- Home

- »

- Pharmaceuticals

- »

-

U.S. Urinary Incontinence Therapeutics Market Report, 2033GVR Report cover

![U.S. Urinary Incontinence Therapeutics Market Size, Share & Trends Report]()

U.S. Urinary Incontinence Therapeutics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Stress Incontinence, Urge Incontinence), By Drug Class, By Gender, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-811-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Urinary Incontinence Therapeutics Market Summary

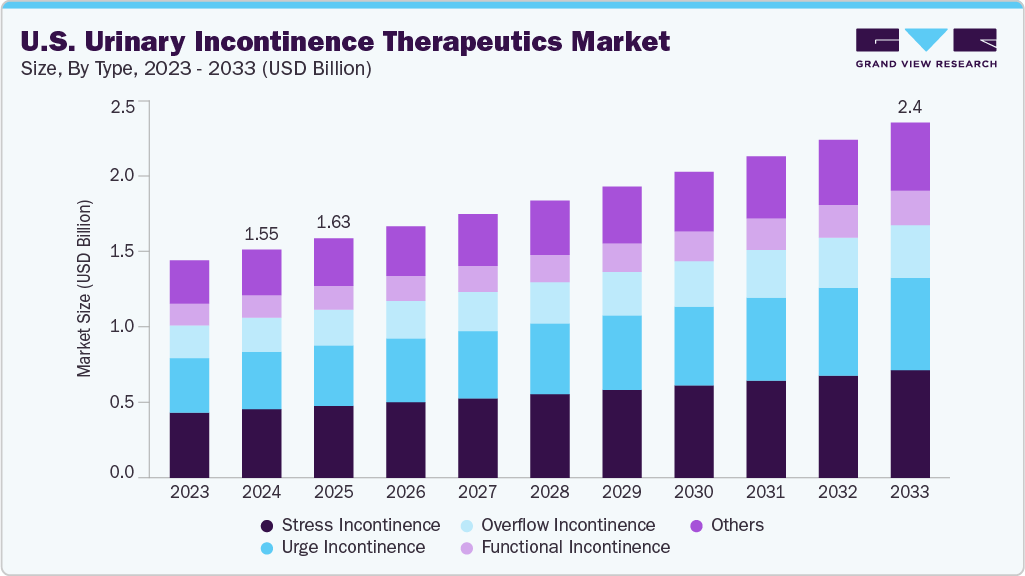

The U.S. urinary incontinence therapeutics market size was estimated at USD 1.55 billion in 2024 and is projected to reach USD 2.41 billion by 2033, growing at a CAGR of 5.06% from 2025 to 2033. The U.S. market is expanding as demand for advanced treatment options rises across key patient groups.

Key Market Trends & Insights

- By type, the stress incontinence segment held the highest market share of 30.05% in 2024.

- By drug class, the anticholinergics dominated the market with the largest revenue share of 33.0% in 2024.

- By gender, the female segment dominated the market with the largest revenue share of 60.11% in 2024.

