- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Recycled Tire Rubber Market, Industry Report, 2033GVR Report cover

![U.S. Recycled Tire Rubber Market Size, Share & Trends Report]()

U.S. Recycled Tire Rubber Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Crumb Rubber/Buffing, Rubber Powder, Tire Chips/Tire-Derived Fuel), By Application (Construction & Infrastructure, Automotive, Cement Industry, Sports & Leisure) And Segment Forecasts

- Report ID: GVR-4-68040-818-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Recycled Tire Rubber Market Summary

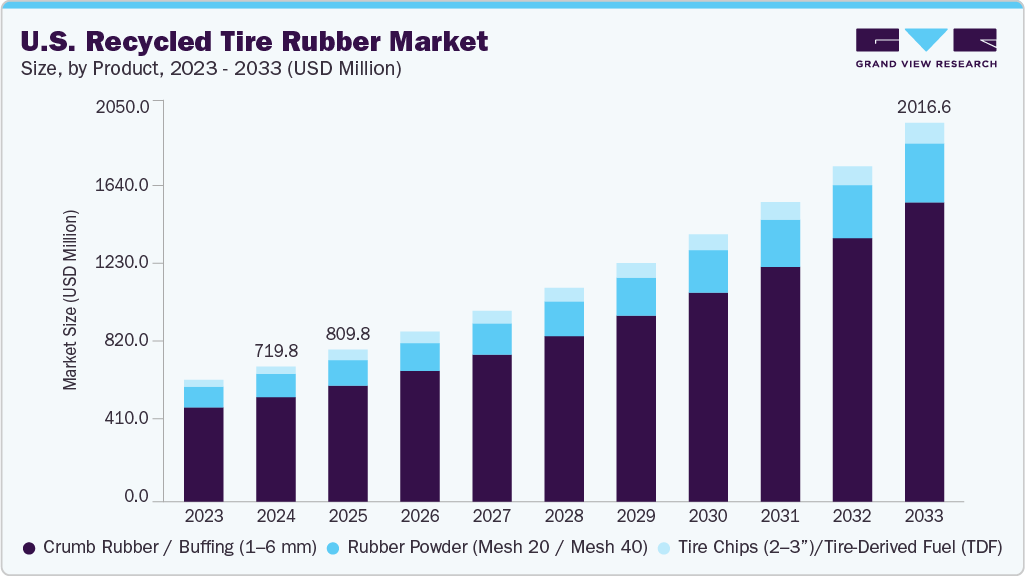

The U.S. recycled tire rubber market size was estimated at USD 719.8 million in 2024 and is projected to reach USD 2,016.6 million by 2033, growing at a CAGR of 12.1% from 2025 to 2033. The growing demand from the automotive, construction & infrastructure, and sports & leisure sectors for sustainable alternatives is driving the market.

Key Market Trends & Insights

- By product, the crumb rubber/buffing (1-6 mm) segment led the market with the largest revenue share of 77.32% in 2024.

