- Home

- »

- Communications Infrastructure

- »

-

Utility Communication Market Size, Industry Report, 2033GVR Report cover

![Utility Communication Market Size, Share & Trends Report]()

Utility Communication Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Wired, Wireless), By Component, By Utility, By Application (Oil & Gas, Power Generation), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-675-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Utility Communication Market Summary

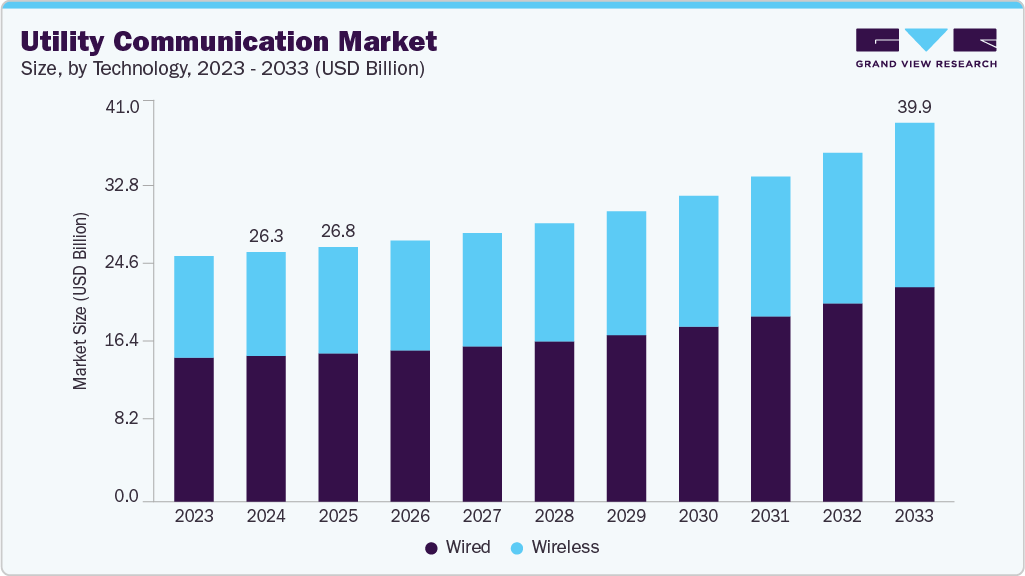

The global utility communication market size was estimated at USD 26.29 billion in 2024, and is projected to reach USD 39.90 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market has been driven by the global push toward grid modernization, growing demand for operational efficiency, and increasing integration of renewable energy sources.

