- Home

- »

- Homecare & Decor

- »

-

U.S. Garage Organization And Storage Market Report, 2033GVR Report cover

![U.S. Garage Organization And Storage Market Size, Share & Trends Report]()

U.S. Garage Organization And Storage Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cabinets & Tool Chests, Shelves/Racks, Overhead/Ceiling Storage), By Application (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-800-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

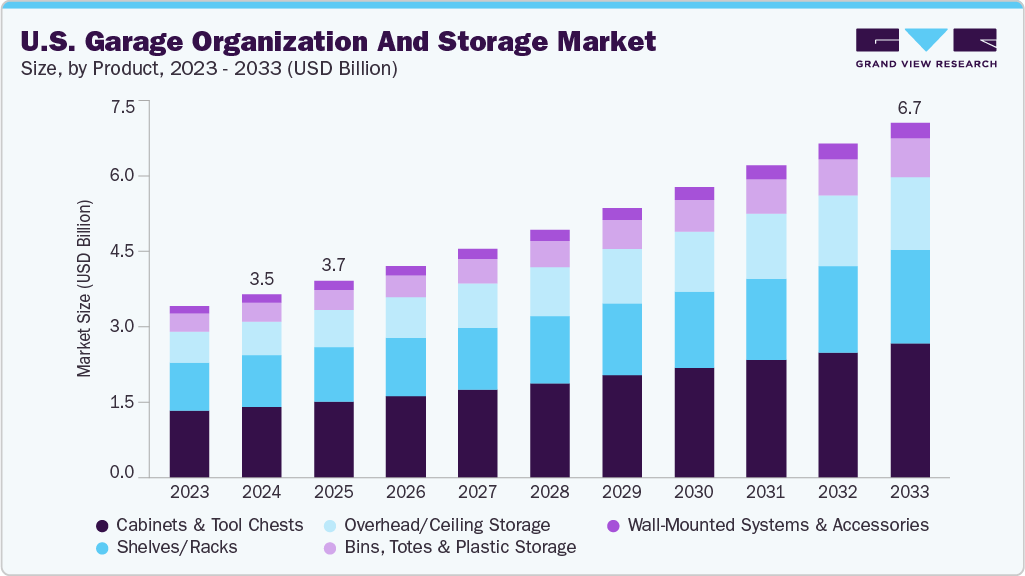

The U.S. garage organization and storage market size was estimated at USD 3.46 billion in 2024 and is projected to reach USD 6.71 billion by 2033, growing at a CAGR of 7.7% from 2025 to 2033. Consumer expenditure on DIY projects and home improvement is directly shaping the industry. As Americans increasingly invest in remodeling and optimizing their homes, garages, once used mainly for parking, are being repurposed into multi-functional spaces like workshops, gyms, or storage hubs. This shift has driven demand for shelving, cabinets, overhead racks, and modular systems that allow homeowners to maximize limited space. Rising home values and high real estate costs further push consumers to make the most of every square foot, with garages becoming prime targets for improvement.

The DIY culture adds a strong layer to this trend. Many homeowners now prefer to take on projects themselves rather than hiring professionals. DIY projects offer cost efficiency, but equally important, they allow for personalization; consumers can customize layouts, finishes, and systems to suit their lifestyles. The widespread availability of modular products, detailed tutorials, and step-by-step guides online makes these projects more accessible than ever. Retailers and manufacturers are also targeting this audience with easy-to-install, customizable solutions.

Gen Z and young homeowners are gaining influence, motivated by cost savings and the need to improve or personalize fixer-upper homes. Millennials (ages 25-44) are particularly active in garage and home DIY, with about 73% reporting engagement in DIY projects, and 26% of all DIYers falling between 31 and 40 years old. Nowadays, women are increasingly active participants in home improvement and DIY projects.

As more households acquire vehicles, the need for efficient storage solutions in garages has grown. Originally designed for parking, garages are now being repurposed for multiple functions such as workshops, home offices, and storage areas. This shift is driving the demand for organized storage systems to accommodate a wide range of items like tools, sports equipment, and seasonal goods.

