- Home

- »

- Disinfectants & Preservatives

- »

-

U.S. Industrial Absorbents Market Size, Industry Report, 2033GVR Report cover

![U.S. Industrial Absorbents Market Size, Share & Trends Report]()

U.S. Industrial Absorbents Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Natural Organic Materials, Natural Inorganic Materials, Synthetic Polymers), By Product, By Absorbent Type, By Absorbency Capacity, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-632-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Industrial Absorbents Market Summary

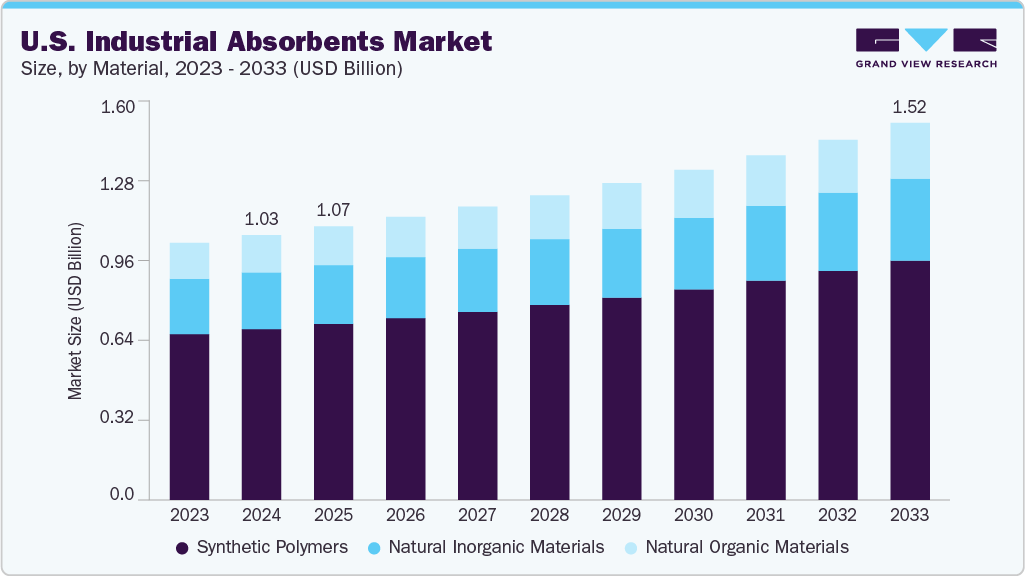

The U.S. industrial absorbents market size was estimated at USD 1,034.9 million in 2024 and is projected to reach USD 1,521.4 million by 2033, at a CAGR of 4.5% from 2025 to 2033. The growth is attributed to industrial absorbents' increased application in the U.S. pharmaceuticals industries.

Key Market Trends & Insights

- By material, the natural organic materials segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue.

- By product, the booms & socks segment is expected to grow at a considerable CAGR of 5.0% from 2025 to 2033 in terms of revenue.

- By absorbent type, the oil-only absorbents segment is expected to grow at a considerable revenue CAGR of 4.8% from 2025 to 2033.

- By absorbency capacity, the high absorbency segment is expected to grow at a considerable CAGR of 4.7% from 2025 to 2033 in terms of revenue.

- By end use, the pharmaceutical & healthcare segment is expected to grow in revenue at a considerable CAGR of 6.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,034.9 Million

- 2033 Projected Market Size: USD 1,521.4 Million

- CAGR (2025-2033): 4.5%

The pharmaceutical industry requires adherence to strict regulatory compliance with FDA and OSHA standards, particularly related to spill control, contamination prevention, and sterile manufacturing. The growing emphasis on cleanroom operations, hazardous drug handling, and GMP-certified production environments has significantly increased the demand for specialized absorbent pads and materials. This demand is further fueled by the U.S.'s leadership in biologics, injectable drugs, and advanced therapies, where maintaining sterile and safe conditions is critical.

Superabsorbent polymer-based industrial absorbents are rapidly growing due to their vital role in spill kits in healthcare and pharmaceutical settings. They are used to quickly contain and clean biological and chemical spills. Pads and powders minimize the spread of hazardous liquids, ensuring safe and efficient cleanup. Biological spills help prevent infection by containing bodily fluids before disinfection. They absorb or neutralize toxic substances for chemical spills, supporting compliance with safety protocols.

