- Home

- »

- Renewable Chemicals

- »

-

U.S. Green Chemicals Market Size, Industry Report, 2033GVR Report cover

![U.S. Green Chemicals Market Size, Share & Trends Report]()

U.S. Green Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Bio-alcohols, Bio-organic Acids, Biopolymers), By Application, And Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-698-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Green Chemicals Market Summary

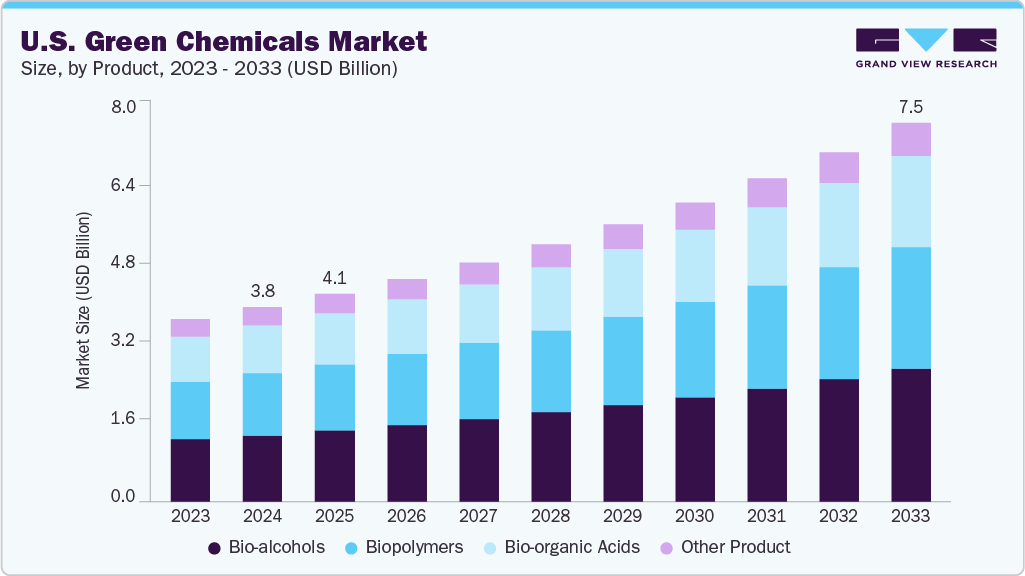

The U.S. green chemicals market size was estimated at USD 3.83 billion in 2024 and is projected to reach USD 7.46 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033. The market is primarily driven by increasing environmental awareness, stringent regulatory mandates from agencies such as the EPA and FDA, and the growing emphasis on sustainable industrial practices.

Key Market Trends & Insights

- The U.S. green chemicals market is projected to grow at a CAGR of 7.8% from 2025 to 2033.

- By product, the bio-alcohols segment led the market with the largest revenue share of 34.3% in 2024.

- By product, the biopolymers segment is expected to grow at a significant CAGR of 7.9% from 2025 to 2033.

