- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Mechanical Watch Market Size, Industry Report, 2033GVR Report cover

![U.S. Mechanical Watch Market Size, Share & Trends Report]()

U.S. Mechanical Watch Market (2025 - 2033) Size, Share & Trends Analysis Report By Price (Entry-Level, Luxury), By End Use (Men, Women), By Distribution Channel (Online, Offline), And Segment Forecasts

- Report ID: GVR-4-68040-820-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mechanical Watch Market Size & Trends

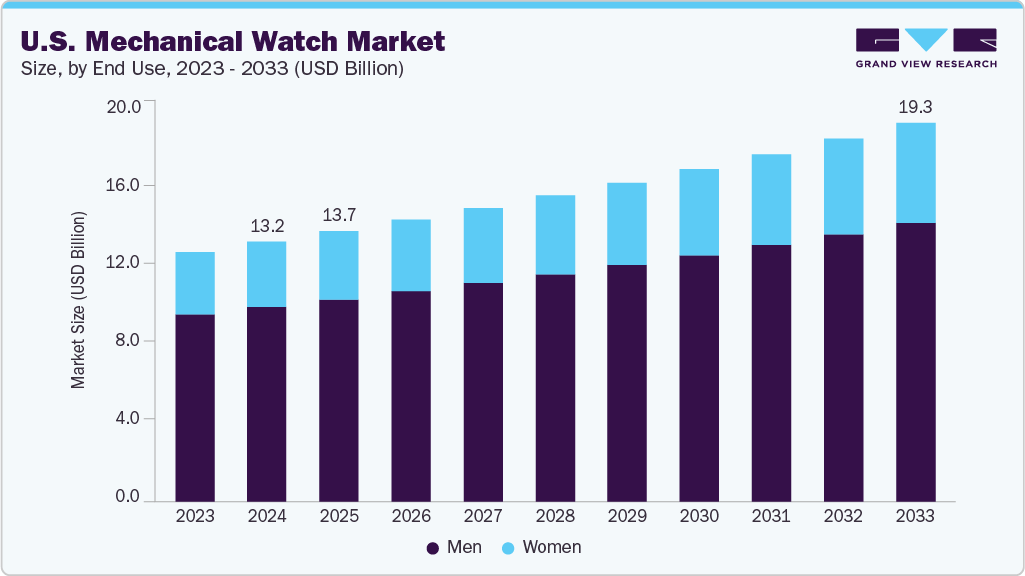

The U.S. mechanical watch market size was estimated at USD 13,194.3 million in 2024 and is projected to reach USD 19,260 million by 2033, growing at a CAGR of 4.3% from 2025 to 2033. This growth can be attributed to the growing interest in luxury and collector watches, as well as the strong demand for premium mechanical timepieces.

