- Home

- »

- Consumer F&B

- »

-

U.S. Popping Boba Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Popping Boba Market Size, Share & Trends Report]()

U.S. Popping Boba Market (2025 - 2030) Size, Share & Trends Analysis Report By Flavor (Fruit, Coffee, Chocolate), By Application (Bubble Tea, Frozen Yogurt Toppings), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-795-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Popping Boba Market Summary

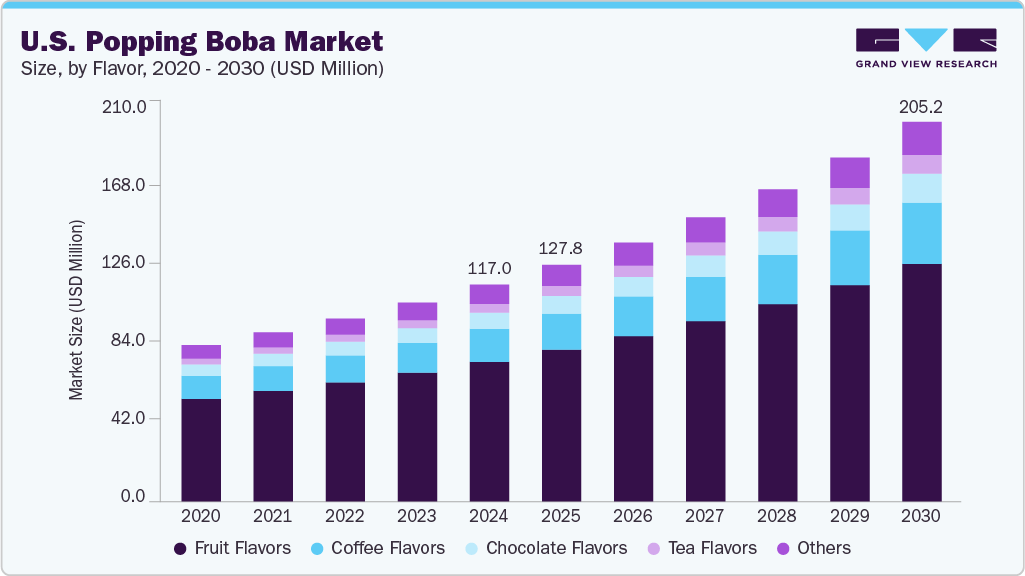

The U.S. popping boba market size was estimated at USD 117.0 million in 2024 and is projected to reach USD 205.2 million by 2030, growing at a CAGR of 9.9% from 2025 to 2030. Innovations in flavor offerings, including fruit, tea-based, and exotic options like matcha, have captured consumer interest and expanded market reach.

Key Market Trends & Insights

- By flavor, the fruit flavors segment held the largest market share of 64.5% in 2024.

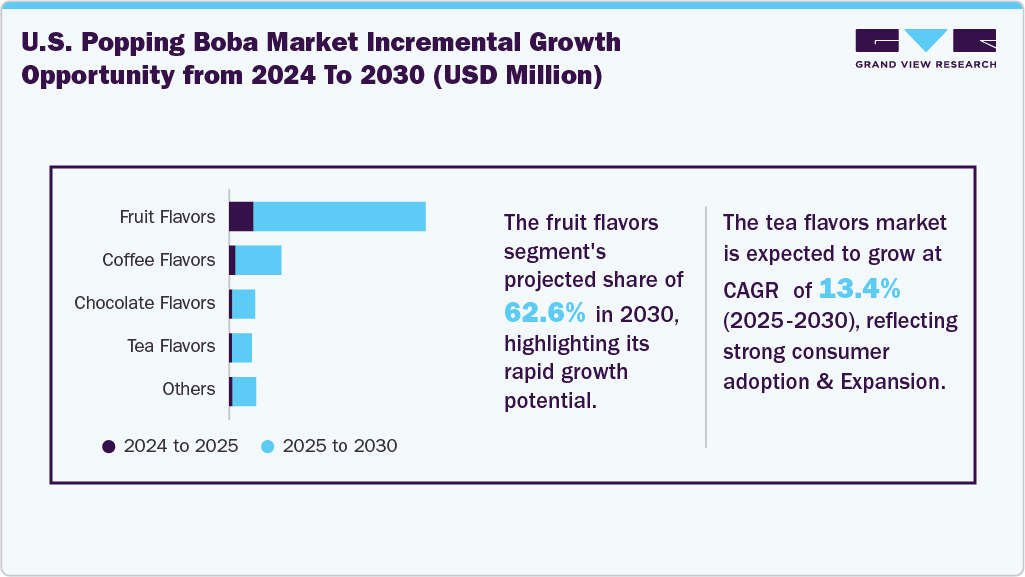

- The tea flavors segment is expected to grow at the fastest CAGR of 13.4% from 2025 to 2030.

