- Home

- »

- Renewable Chemicals

- »

-

U.S. Natural Surfactants Market Size, Industry Report, 2033GVR Report cover

![U.S. Natural Surfactants Market Size, Share & Trends Report]()

U.S. Natural Surfactants Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Anionic, Nonionic), By Application (Detergents, Industrial & Institutional Cleaning, Personal Care, Oilfield Chemicals), And Segment Forecasts

- Report ID: GVR-4-68040-641-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Natural Surfactants Market Summary

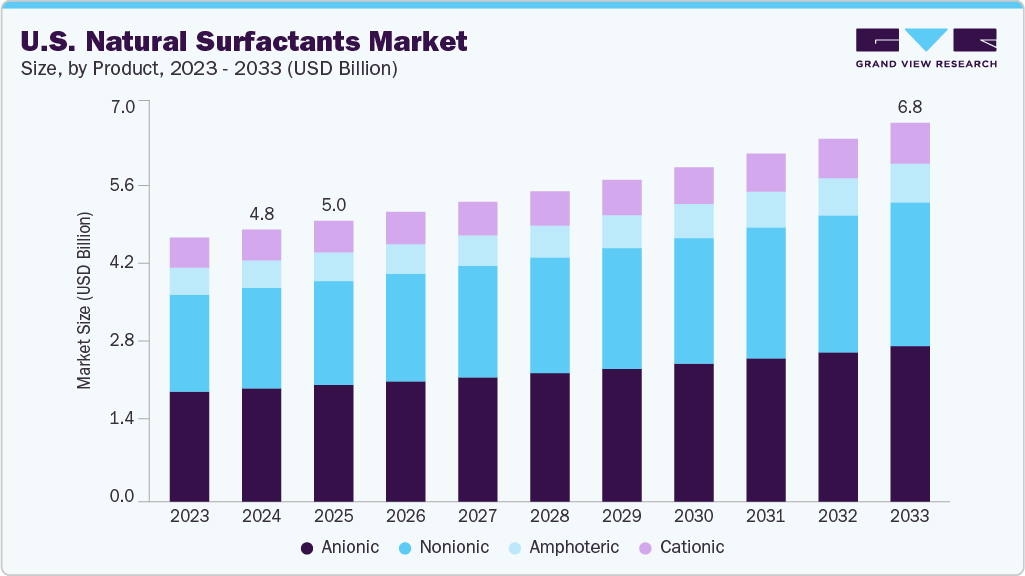

The U.S. natural surfactants market size was estimated at USD 4,854.1 million in 2024 and is projected to reach USD 6,760.1 million by 2030, growing at a CAGR of 3.8% from 2025 to 2033. The market's growth is mainly driven by rising consumer demand for biodegradable, non-toxic ingredients in personal care and cleaning products, strict Environmental Protection Agency (EPA) regulations, growing clean-label trends, and technological advancements in bio-based fermentation and oleochemical processing that improve cost-efficiency, sustainability, and product performance across industries.

Key Market Trends & Insights

- By product, the nonionic segment is expected to grow at a considerable revenue CAGR of 4.1% from 2025 to 2033.

- By application, the personal care segment is expected to grow in revenue at a considerable CAGR of 4.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 4,854.1 Million

- 2033 Projected Market Size: USD 6,760.1 Million

- CAGR (2025-2033): 3.8%

Consumers’ growing preference for biodegradable, eco‑friendly ingredients in personal care and household products propelled the U.S. natural surfactants market. Stringent Environmental Protection Agency (EPA) and U.S. Department of Agriculture (USDA) incentives for bio‑based chemicals reinforce industry adoption. Advances in biotechnological extraction and microbial fermentation have reduced costs while enhancing surfactant efficacy, enabling greener alternatives to petrochemical options. Simultaneously, the clean‑beauty movement amplifies the demand for gentle natural surfactants in shampoos, body washes, and lotions. Even agricultural and industrial cleaning sectors increasingly embrace these ingredients to align performance with sustainability goals.Despite the growth, high production costs for plant‑ or microbe‑based surfactants remain a barrier, given complex extraction, purification, and fermentation techniques. Raw material supply volatility-from feedstocks like coconut, palm, or microbial sugars-is exacerbated by agricultural disruptions and climate risks. Developing stable, multifunctional formulations also requires significant R&D and capital investment. Additionally, labeling regulations and allergen concerns can delay market entry and escalate costs. These factors constrain scalability and slow broader adoption despite favorable market trends.