The demand for hydrotreated vegetable oil (HVO) and renewable diesel technologies industrial absorbents by end use is gradually increasing for the products used as essential pretreating bio-based feedstock, such as vegetable oils and animal fats, by removing contaminants such as phosphorus and trace metals. Their ability to enhance catalyst life and reduce equipment wear makes them valuable in bio-refining processes. With an increasing global focus on cleaner fuels and regulatory pressure to lower emissions, the need for high-performance pretreatment solutions is rising, especially in the U.S., which is investing heavily in renewable diesel. As a result, specialized absorbents are becoming a critical component of sustainable fuel production.

However, market restraints include the high cost of specialty absorbents, such as those designed for cleanrooms or hazardous chemical handling, and the disposal challenges of used absorbents.

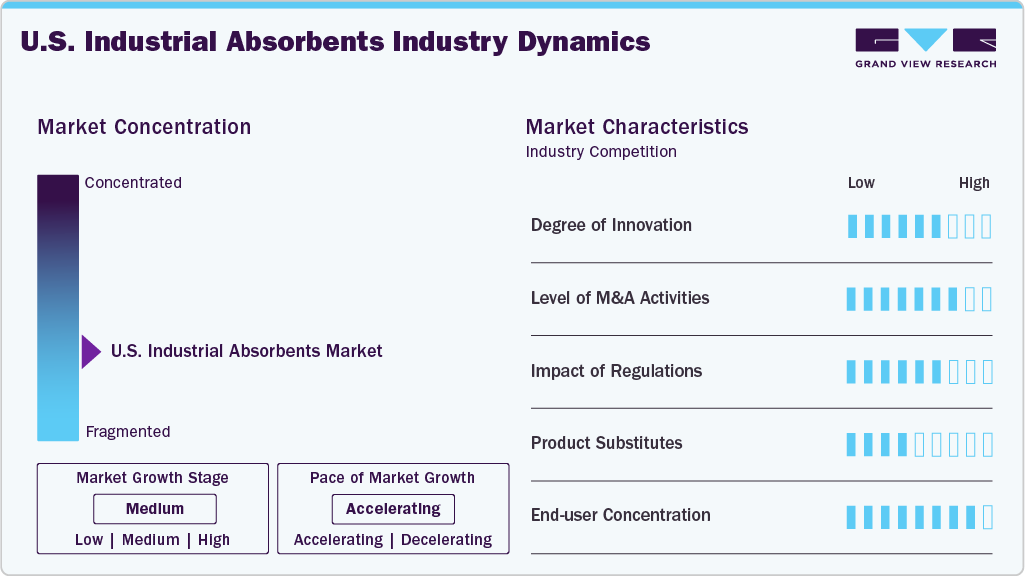

Market Concentration & Characteristics

The U.S. industrial absorbents market is moderately fragmented. These companies cater to various industries, including oil and gas, chemical manufacturing, food processing, and environmental services, with a strong focus on spill control, workplace safety, and regulatory compliance. While commodity absorbents like clay and polypropylene pads are widely used, the market is witnessing increased demand for engineered, eco-friendly, and biodegradable solutions, particularly in sectors emphasizing sustainability and waste minimization.

Material Insights

In the U.S. industrial absorbents market, synthetic polymer-based absorbents account for a commanding 64.2% market share, driven by their superior absorbency, versatility, and widespread industrial utility. Polypropylene (PP) and superabsorbent polymers (SAPs) are the most prominent, particularly in advanced applications like the pharmaceutical and medical sectors. Synthetic polymers play a critical role in the U.S. pharmaceutical and healthcare industries, especially in advanced wound care management. These materials enable the production of high-performance medical bandages and dressings that offer controlled drug release, both hydrophilic and hydrophobic, while maintaining moist wound environments, crucial for faster healing and infection prevention.

Superabsorbent polymers (SAPs) are the fastest-growing segment in the U.S. industrial absorbents market due to their exceptional fluid retention capacity, up to 1,000 times their weight. Their leak-proof gel formation reduces mess and contamination risks, making them ideal for OSHA- and EPA-compliant spill control. SAPs are widely used in medical applications (wound care dressings, surgical pads), personal care products (diapers, incontinence pads), agriculture (soil moisture retention in drought-prone states like California and Texas), and industrial safety (chemical and oil spill containment).

