- Home

- »

- Power Generation & Storage

- »

-

U.S. Power Tool Batteries Market Size, Industry Report, 2030GVR Report cover

![U.S. Power Tool Batteries Market Size, Share, & Trends Report]()

U.S. Power Tool Batteries Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type (Lithium-ion, Nickel-Cadmium, Nickel-Metal Hydride, Others), By Application (Residential, Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-699-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Power Tool Batteries Market Summary

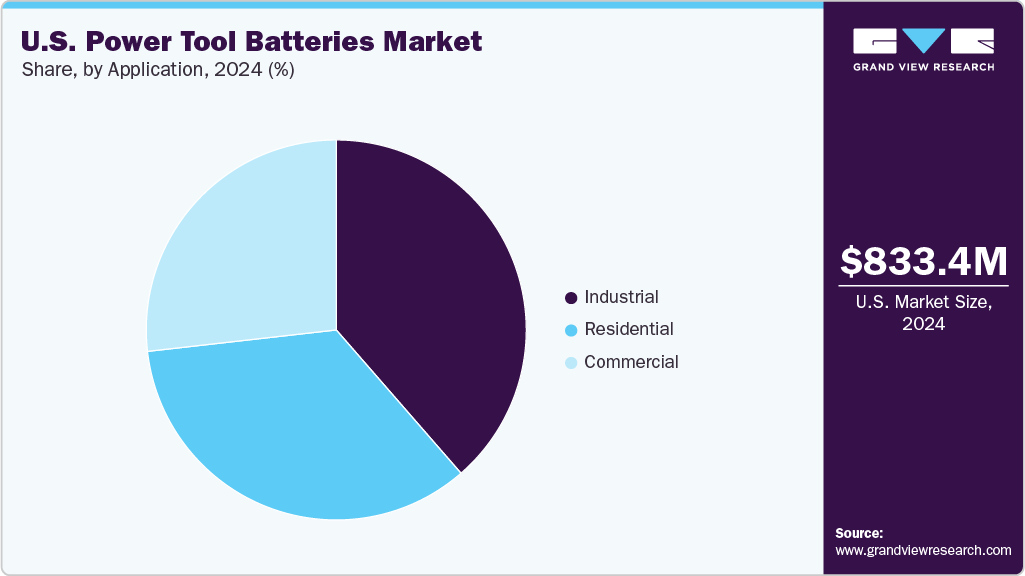

The U.S. power tool batteries market size was valued at USD 833.4 million in 2024 and is projected to reach USD 1,226.4 million by 2030, growing at a CAGR of 6.6% from 2025 to 2030. Homeowners invest in renovating living spaces, upgrading interiors, and maintaining properties independently, which drives demand for cordless tools that rely on efficient and long-lasting battery packs.

Key Market Trends & Insights

- By type, the lithium-ion segment held the highest market share of 70.1% in 2024.

- By type, the nickel-metal hydride segment is expected to grow at a significant CAGR of 4.0% over the forecast period

- Based on application, the industrial segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 833.4 million

- 2030 Projected Market Size: USD 1,226.4 million

- CAGR (2025-2030): 6.6%

Strong growth in residential and commercial construction activity strengthens demand for power tool batteries across the U.S. Contractors and construction professionals increasingly prefer cordless solutions on job sites to ensure flexibility, safety, and operational efficiency, especially in confined or remote work areas with limited access to power outlets. This widespread adoption drives manufacturers to develop advanced technologies that can withstand heavy-duty use, deliver longer run times, and support fast recharging to reduce downtime. Strong DIY activity and homeowners’ willingness to tackle more projects continue to boost demand for cordless tools and batteries. For instance, a survey conducted by Frontdoor in November 2024 among 1,000 individuals found that nearly every U.S. homeowner completed at least one DIY project and 74% plan to start another in 2025. The need for improved productivity, lower maintenance, and compliance with workplace safety standards continues to support the U.S. power tool batteries industry.

Technological innovation further supports the market, with lithium-ion batteries firmly established as the preferred option due to lighter weight, faster charging capabilities, and superior energy density. Manufacturers invest in extending battery lifespan, enhancing thermal safety features, and integrating smart battery management systems that help users monitor power levels and optimize tool performance.

Sustainability initiatives and stricter environmental standards influence product development, encouraging companies to produce recyclable and energy-efficient battery packs. Rising consumer awareness of ecological responsibility encourages key players to expand recycling programs and adopt greener production processes. These factors position the power tool batteries market to benefit from advancing technology, stronger sustainability measures, and a shift in user expectations in both residential and industrial sectors.

Type Insights

The lithium-ion segment accounted for the largest share of 70.1% in 2024. Strong preference for lithium-ion batteries stems from their lighter weight, higher energy density, and faster charging capabilities than nickel-based alternatives. This battery type powers various cordless tools, from drills and saws to heavy-duty equipment, allowing professionals and DIY users to work longer with minimal downtime. Continuous improvements in cell design, thermal management, and smart battery systems help extend runtime, optimize performance, and enhance safety. For instance, in May 2023, Bosch launched the AMPShare 18V battery platform in the U.S. and Canada, enabling cross-brand compatibility that reduces the need for multiple batteries and chargers.

