- Home

- »

- Electronic & Electrical

- »

-

U.S. Greeting Cards Market Size, Industry Report, 2033GVR Report cover

![U.S. Greeting Cards Market Size, Share & Trends Report]()

U.S. Greeting Cards Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (E-Card, Traditional Card), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-817-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - NULL

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Greeting Cards Market Summary

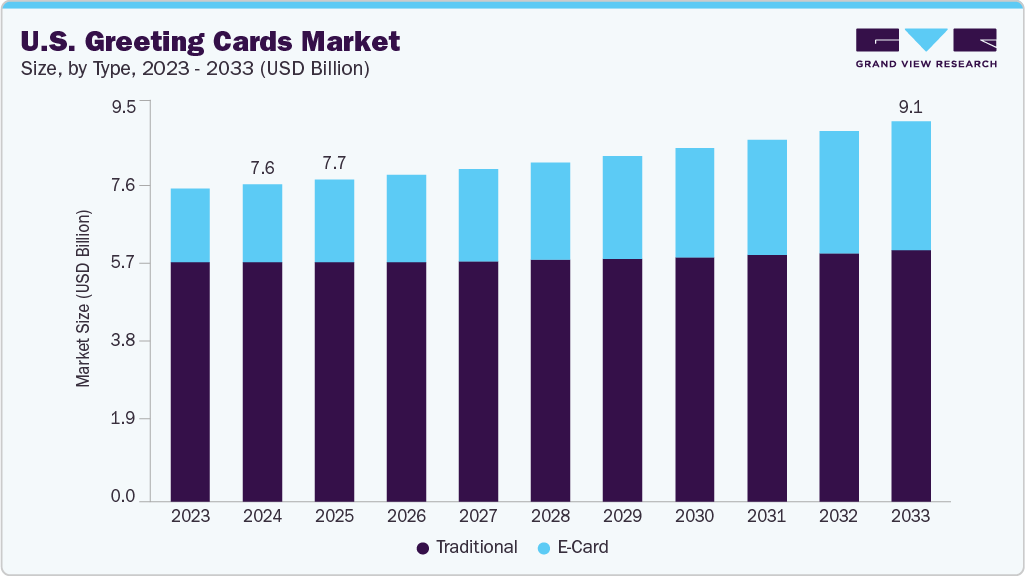

The U.S. greeting cards market size was estimated at USD 7.62 billion in 2024 and is projected to reach USD 9.14 billion by 2033, growing at a CAGR of 2.1% from 2025 to 2033. The market is regaining momentum, driven by a resurgence in consumer interest in thoughtful, tangible expressions of care.

Key Market Trends & Insights

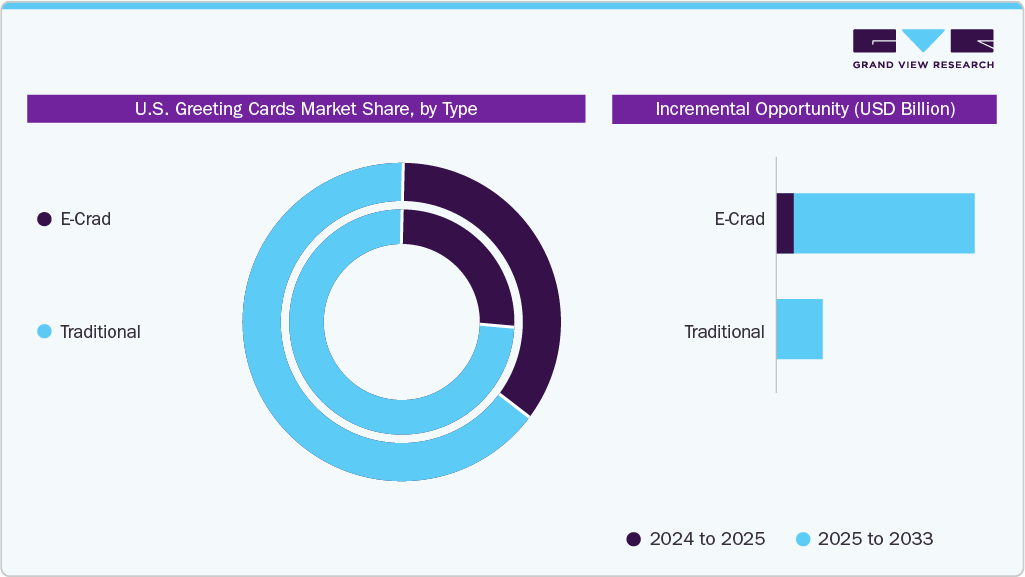

- By type segment, traditional cards held the largest market share of 75.44% in 2024.

