- Home

- »

- Beauty & Personal Care

- »

-

U.S. Sun Care Cosmetics Market Size, Industry Report 2033GVR Report cover

![U.S. Sun Care Cosmetics Market Size, Share & Trends Report]()

U.S. Sun Care Cosmetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tinted Moisturizers, SPF Foundation), By Type (Conventional, Organic), By Distribution Channel (Hypermarkets & Supermarkets, E-commerce), And Segment Forecasts

- Report ID: GVR-4-68040-664-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sun Care Cosmetics Market Trends

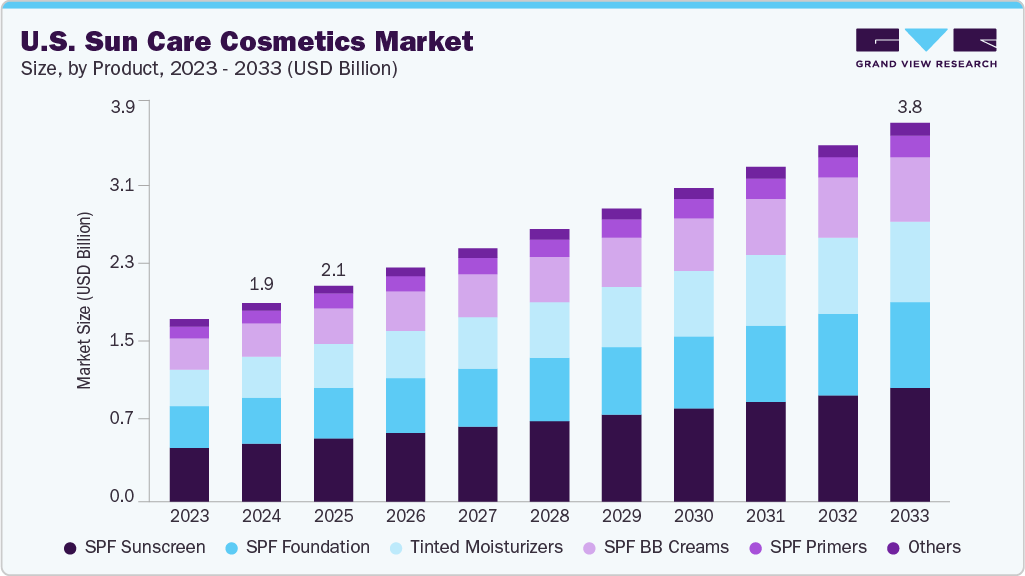

The U.S. sun care cosmetics market size was estimated at USD 1,977.7 million in 2024 and is expected to grow at a CAGR of 7.3% from 2025 to 2033. The market is influenced by changing consumer preferences and a strong focus on innovation. There is a growing demand for multi-functional products that blend sun protection with skincare or makeup benefits, such as SPF-infused foundations, tinted moisturizers, serums, and lip balms. Additionally, consumers increasingly prioritize products with high SPF (30+) and broad-spectrum protection, particularly for facial use, to defend against UVA and UVB radiation.

According to the Veylinx study, while most U.S. consumers enjoy sunny weather, many also express concern about sunburn and long-term skin damage, fueling a rising demand for sunscreens beyond basic UV protection. There is a clear preference for multi-functional products, such as anti-aging sunscreens, which generated 49% more interest than standard options. Moisturizing formulas drew 33% more attention, and those enriched with Vitamin C saw a 23% increase in consumer interest. Environmentally friendly options, such as reef-safe sunscreens, are also gaining traction. The study further highlights that consumers are willing to pay a premium for these enhanced features.

At the same time, there is a growing demand for clean, mineral-based, and reef-safe formulations, with ingredients like zinc oxide and titanium dioxide becoming favorites among environmentally conscious consumers. The inclusive beauty movement is also making strides as brands introduce sheer or invisible sunscreens designed to work across all skin tones, tackling the persistent issue of white-cast SPF, particularly on Black and Brown skin. A notable example is Fenty Skin’s Hydra Vizor Invisible Moisturizer SPF 30, a refillable 2-in-1 product that combines sun protection and hydration with a truly invisible finish ideal for people of color.

