- Home

- »

- Food Safety & Processing

- »

-

U.S. Liquid Packaging Cartons Market Size Report, 2033GVR Report cover

![U.S. Liquid Packaging Cartons Market Size, Share & Trends Report]()

U.S. Liquid Packaging Cartons Market (2025 - 2033) Size, Share & Trends Analysis Report By Carton Type (Brick Liquid Cartons, Shaped Liquid Cartons), By Shelf Life (Long Shelf-Life, Short Shelf-Life), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-681-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Liquid Packaging Cartons Market Summary

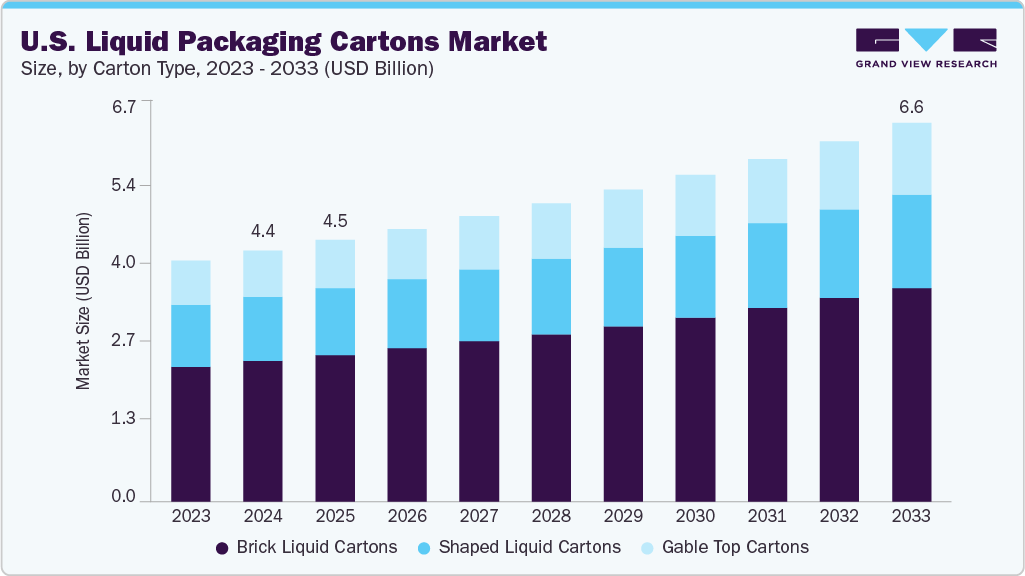

The U.S. liquid packaging cartons market size was valued at USD 4.35 billion in 2024 and is expected to reach USD 6.57 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The industry is driven by growing demand for sustainable and recyclable packaging solutions and the rising consumption of ready-to-drink beverages.

Key Market Trends & Insights

- By carton type, the gable top cartons segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue.

- By shelf life, the short shelf-life cartons segment is expected to grow at a considerable CAGR of 5.2% from 2025 to 2033 in terms of revenue.

- By end use, the alcoholic drinks segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4.35 Billion

- 2033 Projected Market Size: USD 6.57 Billion

- CAGR (2025-2033): 4.7%

Additionally, government regulations promoting eco-friendly packaging and increased preference for convenience formats further support market growth. The industry is witnessing a significant shift toward environmentally friendly packaging alternatives, driven by both consumer preferences and regulatory pressures. Liquid packaging cartons, typically made from renewable resources like paperboard-are gaining favor over plastic bottles and aluminum cans. Brands such as Tetra Pak and SIG have introduced recyclable and FSC-certified cartons that appeal to eco-conscious consumers. The U.S. states such as California and New York are promoting extended producer responsibility (EPR) regulations and single-use plastic bans, further incentivizing the shift to paper-based liquid packaging.