- By distribution channel segment, offline sales held the largest market share in 2024.

- By type segment, e-cards are projected to grow at a CAGR of 5.8% over the forecast period of 2025-2033.

Market Size & Forecast

- 2024 Market Size: USD 7.62 Billion

- 2033 Projected Market Size: USD 9.14 Billion

- CAGR (2025-2033): 2.1%

While digital communication has grown exponentially, the act of giving physical cards remains deeply embedded in American social culture. Industry data suggests that approximately 6.5 billion greeting cards are purchased annually in the U.S., reaffirming their role in milestone celebrations, seasonal holidays, and personal life events. Notably, Millennials and Gen Z are significantly contributing to this revival by viewing cards as authentic, nostalgic tokens, offering a counterpoint to the impersonal nature of online messages. Their continued engagement with physical cards underscores how deeply emotional value remains tied to printed sentiments.

Birthdays remain the dominant occasion for card-giving: one review notes that birthday cards account for more than 50% of all card types sold, with over 7 billion units annually. Younger generations, specifically Millennials and Gen Z, are playing a more active role in shaping the future. Millennials, for example, are now the largest buyers of greeting cards in dollar terms, according to the GCA commentary cited in the media. Personalization, artisan or handmade cards, and eco-friendly materials are gaining importance. The market commentary notes that consumers increasingly seek cards that feel unique or hand-crafted rather than generic mass-printed. Finally, while digital e-cards are available, a significant portion of consumers still prefer mailing physical cards; one study found that 54% of U.S. consumers prefer to mail physical cards. These trends suggest that cards function not just as messages but as emotional stamps and tokens of a relationship.

The category is also being reshaped through innovation and expanded retail versatility. Brands and boutique makers are integrating hybrid formats, such as cards with QR codes linking to audio or video messages, or customizable templates ordered online and delivered by mail. Independent publishers are gaining traction by catering to niche audiences with designs that are humorous, feminist, or culturally specific. Meanwhile, established brands have expanded their reach by optimizing retail placement, moving cards outside of traditional seasonal aisles and positioning them in checkout, lifestyle, and even florist areas. Digital-first players are also flourishing, offering personalized e-cards or physical cards shipped directly to recipients with handwritten add-ons.

U.S. price segmentation remains distinct across the market. Entry-level cards, often found in supermarkets or dollar stores, cater to volume-based shoppers seeking quick and affordable solutions for everyday occasions. The mid-tier includes premium printed designs, specialty formats, and licensed-brand collaborations, appealing to consumers who want something thoughtful but budget-conscious. The high-end segment is driven by artisan studios and designer labels that offer handmade, letterpressed, or multi-component cards priced as miniature art pieces. These often target thoughtful gift-givers and collectors, with sustainability, limited editions, and bespoke typography adding to their appeal. This balanced segmentation allows the greeting card industry to remain inclusive while addressing modern consumer needs for both convenience and emotional depth.