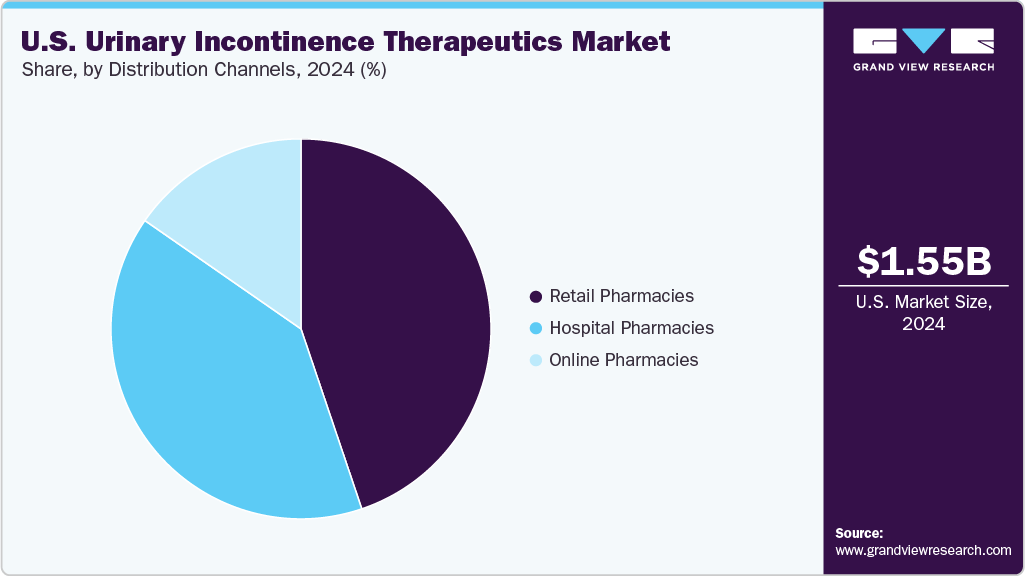

- By distribution channels, the retail pharmacies segment dominated the market with the largest revenue share of 44.81% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.55 Billion

- 2033 Projected Market Size: USD 2.41 Billion

- CAGR (2025-2033): 5.06%

Growth is supported by a steady increase in the elderly population that presents higher rates of bladder control disorders. For instance, August 2024, StatPearls Publishing reported that in the U.S. urinary incontinence affected 13 million individuals; prevalence reached ≥50 % in nursing-facility residents and >75 % in long-term (>100 days) residents; 53 % of homebound older adults were incontinent; hospital admission and discharge rates were 11 % and 23 %, respectively; women aged 20-39 showed 7-37 %; older women 9-39 %; older men 11-34 % with 2-11 % daily; and among ~80 million women, >60 % reported symptoms. Manufacturers introduce improved pharmacological agents that offer better symptom control and stronger adherence outcomes. Awareness programs conducted by clinical organizations help patients seek treatment at earlier stages. Healthcare providers adopt updated diagnostic protocols that support timely therapy initiation. Prescription volumes rise through broader use of anticholinergics, beta-3 agonists, and combination regimens. Patient willingness to transition from unmanaged symptoms to active treatment strengthens overall therapeutic uptake.Market expansion is further influenced by growing recognition of stress, urge, and mixed incontinence across women and men. For instance, May 2024, Elsevier BV reported that in the United States adults who sat for ≥7 hours per day had significantly higher odds of experiencing urinary urgency incontinence (UUI) symptoms; women had elevated odds of stress urinary incontinence (SUI) when sitting ≥7 h; men had elevated odds of mixed urinary incontinence (MUI) when sitting ≥7 h compared with those sitting less. Rising postpartum complications contribute to higher demand for tailored medications. Clinicians report increased preference for minimally invasive options that support long-term symptom relief. Pharmaceutical companies advance R&D pipelines that introduce drugs with improved tolerability profiles. Pharmacy channels record higher footfall as patients seek convenient access points for ongoing therapy. Digital health platforms support medication management and improve follow-through on prescribed regimens. Continuous introduction of patient-centric treatment pathways supports stronger product adoption.

Therapeutic growth is reinforced by rising cases linked to obesity, diabetes, and neurological conditions that impact bladder control. Hospitals and specialty clinics strengthen incontinence care programs that streamline patient evaluation. For instance, June 2024, American Urological Association reported that in the United States the prevalence of overactive bladder (OAB) was estimated at 7 %-27 % in men and 9 %-34 % in women; among women some degree of urinary incontinence was experienced by roughly 24 %-45 %; women aged 20-39 had 7 %-37 %; women older than 60 had approximately 9 %-39 % reporting daily symptoms; older men had rates of 11 %-34 % with daily occurrences in 2 %-11 %. Clinical guidelines highlight structured treatment sequences that elevate demand for pharmacological agents. Urologists and gynecologists emphasize early intervention to reduce long-term complications. Product innovation focuses on agents that deliver fewer side effects and improved dosing comfort. Market players invest in awareness initiatives that encourage patients to seek medical support without delay. Overall utilization increases as more individuals prioritize quality-of-life improvements through regulated therapy plans.