The increasing consumption of ready-to-drink beverages, plant-based milk, and functional drinks has spurred demand for liquid packaging cartons. These cartons are lightweight, easy to transport, and preserve product freshness, making them ideal for busy consumers. According to Beverage Marketing Corporation, U.S. consumption of dairy alternatives like almond and oat milk has seen double-digit growth in recent years. Major beverage producers such as PepsiCo and Nestlé are increasingly using liquid cartons for their health drink lines, signaling strong commercial backing for this format.

Advances in aseptic filling and multilayer barrier technology have enhanced the functionality of liquid packaging cartons, allowing beverages and soups to remain shelf-stable without refrigeration. This is particularly valuable in e-commerce and logistics, where extended shelf life reduces spoilage and transportation costs. For example, companies such as Elopak and Greatview are investing in high-speed aseptic filling lines that reduce contamination risks while extending product longevity. These innovations are making cartons more competitive with traditional PET and glass packaging across the U.S. food and beverage sector.

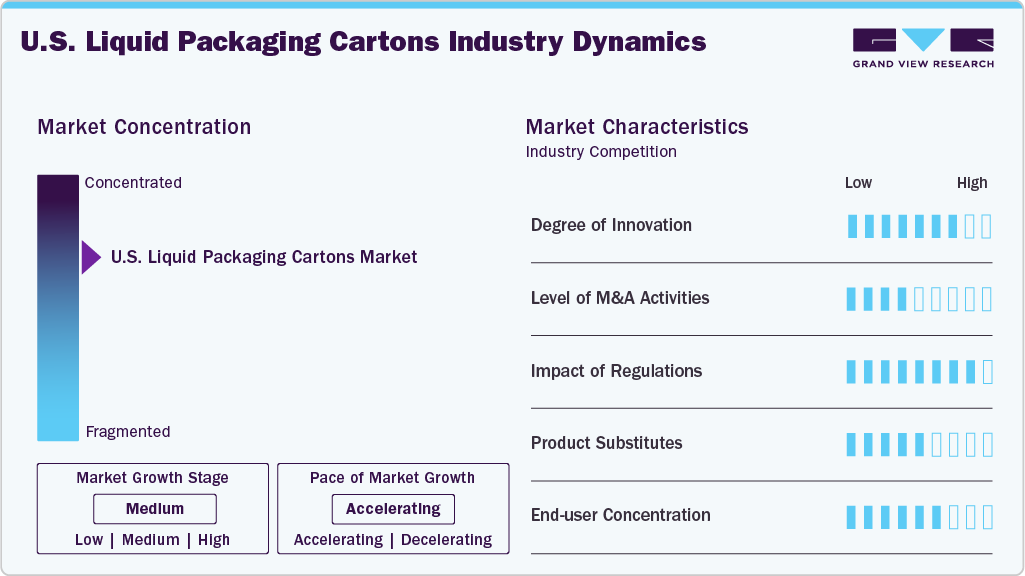

Market Concentration & Characteristics

The industry is dominated by a few major players such as Tetra Pak, SIG, and Elopak, who collectively hold a significant share of the market. These companies offer integrated solutions including packaging material, filling machines, and after-sales services. However, smaller regional players and private label manufacturers are emerging, especially in niche markets like organic beverages and plant-based milks, adding some level of fragmentation.

Sustainability is a defining trait of the industry, with increasing demand for recyclable, renewable, and low-carbon footprint packaging solutions. Most companies are investing in innovations such as bio-based coatings, aluminum-free layers, and paper straws to reduce environmental impact. These characteristics make the sector highly responsive to environmental regulations and consumer trends.

Manufacturing liquid cartons requires advanced technology, particularly for aseptic filling, barrier coatings, and multilayer laminations. Establishing production and filling capabilities involves substantial capital investment and technical expertise, limiting the entry of new competitors. This creates a competitive advantage for established firms but also raises the cost of innovation and operational flexibility.

