- Home

- »

- Animal Health

- »

-

U.S. Pet Microchips Market Size, Industry Report, 2033GVR Report cover

![U.S. Pet Microchips Market Size, Share & Trends Report]()

U.S. Pet Microchips Market (2025 - 2033) Size, Share & Trends Analysis Report By Pet Type (Dogs, Cats), By Product (Microchips, Scanner), By Frequency (134.2 KHz, 125 KHz, 128 KHz), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-793-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pet Microchips Market Summary

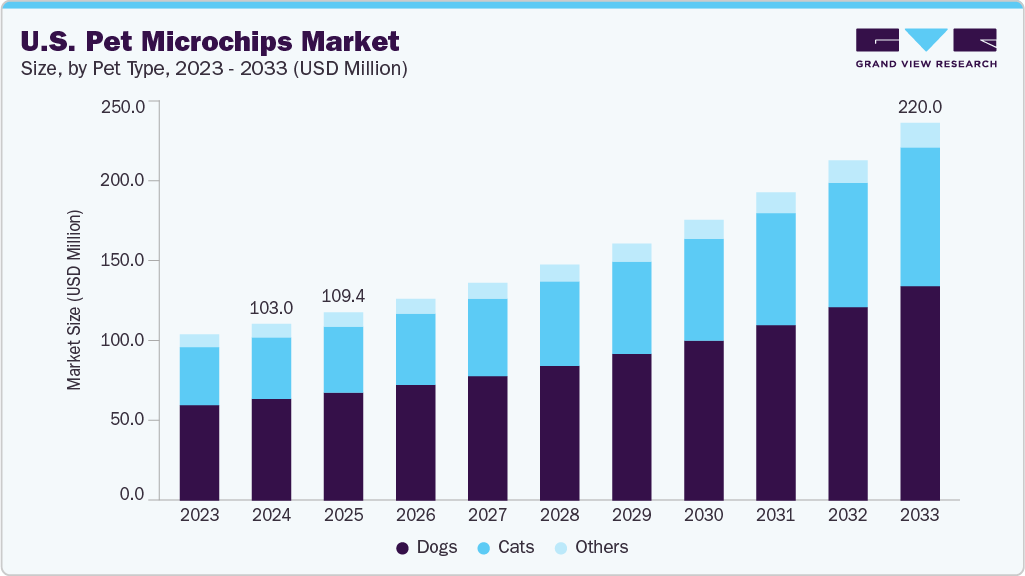

The U.S. pet microchips market size was estimated at USD 103.0 million in 2024 and is projected to reach USD 220.0 million by 2033, growing at a CAGR of 9.12% from 2025 to 2033. The industry is driven by increased incidence of lost companion animals and growing success rates of microchip recovery, growing awareness in promoting microchipping, and rising insurance incentives and safety-linked benefits.

Key Market Trends & Insights

- By pet type, the dog segment held the largest share of 57.44% of the market in 2024

- By product, the microchip segment dominated the market in 2024.

- By frequency, the 134.2 KHz segment held the largest market share in 2024.

- By application, pet identification dominated the market with largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD

- 2033 Projected Market Size: USD

- CAGR (2025-2033):