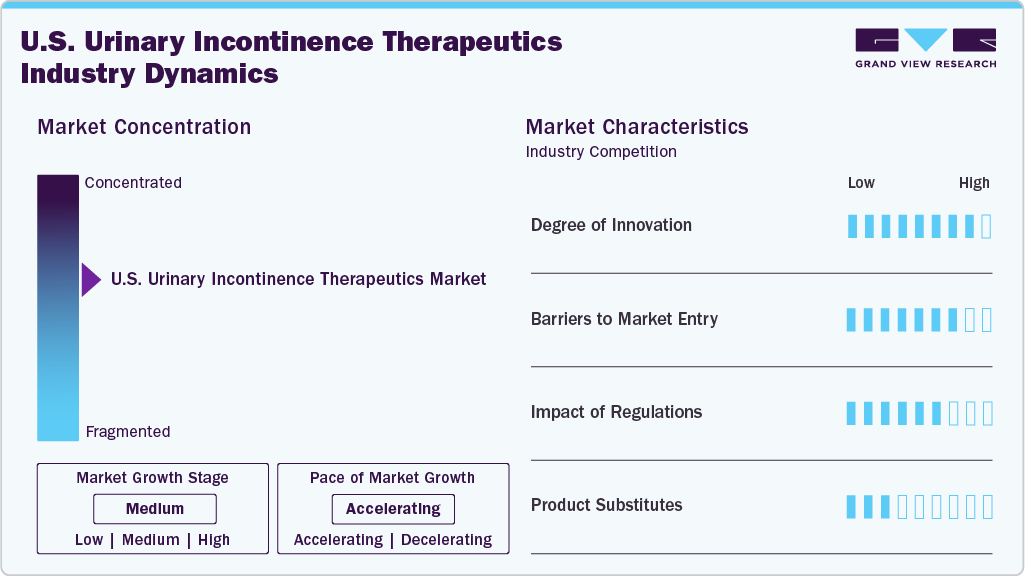

Market Concentration & Characteristics

Innovation in the U.S. Urinary Incontinence Therapeutics Market is shaped by steady progress in drug delivery systems and improved pharmacological profiles. Companies invest in molecules that aim for stronger symptom control with reduced adverse effects. Emerging therapies focus on receptor-specific targeting to enhance treatment precision. Digital adherence tools support better patient monitoring and strengthen clinical outcomes. Research collaborations between academic centers and pharmaceutical firms accelerate development timelines. Overall innovation advances therapeutic options while supporting a more competitive market environment.

New entrants face high development costs tied to long clinical trials and stringent approval pathways. Established brands maintain strong physician trust, creating challenges for new product penetration. Marketing expenses for patient education and physician outreach add further financial pressure. Manufacturing standards require strict quality control systems that demand significant upfront investment. Distribution networks are dominated by large players with long-standing contracts. These conditions limit the number of companies entering the market and reinforce concentrated competition.

Regulatory oversight ensures consistent safety and efficacy across therapeutic classes used for urinary incontinence. Approval processes involve detailed clinical evidence, driving longer development cycles. Labeling and post-marketing surveillance requirements increase operational responsibilities for manufacturers. Changes in prescribing guidelines influence how therapies are positioned and selected by clinicians. Compliance expectations shape formulation strategies and lifecycle management decisions. Overall, regulations create a structured environment that supports patient safety and disciplined market growth.

Patients may shift toward pelvic floor therapies, behavioral interventions, or minimally invasive procedures as alternatives to pharmacological agents. Such options attract individuals seeking symptom relief without long-term medication use. Substitutes gain traction when drug side effects influence therapy switching. Specialty clinics promote non-pharmacological programs that address moderate cases. Surgical treatments remain relevant for severe forms, placing competitive pressure on drug-focused companies. These substitutes shape therapeutic preferences and influence long-term drug adoption rates.