According to The YouGov report on U.S. sunscreen consumer behavior, more than 80% of Americans recognize the importance of sun protection. Consumers consider several key factors to ensure efficacy and comfort when choosing sunscreen. For 53% of users, the top priority is protection against UVA and UVB rays, reflecting widespread awareness of the risks associated with sun exposure. Water resistance is another crucial feature, with 45% favoring products that maintain effectiveness during swimming or sweating. Additionally, around 34% consider the product's formulation, whether gel, lotion, or spray, based on personal preference and ease of use.

Skin sensitivity is another significant consideration, with 30% of respondents opting for sunscreens formulated for delicate or reactive skin, highlighting a rising demand for gentle, dermatologically tested products. Furthermore, 28% of consumers prioritize natural ingredients, signaling a shift toward eco-conscious and skin-friendly options. While effectiveness continues to be the primary driver in sunscreen selection, practical factors influence purchasing decisions: 23% of consumers are motivated by special promotions, and 22% show brand loyalty, preferring trusted names known for quality and consistency.

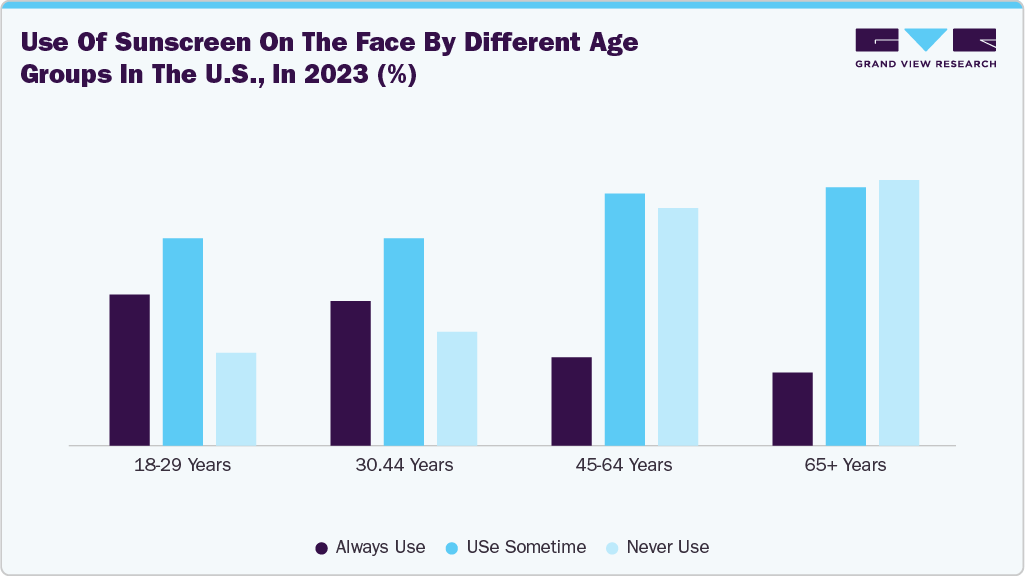

Consumer Insights & Surveys

According to a survey by PubMed, Young adults, especially those between the ages of 18 and 29, are more consistent in their sunscreen use, with 21% reporting regular application. In comparison, only 10% of individuals aged 65 and older do the same, suggesting that older adults may undervalue the importance of sun protection. Sunscreen use is generally higher among women, individuals from higher socioeconomic groups, those with higher education levels, people with darker skin tones, and married individuals. A 2023 U.S. survey found that women are significantly more likely than men to use SPF products daily. Only 8% of male respondents reported daily use, with most applying sunscreen infrequently.

Product Insights

Sunscreen accounted for the largest share of about 29.20% of the U.S. sun care cosmetics industry in 2024. Sunscreen is a daily essential that protects against UVA and UVB rays, helping prevent sunburn, skin cancer, and premature aging. It supports an even skin tone by reducing hyperpigmentation and sunspots while soothing sensitive skin and minimizing redness. Modern formulas often include hydrating ingredients to strengthen the skin barrier and maintain moisture, promoting overall skin health. Innovative sunscreen formats, such as sticks, mists, and compact capsules, are reshaping how consumers integrate sun protection into everyday routines. These portable, easy-to-use options simplify applications, making SPF more accessible and mess-free for busy, on-the-go lifestyles. Stick sunscreens like Kopari’s Sun Shield On-The-Glow SPF 40 provide precise, no-mess coverage, making them perfect for convenient daily reapplication.

