- Home

- »

- Green Building Materials

- »

-

U.S. Rainscreen Cladding Market Size, Industry Report, 2033GVR Report cover

![U.S. Rainscreen Cladding Market Size, Share & Trends Report]()

U.S. Rainscreen Cladding Market (2025 - 2033) Size, Share & Trends Analysis Report By Raw Material (Composite Material, Terracotta, Fiber Cement, Metal, Ceramics), By Application (Residential, Commercial, Office), And Segment Forecasts

- Report ID: GVR-3-68038-007-1

- Number of Report Pages: 112

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Rainscreen Cladding Market Summary

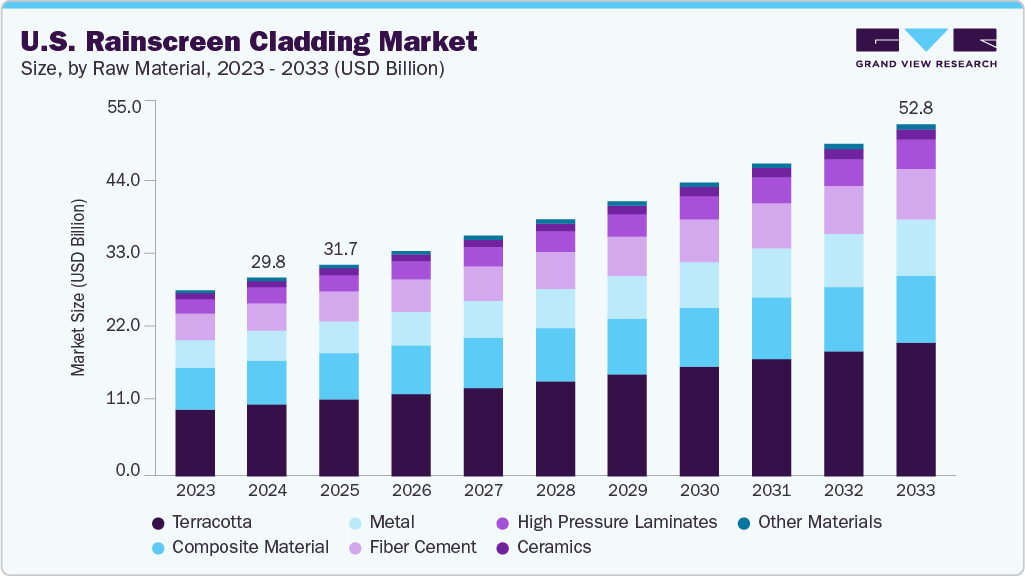

The U.S. rainscreen cladding market size was estimated at 29.79 billion in 2024 and is projected to reach USD 52.78 billion by 2033, growing at a CAGR of 7.4% from 2025 to 2033. Product demand is expected to grow significantly over the projected period due to rising demand in the U.S. residential and non-residential construction industry.

Key Market Trends & Insights

- California dominated the U.S. rainscreen cladding market with the largest revenue share of 11.8% in 2024.

- By raw material, the metal segment is expected to grow at the fastest CAGR of 8.4% over the forecast period.

