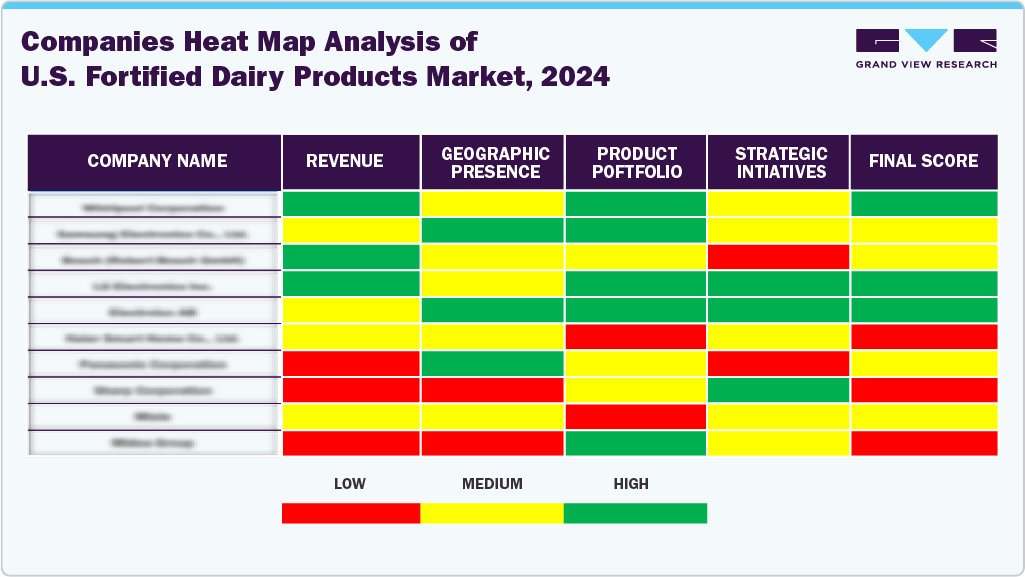

Key U.S. Fortified Dairy Products Company Insights

Key companies in the U.S. fortified dairy products market primarily focus on innovation, ingredient diversity, and health-centric offerings. They are investing in product development, strategic partnerships, and sustainable packaging to cater to evolving consumer preferences, expand their footprint, and strengthen competitiveness across regions.

Key U.S. Fortified Dairy Products Companies:

- Nestlé S. A

- Danone S.A

- FrieslandCampina

- LACTALIS

- The Kraft Heinz Company

- General Mills Inc.

- Dairy Farmers of America, Inc.

- Müller Group

- Yili Group

- AMUL (GCMMF)

Recent Developments

-

In January 2025, General Mills, Inc. completed the sale of its yogurt business in Canada to Sodiaal. This divestiture includes the Canada-based operations of brands such as Yoplait and Liberté, as well as a manufacturing facility located in Saint-Hyacinthe, Québec. The company also plans to sell its U.S. yogurt business to LACTALIS in the same year, subject to regulatory approvals.

-

In November 2024, LACTALIS announced an investment of USD 55 million in the Tulare facility in the U.S. to increase the volume of Président Feta Cheese manufactured in the nation

-

In September 2024, Müller Group announced a collaboration with MyProtein to introduce a new product range consisting of high-protein yogurts and desserts. The collaboration includes products such as high-protein yogurts, low-fat puddings, and low-fat mousses, available in vanilla, chocolate, and salted caramel flavors.

U.S. Fortified Dairy Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.59 billion

Revenue forecast in 2033

USD 28.41 billion

Growth rate

CAGR of 4.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, distribution channel

Country scope

U.S.

Key companies profiled

Nestlé S. A; Danone S.A; FrieslandCampina; LACTALIS; The Kraft Heinz Company; General Mills Inc.; Dairy Farmers of America, Inc.; Müller Group; Yili Group; AMUL (GCMMF)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fortified Dairy Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. fortified dairy products market report based on product, ingredient, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Milk

-

Whole Milk

-

Flavored Milk

-

Others

-

-

Yogurt

-

Regular/Traditional

-

Greek

-

Drinkable

-

Plant-based

-

-

Cheese

-

Butter & Spread

-

Ice Cream

-

Frozen Desserts

-

Others

-

-

Ingredient Outlook (Revenue, USD Billion, 2021 - 2033)

-

Probiotic & Prebiotic

-

Protein

-

Vitamins & Minerals

-

Omega-3 & Essential Fatty Acids

-

Enzymes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hypermarket/Supermarket

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. fortified dairy products market was estimated at USD 19.82 billion in 2024 and is expected to reach USD 20.59 billion in 2025.

b. The U.S. fortified dairy products market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 28.41 billion by 2033.

b. Based on product, milk dominated the U.S. fortified dairy products market in 2024 with a share of about 65.05%.

b. Key players in the U.S. fortified dairy products market are Nestlé S. A; Danone S.A; FrieslandCampina; LACTALIS; The Kraft Heinz Company; General Mills Inc.; Dairy Farmers of America, Inc.; Müller Group; Yili Group; AMUL (GCMMF), among others.

b. Key factors driving U.S. fortified dairy market growth include rising health awareness, nutrient deficiency concerns, functional foods demand, and product innovation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.