Demand for tinted moisturizers is projected to rise at a CAGR of 8.0% from 2025 to 2033. Tinted moisturizers are versatile skincare-makeup hybrids, offering hydration, sun protection, and light, dewy coverage in inclusive shades. Consumers favor lightweight gel-cream textures that simplify routines while delivering a sensorial SPF experience. These formulas often include hyaluronic acid, glycerin, antioxidants, and nourishing oils. For instance, BareMinerals Complexion Rescue Tinted Hydrating Gel Cream SPF 30 combines hydration, sheer coverage, and broad-spectrum sun protection, making it a popular all-in-one solution for daily skincare and makeup.

Type Insights

Conventional sun care cosmetics accounted for about 83.09% of the U.S. sun care cosmetics industry in 2024. Conventional sun care cosmetics are mass-produced, synthetic-based products for broad accessibility and reliable sun protection. These formulations often use chemical UV filters such as oxybenzone, avobenzone, and octinoxate to absorb UVA and UVB rays and may include artificial preservatives (like parabens), synthetic fragrances, and silicones to enhance texture and shelf life. For instance, Neutrogena, a leading U.S. brand, offers various conventional sun care products, including sunscreens, SPF moisturizers, and sprays. Its Ultra Sheer Dry-Touch Sunscreen SPF 55 is a top-selling product that uses chemical filters like avobenzone, homosalate, and oxybenzone to deliver broad-spectrum protection.

The demand for organic sun care cosmetics is estimated to grow with the fastest CAGR of 7.9% over the forecast period, driven by a heightened focus on personal health, environmental sustainability, and ingredient transparency. This shift has boosted the popularity of mineral-based sunscreens that use safer UV filters like zinc oxide and titanium dioxide. The clean beauty movement has also played a key role, with more consumers seeking natural, organic, and non-GMO ingredients and clear labeling and certifications like USDA Organic and NSF/ANSI 305. For instance, Badger Balm is a prominent U.S. brand known for its organic sun care products, including mineral sunscreens, SPF lip balms, and after-sun care made with non-nano zinc oxide and certified organic ingredients. Its products are USDA Certified Organic, NSF/ANSI 305 compliant, cruelty-free, reef-safe, and sustainably packaged.

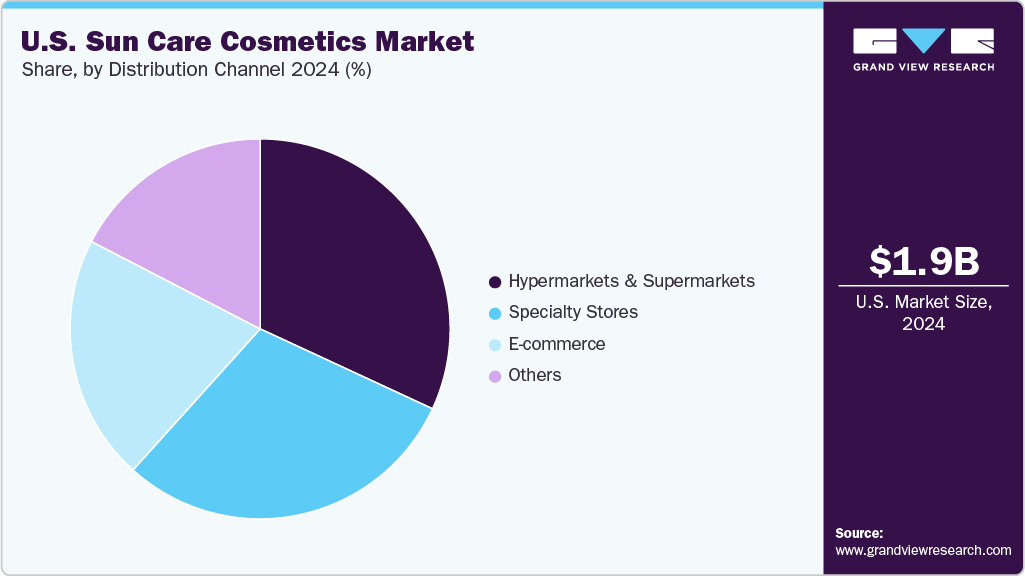

Distribution Channel Insights

Sales through hypermarkets and supermarkets accounted for a revenue share of about 31.91% in 2024, due to their accessibility, affordability, and wide product range. Consumers increasingly return to physical stores, and many seek experiences that digital platforms can’t fully replicate. A survey shows that 56% of shoppers prefer to see and try products in person before making cosmetic purchases, while 67% look for expert guidance when buying high-value items. Moreover, 60% are drawn to stores by exclusive in-store promotions not available online, emphasizing the continued appeal of in-person shopping.