The U.S. has witnessed a steady increase in vehicle ownership over the years. According to the U.S. Department of Transportation, the number of registered vehicles in the country has been on the rise, leading to a greater need for organized garage spaces. This trend is prompting homeowners to invest in storage solutions that maximize garage space, such as wall-mounted shelves, overhead racks, and modular cabinets. Consumer intentions reflect a desire for enhanced garage spaces. Over 50% of homeowners plan to reorganize their garage within the next two years, indicating a proactive approach to improving this area. Additionally, 52% of homeowners aspire to have a garage that impresses their neighbors, highlighting the garage's role in home curb appeal.

Additionally, the increasing interest in household gear, driven by trends such as DIY home improvement and the desire for organized living spaces, is further fueling this demand. Consumers are investing in solutions like modular storage systems, wall-mounted organizers, and overhead racks to make the most of their garage space. Companies are responding to this trend by offering customizable storage solutions designed to meet specific needs, further contributing to market growth.

Consumer Insights

Household Income: Household income strongly influences purchasing behavior in the industry. Higher-income homeowners, typically with multi-car or detached garages, are more inclined to invest in premium modular systems, custom cabinetry, and professional installation services that enhance functionality and aesthetics. Middle-income consumers represent the core market, prioritizing value-driven, durable, and easy-to-install solutions that improve space utilization without high cost. In contrast, lower-income households focus on affordability and practicality, opting for basic shelving units, plastic bins, and portable racks for essential organization needs.

Occupation: Occupation shapes how consumers utilize and equip their garages. Skilled tradespeople and technicians often use the garage as a workspace, driving demand for heavy-duty tool storage, workbenches, and metal shelving. In contrast, professionals and executives view the garage as an extension of the home, emphasizing organized layouts, clean aesthetics, and lifestyle integration-such as home gyms or hobby areas. Retirees and hobbyists also form a distinct segment, seeking ergonomic, easy-to-assemble storage systems that support leisure activities and seasonal organization.