Type Insights

The stress incontinence segment dominated the market with the largest revenue share of 30.05% in 2024, largely due to high prevalence among women experiencing pelvic floor weakening. For instance, August 2024, StatPearls Publishing reported that in the U.S. roughly 37.5% of women with urinary incontinence had the stress subtype; up to 77% of older females in nursing homes were affected; among women with stress incontinence, 77% found leakage bothersome, 28.8% described moderate-to-severe symptoms, and 22% rated their leakage as severe; only about 60% of women with symptoms sought treatment; in men, stress incontinence represented about 10% of cases with a post-prostate-surgery chronic rate of about 5-10%. Many patients sought clinical care after observing increasing leakage during daily activities. Physicians relied on established medications that delivered steady outcomes for mild to moderate cases. Screening in primary care practices improved early detection across older populations. Patients favored therapies that offered predictable relief during routine movement. Pharmacies maintained broad availability of first-line drugs that supported continuous use. These combined influences strengthened the segment’s leading share.

The urge incontinence segment is projected to grow at the fastest CAGR of 5.45% over the forecast period, primarily due to rising demand for treatments that address bladder overactivity with rapid effect. Newer formulations introduced improved tolerability, encouraging long-term therapy continuation. Specialists recommended structured plans that managed frequent urgency episodes effectively. Patients benefited from digital symptom-tracking tools that promoted timely evaluation. Awareness of neurological triggers increased adoption of targeted agents. Clinics emphasized early management to reduce long-term progression. These conditions established a solid pathway for accelerated growth.

Drug Class Insights

The anticholinergics segment dominated the market with the largest revenue share of 33.0% in 2024, driven by strong clinical familiarity among healthcare professionals. These drugs offered consistent relief for both stress and urge presentations. For instance, November 2023, Springer Nature (Adv Ther) reported that in the U.S. a study of 103,250 patients with OAB treated with anticholinergic drugs found that 92 % failed to meet their treatment goals; discontinuation rates exceeded 50 % within one year and many patients switched therapies; adverse effects such as dry mouth and cognitive concerns were frequent and contributed to low persistence in this class. Generic versions improved access for patients seeking affordable therapy. Structured dosing schedules supported reliable treatment continuity. Patients reported stable symptom control, which encouraged high refill activity. Clinics used clear treatment protocols that strengthened physician confidence in prescribing. These factors maintained the segment’s dominant position.

The Beta-3 Adrenoceptor Agonists segment is projected to grow at the fastest CAGR of 6.08% over the forecast period, supported by increased preference for therapies with improved safety and comfort. These agents provided targeted bladder relaxation that extended symptom control throughout the day. Specialists recommended them for patients who faced limitations with older drug classes. Treatment satisfaction rose as individuals experienced fewer interruptions during routine tasks. Digital adherence tools promoted consistent medication use. Clinical studies continued to present favorable outcomes, reinforcing physician trust. These strengths positioned the segment for robust expansion.

Gender Insights

The female segment dominated the market with the largest revenue share of 60.11% in 2024, driven by higher prevalence linked to childbirth-related pelvic changes and menopausal transitions. For instance, August 2024, StatPearls Publishing reported that in the U.S. approximately 24 % to 45 % of women experienced urinary incontinence; among women aged 20‑39 the range was 7 % to 37 %, and in women older than 60 about 9 % to 39 % reported daily symptoms; of adult women (~80 million individuals), over 60 % reported some degree of incontinence and one‑third experienced leakage at least monthly; the most common subtype was stress incontinence at 37.5 %, followed by mixed at 31.3 % and urge at 22 %. Gynecology centers conducted screenings that improved early recognition of symptoms. Many women pursued therapy to maintain quality of life during physical exertion. Physicians recommended tailored plans that addressed combined stress and urge conditions. Pharmacies offered a broad range of drug classes suited for diverse clinical needs. Educational programs prompted women to seek treatment rather than delay evaluation. These factors reinforced the segment’s substantial market share.

The male segment is projected to grow at the CAGR of 4.90%% over the forecast period, fueled by increasing urinary complications associated with aging and prostate-related procedures. Prostatectomy cases expanded the number of individuals requiring ongoing therapy. Urology clinics enhanced diagnostic frameworks that supported timely treatment initiation. New formulations addressed nighttime urgency and improved comfort during extended symptom episodes. Patients engaged more readily with virtual consultations that encouraged early care seeking. Structured regimens supported stable symptom control among long-term users. These patterns strengthened the segment’s growth potential.