Key Market Trends & Insights

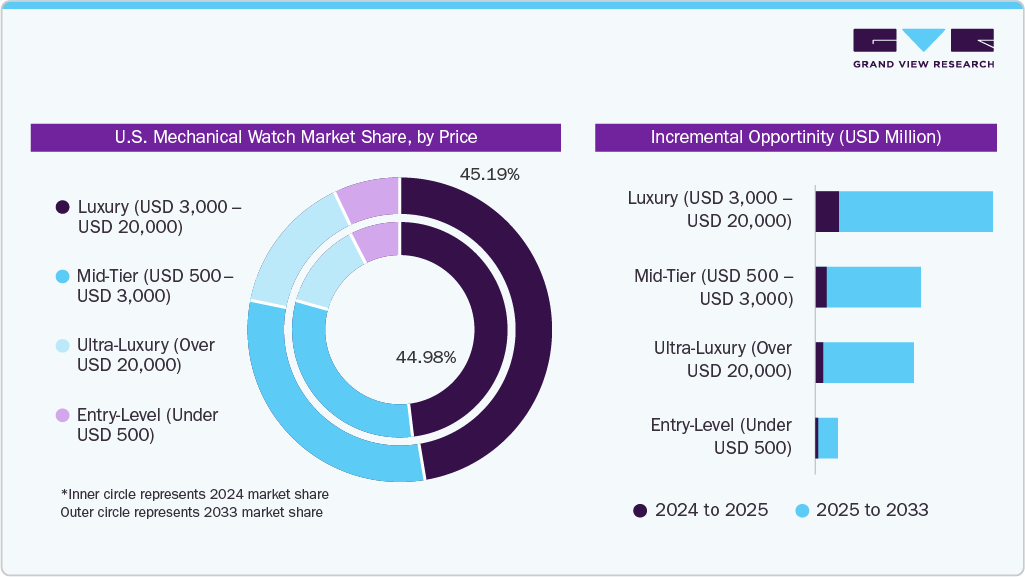

- By price, the luxury mechanical (USD 3,000-20,000) led the market with the largest revenue share of 44.98% in 2024.

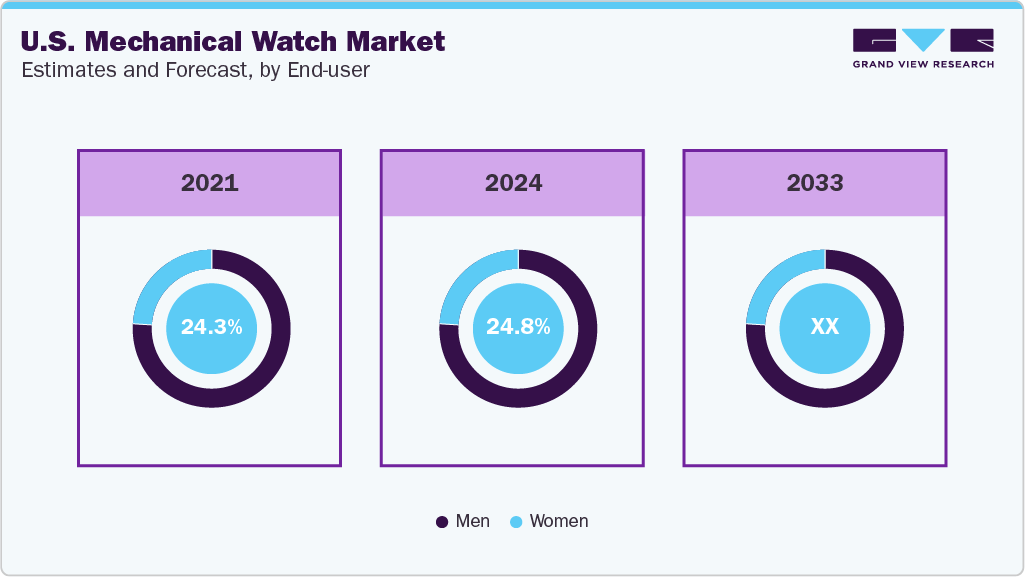

- By end use, the men segment led the market with the largest revenue share of 75.04% in 2024.

