U.S. Pet Snacks & Treats Market Summary

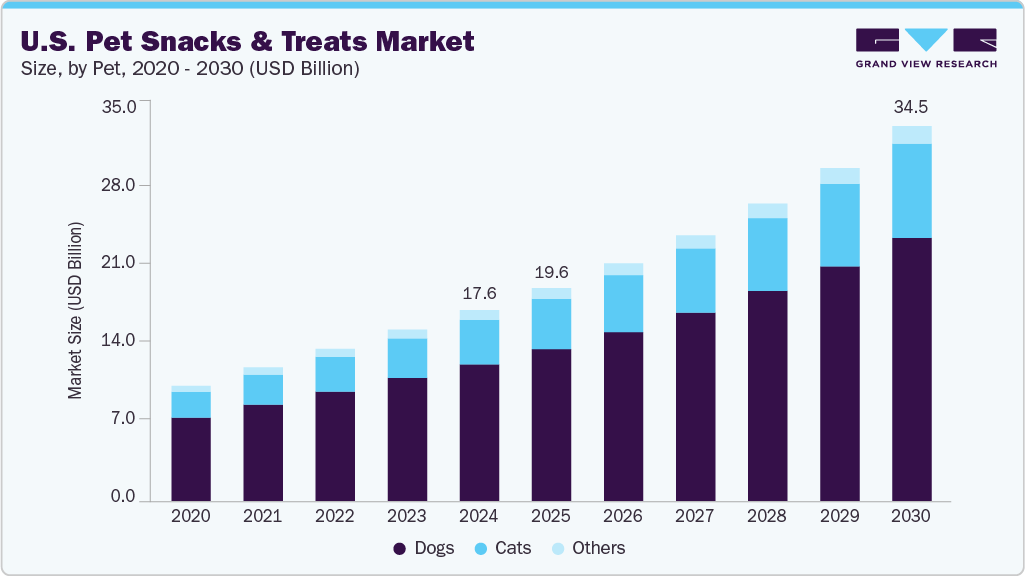

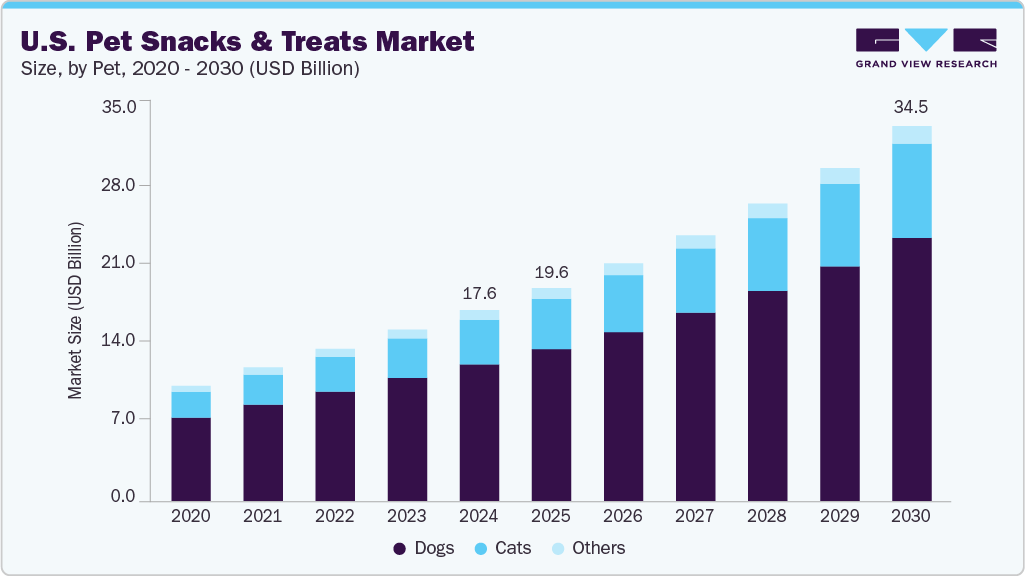

The U.S. pet snacks and treats market size was estimated at USD 17.57 billion in 2024 and is projected to reach USD 34.48 billion by 2030, growing at a CAGR of 12.0% from 2025 to 2030. The market growth is attributed to the rising pet adoption rate in the U.S. and the increasing tendency among owners to treat pets as family members, which has fueled demand for natural, nutritious, flavorful, and health-oriented pet snacks and treats that support the overall well-being and development of companion animals.