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising frequency of lost or stolen companion animals in the U.S. has become a serious concern for their owners, with thousands of animals reported missing each year. Traditional identification methods often fail due to tag loss or removal, leading to emotional distress and financial burden on families. A study by the American Veterinary Medical Association (AVMA) depicted that microchipped pets have a significantly higher recovery rate of 52.2% for dogs versus 21.9%, and 38.5% for cats versus 1.8% without microchips. This emphasized microchipping’s critical role in improving pet reunification and safety. In addition, according to the Human Animal Support Services report pilot shelter data of 2022, 32% of companion animals with microchips were reunited with their owners, compared to 9% of pets without microchips, highlighting the significant impact of microchipping on their recovery. This evidence, highlighted by veterinary professionals and animal welfare organizations, drives trust and motivates consumers to adopt microchipping for security and peace of mind.Furthermore, growing involvement of veterinary clinics, animal shelters, and pet adoption centers in promoting microchipping services is significantly boosting market penetration. They also conduct pet awareness programs and campaigns. For instance, in June 2025, PetPlace launched the Paws for Safety Awareness campaign, urging pet owners to register and update microchips, protecting them from summer risks. Proper registration ensures lost companion animals can safely return home. Animal shelters incorporate microchipping as a routine element of the pet adoption procedure, whereas veterinarians suggest it during regular check-ups or vaccination appointments. In addition, low-cost microchipping initiatives backed by NGOs and pet welfare groups improve both accessibility and awareness. Consumer confidence and adoption rates are on the rise, with more distribution avenues promoting the benefits of microchip usage.

The rise of pet insurance enrollment in the U.S. encouraged their owners to adopt preventive safety measures, including microchipping, to qualify for premium discounts or enhanced coverage benefits. According to the North American Pet Health Insurance Association (NAPHIA), 6.4 million pets were insured in 2024, reporting a 12.7% increase from 2023. Several insurance providers recommend or incentivize microchipping as a risk mitigation strategy, as identifiable pets are easier to recover and cheaper to treat in case of loss or injury. In addition, microchipped pets face lower shelter intake risks, reducing liability for owners and insurers. This alignment of cost protection, safety assurance, and financial incentive fosters a proactive mindset among pet owners, which drives microchip adoption as part of overall risk management.

Latest Developments In Pet Microchip Technology

Category

Update / Development

Details / Implications

Microchip Technology

Read-only microchips

ISO 11784/11785 standards ensure unique, non-rewritable IDs for reliable pet identification.

Advanced transponders (ISO 14223)

Allow storage/retrieval of additional info, authentication methods, and sensor data.

Temperature-sensing microchips

Enable non-invasive sub-dermal wellness monitoring at vet visits or shelters.

NFC & integrated sensors

Store health or identification data, readable with specialized scanners.

Stringent controls

Prevent duplicate or incorrect microchip numbers to ensure accurate identification.

Key Takeaways

Future integration

Microchips may store health and ID info; adoption requires specialized scanners and manufacturer partnerships.