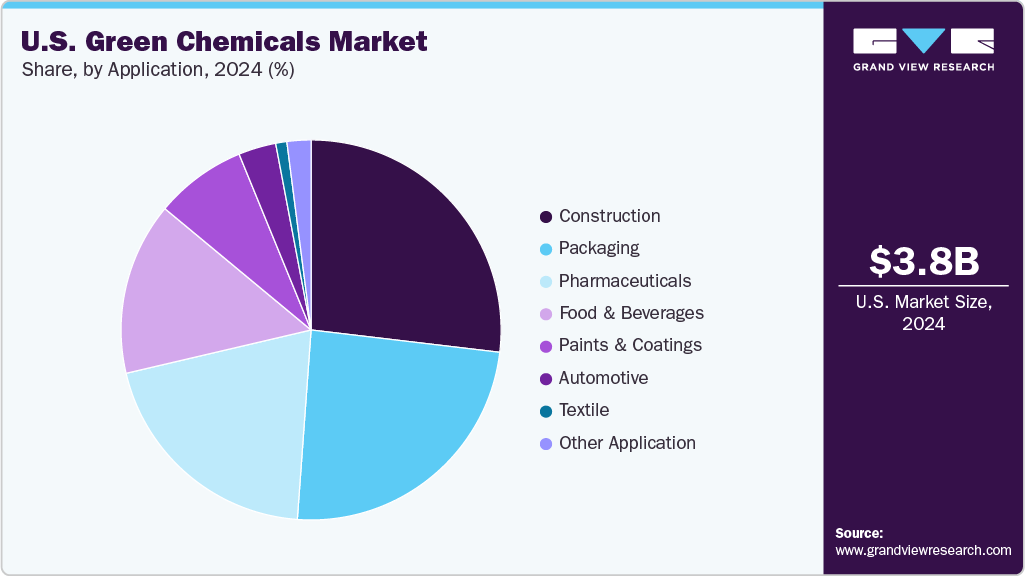

- By application, the construction segment led the market with the largest revenue share of 26.9% in 2024.

- By application, the automotive segment is expected to witness the fastest growth of 8.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3.83 Billion

- 2033 Projected Market Size: USD 7.46 Billion

- CAGR (2025-2033): 7.8%

The rising consumer demand for bio-based and non-toxic products across sectors like packaging, personal care, and food & beverages is accelerating the adoption of green chemicals. The corporate ESG initiatives and the decarbonization efforts of major industries are fostering a shift from petrochemical-based inputs to renewable and biodegradable alternatives.Significant growth opportunities lie in the advancement of bio-refinery technologies, which are improving the cost-efficiency and scalability of green chemical production. Emerging applications in automotive lightweighting, sustainable textiles, and pharmaceutical green synthesis present new frontiers for market expansion. Furthermore, government incentives, rising venture capital funding in green tech, and the increasing integration of circular economy principles across industries are expected to create favorable conditions for innovation and commercialization of high-performance bio-based chemical solutions.

Despite robust growth potential, the market faces several challenges, including the high production costs of bio-based chemicals compared to conventional petrochemical products. Limited availability and price volatility of sustainable feedstocks, coupled with complex supply chain logistics, hinder large-scale adoption. In addition, scalability constraints for emerging technologies and the lack of standardization in bio-based certifications can create barriers for market entry and industry-wide adoption.