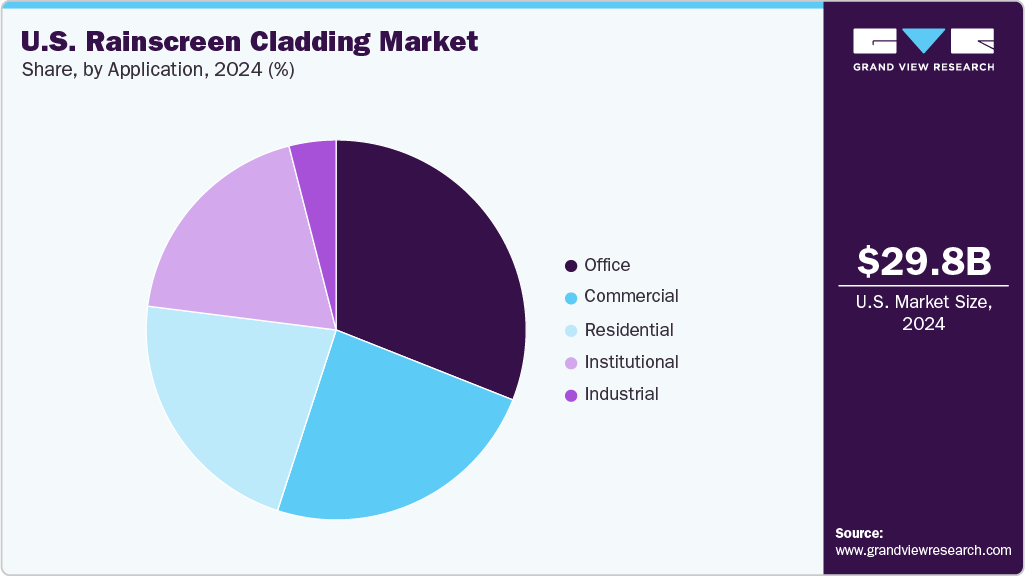

- By application, the office application segment accounted for the largest share of revenue in 2024

Market Size & Forecast

- 2024 Market Size: USD 29.79 Billion

- 2033 Projected Market Size: USD 52.78 Billion

- CAGR (2025-2033): 7.4%

- California: Largest market in 2024

- Louisiana: Fastest growing market

In addition, increasing investment in commercial infrastructure development is anticipated to positively impact industry growth. The rainscreen cladding infrastructure stays on the exterior of the walls, making the building weather-resistant. This placement of the rainscreen cladding structure creates an air cavity in between, thereby protecting any building structure's outermost decorative or safety barriers. It allows moisture that may sometimes penetrate through the external cladding to drain away easily from the building and accelerates the evaporation of any residual moisture with the help of air flowing between the wall and the cladding. The characteristics above are expected to propel market growth over the projected period.Rising demand for environment-friendly infrastructure, owing to increasing stringent regulations on the construction industry and rising awareness regarding environmental deterioration, is expected to positively impact the demand over the forecast period. Rainscreen cladding systems are widely used in the construction industry for various end-use applications such as rainwater & adverse weather protection, improved external appearance, and acoustic performance. Their increasing application scope in institutions, hospitals, stadiums, malls, and offices is also anticipated to fuel market growth over the forecast period.

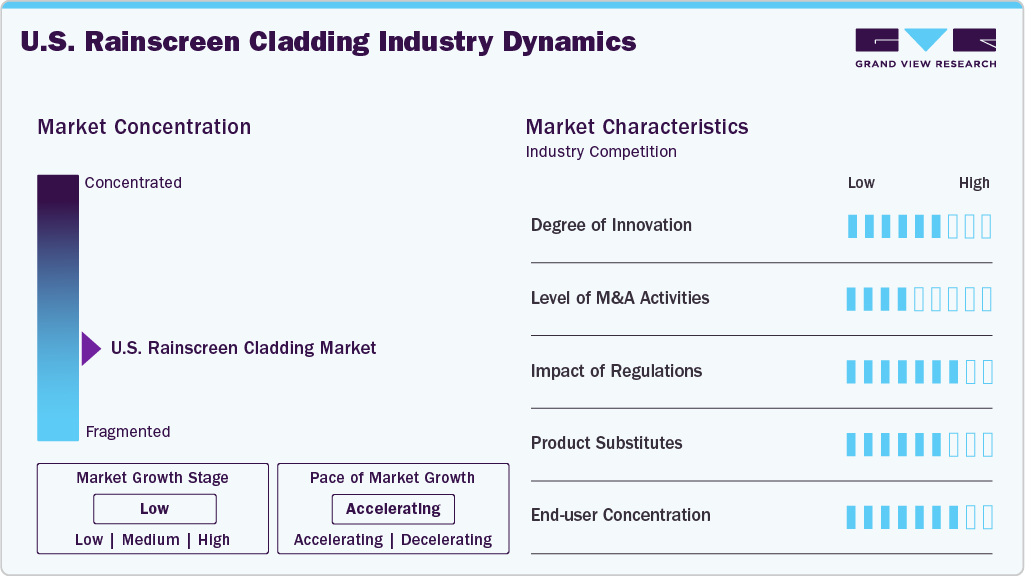

The U.S. market is highly competitive, with a large number of players. The market includes raw material suppliers, component manufacturers, rainscreen cladding assemblers, and installers are different market entities. Technological developments, easy availability of materials, and hassle-free installation processes result in remarkable competition among the players.