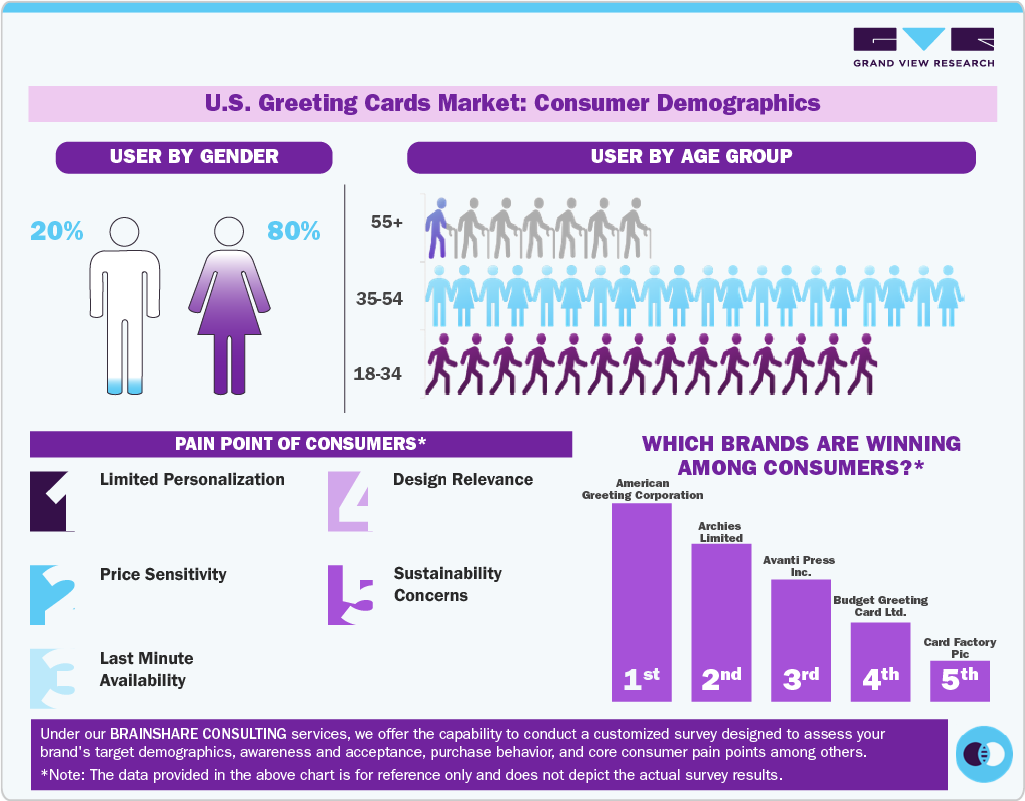

Consumer Insights

In 2023, the U.S. greeting card market continued to showcase distinct consumer demographic trends, particularly across age groups. According to the analysis by GVR, consumers aged 41 to 60 held the largest share of the greeting cards market, in terms of demand, which accounted for 42.1% in 2023. This age group tends to value traditional and sentiment-driven cards, often purchasing them for occasions such as birthdays, Mother's Day, and Christmas. They appreciate the emotional connection of a handwritten note and are more likely to opt for premium or keepsake cards that reflect personal relationships.

Consumers in the 30- to 40-year age group, representing 27.9% of the market, also play a significant role in the greeting cards market, as they often purchase cards for family and social occasions. This group is more likely to seek convenience while maintaining an emotional connection, opting for physical as well as digital formats of cards.

The demand for greeting cards from consumers aged over 60 was recorded at 21.0%, with traditional cards being their primary preference. They often purchase sympathy or thank-you cards and more somber cards for various occasions. Despite the growing trend toward digital communication, older consumers continue to appreciate the personal touch of physical greeting cards. The under-30 demographic, which comprises a smaller portion of the market at 9.0%, has shown a growing interest in eCards, particularly for major life events such as graduations or personal milestones. This age group prefers technology-driven communication, representing a shift in how greeting cards are consumed. Brands are increasingly catering to this demand by offering a wide range of digital options and customizable design formats that appeal to tech-savvy buyers in the country.

According to the Greeting Card Association, the U.S. greeting card industry experienced a notable gender-based purchasing preference in 2023, with women accounting for 80% of the demand for greeting cards. This discrepancy can be attributed to various factors, such as women being the primary organizers of family and social events, including birthdays, holidays, and special occasions, where greeting cards are commonly used to express sentiments. Women are often seen as the primary buyers of cards for both close family members and friends, particularly for special occasions like Mother's Day, Valentine's Day, and anniversaries.

Men, while accounting for a smaller portion of the market with a 20% share, still make up a noteworthy share of greeting card buyers, typically for significant occasions such as Valentine's Day, Father’s Day, and other major celebrations. However, men are less frequent buyers of greeting cards and usually opt for utilitarian or humorous cards and are less inclined toward cards with personal or emotional messages compared to women. The trend also reflects broader consumer behavior, with women more commonly engaged in tasks related to gift-giving and card-sending.