Sales through E-commerce are expected to grow at a CAGR of 8.0% from 2025 to 2033. Online channels are rapidly transforming the way consumers shop for cosmetics, driven by convenience, product variety, personalization, and the rise of social commerce. More than 65% of shoppers prefer to browse and buy cosmetics online after interacting with brand content on social media, and 82% now expect personalized digital shopping experiences. E-commerce platforms make exploring a broad product range easy, comparing prices, reading reviews, and accessing exclusive deals or subscription options. Innovations like AR virtual try-ons, AI-powered product suggestions, and smooth in-app checkout have enhanced the overall experience, increasing engagement and conversion rates by up to 40%.

Key U.S. Sun Care Cosmetics Companies Insights

Key players operating in the U.S. sun care cosmetics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Sun Care Cosmetics Companies:

- Unilever PLC

- Procter & Gamble

- The Estée Lauder Companies Inc.

- Shiseido Company Ltd.

- Groupe Clarins

- L'Oréal Groupe

- Coty Inc.

- Kenvue Brands LLC

- Beiersdorf AG

- Supergoop!

Recent Developments

-

In February 2025, L’Oréal Groupe officially opened its state-of-the-art North America Research & Innovation (R&I) Center in Clark, New Jersey, a $160 million, nearly 250,000 sq ft facility and its largest R&I hub outside of France. The center boasts cutting-edge capabilities tailored to advance multi-benefit SPF products, such as formulas offering hydration, anti-aging, pollution protection, and more.

-

In October 2024, Shiseido expanded its popular Anessa lineup in the U.S. with a new vegan, reef-safe, mineral-based sun care range. These products feature innovative auto-repair technology, which strengthens the UV-blocking film in response to sweat, water, and movement, effectively maintaining protection even through daily activities.

-

In July 2024, Beiersdorf AG introduced a cutting-edge, AI-enhanced skincare offering with highly personalized sun care recommendations. Through its extensive SKINLY skin study, which captures daily user data like skin hydration, tone, and wrinkle depth, Beiersdorf leverages AI and IoT-powered diagnostics to generate consumer-specific skincare insights. This initiative is part of Beiersdorf’s broader strategy to integrate digitalization and AI across its research process.

U.S. Sun Care Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,149.4 million

Revenue forecast in 2033

USD 3,769.9 million

Growth rate

CAGR of 7.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel

Country scope

U.S.

Key companies profiled

Unilever PLC; Procter & Gamble; The Estée Lauder Companies Inc.; Shiseido Company Ltd.; Groupe Clarins; L'Oréal Groupe; Coty Inc.; Kenvue Brands LLC; Beiersdorf AG; Supergoop!

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sun Care Cosmetics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. sun care cosmetics market report based on product, type, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tinted Moisturizers

-

SPF Foundation

-

SPF BB Creams

-

SPF Primers

-

SPF Sunscreen

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

E-Commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. sun care cosmetics market was estimated at USD 1,977.7 million in 2024 and is expected to reach USD 2,149.4 million in 2025.

b. The U.S. sun care cosmetics market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 3,769.9 million by 2033.

b. Sunscreen accounted for the largest share of about 29.20% of the U.S. sun care cosmetics market in 2024. Sunscreen is a daily essential that protects against UVA and UVB rays, helping prevent sunburn, skin cancer, and premature aging.

b. Some of the key players in the U.S. sun care cosmetics market is - Unilever PLC; Procter & Gamble; The Estée Lauder Companies Inc.; Shiseido Company Ltd.; Groupe Clarins; L'Oréal Groupe; Coty Inc.; Kenvue Brands LLC; Beiersdorf AG; Supergoop!

b. The sun care cosmetics market in the U.S. is influenced by changing consumer preferences and a strong focus on innovation. There is a growing demand for multi-functional products that blend sun protection with skincare or makeup benefits, such as SPF-infused foundations, tinted moisturizers, serums, and lip balms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.