Key Market Trends & Insights

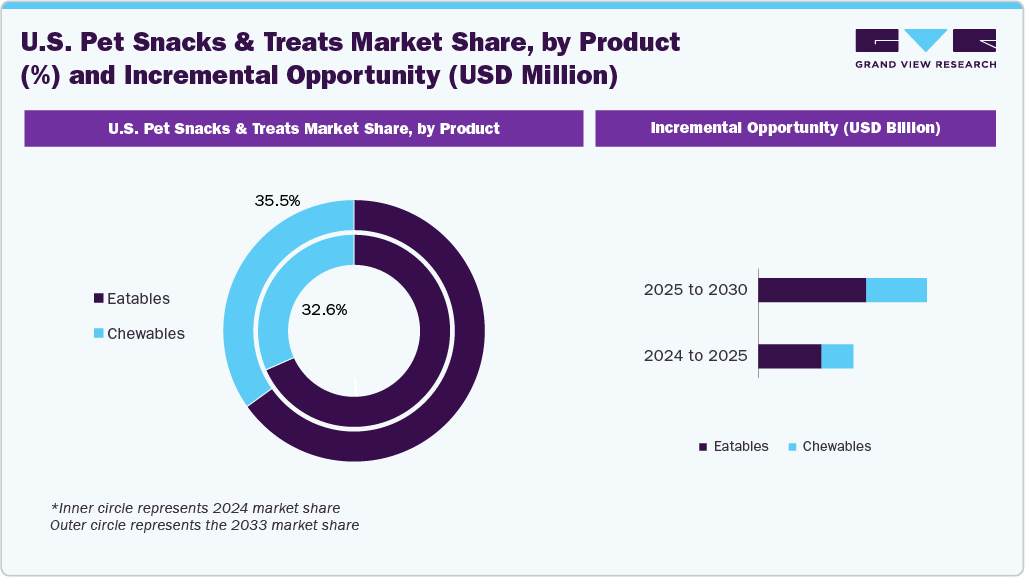

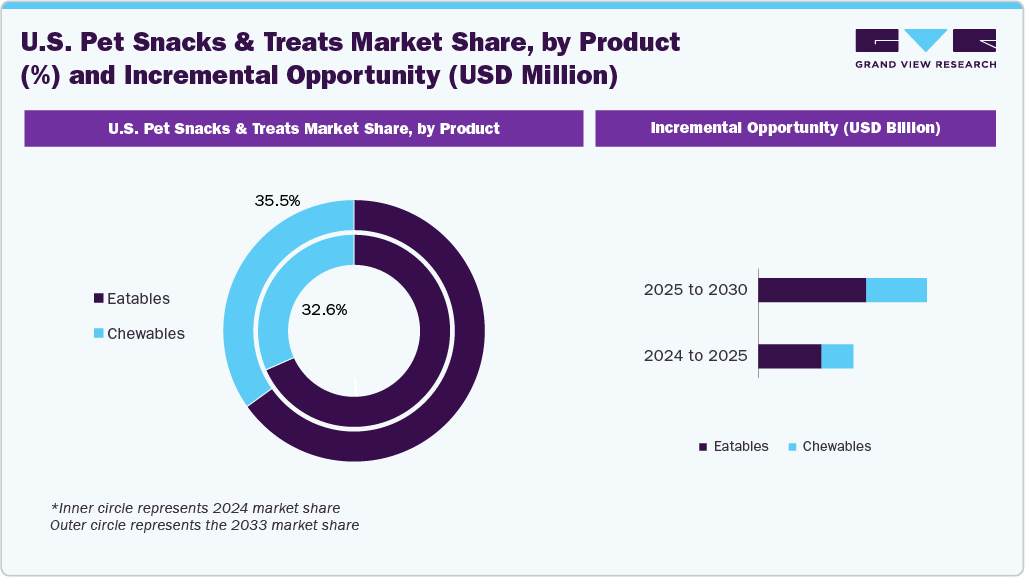

- Based on products, the eatable segment dominated the market with a share of 67.4% in 2024.