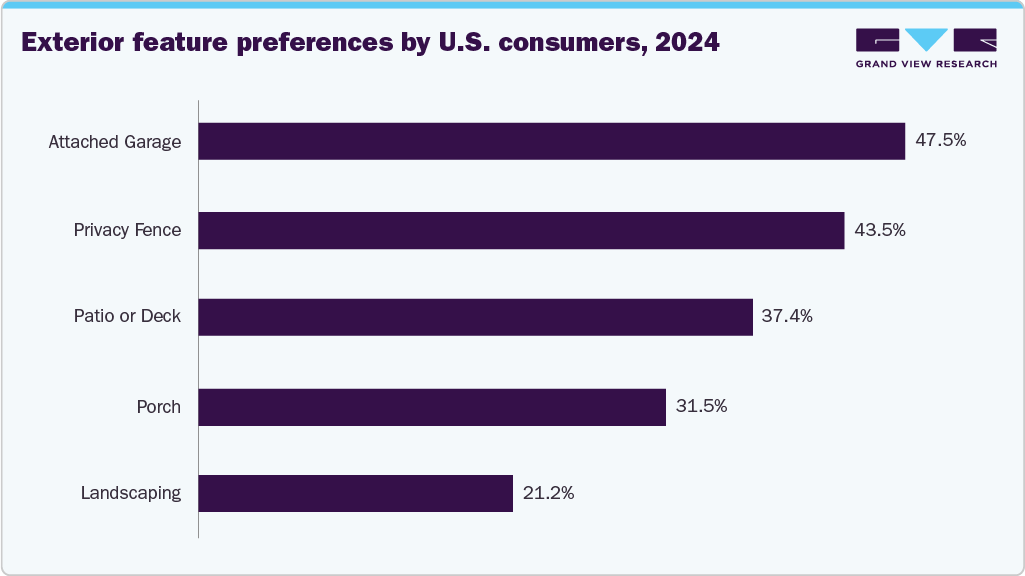

Home Features Preference: Generational differences also shape garage preferences among U.S. homeowners. A 2024 study by Rocket Mortgage surveying around 1,500 homebuyers found that nearly half preferred an attached garage. The preference was strongest among Baby Boomers, with about 65.8% favoring attached garages, reflecting their need for convenience, safety, and weather protection. By contrast, Gen Z buyers showed a comparatively lower preference, likely due to smaller living spaces and urban housing patterns with limited garage availability. These generational variations directly influence demand in the garage organization and storage market. Older homeowners with attached garages tend to invest in built-in cabinets, modular wall systems, and professional installations that enhance accessibility and aesthetics. At the same time, younger consumers focus on compact, portable, and affordable storage solutions for smaller or shared spaces.

Product Insights

Cabinets & Tool Chests accounted for a revenue share of 38.71% in 2024. As American homeowners increasingly convert garages into adaptable spaces for DIY projects, hobbies, and mechanical tasks, demand for these solutions has grown. This shift is driving interest in semi-custom setups that can be tailored to specific layouts, with adjustable dimensions and finish options that align storage with the home’s interior style. Tool chests are also evolving, offering durable builds with advanced features like locking mechanisms, power-integrated compartments, and smooth-slide drawers that support both ease of use and equipment protection.

The overhead/ceiling storage segment is projected to grow at a CAGR of 10% over the forecast period of 2025-2033. Overhead/ceiling storage has grown in popularity among households seeking efficient organization without compromising accessibility, especially in garages with limited space. Products like the FLEXIMOUNTS GL1 demonstrate the increasing demand for robust, adjustable systems that balance safety with user convenience. Modern designs often support high weight capacities, sometimes up to 1,000 pounds, making them suitable for storage bins, outdoor equipment, or holiday décor. Features such as height adjustability and pulley mechanisms further enhance usability, allowing users to raise and lower platforms for easy access to heavy or oversized items without strain.

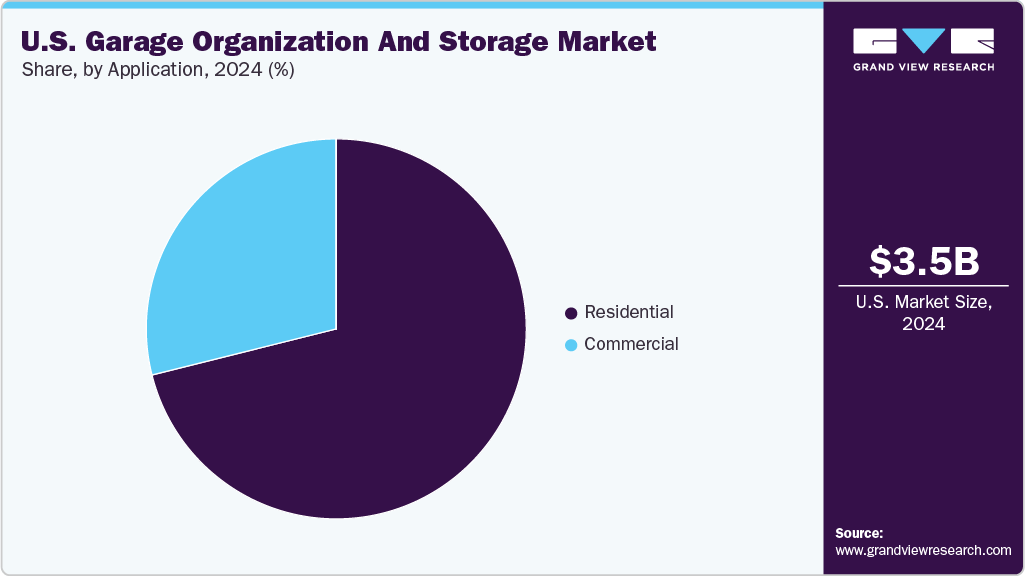

Application Insights

Residential applications accounted for a revenue share of 71.10% in 2024. Urbanization and smaller living spaces are pushing homeowners to maximize garage functionality, while the rising popularity of DIY projects and home improvement activities encourages investment in customized storage systems. Additionally, higher disposable incomes enable consumers to purchase premium, modular, and aesthetically appealing solutions, and growing awareness of the practical and psychological benefits of clutter-free spaces further fuels demand for an organized garage environment.

