- Home

- »

- Medical Imaging

- »

-

Vendor Neutral Archive Market Size, Industry Report, 2033GVR Report cover

![Vendor Neutral Archive Market Size, Share & Trends Report]()

Vendor Neutral Archive Market (2025 - 2033) Size, Share & Trends Analysis Report By Imaging Modalities (Radiology, Cardiology, Pathology), By Deployment Mode (On-premise, Cloud-based), By Component, By End Use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-717-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vendor Neutral Archive Market Summary

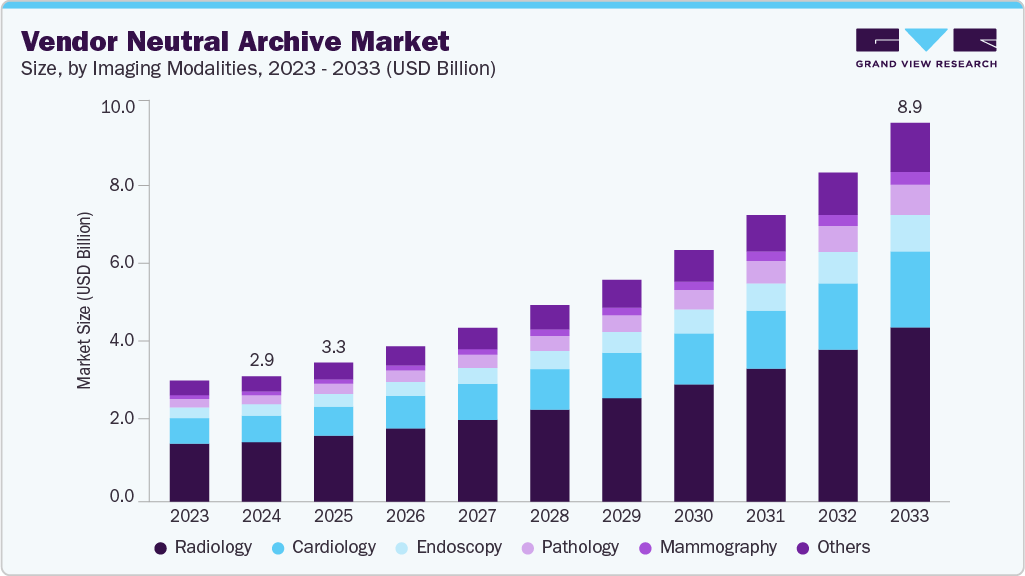

The global vendor neutral archive market size was estimated at USD 2.94 billion in 2024 and is expected to reach USD 8.89 billion, growing at a CAGR of 13.3% from 2025 to 2033. This growth is driven by the increasing imaging volumes across multi-ology workflows (radiology, cardiology, pathology, ophthalmology), and the need to consolidate silos created by legacy PACS during M&A.

Key Market Trends & Insights

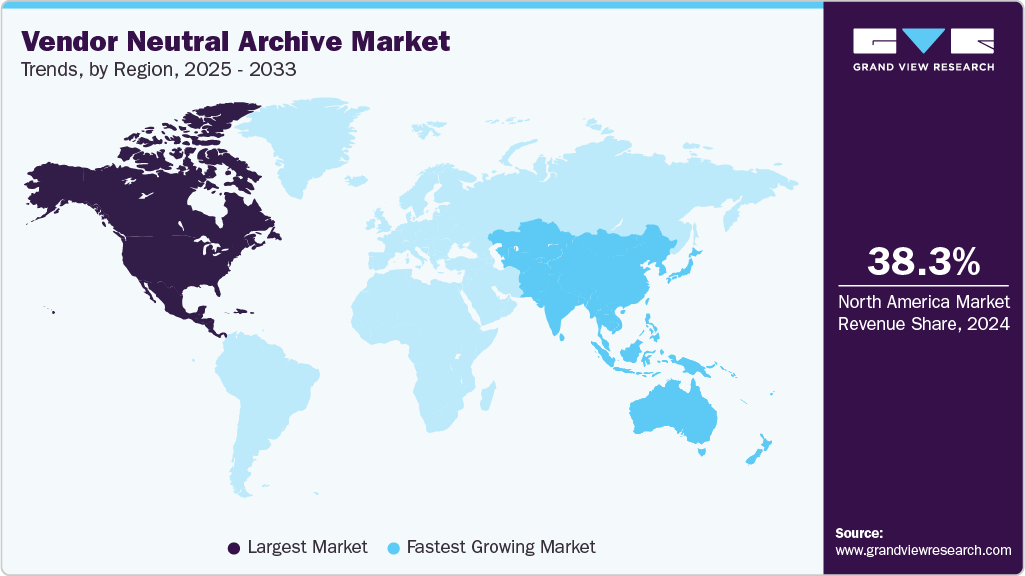

- North America dominated the market and accounted for a 38.29% share in 2024.

- The vendor neutral archive market in the U.S. has seen significant growth over the forecast period due to advanced healthcare infrastructure, high imaging volumes, and strong regulatory support for interoperability and data sharing.

- By imaging Modalities, the radiology segment led the market with a share of 47.67% in 2024.

- By deployment mode, cloud based emerged as the leading procedure segment in 2024 and accounted for 45.86% of the market share.