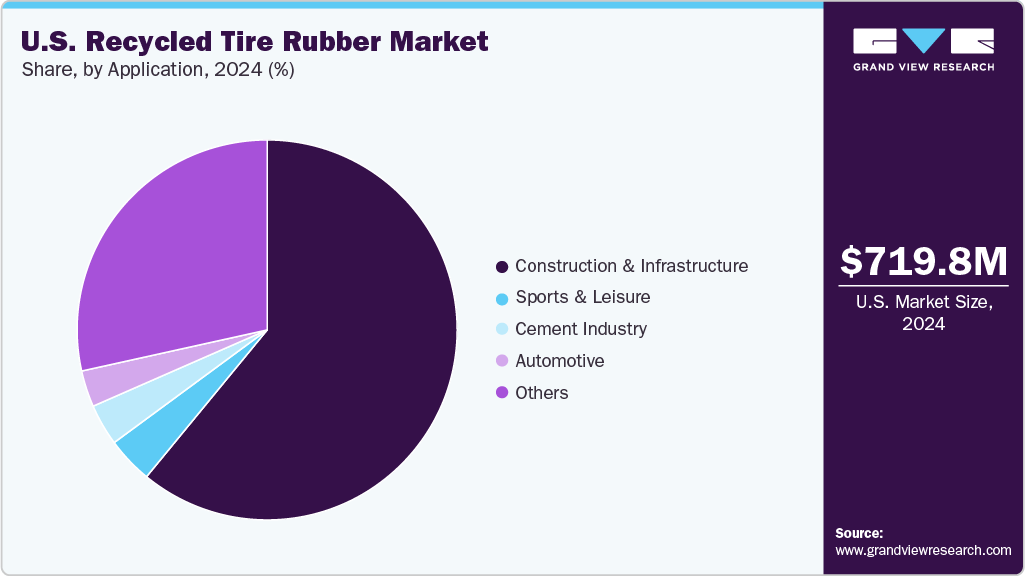

- By application, the construction & infrastructure segment led the market with the largest revenue share of 60.95% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 719.8 million

- 2033 Projected Market Size: USD 2,016.6 million

- CAGR (2025 - 2033): 12.1%

The U.S. recycled tire rubber industry is growing at a steady, mid-single-digit pace as demand diversification raises overall throughput. Crumb rubber remains the largest product stream and is increasingly used in sports surfaces, molded goods, and pavement applications, while tire-derived fuel retains a stable share.

Investment in downstream sorting, ambient, and cryogenic grinding capacity is rising to support a consistent supply. Recent industry forecasts show continued expansion through the decade.

Drivers, Opportunities & Restraints

Stricter state-level disposal rules and municipal circular economy targets are forcing a higher diversion of end-of-life tires into recycling streams. At the same time, public and private road programs are specifying rubberized asphalt and other materials with recycled content to improve durability and meet sustainability targets. These two forces, acting together, increase feedstock capture and create predictable industrial demand for processed outputs.

Technologies such as devulcanization and advanced pyrolysis can convert scrap tires into reclaimed rubber, recovered carbon black, and pyrolysis oil, enabling movement up the value chain. Firms that deploy these processes can shift from low-margin crumb to specialty inputs for tire retreading, polymer compounding, and industrial chemicals. Strategic partnerships with chemical applications and roll-out of modular plants offer scalable, near-term value capture.

Public concern and evolving evidence on chemical exposures from crumb-rubber applications, especially artificial turf and playground infill, are prompting regulatory reviews and procurement restrictions in some municipalities. This regulatory uncertainty reduces demand in key end markets and raises compliance costs. At the same time, inconsistent feedstock quality and regional collection bottlenecks inflate processing costs and compress margins for recyclers.

