- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Golf Apparel Market Size & Share, Industry Report 2033GVR Report cover

![U.S. Golf Apparel Market Size, Share & Trends Report]()

U.S. Golf Apparel Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Topwear, Bottomwear, Gloves, Caps), By End-use, By Distribution, And Segment Forecasts

- Report ID: GVR-4-68040-765-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Golf Apparel Market Size & Trends

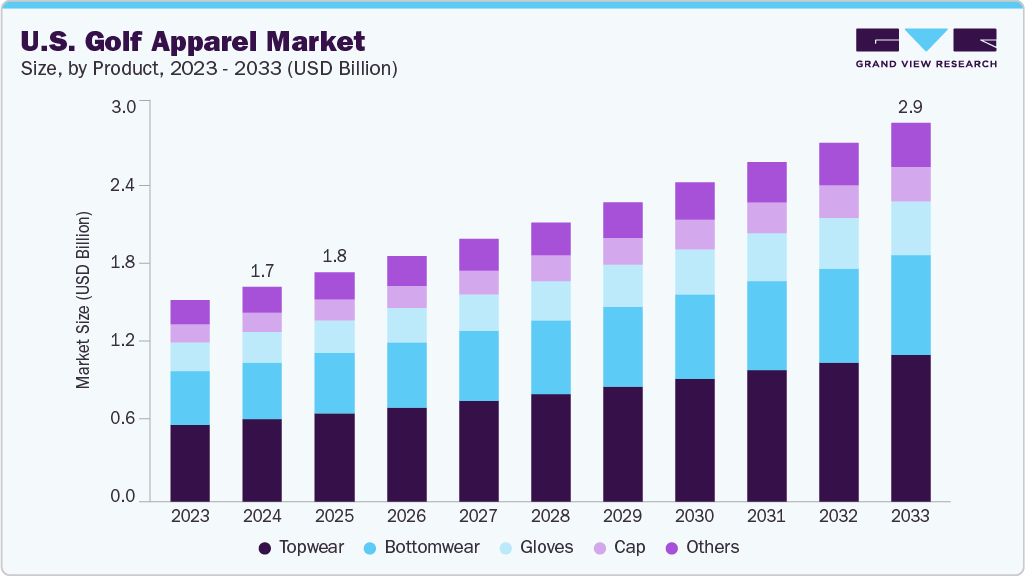

The U.S. golf apparel market size was estimated at USD 1.67 billion in 2024 and is projected to reach USD 2.95 billion by 2033, growing at a CAGR of 6.5% from 2025 to 2033. The U.S. gold apparel industry has experienced robust growth in recent years, driven by a combination of lifestyle, socio-economic, and cultural factors that have expanded its consumer base and enhanced its aspirational appeal.

This expansion is primarily fueled by the increasing popularity of golf as both a recreational and professional sport, with a notable rise in participation among younger demographics, women, and those drawn to the sport’s association with wellness, networking, and lifestyle activities. The market has effectively positioned golf apparel as not only functional sporting gear but also as stylish, multipurpose attire attractive to a broader audience.

Technological advancements play a pivotal role in driving market growth by transforming the design and experience of apparel. Innovative fabric technologies-such as moisture-wicking, UV-blocking, breathability, and stretchability- enhance comfort and performance, catering to consumer demand for products that perform well in diverse weather conditions and physical activities. These innovations have also made golf apparel more versatile and appealing for use beyond the golf course, blurring lines between sportswear, business casual, and everyday fashion.

Economic factors, particularly rising disposable incomes and the post-pandemic shift towards outdoor activities, further drive the market. As the population becomes increasingly health-conscious and invests in recreational sports, spending on premium golf apparel rises, particularly among consumers who perceive golf wear as a symbol of status or who seek durability and innovation in their purchases. The willingness of consumers-particularly Gen-X and Boomer golfers- to invest in high-quality, branded apparel strengthens the premium segment of the market.

Sustainability trends have also strengthened market prospects, as both established brands and emerging players shift toward eco-friendly materials and ethical production practices. Modern consumers, particularly younger demographics, are increasingly prioritizing sustainability in their purchasing decisions, rewarding brands that align with their environmental and social values. This shift not only meets current consumer demands but also prepares the industry for long-term resilience by embedding environmental responsibility into standard business practices.

Digital transformation and e-commerce are crucial catalysts for growth, significantly enhancing consumer access to a diverse range of products. The widespread adoption of user-friendly websites, mobile apps, virtual fitting rooms, and effective social media marketing enables brands to reach new and existing customers more efficiently and personally. These digital innovations also enable smaller, independent brands to compete alongside established players, thereby intensifying market competition and driving innovation.

Endorsements by professional golfers, collaborations with celebrities, and sponsorships of major golf tournaments have bolstered the market’s visibility and aspirational value. These strategies not only increase brand recognition but also elevate the perceived social status of golf apparel, attracting consumers who wish to associate themselves with the sport’s prestige and lifestyle. This confluence of social, economic, technological, and cultural trends ensures ongoing growth and dynamism in the U.S. gold apparel industry.

