- Home

- »

- Communications Infrastructure

- »

-

U.S. Wireless Router Market Size, Industry Report, 2033GVR Report cover

![U.S. Wireless Router Market Size, Share & Trends Report]()

U.S. Wireless Router Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Single Band, Dual Band, Tri Band), By Bandwidth (300 Mbps to 1000 Mbps, Above 1000 Mbps), By Application (Residential, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-633-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wireless Router Market Size & Trends

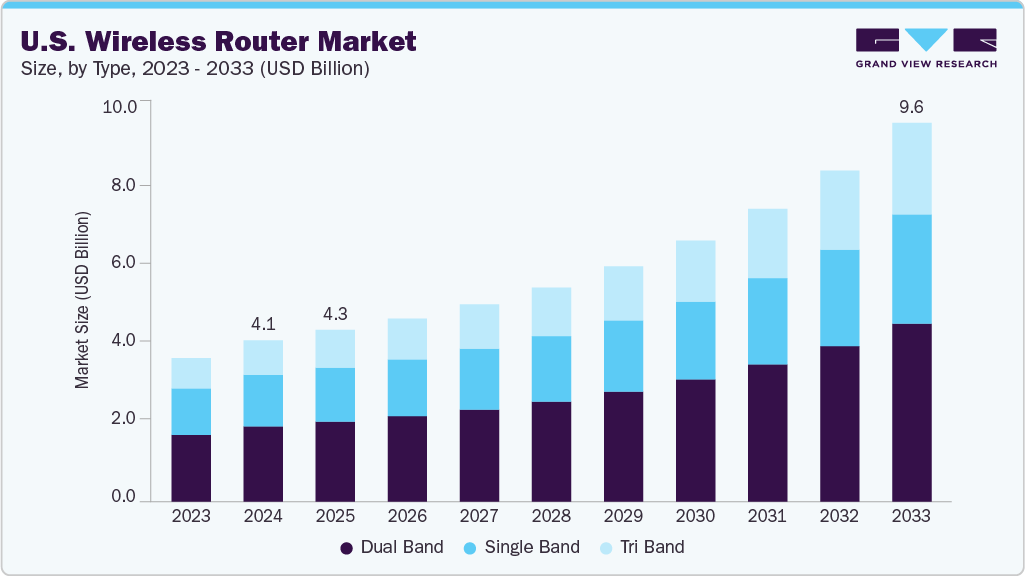

The U.S. wireless router market size was estimated at USD 4.08 billion in 2024 and is projected to reach USD 9.58 billion in 2033, growing at a CAGR of 10.4% from 2025 to 2033. One of the most significant drivers is the increasing demand for high-speed internet connectivity across both residential and commercial sectors. With the rising consumption of bandwidth-intensive applications such as 4K video streaming, online gaming, and virtual conferencing, consumers and businesses alike require routers that deliver faster and more stable connections.

Another major growth catalyst is the rapid adoption of smart home technologies. As U.S. households increasingly integrate smart devices such as connected speakers, thermostats, lights, and appliances, the need for robust wireless networking infrastructure becomes more urgent. Routers serve as the central hub for these devices, which rely on continuous connectivity to function efficiently. This trend is further reinforced by the growing number of connected devices per household, which now averages over 20, placing greater demands on home Wi-Fi networks.Technological advancements in router hardware and wireless standards are also contributing to market expansion. The adoption of Wi-Fi 6 and Wi-Fi 6E, and the anticipated rollout of Wi-Fi 7, bring substantial improvements in speed, latency, capacity, and power efficiency. These innovations make newer routers far more attractive to consumers looking to future-proof their networks. Additionally, growing concerns about cybersecurity are prompting users to seek routers with enhanced security features such as built-in firewalls, advanced encryption, and VPN support, adding another layer of demand.

One significant restraint in the U.S. wireless router market is the complexity of setup and configuration for high-end routers. Advanced features often require technical knowledge to configure properly, such as mesh networking, traffic prioritization (QoS), security settings, and firmware updates. This can discourage non-technical users, especially in the residential segment, from investing in more sophisticated solutions, thereby limiting market penetration.

Type Insights

The dual band segment led the market and accounted for 46.52% of the total revenue in 2024. Dual-band routers, operating on 2.4 GHz and 5 GHz frequencies, cater to diverse needs, offering broader coverage via 2.4 GHz and faster speeds through 5 GHz. Their cost-effectiveness makes them accessible to budget-conscious consumers while still supporting essential tasks like HD streaming, online gaming, and smart home devices. Additionally, their plug-and-play simplicity and strong ISP partnerships further drive adoption.

The tri band segment is expected to witness the highest CAGR of 11.8% over the forecast period. This surge is largely driven by the increasing number of connected devices in both residential and commercial environments, which demand faster and more efficient data transmission. Tri-band routers operate on one 2.4 GHz band and two separate 5 GHz bands (or with Wi-Fi 6E/7, one 6 GHz band), allowing them to manage network traffic more effectively by reducing congestion. This makes them ideal for households with heavy internet usage, such as simultaneous 4K streaming, online gaming, video conferencing, and smart home integration. Businesses with high device density also benefit from tri-band routers' enhanced performance and stability.