Significant opportunities emerge through microbial biosurfactants that offer scalable, biodegradable solutions for cleaning, agrochemicals, and personal care. The U.S. Department of Energy and USDA programs provide grants and incentives to support bio‑based manufacturing facilities, accelerating commercial production. Innovations in multi‑functional surfactant formulations-combining foaming, emulsifying, and wetting properties-reduce formulation complexity and cost. Moreover, environmental, social, and governance (ESG) policies among major brands and rising consumer willingness to pay for green products drive new product lines and industry partnerships, fueling long‑term market expansion.

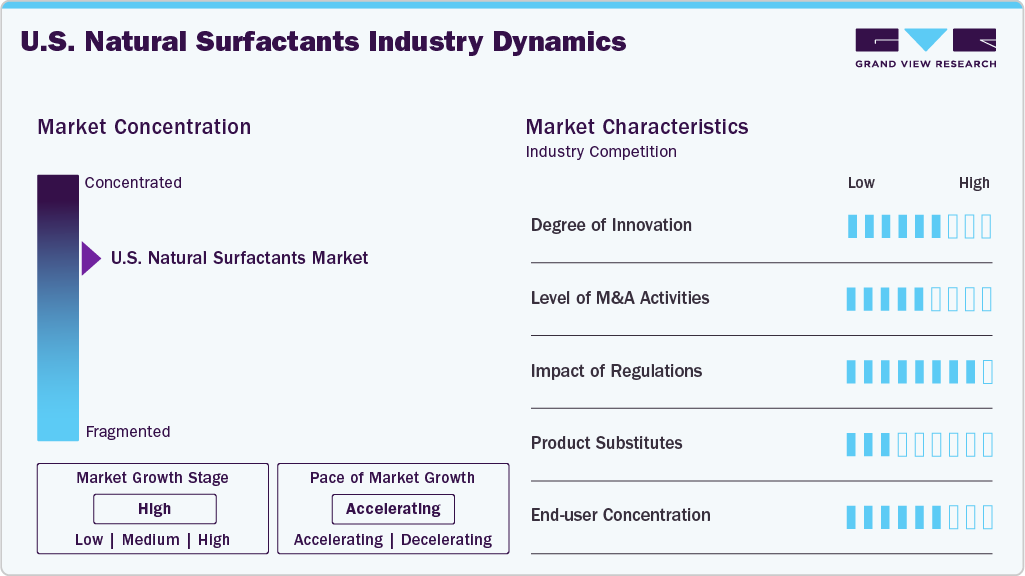

Market Concentration & Characteristics

The U.S. natural surfactants market is moderate to highly concentrated, with a few specialty chemical leaders-such as Croda International plc, Dow, BASF, Evonik Industries AG, and CLARIANT -dominating the landscape. These firms maintain extensive production networks across North America and have grown their biosurfactant offerings through mergers, acquisitions, and strategic alliances. Their scale gives them pricing power and supply-chain control, making it difficult for smaller or new entrants to compete. A smaller tier of regional and niche companies operates within specialized markets such as clean beauty or agricultural biochemicals. Still, they collectively hold a minimal share compared to the industrial giants.

The U.S. natural surfactants market thrives on demand for biodegradable, plant‑ and microbe‑based ingredients. Anionic surfactants-chiefly fatty acid sulfate and glucosides-dominate due to their high cleansing and foaming efficacy. Non‑ionic types, like alkyl polyglucosides, are valued for mildness and eco‑certification compliance, especially in personal care. This segment encompasses diverse end uses-personal care, household detergents, industrial cleaners, and agrochemicals-with personal care driving the fastest growth. Consumer clean‑label preferences, regulatory pressure for sustainability, and continuous technological advances in green extraction and fermentation shape the market.