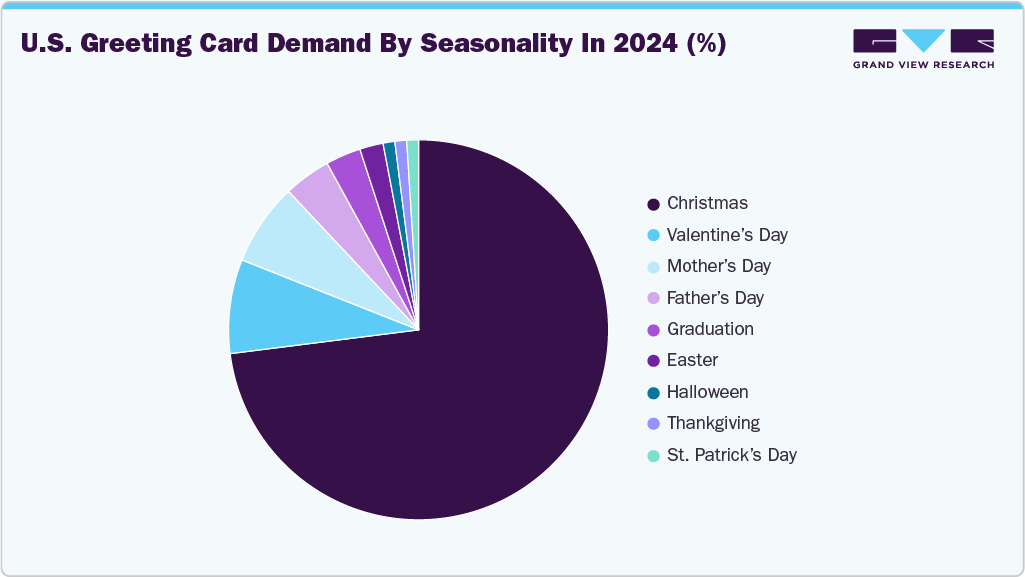

Seasonality Trends

The greeting-card market in the U.S. continues to be strongly shaped by seasonal peaks tied to major occasions such as Christmas/New Year, Valentine’s Day, Mother’s Day, Father’s Day, and graduations. For example, while Christmas remains the highest-volume occasion, other holidays also register significant card-sentiment waves: around 59 million cards are exchanged for graduation and roughly 40 million for Easter. Consequently, industry players time product launches, marketing campaigns, in-store display rollouts, and stocking logistics around these periods to capture the surge in demand.

Seasonality plays a significant role in the demand for greeting cards in the U.S., with key holidays driving the bulk of sales each year. As per the Greeting Card Association, Christmas was the dominant occasion, which accounted for 73.4% of greeting card demand in 2023. This makes it the most significant season for the greeting card industry as people purchase cards for family and friends as well as for colleagues, clients, and acquaintances.

Other holidays, such as Valentine’s Day (8.2%), Mother’s Day (6.4%), and Father’s Day (4.1%), also played a crucial role in the seasonal greeting card market. These occasions reflect personal expressions of love, appreciation, and gratitude, leading to a high demand for cards with heartfelt, intimate messages. Theme-based greeting cards are popular for holidays such as Halloween (1.1%), Thanksgiving (0.9%), and St. Patrick’s Day (0.4%). On these occasions, people prefer using such cards as fun, light-hearted gestures rather than for deeper emotional expression.

For the spring window leading up to Mother’s Day, Father’s Day, and graduations, there is an observable rise in demand for personalized, eco-friendly materials and niche-design greeting cards. Retailers report deploying end-aisle displays and relocating card fixtures into flower, gift, and checkout zones ahead of these occasions. During major gift-giving holidays, the tradition of sending physical cards remains a strong one. However, pressures such as rising mailing/postage costs, as well as digital substitution, are increasing. At the same time, online channels and direct-to-consumer personalization platforms are gaining traction, complementing traditional retail throughput.