Despite the growing popularity of golf, the market faces several challenges. Changes in tariff policies, especially those affecting imports from major manufacturing countries, have led to increases in production and retail costs, compelling brands to adjust their sourcing strategies and, at times, relocate manufacturing to regions with more favorable trade agreements. Regulatory demands for sustainability, such as stricter controls on chemicals and waste in textile manufacturing, further complicate compliance and cost structures for brands operating in the U.S. market.

Golf remains a seasonal sport in much of the U.S., causing demand for apparel to fluctuate throughout the year and complicating inventory management for brands and retailers. This seasonality results in inconsistent revenue and an increased risk of overstocking or stockouts, particularly for smaller brands that are less able to buffer seasonal fluctuations.

Product Insights

The top wear, especially polo shirts, led the market with the largest revenue share of 38.32% in 2024, because it is the most iconic and essential garment for golf players, forming a critical part of the sport’s dress code and tradition. Polos are recognized not only for their association with golf but also for their timeless style, comfort, and versatility, making them suitable for wear both on and off the course. This versatility has made top wear hugely popular beyond just sporting circles, as consumers often choose polo shirts for social, business-casual, and everyday leisure activities, significantly expanding the potential buyer base.

In addition, ongoing product innovation has enhanced the appeal of top wear, incorporating features such as moisture-wicking, breathability, stretch fabrics, and eco-friendly materials. Brands continually update designs with modern colorways and athletic fits that resonate with both traditional golfers and a younger, style-conscious audience. Such advancements not only drive repeat purchases among golf enthusiasts but also attract new customers seeking multipurpose apparel, further consolidating top wear’s dominance.

The bottom wear segment is anticipated to grow at the fastest CAGR during the forecast period, due to a rapid shift in consumer lifestyle and fashion preferences that favor flexibility, comfort, and functionality in apparel. Golf trousers, shorts, and chinos now feature advanced technologies like four-way stretch, weather resistance, and technical tailoring. These appeal to active individuals who value attire that performs both on the course and in everyday scenarios. This crossover utility encourages more frequent purchases and wider use, driving accelerated growth in the segment.

Furthermore, younger consumers and golf newcomers are increasingly opting for contemporary golf bottoms that bridge sporty aesthetics with urban style, fueling strong momentum in this category. Brands are responding with innovative fits, patterns, and practical features such as moisture management and increased durability, making bottom wear a compelling choice not just for play but also for casual, travel, and office settings. This expansion into lifestyle-driven demand ensures bottom wear continues to outpace other categories in growth.

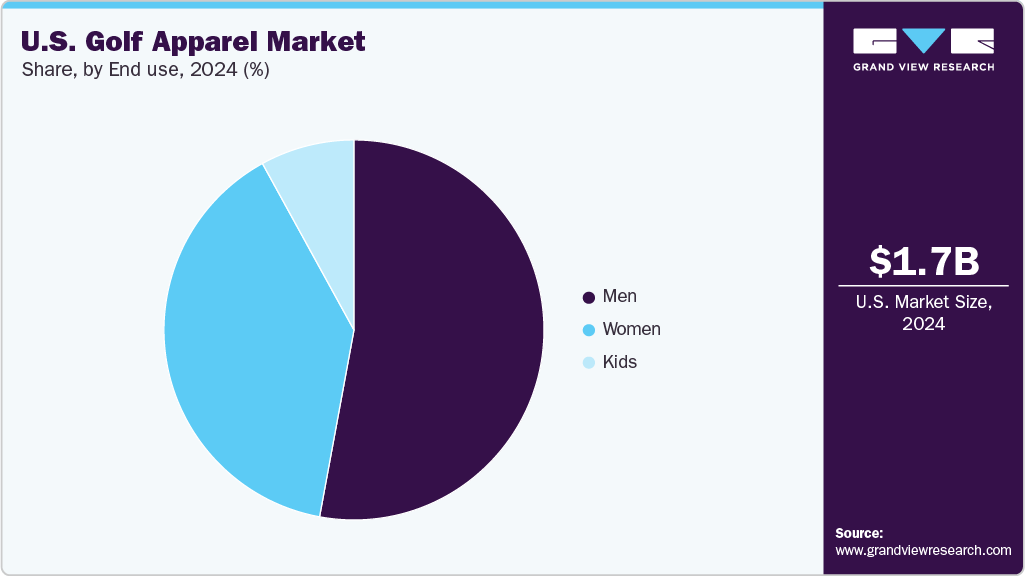

End Use Insights

The men segment led the market with the largest revenue share of 52.87% in 2024, representing the majority demographic due to their long-standing presence and participation in both recreational and professional golf activities. This dominance is driven by golf’s historical male-oriented culture, higher average spending power among male golfers, and the tradition of men’s tournaments and club memberships fueling ongoing demand for male-specific apparel. Men’s golf apparel covers everything from classic polos and trousers to performance-focused outerwear, resulting in a consistently strong sales base.