Product Insights

The anionic segment led the market and accounted for the largest revenue share of 41.6% in 2024. Its exceptional cleansing, foaming, and emulsifying performance drives this growth. Derived from plant-based fatty acid sulfates and sulfonates-typically coconut and palm oils-these surfactants combine high efficacy with biodegradability, aligning with consumer clean-label preferences and regulatory pressure against synthetic chemicals. They are particularly effective in mass-market household detergents and industrial cleaners, benefiting from cost-efficiency and scalability. Recent technological improvements in oleochemical extraction have enhanced their purity and yield, further solidifying the segment’s market leadership.

The nonionic segment is expected to grow fastest with a CAGR of 4.1% from 2025 to 2033 during the forecast period. Sourced mainly from sugar-based glucosides or fatty alcohol derivatives, they are prized for gentle, low-irritant profiles and compatibility with sensitive skins and fragrance systems. These properties match the rising demand for clean beauty and hypoallergenic formulations. Innovations in green bioprocessing have lowered production costs and optimized performance, making nonionics appealing in premium and mass-market emulsions, creams, and specialized cleansers.

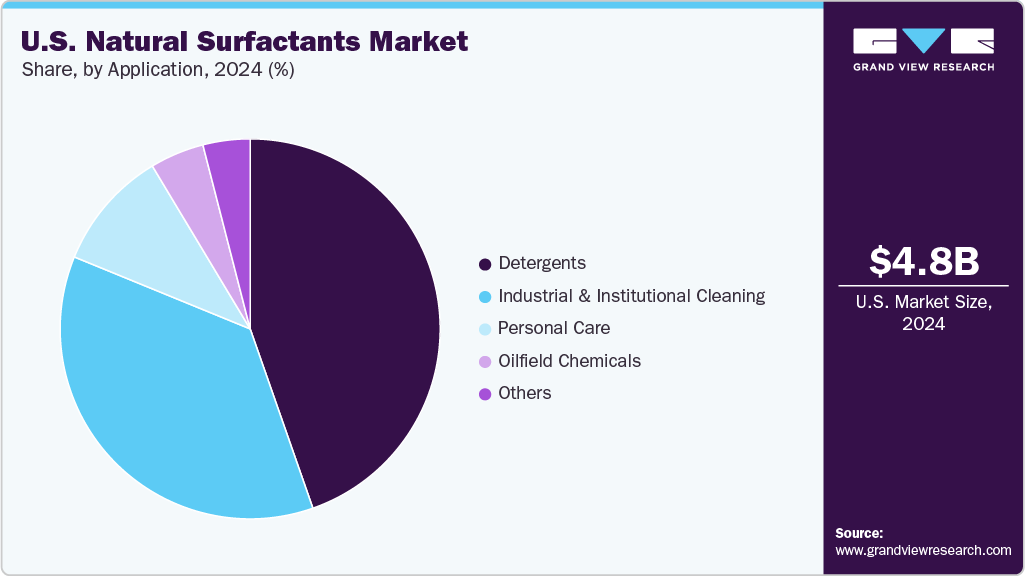

Application Insights

The detergents segment led the market and accounted for the largest revenue share of 44.6% in 2024. Natural anionic surfactants deliver reliable grease and stain removal while supporting environmental goals. Strong household cleaning habits, high washing machine ownership, and regulations limiting phosphates and synthetic agents encourage manufacturers to reformulate using biodegradable components. Consumer demand for eco-certified products has reinforced detergents as the largest revenue source in the natural surfactants market.

The personal care segment is expected to grow fastest with a CAGR of 4.2% from 2025 to 2033 during the forecast period. The surge in clean-label moisturizers, shampoos, and face cleansers drives this growth. These products now commonly use plant-derived nonionic or amphoteric surfactants, which offer mildness, low irritation, and eco-certification. Formulators leverage these ingredients to meet consumer demands for sulfate-free, sustainable products. Ongoing research into bio-based extraction and multifunctional formulas supports premium and mass-market personal care lines, reinforcing the segment’s rapid growth.