Bandwidth Insights

The 300 Mbps to 1000 Mbps (1 Gbps) segment led the market and accounted for 46.85% share of the U.S. revenue in 2024. This dominance reflects a strong consumer and business preference for mid-range routers that balance performance, affordability, and usability. Routers within this speed range are well-suited for typical residential and small office use, where activities such as HD/4K streaming, video conferencing, online gaming, and cloud-based applications require stable and moderately high bandwidth. For most households and small businesses, routers offering speeds between 300 Mbps and 1 Gbps are sufficient to meet daily demands without the higher costs associated with premium high-speed routers.

The above 1000 Mbps segment is expected to witness significant growth from 2025 to 2033, driven by escalating demand for ultra-fast and reliable internet connectivity. This segment includes high-performance routers capable of delivering multi-gigabit speeds, which are increasingly necessary to support the evolving digital landscape in both residential and commercial settings. Another key factor propelling this segment is the expansion of gigabit and multi-gigabit internet services offered by ISPs across the U.S. As fiber-optic and DOCSIS 3.1+ cable networks become more widespread, consumers are increasingly opting for routers that can fully utilize the capabilities of these high-speed plans.

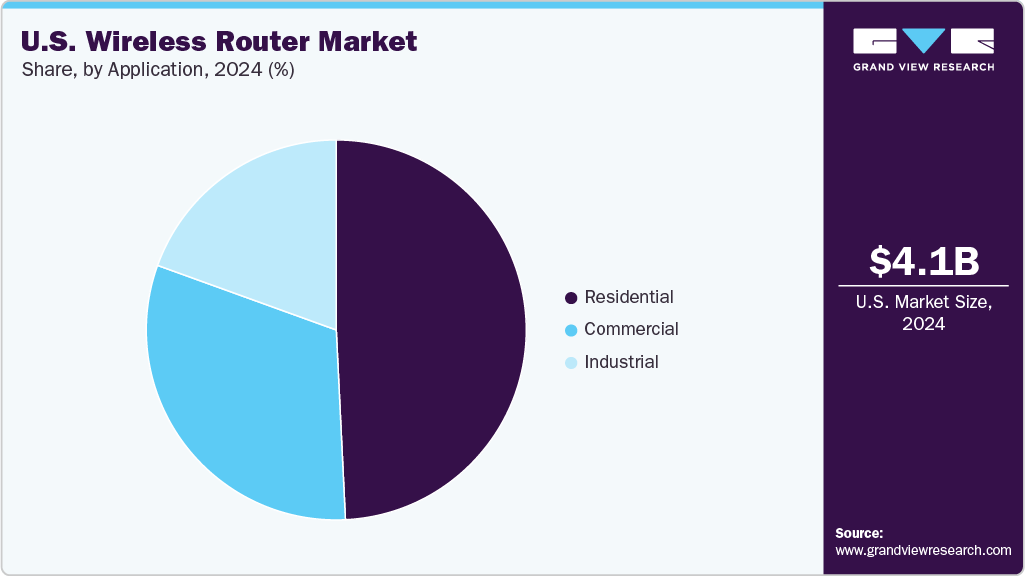

Application Insights

The residential segment led the market and accounted for more than 48% of the U.S. wireless router revenue in 2024. The ongoing expansion of remote work and online education has transformed home environments into multifunctional digital spaces, where seamless internet connectivity is essential for productivity and communication. This has driven a surge in router upgrades and replacements as consumers seek to eliminate buffering, dead zones, and connectivity drops.

The industrial segment of the U.S. wireless router market is expected to witness the fastest growth, with a projected CAGR of 12.3% over the forecast period from 2025 to 2033. This rapid expansion is being driven by the increasing integration of wireless networking technologies into industrial environments as part of broader digital transformation and automation initiatives. Industries such as manufacturing, energy, logistics, mining, and transportation are adopting wireless routers to support Industrial Internet of Things (IIoT) applications, enabling real-time data collection, remote equipment monitoring, and automation of production processes. These applications require highly reliable, low-latency, and secure wireless connectivity, especially in rugged and remote operational settings where traditional wired infrastructure is impractical or cost-prohibitive.

Key U.S. Wireless Router Company Insights

Some key players operating in the U.S. wireless router market include TP-Link Systems Inc., Cisco Systems, Inc., Verizon, AT&T Intellectual Property, and Alphabet Inc. These companies are strategically investing in research and development (R&D) to broaden their product portfolios and strengthen their technological capabilities. A core focus of innovation involves the integration of advanced technologies such as artificial intelligence (AI), machine learning, and blockchain into their wireless networking solutions. These advancements are aimed at enhancing network management, improving cybersecurity, optimizing data traffic flow, and enabling intelligent device connectivity. Such technological progress is contributing to significant improvements in real-time network monitoring, predictive maintenance, and user experience, while also elevating the overall performance of routers across residential, commercial, and industrial sectors.