Distribution Channels Insights

The retail pharmacies segment dominated the market with the largest revenue share of 44.81% in 2024, driven by widespread access to prescription medications for chronic bladder conditions. Pharmacists provided in-person guidance that improved adherence. Community outlets ensured consistent stock of commonly prescribed therapies. Physicians frequently directed patients to retail locations for dependable refill services. Refill programs supported individuals managing persistent symptoms. Counseling services helped patients understand treatment expectations clearly. These advantages secured the segment’s leading revenue contribution.

The online pharmacies segment is projected to grow at the fastest CAGR of 5.93% over the forecast period, fueled by rising preference for discreet purchasing and convenient home delivery. Digital platforms simplified refill scheduling for long-term users. Transparent pricing supported informed decisions among cost-conscious patients. Teleconsultations expanded access to prescriptions in remote regions. User-friendly interfaces increased adoption among multiple age groups. Patients managing mobility limitations found online channels particularly supportive. These benefits positioned the segment for strong future expansion.

Key U.S. Urinary Incontinence Therapeutics Company Insights

Astellas Pharma advances the U.S. urinary incontinence therapeutics market with Beta-3 agonists supported by research. Urovant Sciences / Sumitomo Pharma America expands targeted bladder-relaxation options through development. AbbVie supports the category with established anticholinergic agents and innovation. Pfizer contributes through a broad portfolio addressing overactive bladder symptoms. Merck advances exploration of next-generation pathways influencing bladder control. Sanofi offers formulations aimed at sustained symptom relief in chronic cases. Bayer strengthens therapeutic reach with products improving frequency and urgency management. Eli Lilly drives research on bladder muscle activity. Teva increases access through generics. Johnson & Johnson advances health solutions complementing incontinence therapy.

Key U.S. Urinary Incontinence Therapeutics Companies:

- Astellas Pharma

- Urovant Sciences / Sumitomo Pharma America

- AbbVie

- Pfizer

- Merck

- Sanofi

- Bayer

- Eli Lilly

- Teva Pharmaceutical Industries

- Johnson & Johnson

Recent Developments

-

In October 2025, AbbVie Inc. reported that in the U.S. the Phase 2 ELATE trial of onabotulinumtoxinA (BOTOX®) achieved a matched primary endpoint with a reduction in the Tremor Disability Scale‑Revised (TREDS‑R) total unilateral score of -2.61 versus -1.61 for placebo (p = 0.029); all six secondary endpoints were also met, and the most common adverse event, muscular weakness, occurred in 24.5% of the treated group versus 2.3% of the placebo group.

-

In June 2023, The U.S. Astellas Pharma’s key patent for its incontinence drug mirabegron (marketed as Myrbetriq) was ruled invalid by a U.S. district court; the drug had generated worldwide revenues of ≈ USD 1.35 billion in its most recent fiscal year, a nearly 10% increase year‑on‑year.

-

In April 2023, Alvion Pharmaceuticals announced that their pilot studies of a 25 mg and 50 mg film‑coated prolonged‑release formulation of Mirabegron achieved positive results.

U.S. Urinary Incontinence Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.63 billion

Revenue forecast in 2033

USD 2.41 billion

Growth rate

CAGR of 5.06% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, drug class, gender, distribution channel

Key company profiled

Astellas Pharma; Urovant Sciences / Sumitomo Pharma America; AbbVie; Pfizer; Merck; Sanofi; Bayer; Eli Lilly; Teva Pharmaceutical Industries; Johnson & Johnson.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Urinary Incontinence Therapeutics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. urinary incontinence therapeutics market report based on type, drug class, gender, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Stress Incontinence

-

Urge Incontinence

-

Overflow Incontinence

-

Functional Incontinence

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Anticholinergics

-

Beta-3 Adrenoceptor Agonists

-

Alpha Blockers

-

Estrogen

-

Desmopressin

-

Tricyclic Antidepressants

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

Distribution ChannelsOutlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.