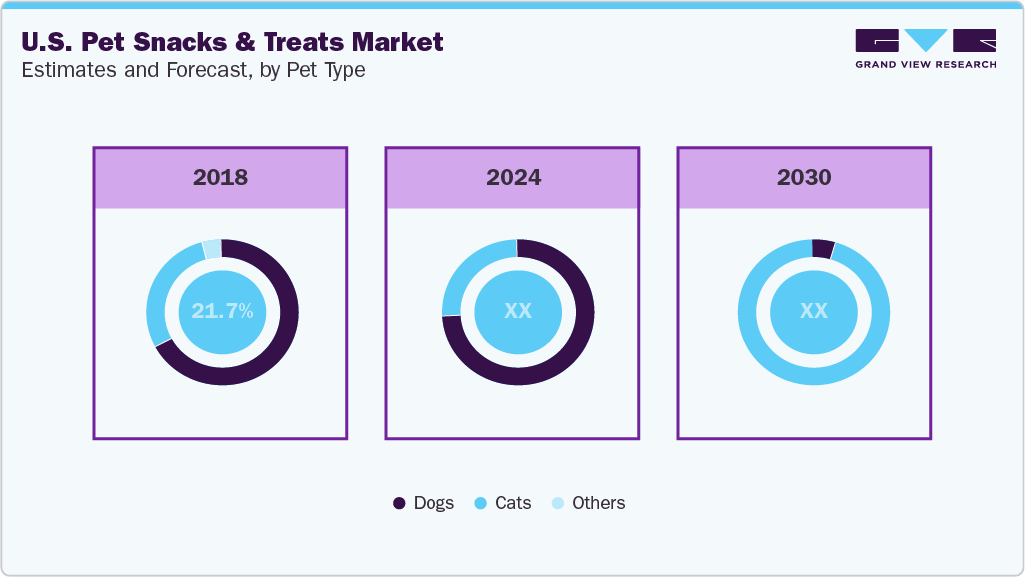

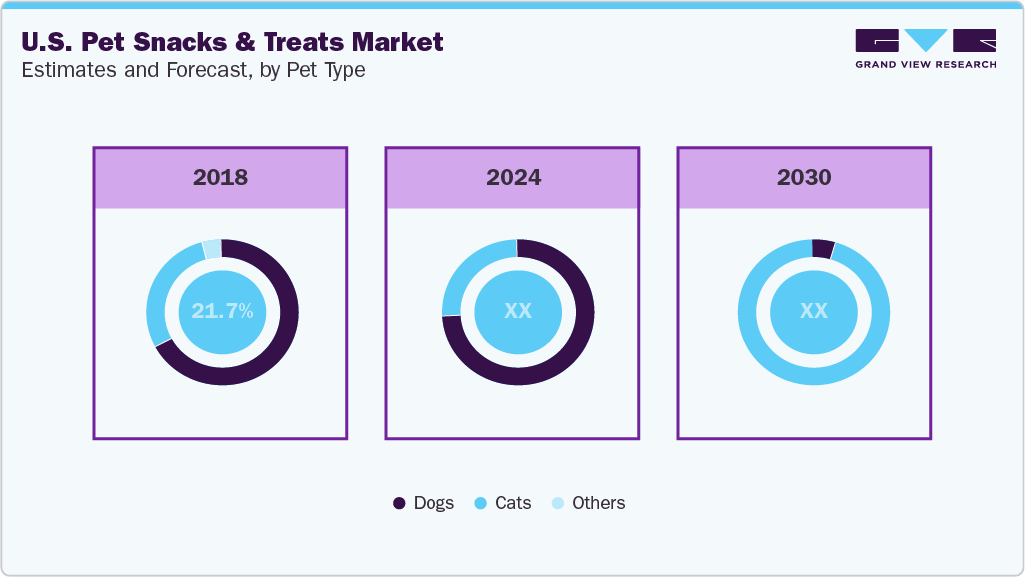

- Based on pet, the dogs segment contributed to the largest revenue share of over 71.5% in 2024.