Carton Type Insights

The brick liquid cartons segment recorded the largest revenue share of over 56.0% in 2024. Brick liquid cartons are rectangular or square-shaped cartons commonly used for long shelf-life products such as UHT milk, juices, and soups. These cartons are known for their space efficiency in transport and storage and are typically made from paperboard with barrier layers of plastic or aluminum to preserve the contents without refrigeration. Brick cartons are driven by the rising demand for aseptic packaging, particularly in developing countries where cold chain logistics are limited. Their compact design reduces logistic costs and maximizes shelf space, making them ideal for supermarkets and retail environments.

The gable top cartons segment is expected to grow at the fastest CAGR of 5.1% during the forecast period. Gable top cartons are characterized by their foldable top that forms a spout-like closure, making them easy to open and reseal. These cartons are widely used for chilled products such as fresh milk, juices, and liquid dairy alternatives. They are typically made from paperboard with a polyethylene coating for moisture resistance and are often found in refrigerated sections of retail outlets. The growth of the gable top carton segment is closely linked to the rising consumption of fresh, refrigerated beverages such as plant-based milks and cold-pressed juices.

Shelf-Life Insights

The long shelf-life cartons segment recorded the largest revenue share of over 68.0% in 2024. Long shelf-life cartons, also known as aseptic cartons, are designed to preserve liquid products such as milk, juice, soups, and plant-based beverages for extended periods-typically 6 to 12 months-without refrigeration. These cartons are manufactured using multi-layer materials that include paperboard, aluminum foil, and polyethylene, which together provide excellent barrier properties against light, oxygen, and microorganisms. This packaging is widely used for products that need to be stored and transported over long distances without relying on cold chain infrastructure. The key driver for long shelf-life cartons is the growing demand for ambient storage solutions, particularly in emerging economies with limited access to refrigeration and cold chain logistics.

The short shelf-life cartons segment is expected to grow at the fastest CAGR of 5.2% during the forecast period. Short shelf-life cartons are mainly used for fresh liquid products that require refrigeration and are typically consumed within a few days to a few weeks after opening. These cartons are common in products like fresh milk, fresh juices, and other perishable dairy beverages. They are made primarily from paperboard and coated with plastic, offering basic protection against contamination while being cost-effective and recyclable. The demand for short shelf life cartons is largely driven by the increasing consumption of fresh and minimally processed beverages in urban markets.

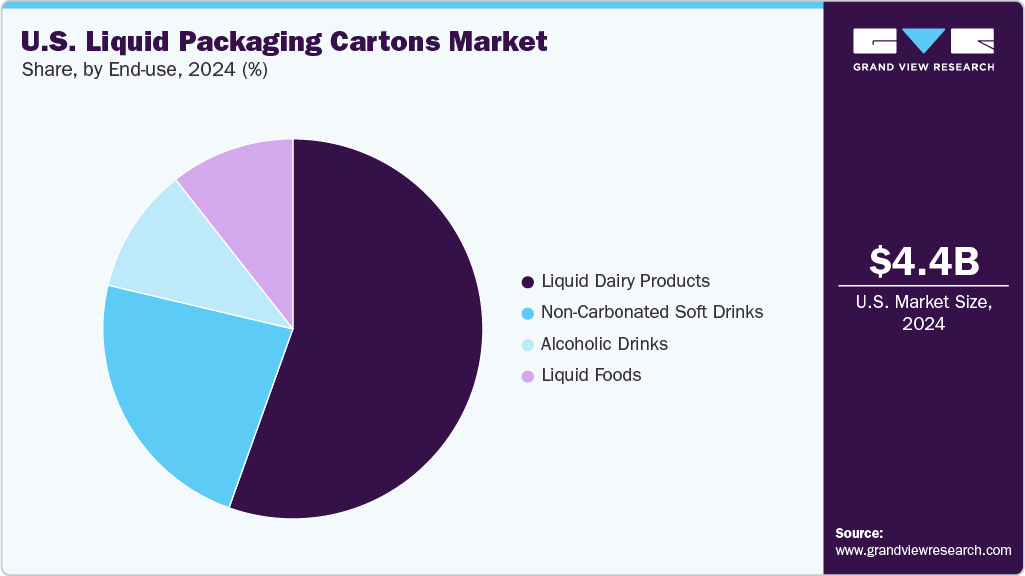

End Use Insights

The liquid dairy products segment recorded the largest market share of over 55.0% in 2024. Liquid dairy products such as milk, flavored milk, yogurt drinks, and cream are the dominant end-use category for liquid packaging cartons. These products are often packaged in aseptic or gable-top cartons, offering long shelf life without refrigeration and preserving nutritional content. The increasing demand for safe, shelf-stable dairy products in both developed and emerging economies drives this segment.