Market Concentration & Characteristics

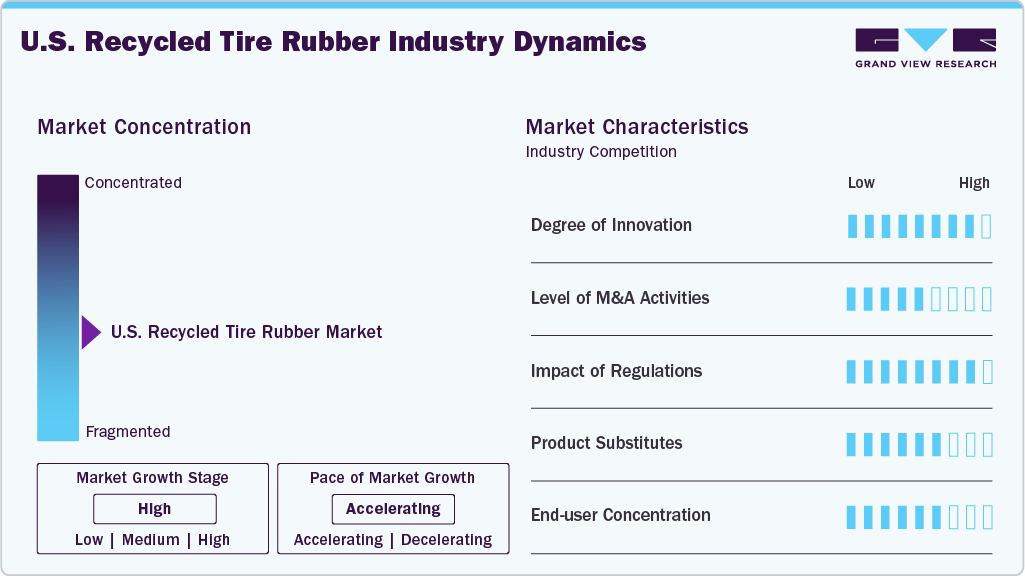

The market growth stage of the U.S. recycled tire rubber industry is high, and the pace is accelerating. The market exhibits consolidation, with key players dominating the industry landscape. Major companies, including Liberty Tire Recycling, Genan Inc., CRM Rubber Manufacturers, Emanuel Tire, LLC, Lakin Tire, Rumpke Tire Recycling, and Entech Inc., among others, play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation in the U.S. recycled tire rubber industry is shifting from mechanical grinding toward chemical and thermal routes that reclaim higher-value inputs. Commercial devulcanization and modular pyrolysis pilots have moved from lab to early commercial scale, enabling reclaimed rubber, recovered carbon black, and pyrolysis oil with improved yields. Incremental improvements in sensor-driven sorting and energy-efficient grinding are also lowering unit costs and improving feedstock uniformity. These advances are enabling recyclers to compete for chemical-grade end markets rather than only commodity uses.

Substitutes for crumb rubber are proliferating where health or performance concerns arise. Natural and engineered infills, such as cork, coated sand, coconut fiber, and vinyl-based systems, are being specified for playgrounds and turf to minimize perceived chemical exposures. In construction and asphalt applications, conventional aggregates, engineered polymer modifiers, and virgin rubber blends remain viable alternatives depending on performance and cost targets. Municipal procurement is increasingly treating substitutes as strategic options, shifting demand patterns where public authorities choose perceived lower-risk materials.

Product Insights

The crumb rubber/buffing (1-6 mm) segment led the market with the largest revenue share of 77.32%in 2024 and is forecasted to grow at the fastest CAGR of 12.6% from 2025 to 2033. Crumb rubber (1-6 mm), also known as buffings, is a flexible, recycled-tire material used in rubberized asphalt, molded products, and sports surfaces. These granules, produced through ambient or cryogenic grinding, enhance asphalt elasticity, reduce cracking, and provide strong noise-dampening performance.

The rubber powder (Mesh 20/Mesh 40) segment is expected to grow at a substantial CAGR of 11.1% during the forecast period. Rubber powder (20-40 mesh) is a fine recycled-tire material (~420-840 μm) used as a cost-effective filler in modified asphalt, thermoplastic blends and concrete mixes. Its controlled particle size improves binder elasticity, rutting resistance, and overall compatibility with polymers, while reducing reliance on higher-cost virgin elastomers.

Application Insights

The construction & infrastructure segment led the market with the largest revenue share of 60.95% in 2024, and is forecasted to grow at the fastest CAGR of 12.7% from 2025 to 2033. Federal infrastructure spending is creating strong momentum for the recycled tire rubber market as states, transportation agencies, and city planners increasingly look for sustainable and high-performance construction materials. Recycled rubber products, especially rubber-modified asphalt (RMA) and tire-derived aggregate (TDA), are gaining attention because they help strengthen road surfaces, improve long-term durability, and lower maintenance budgets by extending how long pavements last before repairs are needed.