Key U.S. Natural Surfactants Company Insights

Some of the key players operating in the market include BASF, Evonik Industries AG, Croda International plc, CLARIANT, Inolex, Inc., WHEATOLEO, and Kao Corporation.

-

Inolex, based in Philadelphia, is an independent manufacturer of sustainable ingredients serving the personal care and cosmetics industries. The company combines natural chemistry with innovation, offering silicone alternatives, functional emollients, and preservation systems that comply with U.S. safety and environmental standards. It has transitioned from a broader industrial base to a full focus on personal care, supported by strong technical service and regulatory expertise. Inolex’s product philosophy aligns with consumer demand for transparency and clean-label formulations. Inolex’s natural surfactants are palm-free, biodegradable, and designed for use in shampoos, facial cleansers, and body washes, emphasizing safety, performance, and responsible sourcing.

Key U.S. Natural Surfactants Companies:

- BASF

- Croda International Plc

- Evonik Industries AG

- Dow

- CLARIANT

- Kao Corporation

- WHEATOLEO

- SEPPIC (Air Liquide Healthcare)

- Indorama Ventures

- Stepan Company

- Inolex, Inc.

Recent Development

-

In June 2023, BASF announced expansion plans for bio-based alkyl polyglucoside (APG) production in Asia-Pacific and North America, including new lines at its Cincinnati, Ohio, facility. This strategic move aims to meet growing U.S. demand for sustainable, non-ionic surfactants in personal care, home care, and agriculture, while improving regional supply resilience and reducing logistics impact.

-

In February 2022, Clariant launched its Vita range of surfactants and polyethylene glycols (PEGs), made entirely from renewable, plant-based carbon sources. Using bio-ethanol from sugarcane or corn, the range offers low-carbon, fossil-free alternatives for personal care, agriculture, and home care, supporting sustainable U.S. formulations and reducing supply chain emissions.

U.S. Natural Surfactants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,007.8 million

Revenue forecast in 2033

USD 6,760.1 million

Growth rate

CAGR of 3.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product and application

Country scope

U.S.

Key companies profiled

BASF; Croda International Plc; Evonik Industries AG; Dow; CLARIANT; Kao Corporation; WHEATOLEO; SEPPIC (Air Liquide Healthcare); Indorama Ventures; Evonik Industries AG; Stepan Company; Inolex, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to the country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Natural Surfactants Market Report Segmentation

This report forecasts volume & revenue growth at a U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. natural surfactants market report based on product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Anionic

-

Nonionic

-

Cationic

-

Amphoteric

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Detergents

-

Industrial & Institutional Cleaning

-

Personal Care

-

Oilfield Chemicals

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. natural surfactants market size was estimated at USD 4,854.1 million in 2024 and is expected to reach USD 5,007.8 million in 2025.

b. The U.S. natural surfactants market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2033 to reach USD 6,760.1 million in 2033.

b. The anionic natural surfactant segment led with 41.6% revenue share in 2024. In the U.S. market, the segment dominated with strong revenue share due to their superior foaming, cleansing, and emulsifying capabilities. Sourced from coconut and palm oils, they offer biodegradable performance suited for industrial and household cleaners.

b. Some key players operating in the natural surfactants market include BASF, Croda International Plc, Evonik Industries AG, Dow, CLARIANT, Kao Corporation, WHEATOLEO, SEPPIC (Air Liquide Healthcare), Indorama Ventures, Evonik Industries AG, Stepan Company, Inolex, Inc.

b. The market's growth is mainly driven by strong consumer demand for eco-friendly products and supportive Environmental Protection Agency (EPA) and U.S. Department of Agriculture bio-based initiatives. Industry-academia R&D collaboration further accelerates sustainable surfactant development, fueling robust market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.