The commercial segment is projected to grow at a CAGR of 9.1% over the forecast period of 2025-2033. Commercial garages and warehouses increasingly integrate smart technologies into their storage systems to enhance efficiency and accuracy. Automated shelving, remote-controlled lighting, and inventory-tracking systems help businesses optimize space and reduce manual errors. For instance, Flexi-Lift and AutoStore are automated storage and retrieval systems commonly used in warehouses, distribution centers, and large commercial garages.

Key U.S. Garage Organization And Storage Companies Insights

Key players operating in the U.S. garage organization & storage market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Garage Organization And Storag Companies:

- Gladiator GarageWorks

- Rubbermaid

- Organized Living

- Seville Classics Inc.

- Flow Wall Systems

- Ulti-MATE Garage Cabinets

- Sandusky Lee Corporation

- Monkey Bars Storage

- NewAge Products Inc.

- Kobalt (Lowe’s Companies, Inc.)

Recent Developments

-

In July 2025, Sonic entered a collaboration with Obsessed Garage to make its professional tool cabinets and modular storage systems available to homeowners who want workshop-level setups in their own garages. Through this partnership, Obsessed Garage will offer Sonic’s drawers, cabinets, and foam-organised tool layouts as part of its custom design and installation service, allowing buyers to build high-performance, visually coordinated garage spaces. The move extends Sonic’s reach beyond commercial workshops and positions its products as a premium choice for enthusiasts upgrading residential garages.

-

In July 2025, SafeRacks rolled out a new bin-based storage rack aimed at simplifying clutter management in homes and garages. The system is built on a heavy-duty steel frame similar to the company’s ceiling-mounted platforms and is designed to hold multiple storage totes while keeping them easy to access. Positioned as a space-saving alternative to traditional shelving, the rack allows homeowners to use vertical space more efficiently and quickly organize seasonal gear, tools, or household supplies. The product’s strong consumer response reflects SafeRacks’ effort to move beyond overhead garage units and establish itself as a broader home-organization brand.

U.S. Garage Organization & Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.71 billion

Revenue forecast in 2033

USD 6.71 billion

Growth rate

CAGR of 7.7% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Gladiator GarageWorks; Rubbermaid; Organized Living; Seville Classics Inc.; Flow Wall Systems; Ulti-MATE Garage Cabinets; Sandusky Lee Corporation; Monkey Bars Storage; NewAge Products Inc.; Kobalt (Lowe’s Companies, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Garage Organization And Storage Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. garage organization and storage market report on the basis of product, and application:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cabinets & Tool Chests

-

Shelves/Racks

-

Overhead/Ceiling Storage

-

Bins, Totes & Plastic Storage

-

Wall-Mounted Systems & Accessories

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. Key players in the U.S. garage organization & storage market are Gladiator GarageWorks, Rubbermaid, Organized Living, Seville Classics Inc., Flow Wall Systems, Ulti-MATE Garage Cabinets, Sandusky Lee Corporation, Monkey Bars Storage, NewAge Products Inc., Kobalt (Lowe’s Companies, Inc.)

b. The U.S. garage organization and storage market is being propelled by rising home improvement activity and the growing need for efficient space utilization, especially in suburban households. Increased interest in DIY projects, vehicle care, and decluttering solutions is further driving demand for customizable and durable garage storage systems.

b. The U.S. garage organization and storage market was estimated at USD 3.46 billion in 2024 and is expected to reach USD 3.71 billion in 2025.

b. The U.S. garage organization & storage market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2033 to reach USD 6.71 billion by 2033.

b. Cabinets & tool chests accounted for a revenue share of 38.71% in the year 2024 in the overall U.S. garage organization & storage industry. Their dominance reflects consumer preference for durable, enclosed storage solutions that help maximize space and maintain a clean, secure environment for tools and equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.