The automotive segment is expected to expand at a substantial CAGR of 10.9% through the forecast period. Electrification and zero-emission regulations are pushing automakers to redesign vehicles to be quieter, lighter, and more sustainable. This shift is increasing the use of recycled-rubber components because they help improve noise, vibration, and harshness (NVH) performance while also offering strong sealing and wear resistance. Recycled rubber in crumb and powder form is being used in underbody acoustic panels, floor mats, gaskets, and vibration-control mounts. These materials help reduce cabin noise, protect wiring and electrical systems, and extend part life, all while lowering overall material costs for manufacturers.

U.S. Recycled Tire Rubber Company Insights

The U.S. recycled tire rubber industry is highly competitive, with several key players dominating the landscape. Major companies include Liberty Tire Recycling, Genan Inc., CRM Rubber Manufacturers, Emanuel Tire, LLC, Lakin Tire, Rumpke Tire Recycling, and Entech Inc. The U.S. recycled tire rubber industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key U.S. Recycled Tire Rubber Companies:

- Liberty Tire Recycling

- Genan Inc.

- CRM Rubber Manufacturers

- Emanuel Tire, LLC

- Lakin Tire

- Rumpke Tire Recycling

- Entech Inc.

Recent Developments

-

In November 2025, Liberty Tire Recycling announced plans to open two new recycling facilities in Alabama. These facilities were developed in response to Alabama's decision to ban the landfilling of whole scrap tires by the end of 2027. The Mobile-area facility is set to produce tire-derived fuel, while the north Alabama plant is planned to produce crumb rubber feedstock for manufacturing. Liberty aimed to process over 4 million tires annually in Alabama and nearby regions.

-

In October 2025, I Squared Capital acquired Liberty Tire Recycling, North America's leading end-of-life tire recycling company, from Energy Capital Partners. Liberty collects and processes over 215 million tires annually, converting them into reusable materials to support various markets. The acquisition added Liberty to I Squared’s portfolio of environmental infrastructure assets, reinforcing the firm's commitment to sustainable business growth.

U.S. Recycled Tire Rubber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 809.8 million

Revenue forecast in 2033

USD 2,016.6 million

Growth rate

CAGR of 12.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segment covered

Product, application

Country Scope

U.S.

Key companies profiled

Liberty Tire Recycling; Genan Inc.; CRM Rubber Manufacturers; Emanuel Tire, LLC; Lakin Tire; Rumpke Tire Recycling; Entech Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Recycled Tire Rubber Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. recycled tire rubber market report based on the product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Crumb Rubber / Buffing (1-6 mm)

-

Flooring, Tiles, Mats

-

Landscaping

-

Others

-

-

Rubber Powder (Mesh 20 / Mesh 40)

-

Modified Asphalt

-

Waterproofing

-

Automotive Brake Pads

-

Sports Surfaces

-

Others

-

-

Tire Chips (2-3”)/Tire-Derived Fuel (TDF)

-

Cement Plants

-

Landscaping & Playgrounds

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Construction & Infrastructure

-

Automotive

-

Cement Industry

-

Sports & Leisure

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. recycled tire rubber market size was estimated at USD 719.8 million in 2024 and is expected to reach USD 809.8 million in 2025.

b. The U.S. recycled tire rubber market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2033 to reach USD 2,016.6 million by 2033.

b. Crumb rubber / buffing (1–6 mm) dominated the U.S. recycled tire rubber market across the product segmentation in terms of revenue, accounting for a market share of 77.32%in 2024 and is forecasted to grow at 12.6% CAGR from 2025 to 2033.

b. Some key players operating in the U.S. recycled tire rubber market include Liberty Tire Recycling, Genan Inc., CRM Rubber Manufacturers, Emanuel Tire, LLC, Lakin Tire, Rumpke Tire Recycling, and Entech Inc.

b. The growing demand from the automotive, construction & infrastructure, and sports & leisure sectors for sustainable alternatives is driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.