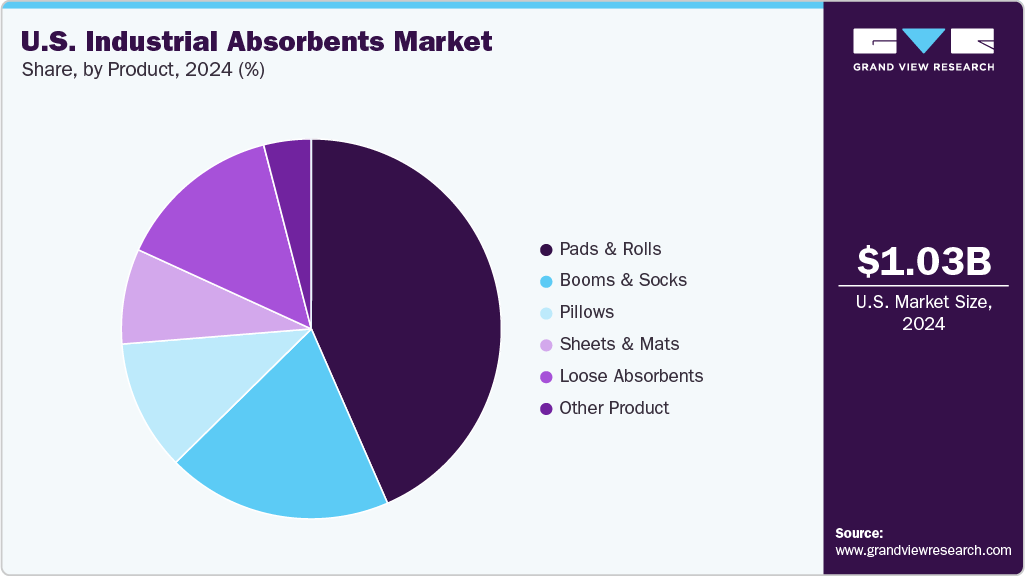

Product Insights

Pads and rolls-based chemical absorbents dominated the industrial absorbents market, with a market share of 43.1% for their use as highly effective for cleaning surfaces and removing rust from metal substrates such as carbon steel and stainless steel. The abrasive grains break down rust and corrosion, leaving surfaces clean and ready for further processing, making them especially valuable in metal maintenance and restoration industries. Additionally, they are designed to generate decorative finishes on materials like brass and aluminum, making them ideal for polishing metals to achieve a smooth, aesthetically pleasing surface. This application is particularly important for high-end products like jewelry, hardware, and automotive parts, where consistent and attractive finishes are essential.

Sheets & mats type industrial absorbent market products are the fastest growing market, with a CAGR of 5.0%, driven by the increasing need for effective petroleum spill management across industries such as railroad maintenance, refueling stations, and automotive service centers. Their ability to provide maximum coverage and absorb large quantities of petroleum products while preventing soil contamination supports stringent environmental regulations. The economical and eco-friendly design also offers long-term cost savings, while the non-slip backing enhances workplace safety. As industries focus on minimizing environmental impact and improving safety protocols, the demand for these mats continues to rise.

Absorbent Type Insights

The universal absorbent type industrial absorbent dominated the market, with a share of 52.5%, due to its versatility and ability to address a wide range of industrial spill scenarios. Gray and blue absorbents (COWS - Coolants, Oils, Waters, and Solvents) are favored in MRO (Maintenance, Repair, and Operations) applications for blending into industrial settings, absorbing common liquids like oils and solvents while minimizing cleanup time. Yellow absorbents serve as high-visibility safety tools, drawing attention to hazardous spills and providing caution in high-risk areas. Pink absorbents, designed for hazardous materials, meet the increasing need for chemical spill response in various industries by offering a highly visible, chemically resistant solution.

The oil-only absorbents are the fastest-growing industrial absorbents market, with a CAGR of 4.2%, due to their hydrophobic properties, allowing them to absorb oil while repelling water, making them ideal for oil spill response on water bodies and routine facility maintenance. White absorbents are widely used in marine spills due to their visibility and flotation. At the same time, tan and dark-colored variants are preferred for indoor and stormwater applications where aesthetics and regulatory compliance are priorities. Introducing multicolored filter mats for land use further expands their applicability in stormwater management and environmental protection, supporting stricter U.S. ecological standards and industrial spill prevention practices.