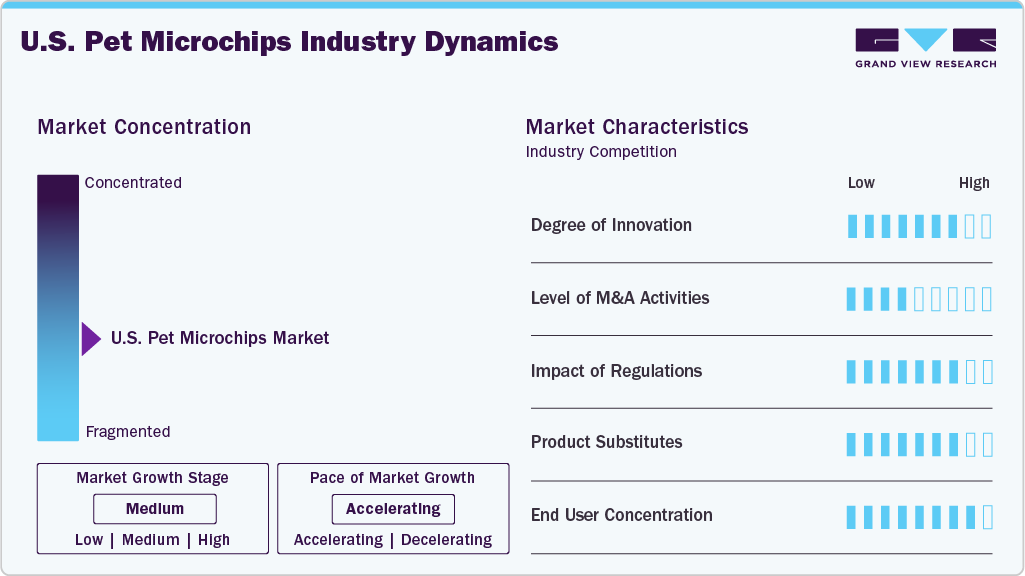

Industry Concentration & Characteristics

The industry demonstrates moderate concentration and the pace is accelerating, dominated by key players such as Merck & Co., Inc., Trovan Ltd. and Peeva Inc. These companies utilize strong brand recognition, extensive veterinary partnerships, and advanced tracking technology, whereas smaller providers compete through niche offerings, price differentiation, and localized services, sustaining competitive pressure in the sector.

Innovation in the industry is focused on improving chip reliability, read range, and data management. Advanced features like GPS-enabled chips and digital registry integration are emerging. For instance, in October 2025, AKC Reunite launched a temperature-sensing ISO microchip, enabling non-invasive companion animals’ temperature checks during veterinary visits and shelter intake, enhancing wellness monitoring for pets, owners, and breeders.

Mergers and acquisitions in the industry are moderate, driven by consolidation among leading providers. Strategic acquisitions aim to expand market reach, integrate technology platforms, and enhance service offerings.

Regulatory frameworks impact pet microchip adoption and market operations. Compliance with ISO standards (11784/11785) ensures interoperability and international acceptance. U.S. federal and state-level pet identification laws, animal welfare mandates, and data privacy rules influence registration practices.

Product substitutes for pet microchips include collars, tags, GPS trackers, and wearable devices. While tags provide visual identification, GPS trackers offer real-time location monitoring. However, microchips remain the most reliable permanent solution, especially for lost dogs or cats.

The industry has a diverse end-user base, including its owners, veterinary clinics, shelters, and retailers. Veterinary clinics represent the largest segment due to their direct access to companion animals. High fragmentation among individual pet owners balances concentration, whereas shelters and rescue organizations play a crucial role in adoption-related microchipping initiatives, influencing demand patterns. For instance, in June 2025, Lucky Dog Animal Rescue emphasized microchipping during National Microchip Month, highlighting that permanent IDs reliably reunite lost dogs or cats with their families, unlike collars or tags.

Pet Type Insights

On the basis of pet, the dogs segment held the largest revenue share of 57.44% in 2024, owing to widespread ownership and a higher likelihood of outdoor activities, which increases the risk of pets going missing. According to a June 2025 report, more than 1.7 million pets were lost in the U.S. in 2024, including 1.2 million dogs. Dog owners prioritize permanent identification for dogs to ensure quick recovery if lost. Veterinary clinics, shelters, and rescue organizations frequently recommend microchipping for dogs, further driving adoption. In addition, regulatory and breeding requirements often mandate microchipping for certain dog breeds.

Cats are the fastest-growing segment in the market, driven by rising cat ownership and increasing awareness of their safety. Pet owners, shelters, and veterinary clinics are increasingly recognizing microchipping as an important solution for ensuring safe reunification. Campaigns promoting responsible pet ownership and National Microchip Month initiatives have further boosted adoption. For instance, in August 2025, in view of National Check the Chip Day, Michigan Department of Agriculture and Rural Development (MDARD) urged Michigan pet owners to microchip pets and ensure registration is current, helping lost animals reunite quickly with their families.

Product Insights

On the basis of product, the microchip segment accounted for the largest revenue share in the market, due to its reliability, permanence, and effectiveness in reuniting lost pets with owners. Microchips cannot be removed or lost as of collars or tags that are detachable, making them a preferred choice among their owners, veterinary clinics, and animal shelters. In addition, technological advancements and the availability of centralized, easy-to-update registries reinforce microchips as the dominant solution.