Key Market Trends & Insights

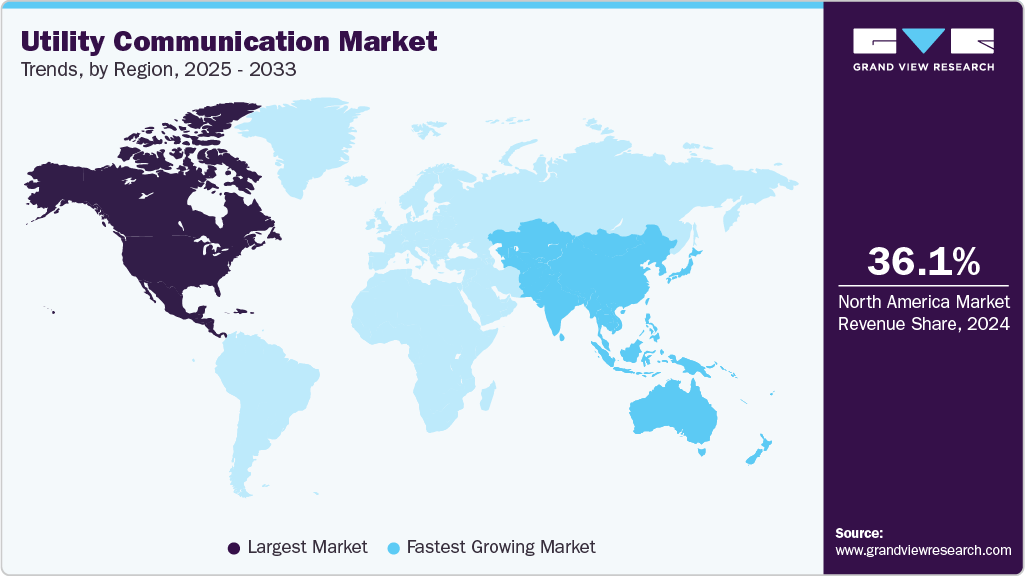

- North America utility communication market accounted for a 36.1% share of the overall market in 2024.

- In 2024, the U.S. utility communication market held a dominant position in the North America region.

- By technology, the wired segment accounted for the largest share of 58.4% in 2024.

- By component, the hardware segment held the largest market share in 2024.

- By utility, the public segment dominated the market with the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.29 Billion

- 2033 Projected Market Size: USD 39.90 Billion

- CAGR (2025-2033): 5.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest market

Utilities have been compelled to adopt advanced communication systems to enable real-time monitoring, remote asset management, and enhanced customer engagement. The proliferation of distributed energy resources (DERs), electric vehicles (EVs), and smart metering infrastructure has intensified the need for robust, secure, and scalable communication networks across electric, gas, and water utilities.Technological advancements have reshaped the market landscape, with significant emphasis placed on the convergence of wired and wireless communication solutions. Adoption of technologies such as RF mesh, fiber optics, private LTE, and increasingly, 5G, has been accelerated to support two-way communication, high-speed data transmission, and low-latency grid applications. Integration of IoT, edge computing, and AI-based analytics has also been prioritized, enabling predictive maintenance, fault detection, and real-time decision-making across utility networks.

Substantial investments have been observed across regions, particularly in smart grid and AMI projects, with public and private funding increasingly allocated to infrastructure upgrades. Leading utilities and governments have allocated multi-billion-dollar budgets to replace aging infrastructure and deploy intelligent communication systems. Partnerships between utilities and technology providers have been strengthened to co-develop customized solutions that address specific operational challenges while enhancing system resilience.

The regulatory landscape has continued to evolve in favor of utility communication system deployment, driven by national energy efficiency mandates, cybersecurity guidelines, and sustainability goals. In markets such as North America and Europe, regulatory bodies have mandated the rollout of smart meters and grid modernization initiatives. International standards for data interoperability, network security, and communication protocols have been established to ensure seamless integration and system compatibility across diverse utility ecosystems.

However, several restraints have hindered the widespread adoption of utility communications technologies. High upfront costs, complex system integration, and legacy infrastructure challenges have slowed deployment, particularly in developing markets. Concerns around data privacy, cyber threats, and the lack of standardization in emerging regions have further constrained market scalability. In addition, regulatory uncertainties in certain geographies have delayed investment decisions and slowed the pace of digital transformation in the utility sector.

Technology Insights

The wired segment accounted for the largest share of 58.4% in 2024. The need for highly reliable, low-latency communication fuels the growth of the market. Wired technologies, especially fiber optics and Ethernet, offer stable and uninterrupted connectivity that is critical for real-time applications such as SCADA (Supervisory Control and Data Acquisition), substation automation, and grid protection systems. Utilities rely on these wired systems to ensure accurate data transmission and minimal communication delay, particularly in mission-critical infrastructure, where any disruption can lead to service outages or operational risks.

The wireless segment is expected to grow at the fastest CAGR during the forecast period. Wireless communication systems offer faster and more flexible deployment compared to traditional wired infrastructure. Utilities, particularly in remote or hard-to-reach areas, find wireless technologies cost-effective as they eliminate the need for extensive trenching and cabling. This is especially beneficial for last-mile connectivity and rural grid extensions where deploying fiber or copper wires can be economically unviable and logistically challenging.