The market is characterized by contracts between suppliers, manufacturers, installers, and end-users. Raw material suppliers and component manufacturers enter into long-term agreements. Installers and end-users prefer short-term contracts for installing and maintaining structures. Rainscreen claddings are customized according to the building structure in terms of size and shape; hence, the pricing of the structure varies depending on the application area.

Market Concentration & Characteristics

The U.S. rainscreen cladding industry is in a medium growth stage, accelerating expansion due to increasing demand for energy-efficient and sustainable building solutions. The industry is fragmented, comprising medium to large-scale players offering diverse materials such as aluminum composite panels, high-pressure laminates, fiber cement, terracotta, and natural stone systems. Leading companies invest in innovation, research and development, and product customization to enhance aesthetics, durability, and weather resistance. They also focus on advanced attachment systems, fire-rated panels, and eco-friendly materials to meet evolving building safety codes and green construction standards.

Integrating digital technologies, such as building information modeling (BIM), automation in fabrication, and data-driven design optimization, is helping manufacturers streamline production, minimize material wastage, and reduce installation time and cost. These advancements, coupled with the growing adoption of rainscreen systems in commercial and residential applications, are accelerating market growth in the U.S.

The market is further driven by stringent building energy codes and sustainability mandates that encourage using ventilated façades to improve thermal efficiency and moisture management. Moreover, the ongoing trend toward modern architectural aesthetics emphasizing clean lines, texture diversity, and natural finishes propels demand for rainscreen cladding systems across new construction and renovation projects.

The buyers play a crucial role in influencing market trends. Their growing preference for durable, low-maintenance, and aesthetically appealing façade solutions continues to support demand. In addition, as competition for raw materials and sustainable supply chains intensifies, companies invest in strategic sourcing and recycling initiatives to maintain cost efficiency and ensure consistent supply.

Raw Materials Insights

Terracotta led the U.S. market and accounted for a revenue of USD 10.81 billion in 2024, owing to its UV resistance, weatherproof and fireproof properties, and easy installation. Claddings made with terracotta are used to create panel designs in combination with other materials such as glass, stone surfaces, and paint. Terracotta cladding can look similar to exposed bricks with a smooth finish. These panels can be glazed or unglazed and are available in different colors, shapes, and sizes.

Metal was the fastest-growing raw material in terms of revenue for the U.S. market with an 8.4% CAGR from 2025 to 2033. Metals are used to manufacture exterior panels or facades for rainscreen cladding structures. Zinc, copper, stainless steel, and aluminum are the major raw materials for manufacturing panels. The demand for metallic panels is increasing due to their high tensile strength, durability, corrosion resistance, superior flatness, rigidity & stability under changing thermal conditions, and low maintenance.

The demand for fiber cement-based rainscreen cladding is likely to grow due to its cost-effectiveness, high durability, and low maintenance costs. Fiber cement is manufactured using cement, cellulose fiber, pulverized limestone, and water. These panels are gaining increasing acceptance in the market as they are weatherproof and can easily resist high-pressure winds and rainwater. Therefore, the demand for fiber cement raw material is expected to increase further in the U.S.

Composite materials had a revenue of USD 6.59 billion in 2024 as they are employed on a large scale for manufacturing rainscreen cladding panels. The demand for composite materials-based rainscreen cladding is likely to grow due to their high durability, low maintenance cost, and weatherproof and fireproof properties. Composite materials are manufactured by combining two materials of different properties; when combined, the resultant product has significantly different physical and chemical properties. Growing demand for these panel manufacturing products is expected to bolster their market growth further.

Application Insights

The office application segment accounted for the largest share of revenue in 2024. The growing demand for office building renovations and new construction is expected to positively impact the industry’s growth. Increasing investments in working spaces to improve their aesthetic appeal, provide safety against harsh weather conditions, and increase energy efficiencies are expected to propel the demand for rainscreen cladding over the projected period.

Commercials emerged as the second-largest application segment in the industry in 2024. Increasing demand for packaged and readily available food products and high consumer spending on daily activities are expected to positively impact industry growth over the projected period. Furthermore, rising investments by both public and private contractors to build aesthetically appealing buildings are expected to propel industry growth over the forecast period.

In the U.S., rainscreen cladding demand in residential applications is expected to grow at a CAGR of 6.9% over the projected period. Single-family constructions account for the highest share of overall residential constructions and are likely to grow faster than multi-family constructions over the projected period. Rising consumer demand for individual houses and high consumer spending capacities are expected to be the key factors behind this trend.