In addition, the men’s segment is bolstered by a mature, loyal customer base that values brand reputation, technical innovation, and style updates, driving premium and repeat purchases. Many leading brands concentrate their product development and marketing resources on men’s lines, sustaining segment leadership with innovations in fit, fabric, and versatility that appeal to both traditional and modern lifestyles.

The women segment is anticipated to grow at the fastest CAGR of 6.7% over the forecast period, reflecting a surge in female participation in golf and a shift toward inclusive, fashion-forward product designs. The industry has seen a notable increase in women golfers, supported by targeted women’s tournaments, golf clinics, and community programs that welcome newcomers and promote golf as a lifestyle sport for women of all ages. As women’s apparel demand rises, brands are rapidly expanding their collections with stylish, performance-driven products tailored specifically to female golfers’ preferences for fit, comfort, and versatility.

This growth is further propelled by broader societal trends emphasizing gender inclusion in sports, along with the influence of social media, celebrity golfers, and athleisure fashion, all of which have made golf more appealing and accessible to women. Brands leveraging these trends with dedicated marketing and innovative, female-centric designs are experiencing above-average growth, making women the fastest-growing end-user segment in the U.S. golf apparel landscape.

Distribution Insights

The sports stores segment led the market with the largest revenue share of 34.56% in 2024, significantly outpacing other offline channels such as pro shops and exclusive brand outlets. This leadership is due to the broad selection, expert staff, and the convenience they provide in allowing customers to try on products and receive specialized advice, which is especially valued by golfers seeking fit and function. Sporting goods stores also feature both premium and value brands, drawing a diverse customer base throughout the year.

Pro shops and on-course stores remain important retail points. Still, their share is smaller compared to multi-brand sports stores, which benefit from strategic locations, robust supply chains, frequent in-store promotions, and wider consumer reach. The combination of accessible locations and knowledgeable staff makes sports stores the primary destination for golf apparel purchases, sustaining their dominance within the offline channel.

The online retail segment is anticipated to grow at the fastest CAGR during the forecast period, bolstered by a rapid shift toward digital commerce and direct-to-consumer (DTC) brand models. E-commerce platforms achieve high growth rates due to their convenience, broad product accessibility, and personalized experiences through AI-driven sizing tools, livestream demos, and flexible return policies.

Online channels succeed in attracting younger consumers and occasional golfers who value quick browsing, transparent pricing, and exclusive or limited-edition releases that are frequently updated based on real-time data and trends. Brands also leverage digital marketing, social media, and influencer partnerships to accelerate their reach and conversion rates, driving the rapid expansion of online golf apparel sales in the U.S. market.

Key U.S. Golf Apparel Company Insights

The U.S. golf apparel industry is highly competitive, featuring a mix of multinational sportswear giants, traditional golf brands, premium lifestyle labels, and new direct-to-consumer players. The competitive landscape is led by major brands such as Nike, Adidas, Under Armour, FootJoy (Acushnet Company), TaylorMade Golf, Callaway Golf, Ralph Lauren, Puma SE, Peter Millar, and Mizuno. These players continually invest in product innovation, sustainability initiatives, and athlete endorsements to differentiate their brands and capture share in both core golf and lifestyle segments.

The market is further shaped by a surge of innovative disruptors and DTC (direct-to-consumer) brands that appeal to younger and more diverse golfers, often using social media and digital engagement to accelerate customer acquisition. Strategic collaborations, celebrity and athlete endorsements, and M&As fuel continued rivalry-examples include limited-edition drops, eco-friendly lines, and tech smartwear releases. With shifting trends toward athleisure, inclusivity, and sustainability, brand agility and marketing prowess are increasingly critical for gaining and sustaining competitive advantage.

Key U.S. Golf Apparel Companies:

- Nike, Inc.

- Adidas AG

- Under Armour, Inc.

- FootJoy (Acushnet Company)

- Puma SE

- Callaway Golf Company

- TaylorMade Golf Company, Inc.

- Ralph Lauren Corporation

- Peter Millar

- TravisMathew

- Mizuno Corporation

- Antigua Sportswear

- Oakley, Inc.

- J.Lindeberg

- Galvin Green

U.S. Golf Apparel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.78 billion

Revenue forecast in 2033

USD 2.95 billion

Growth rate

CAGR of 6.5% from 2024 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution, region

Country scope

U.S.

Key companies profiled

Nike, Inc.; Adidas AG; Under Armour, Inc.; FootJoy (Acushnet Company); Puma SE; Callaway Golf Company; TaylorMade Golf Company, Inc.; Ralph Lauren Corporation; Peter Millar; TravisMathew; Mizuno Corporation; Antigua Sportswear; Oakley, Inc.; J.Lindeberg; Galvin Green

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Golf Apparel Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the U.S. golf apparel market report based on the product, end use, distribution, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Topwear

-

Bottomwear

-

Gloves

-

Cap

-

Others

-

-

End-Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Men

-

Women

-

Kids

-

-

Distribution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retail

-

Specialty Stores

-

Sports Store

-

Online Retailers

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.