Component Insights

The hardware segment held the largest market share in 2024. The global shift toward smart grids drives the growth of hardware demand in the utility communications market. Utilities are investing heavily in physical communication infrastructure, including routers, switches, relays, smart meters, remote terminal units (RTUs), and intelligent electronic devices (IEDs), to support real-time data acquisition and remote control. These hardware components form the backbone of utility communication networks, enabling monitoring, automation, and fault detection across transmission and distribution systems.

The software segment is expected to grow at the fastest CAGR during the forecast period. Rising adoption of advanced metering infrastructure has expanded the need for software that can manage, interpret, and visualize metering data. AMI software enables utilities to analyze customer consumption patterns, generate accurate billing, and support demand response programs. This is particularly important for residential and commercial segments where usage behavior drives grid load. Software platforms also provide tools for remote meter configuration, outage detection, and customer communication, drastically improving utility service quality and efficiency.

Utility Insights

The public segment dominated the market in 2024. Public utilities typically manage critical infrastructure with large service territories and high customer density, making the reliability and scalability of communications systems essential. From electricity and gas to water and wastewater networks, these utilities require comprehensive communication platforms to monitor, control, and respond to operational issues. The scale of public utility operations demands investments in high-capacity, redundant, and secure communication systems, whether wired, wireless, or hybrid.

The private segment is projected to grow at the fastest CAGR over the forecast period. Compared to public entities, private utilities typically have fewer bureaucratic hurdles and shorter decision-making cycles. This allows them to rapidly adopt emerging technologies, such as private LTE/5G networks, smart metering platforms, and AI-enabled grid management software. The ability to invest in cutting-edge communication infrastructure and tailor solutions to specific operational needs gives private utilities a competitive edge and drives the growth of this segment.

Application Insights

The power generation segment dominated the market in 2024. The rising share of renewable energy, such as solar, wind, and hydro, in the global energy mix is a major driver for communication systems in power generation. Renewable energy sources are intermittent and geographically dispersed, requiring real-time monitoring and control to ensure grid stability. Utility communication systems enable power plants to transmit performance data, forecast generation, and coordinate with grid operators.

The oil and gas segment is projected to grow at a significant CAGR over the forecast period. The oil and gas sector relies on geographically dispersed and often hazardous infrastructure, pipelines, offshore platforms, refineries, and wellheads, which require real-time monitoring and control to ensure operational safety and efficiency. Utility communication systems enable remote data transmission from sensors and control devices to central systems, allowing operators to monitor pressure, temperature, flow rates, and equipment status in real time.