Absorbency Capacity Insights

Medium absorbency type industrial absorbents dominated the market, with a market share of 51.5%, due to their versatility and cost-effectiveness in managing petroleum-based liquid spills like oil, gasoline, kerosene, and diesel. These absorbents are widely used across industrial, transportation, and environmental cleanup sectors, particularly in spill response kits, maintenance operations, and outdoor applications where water repellency is crucial. Their dimple bond design enhances durability and performance, making them suitable for high-traffic areas and continuous leak scenarios. As regulatory pressure increases for environmental safety and spill preparedness, the U.S. market continues to favor medium absorbents for their balance of performance, affordability, and ease of deployment.

High absorbency industrial absorbents are growing steadily due to increasing chemical use across industries and stricter safety and environmental regulations. These absorbents are essential for quickly and safely managing spills of acids, bases, and other corrosive substances, particularly in laboratories, manufacturing plants, and transport sectors. Compliance with OSHA and EPA standards further drives adoption as businesses prioritize workplace safety, spill preparedness, and environmental protection.

End Use Insights

Oil and gas end uses dominated the industrial absorbent market with a market share of 28.3% due to their wide use to manage leaks and spills of oil, fuels, and hazardous chemicals during extraction, refining, and transport operations. Absorbent pads, socks, and granular materials help quickly contain spills, preventing environmental damage and ensuring worker safety. They are also crucial for routine maintenance and spill preparedness, particularly near heavy equipment and storage tanks. This sector's demand for reliable absorbent solutions remains strong with strict environmental regulations and a high-risk operating environment. As the U.S. oil demand is projected to rise steadily, the oil and gas industry's reliance on effective absorbent solutions for spill containment and cleanup is expected to significantly boost the industrial absorbent market over the coming years.

Pharmaceutical & healthcare industrial absorbents by end-use is the fastest growing industrial absorbent market for their use as purified absorbent cotton coils to maintain product integrity during storage and transportation. These coils are widely used in the bottled packaging of tablets, capsules, and gels, where they function as natural, high-absorbency desiccants, effectively controlling moisture and humidity levels within the container. Their high purity, sterility, and compliance with USFDA standards make them ideal for pharmaceutical use, ensuring protection from contamination, degradation, and microbial growth. Additionally, being eco-friendly and biodegradable, they align with a growing industry focus on sustainable packaging solutions. The ability to custom-fit these coils for diverse pharmaceutical packaging applications further enhances their market utility, making them a preferred absorbent material across pharmaceutical manufacturers and packaging companies.

Key U.S. Industrial Absorbents Company Insights

Some of the key players operating in the U.S. industrial absorbents market include Kimberly-Clark Worldwide, Inc. and New Pig Corporation.

-

New Pig Corporation, headquartered in Tipton, Pennsylvania, is a well-established and dominant player in the U.S. industrial absorbents market, recognized for its comprehensive range of high-performance spill control and containment solutions. With a strong focus on workplace safety and compliance, New Pig specializes in products like absorbent mats, socks, booms, spill kits, and secondary containment systems designed to manage oil, chemical, and general-purpose spills. The company is known for its innovation, user-friendly product design, and industry-leading customer service. By prioritizing regulatory compliance, environmental protection, and operational efficiency, New Pig continues to serve a broad spectrum of industries including manufacturing, transportation, energy, and government sectors. Its commitment to sustainability, employee safety, and product reliability makes it a trusted partner in maintaining cleaner and safer industrial environments.

ITU AbsorbTech, Inc. and Twin Specialties Corp are emerging participants in the Industrial Absorbents market.

- ITU AbsorbTech, Inc., a U.S.-based environmental services leader headquartered in New Berlin, Wisconsin, is an emerging yet influential player in the industrial absorbents market. The company specializes in launderable, reusable absorbent products and managed service programs designed to reduce waste, improve safety, and support sustainable industrial operations. With decades of experience and a strong regional presence, ITU AbsorbTech delivers innovative absorbent solutions under trusted brands such as SorbIts and Ultra Shop Towels, enabling manufacturers to meet regulatory compliance and environmental goals. The company's focus on service excellence, waste reduction reporting, and customer training sets it apart as a reliable partner for cleaner, more sustainable industrial environments across the eastern U.S.

Key U.S. Industrial Absorbents Companies:

- 3M

- New Pig Corporation.

- Oil-Dri Corporation of America

- Meltblown Technologies Inc.

- Brady Worldwide, Inc.

- Twin Specialties Corp

- American Textile & Supply

- Textile Absorbent Products Co., LLC

- SpillTech Environmental Incorporated.