Greeting-card businesses have responded to these seasonal rhythms by forging partnerships and innovating formats that align with occasion timing and consumer expectations of novelty, speed, and personalization. For instance, in August 2023, Hallmark partnered with Venmo to launch a special collection of cards embedded with a scannable QR code, allowing senders to include digital cash gifts directly within the physical card. This line was strategically introduced ahead of graduation season and later expanded for Mother’s Day and Christmas, tapping into occasions where cash gifting and personalized notes often go hand in hand. The format enabled consumers to merge the sentimental value of a handwritten message with the convenience of mobile payments, helping Hallmark appeal to younger, tech-savvy buyers who still value the tradition of giving cards but seek added functionality.

Type Insights

Traditional greeting cards accounted for a revenue share of 75.44% in 2024. These cards remain accessible and affordable, appearing everywhere from local grocery stores and bookstores to national retail chains. Their sentimental value, combined with the joy of receiving a physical token of thoughtfulness, keeps them relevant even as digital greetings gain ground. The personal touch and emotional connection that traditional cards deliver continue to resonate strongly with American consumers of all ages.

E-cards are projected to grow at a CAGR of 5.8% over the forecast period of 2025-2033. Many U.S. platforms now offer personalized designs featuring video, animation, or voice notes, allowing users to create a more interactive and emotionally rich experience than traditional paper cards. This format also aligns well with growing environmental awareness, particularly among younger generations who prefer paperless, low-waste alternatives. In addition, the seamless integration of e-cards with smartphones, social media platforms, and digital calendars allows users to schedule greetings, automate recurring reminders, or share sentiments instantly.

Distribution Channel Insights

Offline sales of greeting cards accounted for a revenue share of 61.79% in 2024 in the U.S. greeting cards industry. Supermarkets, pharmacies, bookstores, and dedicated card shops play an important role, especially for shoppers seeking last-minute or impulse purchases. These physical outlets also cater to a broad spectrum of budgets, from low-cost everyday cards found in retail chains to more premium options offered by specialty brands like Papyrus and Hallmark Signature, which feature elaborate finishes, luxury materials, or handcrafted elements. This variety enables brick-and-mortar stores to attract both value-seeking customers and those seeking memorable, keepsake-quality cards, thereby reinforcing the role of physical retail in sustaining the traditional greeting card culture in the U.S.

Online sales of greeting cards are projected to grow at a CAGR of 3.3% over the forecast period. U.S.-based platforms such as Minted, Shutterfly, and Hallmark's online store, along with global players like Etsy and Amazon, offer extensive design libraries that cover everything from classic motifs to modern, artist-driven aesthetics. These platforms enable users to personalize cards with their own photos, names, and messages, and many also offer the option to send cards directly or as digital versions, ideal for last-minute occasions or long-distance gifting. The shift toward paperless and on-demand gifting solutions resonates especially with younger, tech-savvy consumers who value sustainability and speed.