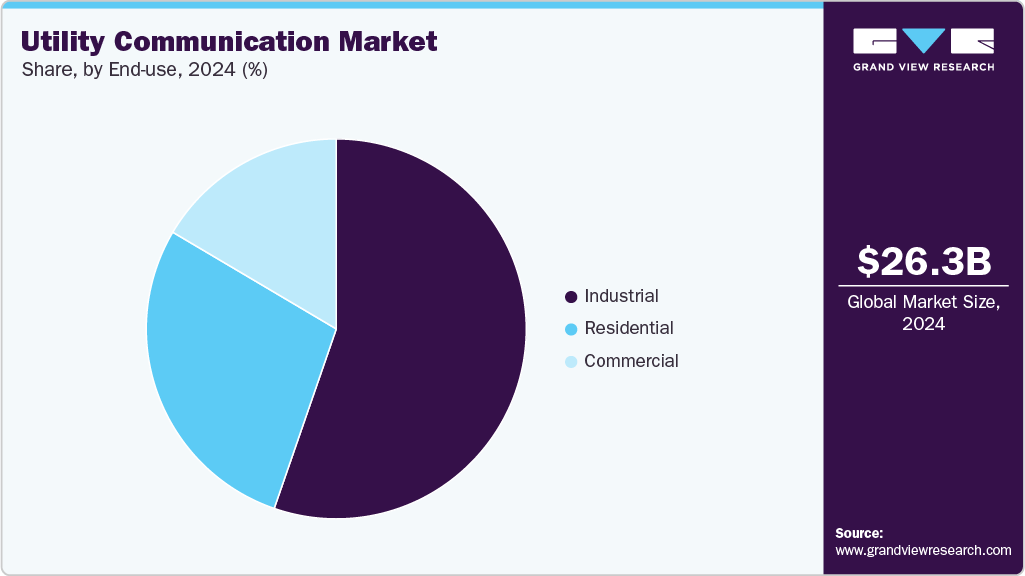

End-use Insights

The industrial segment dominated the market in 2024. Industrial facilities, such as manufacturing plants, refineries, and chemical processing units, rely on uninterrupted utility services (electricity, gas, water) to maintain production. The demand for advanced utility communication is increasing due to the need to automate operations and reduce downtime systems. These systems enable real-time monitoring and control of utility consumption, helping industrial users detect faults, reduce wastage, and optimize energy use.

The residential segment is projected to grow at the fastest CAGR over the forecast period. Residential consumers are becoming more conscious of energy usage and are demanding tools to monitor and manage their consumption. Utility communication systems support customer engagement platforms that provide real-time usage data, alerts, and personalized recommendations for energy savings. These systems enhance transparency and empower consumers to reduce energy bills, particularly through demand response programs and dynamic pricing.

Regional Insights

The North America utility communication market held the largest share in 2024. The market is characterized by strong investments in grid modernization, widespread deployment of Advanced Metering Infrastructure (AMI), and a mature regulatory landscape supporting digital utility infrastructure. The region is a leader in smart grid communication technologies, with significant uptake of both wired and wireless systems across electric, water, and gas utilities.

U.S. Utility Communication Market Trends

The U.S. utility communication market held a dominant position in 2024. In the U.S., utility communications are being rapidly transformed by federal infrastructure funding and state-level mandates aimed at enhancing grid resilience and decarbonization. Utilities are upgrading legacy systems with fiber optics, RF mesh networks, and private LTE solutions to support advanced grid management and customer engagement.

Europe Utility Communication Market Trends

The Europe utility communication market was identified as a lucrative region in 2024. Stringent EU regulations, energy efficiency targets, and a strong push toward smart city development drive the growth in the region. Countries across the region are investing in advanced communication systems to support smart metering, substation automation, and demand response programs.

The UK utility communication market is expected to grow rapidly in the coming years. The UK is witnessing significant growth in utility communication systems as part of its national smart meter rollout and net-zero emission commitments. The adoption of cloud-based communication platforms and digital substations is enabling real-time grid monitoring and energy efficiency.

Asia Pacific Utility Communication Market Trends

The Asia Pacific utility communication market is expected to grow at the fastest CAGR of 6.0% over the forecast period of 2025-2033. The region is experiencing robust growth fueled by rapid urbanization, infrastructure development, and strong government support for smart grid projects. Countries in the region are actively deploying wired and wireless technologies to enhance energy distribution, reduce losses, and improve utility efficiency.

The utility communication market in Japan is expected to grow rapidly in the coming years. Japan’s utility communications landscape is advanced, with widespread adoption of smart grid systems and automation technologies. Utilities are increasingly leveraging high-speed fiber-optic networks and private communication infrastructures to enable efficient energy distribution and disaster resilience. The country’s focus on grid reliability, especially after the Fukushima incident, has led to significant investments in real-time monitoring and communication solutions.

The China utility communication market held a substantial market share in 2024. The growth in the country is supported by large-scale government initiatives such as the State Grid Corporation’s smart grid projects. Massive investments are being made in AMI, substation automation, and IoT-enabled communication systems across urban and rural areas.