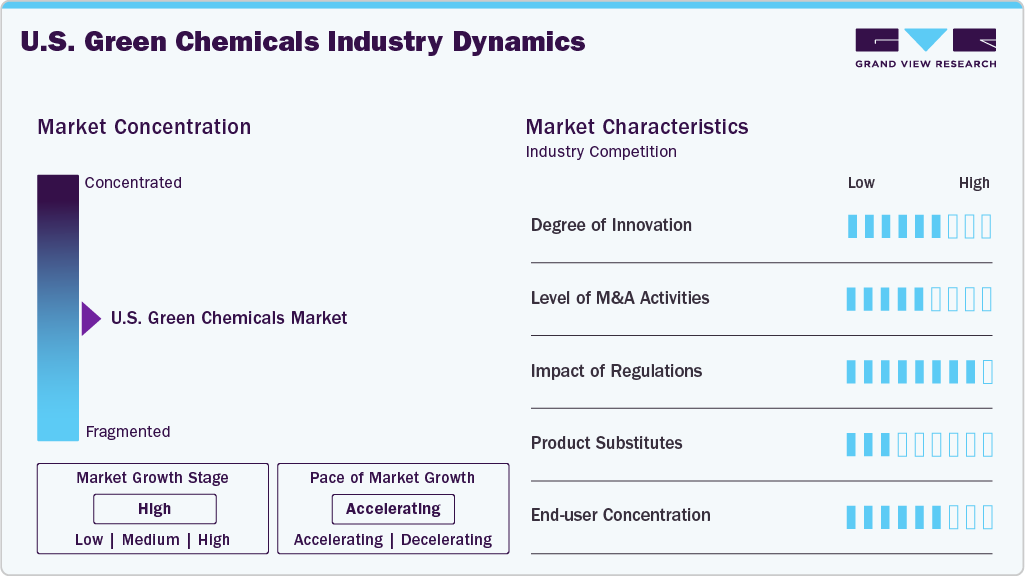

Market Concentration & Characteristics

The U.S. green chemicals industry is moderately fragmented, with leadership held by several large, vertically integrated chemical manufacturers. These major players capitalize on economies of scale, internal sourcing of bio-based raw materials such as natural oils, sugars, bio-based acids, and expansive global distribution networks to sustain their competitive edge. Their integration across the green chemical value chain from feedstock processing to the production of bio-alcohols, biopolymers, and bio-based solvents, allows for improved cost efficiency, product consistency, and dependable supply.

Leading players in the U.S. green chemicals industry are adopting a mix of strategic initiatives to strengthen their market position, including expanding biorefinery capacities, forming strategic partnerships, and investing heavily in R&D for advanced bio-based formulations. Companies such as Cargill, DuPont, and NatureWorks are focusing on developing high-performance biopolymers and bio-alcohols tailored for specific end-use industries like packaging, automotive, and pharmaceuticals. Many players are also entering joint ventures with startups and research institutions to accelerate the innovation and commercialization of next-generation green chemicals. The market leaders are actively pursuing sustainability certifications and integrating digital technologies into their operations to optimize supply chains, enhance transparency, and align with evolving regulatory and ESG requirements.

Product Insights

The bio-alcohols segment led the market with the largest revenue share of 34.3% in 2024 and is projected to grow at the fastest CAGR during the forecast period, primarily driven by its widespread industrial applicability, cost competitiveness, and regulatory support for renewable fuel alternatives. Bio-ethanol, the most prominent bio-alcohol, is extensively used as a fuel additive to reduce greenhouse gas emissions, particularly in the U.S. transportation sector. Moreover, bio-alcohols serve as critical building blocks in the production of solvents, personal care products, pharmaceuticals, and plastics, contributing to their broad market penetration. Favorable government mandates, such as the U.S. Renewable Fuel Standard (RFS), continue to bolster demand. At the same time, advancements in second-generation feedstocks have enhanced production efficiency and scalability, reinforcing the segment's dominance.

The biopolymers segment is anticipated to grow at a significant CAGR during the forecast period, due to rising demand across food, packaging, and pharmaceutical applications. Bio-organic acids such as lactic, succinic, and citric acids are increasingly used as preservatives, acidulants, and monomers for biodegradable plastics. Meanwhile, biopolymers are rapidly gaining traction in the sustainable packaging and textile industries, with the growing adoption of PLA (polylactic acid) and PHA (polyhydroxyalkanoates). The other product category, which includes biosurfactants, bio-solvents, and specialty green chemicals, is emerging as a niche yet promising segment, driven by demand in cosmetics, agriculture, and specialty coatings. Together, these segments reflect the market’s ongoing transition toward safer, renewable, and environmentally responsible chemical alternatives.

Application Insights

The construction segment led the market with the largest revenue share of 26.9% in 2024, primarily due to the growing emphasis on sustainable infrastructure and the widespread adoption of green building standards such as LEED and WELL. Green chemicals are increasingly utilized in a wide array of construction applications, including low-VOC paints and coatings, bio-based adhesives and sealants, insulation materials, and concrete admixtures. With federal and state governments prioritizing energy-efficient and environmentally responsible construction, demand for non-toxic, biodegradable, and high-performance chemical alternatives has surged. Moreover, real estate developers and contractors are integrating sustainable materials to meet consumer expectations and comply with evolving regulatory frameworks, further solidifying the segment’s leading position.