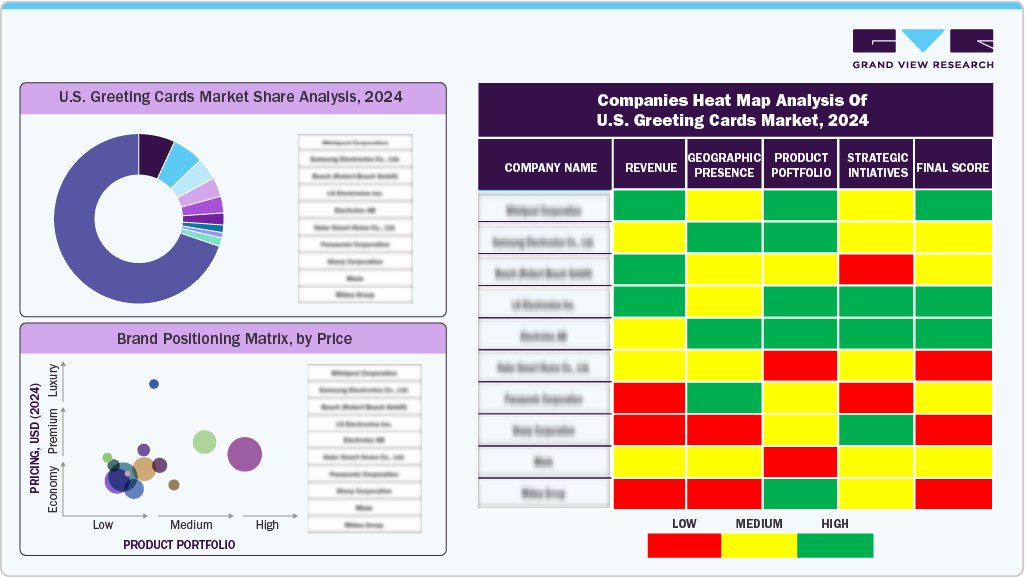

Key U.S. Greeting Cards Company Insights

The greeting cards industry is shaped by a mix of long-standing brands and emerging designers who continue to innovate in themes, formats, and sustainability to suit evolving consumer preferences. Leading companies focus on delivering high-quality designs, premium materials, and emotionally resonant messages, while also integrating elements such as personalization, multimedia features, and eco-friendly production methods. By partnering with large retail chains, supermarkets, bookstores, and specialty gift shops, as well as expanding through online marketplaces and customizable card platforms, these players are ensuring strong omnichannel accessibility and a greater market reach.

Key U.S. Greeting Cards Companies:

- American Greeting Corporation

- Archies Limited

- Avanti Press Inc.

- Budget Greeting Cards Ltd.

- Card Factory plc

- Carlton Cards Ltd.

- Crane & Co.

- Galison Publishing LLC

- Hallmark Cards, Inc.

- IG Design Group Plc

- John Sands (Australia) Ltd.

Recent Developments

-

In September 2025, American Greetings launched a new digital birthday greeting in its SmashUps series featuring Rob Lowe, in which the actor delivers a humorous take on the concept of aging. The video e-card, available via the company’s online and mobile channels, allows senders to personalize the recipient’s name and age and share it via email, text, or social media. Recipients can access it through the company’s subscription model, which offers unlimited sending for varying membership durations.

-

In February 2025, American Greetings expanded its digital gifting services by integrating new partners that enable users to send not just e-cards, but also personalized experiences, custom songs, and cash gifts. Through collaborations with Virgin Experience Gifts, Songfinch, and Birdie, the company now offers a range of services, including vineyard tours, bespoke music, and direct monetary transfers, all delivered alongside digital greetings. This move underscores American Greetings’ commitment to blending emotional expression with modern convenience, addressing the growing demand for fast, meaningful, and customizable gifting options in a digital-first world.

U.S. Greeting Cards MarketReport Scope

Report Attribute

Details

Market size value in 2025

USD 7.74 billion

Revenue forecast in 2033

USD 9.14 billion

Growth rate

CAGR of 2.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel

Country scope

U.S.

Key companies profiled

American Greeting Corporation; Archies Limited; Avanti Press Inc.; Budget Greeting Cards Ltd.; Card Factory plc; Carlton Cards Ltd.;Crane & Co.; Galison Publishing LLC; Hallmark Cards, Inc.; IG Design Group Plc; John Sands (Australia) Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Greeting Cards Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. greeting cards market report on the basis of type and distribution channel.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Traditional card

-

E-card

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. Traditional greeting cards accounted for a revenue share of 75.44% in the year 2024 as their tangible, keepsake-oriented format continues to drive consumer spending, particularly for occasions where emotional expression and perceived effort remain key purchase motivators.

b. Some key players operating in the U.S. greeting cards market include American Greetings Corporation, Hallmark Cards, Inc., Card Factory plc, John Sands (Australia) Ltd., and IG Design Group Plc

b. Key factors that are driving the U.S. greeting cards market growth include changing consumer preferences towards personalized and unique cards, increasing demand for cards for non-traditional occasions, and the rise in popularity of e-cards.

b. The U.S. greeting cards market size was estimated at USD 7.62 billion in 2024 and is expected to reach USD 7.74 billion in 2025.

b. The U.S. greeting cards market is expected to grow at a compound annual growth rate of 2.1% from 2025 to 2033 to reach USD 9.14 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.