Scanners are the fastest-growing segment in the market with highest CAGR, attributed to increasing microchip adoption and the need for efficient, reliable pet identification. Scanners also prevent unnecessary shelter visits. For instance, in July 2025, Tulsa Fire stations offered microchip scanners for found dogs or cats through a partnership with Tulsa Animal Services (TAS) and Best Friends Animal Society, helping owners reunite quickly. Veterinary clinics, animal shelters, and rescue organizations rely on advanced scanners to quickly read microchips, access owner information, and facilitate reunification.

Frequency Insights

On the basis of frequency, the 134.2 KHz segment represented the largest revenue share in the market and is projected to be the fastest-growing segment over the forecast period. The market is propelled by its compliance with ISO 11784/11785 international standards, ensuring universal compatibility with most scanners used by veterinarians, shelters, and animal control agencies. This frequency offers reliable readability, broader interoperability, and enhanced accuracy, making it the preferred choice for permanent pet identification.

The universal/multifrequency devices are the second fastest growing segment in the market, given by their ability to read multiple chip frequencies, including 125 KHz, 128 KHz, and 134.2 KHz. This versatility makes them highly valuable for veterinarians, shelters, rescue organizations, and animal control agencies handling diverse implanted microchips.

Application Insights

On the basis of application, pet identification dominated the market with the largest revenue share in 2024, due to the growing need for permanent, reliable solutions to reunite lost pets with their owners. According to the American Veterinary Medical Association report of July 2025, Digital pet ID tags are replacing traditional metal tags with QR, NFC, Bluetooth, and online profiles, enabling fast identification and faster uniting with pet owners. Companies such as PetHub report high recovery rates within 24 hours with the use of digital pet IDs. This shift marks a new era in smart, efficient pet identification.

Disease tracking and vaccination management is the fastest-growing segment in the market, due to increasing integration of health data into microchip registries. Advanced microchips linked to digital platforms enable veterinarians and owners to track vaccination schedules, monitor disease outbreaks, and maintain accurate medical records. Rising awareness of preventive healthcare, regulatory emphasis on vaccination compliance, and demand for streamlined wellness monitoring are fueling this growth.

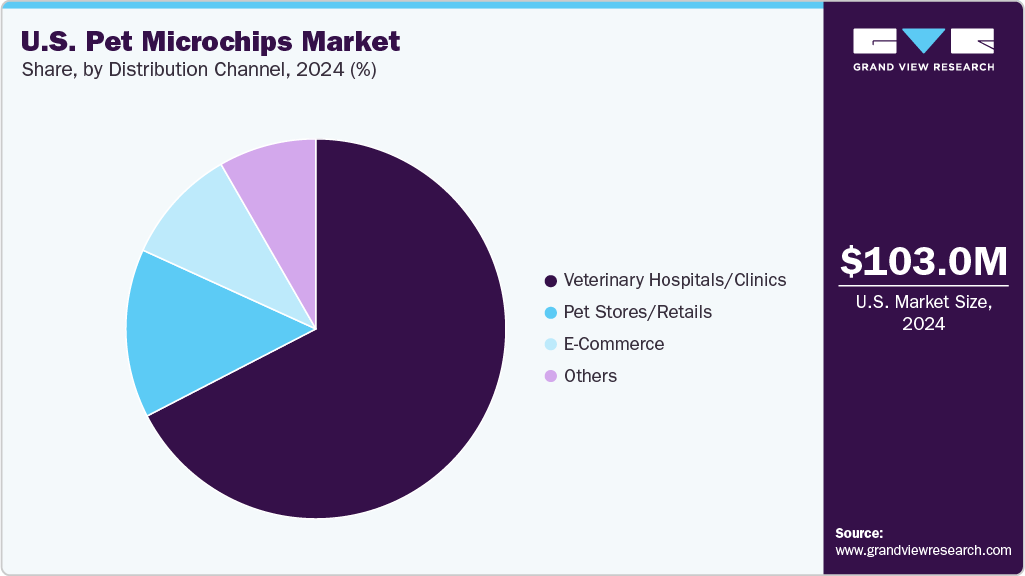

Distribution Channel Insights

On the basis of distribution channel, veterinary hospitals and clinics reported as the largest revenue share segment in 2024, as they play a central role in veterinary healthcare and ownership onboarding. These facilities are the primary point of contact for pet owners, making them the most trusted providers for microchip implantation and registration services. Regular wellness visits, vaccination schedules, and adoption-related procedures further drive microchipping through clinics. In addition, veterinarians often educate owners on the importance of permanent identification, contributing to widespread adoption.