The nickel-metal hydride segment is expected to grow at a significant CAGR of 4.0% over the forecast period, supported by demand for cost-effective and durable battery options in select power tool applications. NiMH batteries continue to serve specific needs where affordability and proven performance are prioritized. Continuous improvements in NiMH cell design and compatibility help extend the lifespan of older tools, reduce electronic waste, and provide users with dependable performance for less demanding tasks.

Application Insights

The industrial segment held the largest market share in 2024. Strong demand from construction, automotive, and manufacturing sectors drives the need for robust, high-capacity power tool batteries that deliver reliable performance under heavy workloads. Industrial users prefer cordless tools for the power and portability they provide, enabling teams to handle complex tasks without the limitations of cables or the emissions of fuel-powered equipment. This flexibility supports large-scale construction sites, fabrication shops, and repair operations where safe, efficient, and uninterrupted tool use remains critical. The shift toward energy efficiency and sustainability reinforces this trend, helping industrial companies meet stricter environmental standards while reducing reliance on fossil fuels. New infrastructure and manufacturing projects continue to expand nationwide and support the U.S. power tool batteries industry by driving steady demand for dependable cordless systems in industrial applications.

The commercial segment is expected to grow at the fastest CAGR over the forecast period. The need for greater mobility and convenience in diverse work environments, such as building maintenance, automotive repair, and light construction, supports the rising preference for cordless tools in commercial applications. Freedom from cords allows workers to access tight or remote areas with fewer restrictions, directly improving efficiency and task completion speed.

Enhanced workplace safety is another major driver, as cordless tools eliminate tripping hazards associated with power cords and reduce the risk of worksite accidents. Continued improvements in battery technology, including higher energy density and faster charging, further strengthen the appeal of battery-powered tools for commercial operators who prioritize flexibility, reliability, and safe operations. These factors continue to support the U.S. power tool batteries industry by driving demand for safer, high-performance cordless solutions.

Key U.S. Power Tool Batteries Company Insights

Some key players in the U.S. power tool batteries market include DEWALT; Techtronic Industries Co. Ltd.; Robert Bosch LLC and others.

-

Techtronic Industries Co., Ltd. is recognized for its high-performance lithium-ion battery platforms, continuous advancements in cell technology, and versatile systems designed to meet the needs of professional contractors and DIY users across the construction, automotive, and industrial sectors in the U.S.

-

DEWALT is a flagship power tools brand under Stanley Black & Decker, widely trusted for its durable and efficient cordless tools and battery packs. The company delivers next-generation lithium-ion solutions that power a broad range of professional-grade equipment, focusing on runtime, safety, and cross-platform compatibility to support demanding job site requirements nationwide.

Key U.S. Power Tool Batteries Companies:

- DEWALT

- Techtronic Industries Co. Ltd.

- Makita U.S.A., Inc.

- Robert Bosch LLC.

- Ryobi Limited.

- East Penn Manufacturing Company

- Clarios

- Hilti Aktiengesellschaft

Recent Developments

-

In October 2024, East Penn Manufacturing Company became the first U.S. company to receive UL1973 certification for its reserve-power lead-acid battery line, strengthening safety standards and reliability in the market.

-

In November 2024, Makita U.S.A Inc. launched the XGT 40V max 4.0Ah High Power Battery. It offers more power, providing the power required to maintain performance under continuous heavy load applications and run cooler.

U.S. Power Tool Batteries Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 889.54 million

Revenue forecast in 2030

USD 1,226.4 million

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type and application

Country scope

U.S.

Key companies profiled

DEWALT; Techtronic Industries Co. Ltd.; Makita U.S.A., Inc.; Robert Bosch LLC.; Ryobi Limited. ;East Penn Manufacturing Company; Clarios; Hilti Aktiengesellschaft

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Power Tool Batteries Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. power tool batteries market report based on type & application:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-ion

-

Nickel-Cadmium

-

Nickel-Metal Hydride

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. power tool batteries market size was estimated at USD 833.44 million in 2024 and is expected to reach USD 889.54 million in 2025.

b. The U.S. power tool batteries market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach USD 1,226.39 million by 2030.

b. Based on the type segment, the Lithium-ion subsegment held the largest revenue share, more than 70%, in the U.S. Power Tool Batteries market in 2024.

b. Some of the key players in the U.S. power tool batteries market include DeWalt (Stanley Black & Decker), Milwaukee Tool (Techtronic Industries), Makita, Bosch, Ryobi, East Penn Manufacturing Co., among others.

b. The U.S. power tool battery market is driven by the rapid adoption of cordless tools and advancements in lithium-ion battery technology. Additional factors include growing construction activity, DIY trends, and increasing demand for smart, efficient, and fast-charging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.