- Kimberly-Clark Worldwide, Inc.

- ITU AbsorbTech, Inc

Recent Developments

-

In May 2025, ITU AbsorbTech has expanded its presence in the U.S. absorbent market by acquiring Industrial Absorbent Solutions (IAS), a South Carolina-based provider of reusable oil absorbents. This strategic move strengthens ITU’s footprint in the southeastern U.S., enhancing its capacity to deliver SorbIts, Ultra Shop Towels, and other managed service programs. The acquisition reflects growing demand for sustainable, launderable absorbent solutions in industrial sectors and supports ITU’s commitment to waste reduction, safety, and service excellence. With this expansion, ITU solidifies its position as a key player in the environmental absorbent services market.

-

In April 2025, Kimberly-Clark Professional has enhanced its WypAll X70 and X80 cleaning cloths, increasing absorbency and sheet size to better meet the needs of industrial and manufacturing environments in the U.S. market. These improvements-such as 20% higher oil and water absorption for X70 and a tougher surface for X80-are designed to boost performance in cleaning oil, water, and grease, reducing operational downtime. With growing demand for high-performance, disposable absorbent solutions, these upgrades strengthen WypAll’s position as the top branded disposable wipe in the U.S. and Canada, reflecting a strong market demand for efficient and reliable industrial absorbents.

U.S. Industrial Absorbents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,072.6 million

Revenue forecast in 2033

USD 1,521.4 million

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Material, product, absorbent type, absorbency capacity, end use

Key companies profiled

3M; New Pig Corporation.; Oil-Dri Corporation of America; Meltblown Technologies Inc.; Brady Worldwide, Inc.; Twin Specialties Corp; American Textile & Supply; Textile Absorbent Products Co., LLC; SpillTech Environmental Incorporated.; Kimberly-Clark Worldwide, Inc.; ITU AbsorbTech, Inc

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Absorbents Market Report Segmentation

This report forecasts revenue growth in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. industrial absorbents market report based on material, product, absorbent type, absorbency capacity, and end use:

-

Material Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Natural Organic Materials

-

Cellulose

-

Cotton Fibers

-

Peat Moss

-

Sawdust/Wood Fibers

-

Other Natural Organic Materials

-

-

Natural Inorganic Materials

-

Clay

-

Perlite

-

Vermiculite

-

Diatomaceous Earth

-

Other Inorganic Organic Materials

-

-

Synthetic Polymers

-

Polypropylene (PP)

-

Polyester (PET)

-

Superabsorbent Polymers

-

Other Synthetic Polymers

-

-

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Pads & Rolls

-

Booms & Socks

-

Pillows

-

Sheets & Mats

-

Loose Absorbents

-

Other Product

-

-

Absorbent Type Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Oil-only Absorbents

-

Universal Absorbents

-

Chemical/Hazmat Absorbents

-

-

Absorbency Capacity Type Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Low Absorbency

-

Medium Absorbency

-

High Absorbency

-

-

End Use Type Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Oil & Gas

-

Food & Beverage Processing

-

Chemical & Petrochemical

-

Pharmaceutical & Healthcare

-

Automotive & Transportation

-

Water & Wastewater Treatment

-

Other End Use

-

Frequently Asked Questions About This Report

b. The U.S. industrial absorbents market size was estimated at USD 1,034.9 million in 2024 and is expected to reach USD 1,072.6 million in 2025.

b. The U.S. industrial absorbents market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 1,521.4 million by 2033.

b. Synthetic polymers dominated the U.S. industrial absorbents market, with a share of 64.2% in 2024. This is attributable to their superior absorbency, durability, chemical resistance, and widespread use across industries such as oil and gas, pharmaceuticals, and manufacturing. Their ability to handle hazardous spills, comply with OSHA and EPA standards, and support high-performance applications like medical dressings and spill containment systems makes them the preferred choice in the U.S. market.

b. Some key players operating in the U.S. industrial absorbents market include 3M Company, New Pig Corporation, Oil‑Dri Corporation of America, Meltblown Technologies Inc., Brady Corporation, and Twin Specialties.

b. The U.S. industrial absorbents market is driven by stringent environmental and workplace safety regulations, increasing industrial spill incidents, strong presence of oil & gas and chemical industries, and growing demand for high-performance absorbent materials. Advancements in synthetic polymers and rising adoption in healthcare, automotive, and manufacturing sectors further fuel market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.