E-commerce is the fastest-growing segment in the market, fueled by increasing online shopping convenience and wider access to microchip products and related services. Companion animal owners increasingly prefer purchasing microchips, scanners, and registration packages through online platforms for affordability, quick delivery, and bundled offers. Digital platforms also provide easy access to reviews, product comparisons, and subscription-based registry services.

Key U.S. Pet Microchips Companies Insights

Key players operating in the U.S. pet microchips market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Pet Microchips Companies:

- Peeva Inc

- Avid Identification Systems, Inc.

- Microchip Identification Systems

- Merck & Co., Inc.

- AKC REUNITE

- Barking Labs

- Pethealth Inc.

- Datamars

- Trovan Ltd.

- Nestlé Purina PetCare

Recent Developments

-

In October 2025, AKC Reunite introduced a new ISO 134.2 kHz temperature-sensing microchip, enabling non-invasive wellness checks during veterinary and shelter intake, improving pet comfort and care efficiency. This innovation enhances pet health monitoring and recovery accuracy.

-

In August 2024, MDARD urges Michigan pet owners on National Check the Chip Day to microchip and update registration details to ensure quick reunification if pets are lost or stolen. Accurate registration strengthens the bond between pets and families.

-

In February 2024, following the closure of Save This Life, affected pet owners must re-register their microchips with another provider, as registry data is no longer searchable despite chips remaining readable. Timely re-registration is vital to protect lost pets’ recovery.

U.S. Pet Microchips Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 109.4 million

Revenue forecast in 2033

USD 220.0 million

Growth rate

CAGR of 9.12% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, product, frequency, application, distribution channel

Country scope

U.S.

Key companies profiled

Peeva Inc.; Avid Identification Systems, Inc.; Microchip Identification Systems; Merck & Co., Inc.; AKC REUNITE; Barking Labs; Pethealth Inc.; Datamars; Trovan Ltd.; Nestlé Purina PetCare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Microchips Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. pet microchips market report based on pet type, product, frequency, application and distribution channel.

-

Pet Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Cats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Microchips

-

Scanner

-

Handheld Scanners

-

Stationary Scanners

-

-

Frequency Outlook (Revenue, USD Million, 2021 - 2033)

-

134.2 KHz

-

125 KHz

-

128 KHz

-

Universal/Multifrequency Devices

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Pet Identification

-

Disease Tracking & Vaccination Management

-

Theft Prevention

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals/Clinics

-

Pet Stores/Retails

-

E-Commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. pet microchips market size was estimated at USD 103.0 million in 2024 and is expected to reach USD 109.4 million in 2025.

b. The U.S. pet microchips market is expected to grow at a compound annual growth rate of 9.12% from 2025 to 2033 to reach USD 220.0 million by 2033.

b. On the basis of pet, dogs held the largest revenue segment with a share of 57.44% in 2024, owing to widespread ownership and higher likelihood of outdoor activities, which increase the risk of pets going missing.

b. Some key players operating in the U.S. pet microchips market include Peeva Inc, Avid Identification Systems, Inc., Microchip Identification Systems, Merck & Co., Inc., AKC REUNITE, Barking Labs, Pethealth Inc., Datamars, Trovan Ltd., Nestlé Purina PetCare

b. Key factors that are driving the market growth include increased incidence of lost companion animals and growing success rates of microchip recovery, growing awareness in promoting microchipping and rising insurance incentives and safety-linked benefits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.