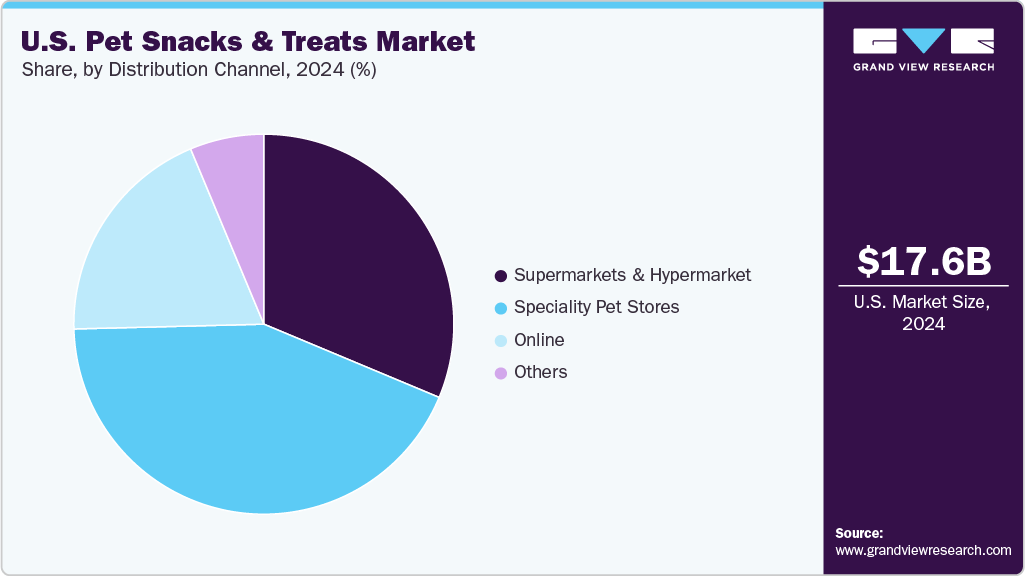

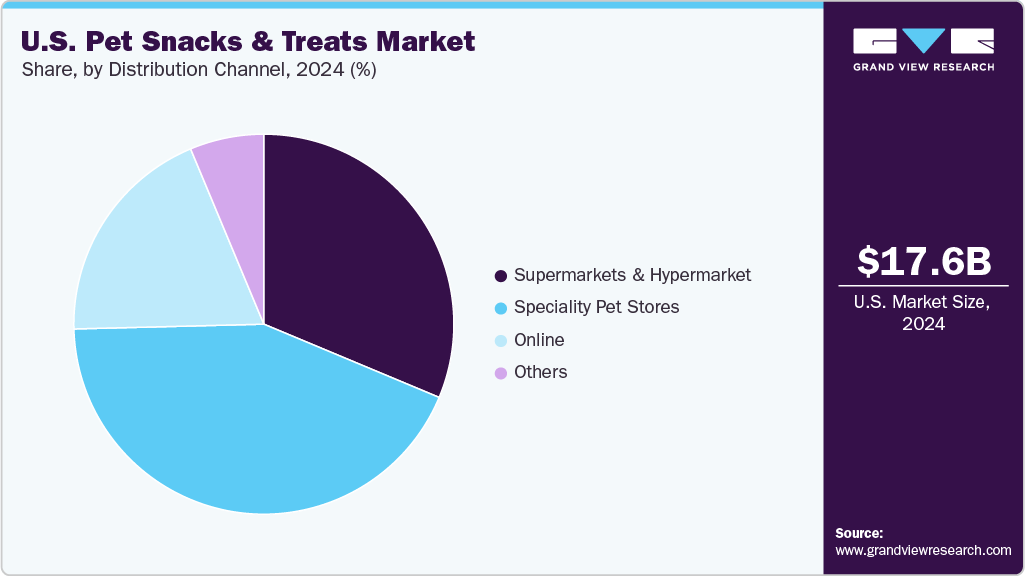

- By distribution channel, the specialty pet store segment dominated the U.S. pet snacks & treats market, with a share of 43.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.57 Billion

- 2030 Projected Market Size: USD 34.48 Billion

- CAGR (2025-2030): 12.0%

The U.S. pet snacks and treats industry is experiencing robust growth, driven by pet humanization and increasing awareness of pet health and nutrition. Pet owners are increasingly viewing their pets as family members, driving demand for natural, functional, and premium snacks that support overall well-being. Innovations such as plant-based, grain-free, and human-grade treats are gaining traction.

The growing focus on digestive health, weight management, and immunity-boosting ingredients further enhances product development. Additionally, the increasing online retail penetration and premiumization trends are expanding the accessibility and appeal of high-quality pet treats nationwide.