The alcoholic drinks segment is projected to grow at the fastest CAGR of 7.1% during the forecast period. Though relatively niche, this segment is gaining traction with products such as wine, cocktails, and traditional liquors being packaged in cartons, particularly in portable, single-serve formats. Additionally, consumer interest in casual, on-the-go alcoholic beverages and premium boxed wine is supporting the segment’s expansion, especially in urban retail formats and duty-free sales.

Key U.S. Liquid Packaging Cartons Companies Insights

Key players operating in the U.S. liquid packaging cartons market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Liquid Packaging Cartons Companies:

- Tetra Pak International S.A.

- SIG

- Elopak

- Mondi

- Nippon Paper Industries USA Co., Ltd.

- UFlex Limited

- Greatview Aseptic Packaging Company Limited

- WestRock Company

- Stora Enso

- Pactiv Evergreen Inc.

Recent Developments

-

In July 2025, SIG launched the world’s first aseptic 1-liter carton pack that offers full barrier protection without an aluminum layer, reducing the carbon footprint by up to 61%. Made from over 80% paper and renewable materials, the sustainable packaging maintains up to 12 months of shelf life and works with existing filling lines.

-

In July 2025, Greatview, a U.S. supplier of aseptic carton packaging solutions, opened a new manufacturing facility in Perugia, Italy, through its major shareholder NewJF International. This strategic expansion aims to meet the increasing demand for high-quality, sustainable aseptic carton packaging specifically for liquid food products such as dairy in Europe. The new plant addresses the growing need for European-produced, environmentally conscious packaging, offering customers a reliable and competitive option while reinforcing Greatview’s commitment to sustainability and local sourcing.

U.S. Liquid Packaging Cartons Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.54 billion

Revenue forecast in 2033

USD 6.57 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Carton type, shelf-life, end use

Key companies profiled

Tetra Pak International S.A.; SIG; Elopak; Mondi; Nippon Paper Industries USA Co., Ltd.; UFlex Limited; Greatview Aseptic Packaging Company Limited; WestRock Company; Stora Enso; Pactiv Evergreen Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Liquid Packaging Cartons Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. liquid packaging cartons market report based on carton type, shelf-life, and end use:

-

Carton Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Brick Liquid Cartons

-

Shaped Liquid Cartons

-

Gable Top Cartons

-

-

Shelf-Life Outlook (Revenue, USD Million, 2021 - 2033)

-

Long Shelf-Life Cartons

-

Short Shelf-Life Cartons

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid Dairy Products

-

Non-Carbonated Soft Drinks

-

Liquid Foods

-

Alcoholic Drinks

-

Frequently Asked Questions About This Report

b. The U.S. liquid packaging cartons market was estimated at around USD 4.35 billion in the year 2024 and is expected to reach around USD 4.54 billion in 2025.

b. The U.S. liquid packaging cartons market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach around USD 6.57 billion by 2033.

b. Liquid dairy products segment emerged as the dominating end use segment in the U.S. liquid packaging cartons market due to their high daily consumption and need for extended shelf life.

b. The key players in the liquid packaging cartons market include Tetra Pak International S.A.; SIG; Elopak; Mondi; Nippon Paper Industries USA Co., Ltd.; UFlex Limited; Greatview Aseptic Packaging Company Limited; WestRock Company; Stora Enso; and Pactiv Evergreen Inc.

b. The U.S. liquid packaging cartons market is driven by growing demand for sustainable and recyclable packaging solutions and the rising consumption of ready-to-drink beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.