-

Established in 1984, Cisco Systems, Inc. is a multinational technology company headquartered in San Jose, California, specializing in networking hardware, software, and telecommunications equipment. The company’s portfolio encompasses a wide range of products, including routers, switches, security devices, and wireless networking equipment designed for large-scale enterprises, service providers, and data center environments. The company’s U.S. wireless router offerings focus primarily on enterprise-grade solutions that emphasize scalability, reliability, and advanced security features. The company also invests heavily in software integration and cloud-managed network services to enhance network visibility, control, and automation.

-

Verizon is a prominent player in the U.S. wireless router market, leveraging its strong position as a leading telecommunications provider to deliver integrated networking solutions. The company offers a range of wireless routers and gateway devices tailored for both residential and enterprise use, often bundled with its high-speed broadband services, including Verizon Fios and 5G Home Internet. Verizon is actively investing in next-generation wireless technologies, including Wi-Fi 6, 5G, and multi-gigabit internet solutions, to enhance connectivity, network speed, and user experience. The company also focuses on smart home integration, offering mesh networking systems and routers that support seamless connectivity across multiple devices within a home or office environment.

Key U.S. Wireless Router Companies:

- Cisco Systems, Inc.

- NETGEAR, Inc.

- TP-Link Systems Inc.

- D-Link Corporation

- Ubiquiti, Inc.

- Linksys Holdings, Inc.

- Verizon

- Alphabet Inc.

- AT&T Intellectual Property

- ASUSTeK Computer Inc.

Recent Developments

-

In January 2025, ASUSTeK Computer Inc. introduced a range of AI-integrated Wi-Fi 7 networking solutions at CES 2025, aimed at addressing connectivity requirements across gaming, travel, mobile, and outdoor use cases. The ROG Rapture GT-BE19000AI, positioned as the first AI-enabled gaming router with an integrated Neural Processing Unit (NPU), incorporates a tri-core architecture to enhance local processing, reduce network latency by up to 34%, and improve energy efficiency by 46%. Additionally, the company launched the RT-BE58 Go, a compact travel router supporting tri-mode connectivity, including 4G/5G tethering, WISP mode, and traditional routing, offering speeds up to 3600 Mbps with integrated security features and mesh networking support.

-

In January 2024, Ubiquiti, Inc. announced the launch of its UniFi 7 platform, featuring the U7 Pro, a high-performance Wi‑Fi 7 access point designed for enterprise-scale deployments. The U7 Pro leverages the 6 GHz spectrum to deliver near-wired wireless performance, enhanced interference resistance, and improved overall efficiency. This launch reflects the company’s ongoing commitment to providing cost-effective, high-performance networking solutions. By integrating advanced wireless technology with its unified software management platform, the company continues to position itself as a leader in delivering scalable, enterprise-grade connectivity with a low total cost of ownership.

U.S. Wireless Router Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.34 billion

Revenue forecast in 2033

USD 9.58 billion

Growth rate

CAGR of 10.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, bandwidth, application

Key companies profiled

Cisco Systems, Inc.; NETGEAR, Inc.; TP-Link Systems Inc.; D-Link Corporation; Ubiquiti, Inc.; Linksys Holdings, Inc.; Verizon; Alphabet Inc.; AT&T Intellectual Property; ASUSTeK Computer Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wireless Router Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. wireless router market report based on type, bandwidth, and application.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Band

-

Dual Band

-

Tri Band

-

-

Bandwidth Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 300 Mbps

-

300 Mbps to 1000 Mbps (1 Gbps)

-

Above 1000 Mbps

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. wireless router market size was estimated at USD 4.08 billion in 2024 and is expected to reach USD 4.34 billion in 2025.

b. The U.S. wireless router market is expected to grow at a compound annual growth rate of 10.4% from 2025 to 2030 to reach USD 9.58 billion by 2033.

b. The residential segment accounted for the largest market share of 48.69% in 2024, driven by sustained demand for high-performance home networking solutions. The shift toward remote and hybrid work models remained a key factor, as households continued to invest in reliable Wi-Fi to support video conferencing, cloud-based applications, and multiple connected devices.

b. Some key players operating in the U.S. wireless router market include Cisco Systems, Inc.; NETGEAR, Inc.; TP-Link Systems Inc.; D-Link Corporation; Ubiquiti, Inc.; Linksys Holdings, Inc.; Verizon; Alphabet Inc.; AT&T Intellectual Property; and ASUSTeK Computer Inc.

b. The U.S. wireless router market is growing steadily due to increasing broadband penetration, the rise of remote work and smart home adoption, and a surge in connected devices per household. Consumers and businesses alike are driving demand for high-performance routers with advanced features like Wi-Fi 6, mesh networking, and built-in cybersecurity. Federal investments in broadband infrastructure and the growing need for secure, reliable internet access across homes and small businesses are further fueling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.