Product Insights

The eatables segment led the market, accounting for the largest revenue share of 67.4% in 2024. Increasing awareness among pet owners about the functional benefits of pet food and snacks, such as supporting joint health, digestion, immunity, and skin & coat condition, drives the demand for edible pet snacks and treats. Consumers are seeking products that provide nutrition and promote overall well-being and longevity for their pets. In response, prominent industries are actively innovating and launching a diverse range of products, including natural, grain-free, plant-based, and nutrient-enriched treats. Focusing on health-oriented, functional, and convenient snack options is fueling the growth of the pet snacks and treats market in the U.S.

The chewable segment is expected to grow at the fastest CAGR of 13.5% over the forecast period. Many chewables are enriched with vitamins, minerals, probiotics, or joint-health ingredients such as omega-3 or glucosamine, which is anticipated to drive market growth.

Pet Insights

The dogs segment led the market with the largest revenue share of 71.5% in 2024. The increasing perception of dogs as family members has fueled demand for natural, nutritious, and functional snacks that support overall health and well-being. Approximately 68 million U.S. households own dogs. This trend presents favorable opportunities for key market players to introduce innovative products that cater to specific health needs, such as digestion, immunity, and weight management. According to the World Animal Foundation, pet ownership remains a fundamental part of American life. APPA’s 2025 Industry Report reveals that 94 million U.S. households own a pet, representing 71% of all households. The high pet ownership rate, rising disposable incomes, and evolving consumer preferences for high-quality specialty treats are expected to continue propelling market growth over the forecast period.

The cats segment is expected to grow at the fastest CAGR of 13.3% from 2025 to 2030. The U.S. cat snacks and treats market is experiencing significant growth, driven by rising cat ownership and increasing awareness of feline health and nutrition. According to the World Animal Foundation, 49 million U.S. households have cats, highlighting the substantial market potential. Pet owners are increasingly seeking treats that provide functional benefits, such as supporting urinary tract health, digestion, and hairball control, while also being tasty and enjoyable for their cats.

Distribution Channel Insights

Based on distribution channel, the specialty pet stores segment led the U.S. pet snacks and treats market, accounting for the largest revenue share of 43.3% in 2024. These stores are increasingly forming partnerships with leading manufacturers of pet snacks and treats, introducing innovative and premium products to attract consumers. According to APPA, U.S. consumers spent USD 152 billion on their pets in 2024, with projections reaching USD 157 billion in 2025, highlighting the strong purchasing power of pet owners and the importance of specialty retail channels in meeting evolving demand.

The online sales channel segment is expected to grow at the fastest CAGR of 13.2% from 2025 to 2030, driven by increasing internet penetration, e-commerce adoption, and consumers’ preference for convenience and doorstep delivery. Pet owners increasingly turn to online platforms to access premium, natural, grain-free, and functional treats, often with detailed product information and customer reviews. Subscription services and direct-to-consumer offerings are further boosting online sales.

Key U.S. Pet Snacks & Treats Company Insights

Some of the key players in the U.S. pet snacks and treats market include VAFO Group and Wellness Pet Company.

Key U.S. Pet Snacks & Treats Companies:

- Mars, Incorporated

- J.M. Smucker Co.

- General Mills Inc.

- Colgate-Palmolive Company

- Wellness Pet, LLC

- Merrick Pet Care

- Spectrum Brands, Inc.

Recent Developments

-

In August 2025, at SUPERZOO 2025, Wellness Pet Company introduced over 20 new mealtime products, including wet cat food offerings. The lineup features 93 varieties across multiple flavors and formats, incorporating proteins such as lamb, shrimp, and egg, along with new packaging designs to promote hydration.

-

In August 2023, Spectrum Brands, Inc. introduced Meowee! cat treats. Exclusively accessible at Chewy.com, Meowee! Products aim to enhance treat time for both cats and pet owners, offering a diverse range of textures and delightful flavors. Crafted by veterinarians, Meowee! Treats prioritize natural ingredients and are free from artificial colors, flavors, and animal by-products.

U.S. Pet Snacks & Treats Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 19.59 billion

|

|

Revenue forecast in 2030

|

USD 34.48 billion

|

|

Growth rate

|

CAGR 12.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, pet, distributional channel

|

|

Key company profiled

|

Mars, Incorporated; J.M. Smucker Co.; General Mills Inc.; Colgate-Palmolive Company; Wellness Pet, LLC; Merrick Pet Care; Spectrum Brands, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Pet Snacks And Treats Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. pet snacks & treats market report on the basis of product, pet, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pet Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)