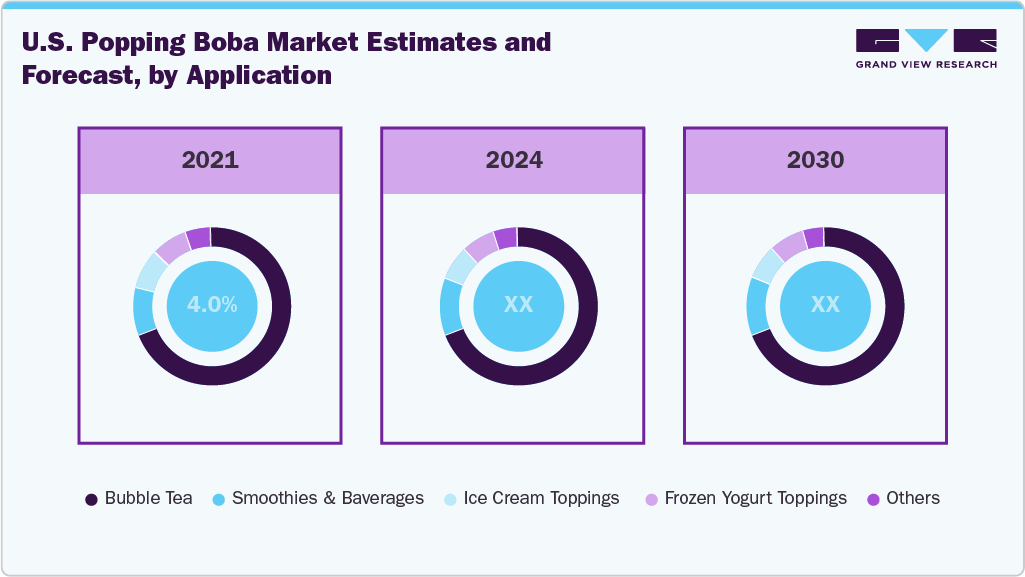

- By application, the bubble tea segment dominated the market with a revenue share of 72.7% in 2024.

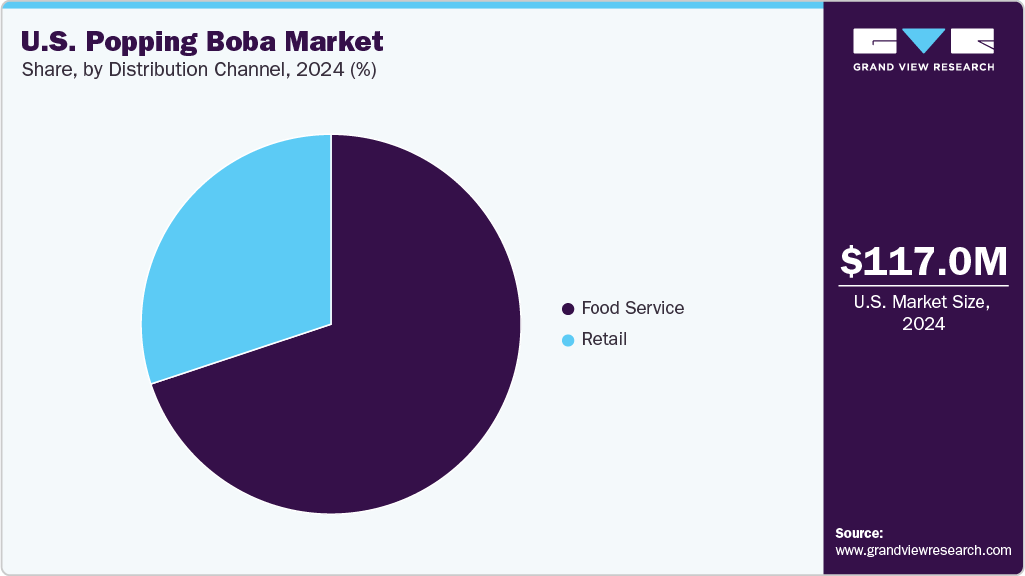

- By distribution channel, the food service segment dominated the popping boba market with a revenue share of 70.3% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 117.0 Million