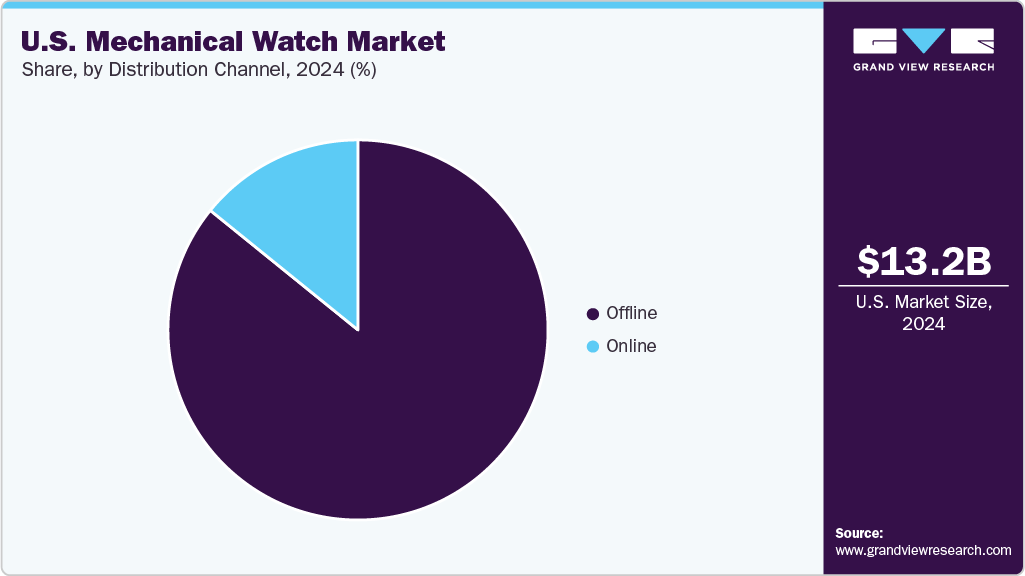

- By distribution channel, the offline segment led the market with the largest revenue share of 85.83% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13,194.3 Million

- 2033 Projected Market Size: USD 19,260.0 Million

- CAGR (2025-2033): 4.3%

A key ongoing trend in the U.S. mechanical watches industry is the growing popularity of vintage and heritage-inspired timepieces, with collectors and younger buyers seeking limited editions and classic designs that combine craftsmanship with status appeal.A key factor driving the market growth is the rising demand for luxury and heritage craftsmanship. U.S. consumers increasingly value the intricate engineering, precision, and artisanal appeal of mechanical watches, which are seen as both status symbols and investment pieces. Brands with strong histories, such as Rolex, Omega, and Grand Seiko, benefit from this trend, as buyers are willing to pay premium prices for authenticity, durability, and the prestige associated with iconic models.

The second driver is the rising purchasing power of affluent and aspirational consumers, particularly among the 25-44 age group. Higher disposable incomes, coupled with a growing interest in horology, have expanded the market for mid-to-high-end mechanical watches. Younger collectors are also entering the market, motivated by social media trends, influencer endorsements, and the appeal of limited-edition or iconic releases, which has increased demand for both entry-level and premium mechanical timepieces.

According to a September 2025 American Business Times article, Millennials and Gen Z now drive over 45% of new luxury mechanical-watch purchases, drawn to vintage icons, independent makers, and pieces that reflect identity, craftsmanship, and investment value. The article also highlights how platforms like TikTok, Instagram, and Reddit are democratizing watch knowledge, helping younger buyers learn, share, and collect more confidently, fueling demand for limited editions and personalized models.

Moreover, as consumers become increasingly saturated with screens and smart devices, many Americans are gravitating toward mechanical watches as a tactile, enduring alternative to digital tech. The appeal of hand-assembled movements, visible mechanics, and timeless aesthetics has strengthened the emotional value of mechanical watches, making them symbols of intentional living and personal expression. This broader lifestyle shift has brought new buyers into the category and reinforced long-term demand across price segments.

Consumer Insights

The U.S. mechanical watch industry remains predominantly male-driven.

-

Men accounting for 75% of buyers. This reflects the historic and cultural association of mechanical watches with craftsmanship, engineering, and status, which appeals strongly to male enthusiasts.

-

Women represent a smaller, but steadily growing, segment, often seeking mechanical watches as luxury fashion statements or investment pieces, particularly from established Swiss brands.

Age plays a significant role in buyer behavior.

-

The 25-44 age group leading the market, highlighting a demographic that combines both disposable income and interest in horology.

-

The 45+ segment ranks second, representing established buyers who can afford higher-priced luxury mechanicals and often have loyalty to premium brands.

-

Meanwhile, the 18-24 cohort ranks third, reflecting aspirational interest and early adoption of entry-level mechanical watches, even though their purchasing power is relatively limited.

Consumers face a set of consistent pain points in this U.S. mechanical watch industry.

-

High pricing and service costs are barriers to both entry-level and luxury buyers, while counterfeits and authenticity concerns drive caution and careful brand selection.

-

Additionally, the fragility of mechanical movements makes maintenance a priority, and the complexity of choice-given the sheer number of brands, models, and complications-can overwhelm even informed buyers. These challenges influence both purchase timing and brand loyalty.

Among brands, Rolex and Omega dominate due to their strong heritage, reliability, and resale value, appealing to both aspirational and established collectors. Tissot and Seiko/Grand Seiko perform strongly in entry-to-mid and premium segments, offering craftsmanship at more accessible price points. TAG Heuer continues to resonate with younger buyers and enthusiasts seeking sporty, luxury watches.