The automotive segment is anticipated to grow at the fastest CAGR during the forecast period. The automotive industry is adopting green chemicals for lightweight bio-composites, lubricants, and interior materials. Also, the construction industry is increasingly using green chemicals in adhesives, sealants, and low-VOC paints, driven by the rising adoption of LEED-certified buildings. The pharmaceutical sector is leveraging green chemistry to streamline synthesis processes, reduce hazardous waste, and align with stricter environmental regulations. In food and beverages, bio-organic acids and biopolymers are widely used as preservatives and in sustainable food contact materials. Meanwhile, textiles benefit from bio-based dyes, surfactants, and biodegradable fibers to meet sustainability targets. The paints and coatings segment also embraces bio-based resins and low-toxicity ingredients to cater to both consumer safety and environmental standards. These varied application areas highlight the expansive integration of green chemicals across the U.S. industrial value chain.

Key U.S. Green Chemicals Company Insights

Some of the key players operating in the U.S. green chemicals industry include BASF SE, Arkema S.A., and Evonik Industries AG.

- Evonik Industries AG is a global leader in specialty chemicals, operating in over 100 countries and generating approximately USD 16.6 billion in sales, supported by a workforce of around 32,000 professionals. Through its Active Oxygens division, the company produces some of the world’s cleanest chemicals, such as hydrogen peroxide, peracetic acid, and persulfates, that degrade into benign end products while serving high-value uses in semiconductor fabrication, water treatment, and soil remediation. Notably, Evonik is advancing sustainability by upgrading these foundational green chemistries into even greener forms, prioritizing lifecycle impact, value chain decarbonization, and alignment with UN Sustainable Development Goals across the Active Oxygens platform. The company’s broader restructuring efforts, focusing on two core segments, Custom Solutions and Advanced Technologies, underline a strategic shift toward high-performance, low-emission specialty chemicals and efficiency boosts amid persistent industry headwinds.

Key U.S. Green Chemicals Companies:

- Evonik Industries AG

- BASF SE

- Arkema S.A.

- DuPont

- Braskem S.A.

- Vertec BioSolvents Inc.

- CD BioSciences-GreenChemistry

- Viridis Chemical Company

- Corbion N.V.

- GENEDGE

U.S. Green Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.09 billion

Revenue forecast in 2033

USD 7.46 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

US

Key companies profiled

Evonik Industries AG; BASF SE; Arkema S.A.; DuPont; Braskem S.A.; Vertec BioSolvents Inc.; CD BioSciences-GreenChemistry; Viridis Chemical Company; Corbion N.V.; GENEDGE

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Green Chemicals Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. green chemicals market report based on product and application

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Bio-alcohols

-

Bio-organic acids

-

Biopolymers

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Construction

-

Pharmaceuticals

-

Packaging

-

Food and Beverages

-

Paints and Coatings

-

Automotive

-

Textile

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. green chemicals market size was estimated at USD 3.83 billion in 2024 and is expected to reach USD 4.09 billion in 2025.

b. The U.S. green chemicals market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 7.46 billion by 2033.

b. The bio-alcohols segment held the largest revenue share due to its extensive use in fuel additives, solvents, and personal care formulations, driven by favorable U.S. renewable fuel standards and rising demand for low-emission alternatives. Its cost-effectiveness and scalability further support widespread industrial adoption across multiple sectors.

b. Some of the key players operating in the U.S. green chemicals market include Evonik Industries AG, BASF SE, Arkema S.A., DuPont, Braskem S.A., Vertec BioSolvents Inc., CD BioSciences-GreenChemistry, Viridis Chemical Company, Corbion N.V., GENEDG.

b. The market is driven by increasing regulatory pressure to reduce carbon emissions, rising consumer demand for sustainable and non-toxic products, and growing corporate ESG commitments. Technological advancements in bio-based chemical production are further enabling cost-effective and scalable green alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.