- 2030 Projected Market Size: USD 205.2 Million

- CAGR (2025-2030): 9.9%

The rise of health-conscious trends, including natural sweeteners and allergen-free options, is influencing consumer choices, further driving demand. Innovation plays a crucial role in the evolving U.S. popping boba industry. Companies are introducing new flavors and formats to cater to the diverse preferences of consumers. For instance, in January 2025, Unifying Spirits announced the launch of Boba POPS, a vegan, gluten-free, and the world's only patented alcoholic popping boba. It is available in strawberry, blueberry, raspberry, lychee, peach, and several seasonal flavors. This launch targets adult beverage applications, expanding usage beyond bubble tea. Major players are focusing on establishing domestic production lines to reduce the reliance on imports. For instance, in September 2025, Parker Food Group (PFG), a manufacturer of specialty ingredient solutions, officially launched its new Popping Boba product line, made at its facility in Mexico, to ensure consistency and reduce supply chain risks.

Flavor Insights

The fruit flavors segment held the largest market revenue share of 64.5% in 2024. This growth is driven by the rising consumer preference for natural, refreshing, and visually appealing ingredients in beverages and desserts. Fruit-flavored popping boba delivers a burst of flavor and vibrant colors, aligning perfectly with the trend of experiential and customizable food and drink experiences. In the U.S., fruit-flavored popping boba has gained attention through innovative offerings by various market players. For instance, in January 2025, Del Taco LLC announced its plan to roll out NEW Dragon Fruit Blueberry Poppers beverages, a trio of refreshing popper beverages including lemonade, Sprite, and a creamy shake. The versatility of fruit-flavored popping boba used in bubble tea, yogurt parfaits, desserts, and cocktails continues to drive its adoption. As consumers seek more interactive and novel food experiences, this segment is expected to maintain strong growth and innovation.

The tea flavors segment is expected to grow at the fastest CAGR of 13.4% over the forecast period. The popularity of tea-flavored popping boba is largely attributed to the growing consumer interest in beverages that offer functional benefits and unique flavor profiles. Tea-infused boba pearls, such as matcha, jasmine, and oolong, provide a sophisticated taste experience that appeals to health-conscious individuals seeking antioxidants and a more refined palate. This trend aligns with the broader movement towards premium and wellness-oriented food and beverage options. Tea-flavored popping boba is gaining traction as a versatile topping for bubble tea, iced teas, and desserts. These pearls offer authentic tea flavor, enhancing the overall drinking experience. Their appeal lies in their ability to complement a variety of beverages, from traditional milk teas to fruit-infused concoctions, adding texture and a distinctive taste. With the rising popularity of sophisticated and health-focused flavor profiles among consumers, tea-flavored popping boba is gaining traction as a balanced option that merges wellness with innovative taste.

Application Insights

The bubble tea segment dominated the U.S. market with a revenue share of 72.7% in 2024. This segment remains the primary application area driving the demand for popping boba, supported by the expansion and strong appeal among younger consumers. The addition of popping boba imparts novelty, texture, and visual appeal, aligning with the customization and social-media-friendly nature of bubble tea culture. Popping boba is a staple in bubble tea formulations, wherein it is used as a topping or a core ingredient alongside traditional tapioca pearls. It enhances beverage variety, offering multiple flavors and texture combinations to tea shops. Bubble tea chains and independent cafes are introducing innovative flavor pairings to attract a broader audience. For instance, Hojalicious, a U.S.-based brand, is recognized for its ready-to-serve popping boba line, which is ideal for bubble tea and other tea-based beverages. The company highlights how its popping boba complements fruit and milk teas, enabling cafés to create vibrant, layered drinks that meet both visual and sensory expectations.

The smoothies and beverages segment is expected to grow at the fastest CAGR over the forecast period. Segment growth is driven by the surge in popularity of smoothies and beverages featuring popping boba, as well as growing consumer demand for customizable, visually appealing, and engaging drink options. Popping boba adds a burst of flavor and a playful element to beverages, aligning with the trend toward experiential and Instagram-worthy food and drinks. These pearls are commonly used in fruit smoothies, iced teas, lemonades, and sodas, offering a unique contrast to the creamy or tangy bases. The versatility of popping boba allows for a wide range of flavor combinations, catering to diverse consumer preferences and enhancing the overall drinking experience.