- Insight: U.S. consumers are discerning, brand-conscious, and experience-driven, valuing craftsmanship, status, and long-term value in mechanical watches.

Price Insights

The luxury (USD 3,000 - USD 20,000) segment led the market with the largest revenue share of 44.98% in 2024. The U.S. market is heavily skewed toward affluent consumers who view luxury watches as status symbols, long-term value assets, and collectible items. Strong brand recognition (Rolex, Omega, Cartier), high replacement and gifting purchases, and the rise of investment-driven watch buying maintain high average spending. Limited-edition releases also encourage consumers to purchase higher-priced SKUs, enabling the luxury segment to dominate overall revenue despite lower sales volume.

The ultra-luxury (Over USD 20,000) segment is anticipated to grow at the fastest CAGR of 5.8% from 2025 to 2033, as demand is increasingly driven by wealth-concentration effects and collector-behavior, not broad consumer trends. Post-2023, U.S. HNWIs have continued shifting discretionary spending toward scarce, asset-backed goods, and brands like Patek Philippe, Audemars Piguet, and Richard Mille have intentionally tightened allocations, pushing more buyers into higher-ticket segments where availability is slightly better than in the USD 10k-20k range. At the same time, the U.S. secondary market for ultra-luxury mechanical pieces has stabilized after the 2022-23 correction, restoring confidence among investors and collectors.

End Use Insights

The men segment led the market with the largest revenue share of 75.04% in 2024. Mechanical watches function as one of the few socially accepted luxury accessories for men, serving as status markers, collectibles, and investment pieces; this makes male buyers far more likely to purchase multiple watches, follow brand drops, and engage in hobbyist collecting compared to women, who distribute luxury spending across a wider range of categories.

The women segment is anticipated to witness at the fastest CAGR of 5.0% from 2025 to 2033, as brands are finally investing in women-focused mechanical offerings, slowly moving away from quartz and “jewelry-first” designs toward true mechanical movements, slimmer calibers, and high-aesthetic pieces. This shift, combined with rising female participation in luxury self-purchase, visibility of women collectors on social media, and the growing appeal of heritage craftsmanship over disposable fashion accessories, is expanding demand and pulling more women into the mechanical category.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 85.83% in 2024. Mechanical watch buyers in the U.S. overwhelmingly prefer offline channels because these purchases are high-value, emotionally driven, and depend on in-person validation. Authorized dealers and boutiques also offer trust, after-sales service, and immediate product availability, all of which are critical in a category where counterfeits are common and buyers want absolute assurance before spending thousands.

The online segment is expected to grow at the fastest CAGR of 4.1% from 2025 to 2033, as U.S. consumers become more comfortable buying high-value items digitally, driven by stronger authentication guarantees, better return policies, virtual try-on tools, and the rise of trusted e-commerce platforms for new mechanical watches.