Key Company Insights

Some key market players include CENTRIA and Sto Corp.

-

CENTRIA is a global company specializing in rainscreen panels and cladding solutions designed for superior aesthetics and performance. The company offers various rainscreen products, including concealed and exposed fastener panels, modular metal panels, and specialized systems. These panels offer seamless integration, featuring concealed fasteners for a clean appearance and interchangeable designs for flexible customization..

-

Sto Corp offers building envelope solutions, including high-performance exterior coatings, insulation, air-and water-resistive barriers, and rainscreen systems. Its products are widely used globally in commercial, industrial, and residential construction projects. The company's main screen cladding systems combine advanced materials such as StoVentec Render and StoVentec Glass and are used for building facades.

ECO Cladding, GRIDWORX, and Desana Partners are some of the emerging market participants.

-

ECO Cladding designs and manufactures advanced cladding attachment systems for ventilated rainscreen facades. The company offers high-quality, non-combustible materials and supports diverse cladding types, including stone, ceramic, fiber cement, terracotta, and wood. Its rainscreen systems help address critical performance metrics such as thermal bridging, structural loads, and building code compliance.

-

GRIDWORX offers a range of materials and solutions for architectural facades. The company's cladding system incorporates various durable materials, such as granite, limestone, porcelain, and quartzite, ensuring aesthetic versatility and enduring performance. The company also manufactures the advanced Pressure Equalized Rainscreen cladding system, which is pre-engineered for use with steel studs, concrete, CMU block, and wood frame construction.

Key U.S. Rainscreen Cladding Companies:

- Kingspan Insulation plc

- Carea Ltd.

- Cladding Corp

- Celotex Ltd.

- CGL Facades Co

- Rockwool International A/S

- Eco Earth Solutions Pvt. Ltd.

- FunderMax

- Everest Industries Limited

- OmniMax International, Inc.

- Trespa International B.V.

- Middle East Insulation LLC

- Euro Panels Overseas N.V.

- Centria International

- Dow Building Solutions

- TERREAL Group

- NVELOPE Rainscreen Systems Ltd

- Avenere Cladding LLC

Recent Developments

- In September 2024, Sto Corp announced the introduction of Sto Fireblocking, its new solution to meet fire-blocking requirements in the 2022 NYC Building Code (BC). The system is used in various wall envelope solutions, including StoVentec Rainscreen systems.

U.S. Rainscreen Cladding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.75 billion

Revenue forecast in 2033

USD 52.78 billion

Growth rate

CAGR of 7.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in thousand square meters, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Segments covered

Raw material, application

Key companies profiled

Kingspan Insulation plc; Carea Ltd.; Cladding Corp; Celotex Ltd.; CGL Facades Co; Rockwool International A/S; Eco Earth Solutions Pvt. Ltd.; FunderMax; Everest Industries Limited; OmniMax International, Inc.; Trespa International B.V.; Middle East Insulation LLC; Euro Panels Overseas N.V.; Centria International; Dow Building Solutions; TERREAL Group; NVELOPE Rainscreen Systems Ltd; Avenere Cladding LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Rainscreen Cladding Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. rainscreen cladding market based on raw material and application:

-

Raw Material Outlook (Volume, Thousand Square Meters; Revenue, USD Million, 2021 - 2033)

-

Fiber Cement

-

Composite Material

-

Metal

-

High Pressure Laminates

-

Terracotta

-

Ceramics

-

Others

-

-

Application Outlook (Volume, Thousand Square Meters; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Office

-

Institutional

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. rainscreen cladding market size was estimated at USD 29.79 billion in 2024 and is expected to reach USD 31.75 billion in 2025.

b. The U.S. rainscreen cladding market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2033 to reach USD 52.78 billion by 2033.

b. Terracotta raw material dominated U.S. rainscreen cladding market with a share of 36.3% in 2024 owing to its ability to create panel designs in combination with other materials such as glass, stone surfaces, and paint.

b. Some of the key players operating in the U.S. rainscreen cladding market include Kingspan Insulation plc, Carea Ltd., Cladding Corp, Celotex Ltd., CGL Facades Co., and Rockwool International A/S.

b. The key factor which is driving U.S. rainscreen cladding market is increasing construction activities in the U.S. and rainscreen cladding improves the aesthetics of the building while protecting it from heavy rainfall and high air pressure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.