Distribution Channel Insights

The food service segment accounted for the largest revenue share of 70.3% in 2024. The growth of this segment can be attributed to cafés, quick-service restaurants, and dessert shops that continually seek new and visually engaging ingredients to differentiate their menus and enhance customer engagement. In this channel, popping boba is integrated into drink and dessert offerings, from bubble tea and smoothies to ice cream sundaes and specialty drinks on café menus. For instance, in April 2024, Boba Cucue, a boba tea franchise offering delicious boba drinks along with sweet treats and custom merch, announced the opening of its new location in Farmington, New Mexico. Such restaurants are likely to drive demand for popping boba, further driving segment growth.

There is a surge in the demand for unique and interactive food experiences in food service establishments, with consumers seeking innovative toppings and additions to their beverages and desserts. Food-service operators appreciate that popping pearls add an experiential element, allowing for menu creativity. The ability to portion, top, and customize these pearls fits well with fast-casual and café models. According to an article published by Entrepreneur in September 2023, a survey by Eventbrite suggested that customers want more than just a delicious meal, with 84% of people seeking a surprising menu or theme and 74% seeking a unique experience. Popping boba’s burst of flavor and appealing texture serves food service providers with an opportunity to differentiate their menu offerings, attracting customers who seek new and exciting options.

The retail segment is projected to grow at the fastest CAGR over the forecast period, driven by increasing consumer interest in recreating café-style beverages and desserts at home. The rising popularity of DIY bubble tea kits and ready-to-eat toppings has encouraged retailers to stock popping boba products that cater to convenience, variety, and experiential consumption. Popping boba is now widely available in major grocery chains, specialty stores, and online marketplaces, making it easily accessible to a broader audience. The retail formats range from single-flavor tubs to multi-flavor party packs designed for home use. Consumers are drawn to these products for their vibrant appearance, fun texture, and versatility in smoothies, iced teas, desserts, and cocktails.

Key U.S. Popping Boba Company Insights

Some key players in the market include BOBAVIDA, BRILSTA, and others. Major players are adopting strategies such as innovation, new product development, and distribution partnerships to address changing consumer preferences and the growing demand for extensive product portfolios catering to diverse consumer groups.

Key U.S. Popping Boba Companies:

- BOBAVIDA

- BRILSTA

- Possmei International Co., Ltd.

- Twrl Milk Tea

- Parker Food Group

Recent Developments

-

In April 2024, Twrl Milk Tea launched its first single-serve, plant-based, dye-free Popping Boba in three flavors: Honey, Lychee, and Strawberry. These vegan, gluten-free, and gelatin-free toppings are available in convenient single-serve packets, marking a significant milestone for the brand.

-

In January 2024, Bossenstore announced the launch of Sour Bursting Boba in four flavors: lemon, blue raspberry, cherry, and orange. These products are made with fruit juices captured in thin bubbles using molecular gastronomy and are then formed into juice balls.

U.S. Popping Boba Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 127.8 million

Revenue forecast in 2030

USD 205.2 million

Growth rate

CAGR of 9.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, application, distribution channel

Key companies profiled

BOBAVIDA; BRILSTA; Possmei International Co., Ltd.; Twrl Milk Tea; Parker Food Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Popping Boba Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. popping boba market report based on flavor, application, and distribution channel:

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit Flavors

-

Tea Flavors

-

Coffee Flavors

-

Chocolate Flavors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bubble Tea

-

Frozen Yogurt Toppings

-

Ice Cream Toppings

-

Smoothies and Beverages

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Retail

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. popping boba market size was estimated at USD 117.0 million in 2024 and is expected to reach USD 127.8 million in 2025.

b. The U.S. popping boba is expected to grow at a compounded growth rate of 9.9% from 2025 to 2030 to reach USD 205.2 million by 2030.

b. The bubble tea segment dominated the U.S. popping boba market with a revenue share of 72.7% in 2024. This segment remains the primary application area driving the demand for popping boba, supported by the expansion and strong appeal among younger consumers. The addition of popping boba imparts novelty, texture, and visual appeal, aligning with the customization and social-media-friendly nature of bubble tea culture.

b. Some key players operating in U.S. popping boba market include IBUBBLE TEA; Fresh Leaf UAE; Golden Grains Foodstuff Trading LLC; Tiger Boba

b. Key factors that are driving the market growth include surge in bubble tea and Asian-style beverages and expansion of flavours, formulations and ingredient innovation

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.