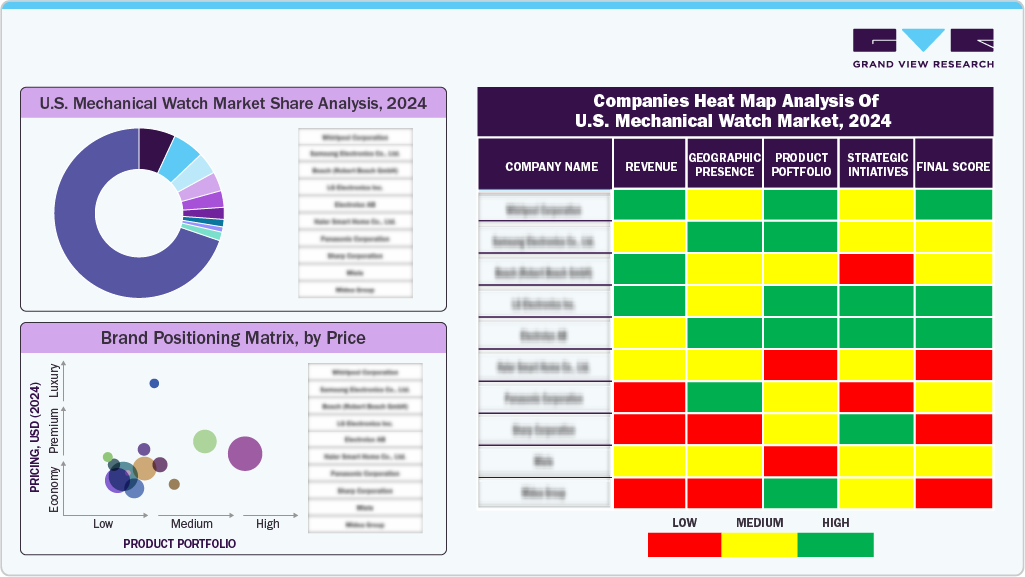

Key U.S. Mechanical Watch Company Insights

The U.S. mechanical watch industry is led by Swiss luxury brands, with Rolex, Omega, and TAG Heuer holding the strongest presence due to deep brand trust, strong resale value, and widespread authorized dealer networks. In the mid-tier, Tissot, Seiko, and Citizen dominate because of their accessible pricing, everyday durability, and strong placement in department stores and specialty retailers.

Premium Japanese brands such as Grand Seiko have gained momentum among U.S. collectors who value craftsmanship without the ultra-luxury price tags.

Swiss maisons continue to control the luxury and ultra-luxury segments, while Japanese brands anchor the entry and premium value tiers. Independent brands and U.S.-popular microbrands are expanding through direct-to-consumer models and online watch communities, attracting younger buyers seeking unique designs. Growth in the limited editions tailored to U.S. buyers, and a strong emphasis on retail experiences are shaping competition and strengthening brand loyalty across the U.S. mechanical watch industry.

Key U.S. Mechanical Watch Companies:

- Rolex

- Omega

- Patek Philippe

- Audemars Piguet

- TAG Heuer

- Tissot

- Seiko

- Grand Seiko

- Citizen

- Breitling

Recent Developments

-

In July 2025, Casio introduced its first-ever mechanical Edifice line with the EFK100 series, marking a major shift from its traditional quartz focus. The new models feature automatic movements, sapphire crystals, refined 39-40 mm cases, and sport-inspired dial designs, signaling Casio’s intent to compete in the entry-level mechanical segment by offering strong craftsmanship at an accessible price point.

-

In April 2024, Bulgari unveiled the Octo Finissimo Ultra COSC, a groundbreaking 1.70 mm-thick mechanical watch that became the thinnest COSC-certified timepiece ever, showcasing advanced engineering with its caseback-integrated movement and reinforcing the brand’s leadership in ultra-thin watchmaking.

U.S. Mechanical Watch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13,735.3 million

Revenue forecast in 2033

USD 19,260.0 million

Growth rate

CAGR of 4.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price, end use, distribution channel

Country scope

U.S.

Key companies profiled

Rolex; Omega; Patek Philippe; Audemars Piguet; TAG Heuer; Tissot; Seiko; Grand Seiko; Citizen; Breitling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mechanical Watch Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. mechanical watch market report based on the price, end use, and distribution channel:

-

Price Outlook (Revenue, USD Million, 2021 - 2033)

-

Entry-Level (Under USD 500)

-

Mid-Tier (USD 500-USD 3,000)

-

Luxury (USD 3,000-USD 20,000)

-

Ultra-Luxury (Over USD 20,000)

-

-

End Use Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. mechanical watch market size was estimated at USD 13,194.3 million in 2024 and is expected to reach USD 13,735.3 million in 2025.

b. The U.S. mechanical watch market is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2025 to 2033 to reach USD 19,260 million by 2033.

b. Luxury (USD 3,000 - USD 20,000) accounted for a 44.78% share of the revenue in 2024. The U.S. market is heavily skewed toward affluent consumers who view luxury watches as status symbols, long-term value assets, and collectible items.

b. Some key players in the U.S. mechanical watch market include Rolex; Omega; Patek Philippe; Audemars Piguet; TAG Heuer; Tissot; Seiko; Grand Seiko; Citizen; Breitling

b. The U.S. mechanical watch market is growing due growth to the increasing interest in luxury and collector watches, and strong demand for premium mechanical timepieces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.