Key Utility Communication Company Insights

Some of the key companies in the utility communication market include Siemens, Schneider Electric,ABB, GE Grid Solutions, LLC, Cisco Systems, Inc., and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Siemens is a provider of utility communication, offering comprehensive, tailored communication network solutions designed to support the evolving needs of modern power transmission and distribution grids. Siemens provides advanced technologies such as fiber-optic networks (including Optical Ground Wire - OPGW), Synchronous Digital Hierarchy (SDH), Multi-Protocol Label Switching (MPLS), and digital high-voltage power line carrier systems to ensure reliable, secure, and efficient data transmission across substations and control centers.

-

Schneider Electric is a provider of advanced digital solutions that enable utilities to modernize and optimize their grid operations. Schneider Electric’s offerings include the One Digital Grid Platform, which integrates mission-critical software into a secure, scalable ecosystem designed to enhance grid resilience, flexibility, and security. This platform supports real-time insights, predictive analytics, and automation, helping utilities reduce outages by up to 40%, accelerate distributed energy resource (DER) integration, and streamline application deployment.

Key Utility Communication Companies:

The following are the leading companies in the utility communication market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens

- Schneider Electric

- ABB

- GE Grid Solutions, LLC

- Cisco Systems, Inc.

- Motorola Solutions, Inc

- Nokia

- Telefonaktiebolaget LM Ericsson

- Trilliant Holdings Inc.

- Itron Inc.

Recent Developments

-

In December 2024, Siemens Smart Infrastructure (SI) partnered with Tietoevry, a Nordic digital services and software company, to accelerate the digitalization of the power utility sector in the Nordic region. This collaboration aims to create intelligent, adaptive infrastructure by integrating energy systems, buildings, and industries through advanced digital technologies. Siemens Smart Infrastructure offers a comprehensive end-to-end portfolio that covers everything from power generation to consumption, enabling utilities to enhance operational efficiency, sustainability, and grid resilience.

-

In August 2024, The Utilities Technology Council (UTC) and the 450 MHz Alliance announced a strategic partnership to enhance communication networks for utilities and critical infrastructure providers globally. The collaboration combines UTC’s extensive experience in serving critical infrastructure stakeholders with the 450 MHz Alliance’s focus on promoting the use of the 450 MHz spectrum, which is particularly well-suited for wide-area, secure, and mission-critical wireless communications. The partnership aims to accelerate the adoption of 450 MHz technology to support resilient, reliable, and secure connectivity essential for utility operations, including smart grid applications, remote monitoring, and emergency response.

Utility Communication Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.81 billion

Revenue forecast in 2033

USD 39.90 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, utility, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Siemens; Schneider Electric; ABB; GE Grid Wireds, LLC; Cisco Systems, Inc.; Motorola Wireds, Inc; Nokia; Telefonaktiebolaget LM Ericsson; Trilliant Holdings Inc.; Itron Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Utility Communication Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global utility communication market report based on technology, component, utility, application, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired

-

Wireless

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

-

Utility Outlook (Revenue, USD Million, 2021 - 2033)

-

Public

-

Private

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil and Gas

-

Power Generation

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global utility communications market size was estimated at USD 26.29 billion in 2024 and is expected to reach USD 26.81 billion in 2025.

b. The global utility communications market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 39.90 billion by 2033.

b. North America dominated the utility communications market with a share of 36.1% in 2024. The utility communications market in North America is characterized by strong investments in grid modernization, widespread deployment of Advanced Metering Infrastructure (AMI), and a mature regulatory landscape supporting digital utility infrastructure.

b. Some key players operating in the utility communications market include Siemens; Schneider Electric; ABB; GE Grid Wireds, LLC; Cisco Systems, Inc.; Motorola Wireds, Inc; Nokia; Telefonaktiebolaget LM Ericsson; Trilliant Holdings Inc.; Itron Inc.

b. The utility communications market has been driven by the global push toward grid modernization, growing demand for operational efficiency, and increasing integration of renewable energy sources.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.