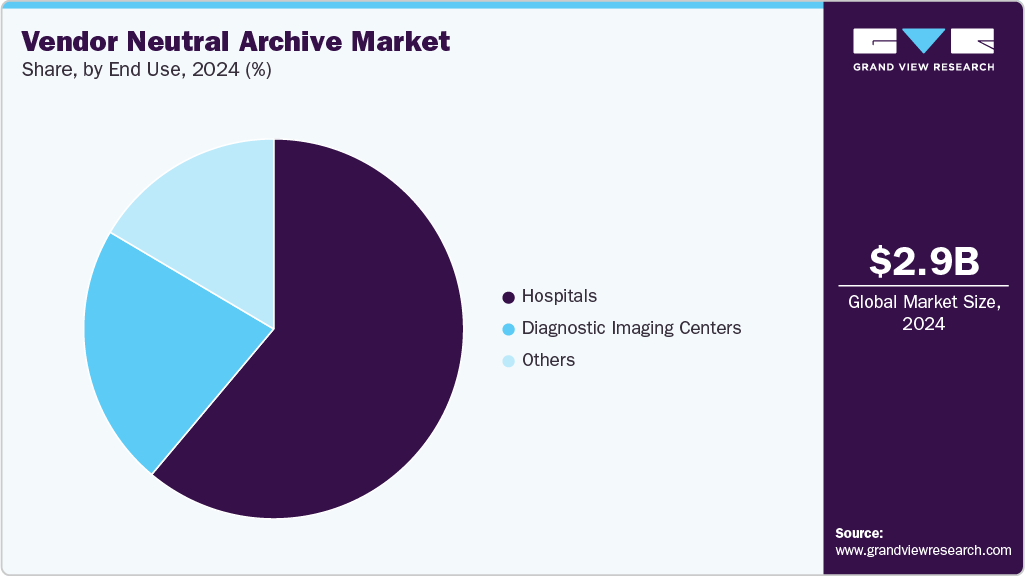

- By end use, the hospitals segment was the leading in 2024 and accounted for 61.10% of the market share.

Market Size & Forecast

- 2024 Market Size: USD 2.94 Billion

- 2033 Projected Market Size: USD 8.89 Billion

- CAGR (2025-2033): 13.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

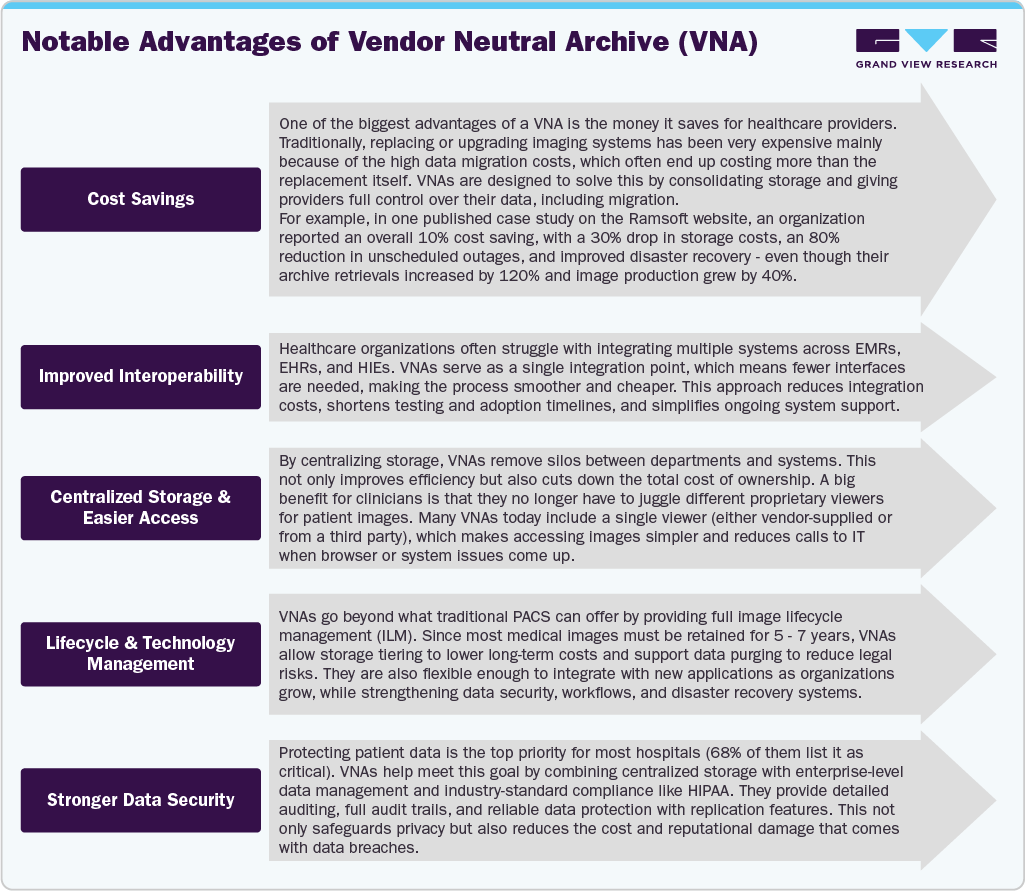

CIOs are prioritizing interoperability-DICOM, HL7/FHIR, and IHE-XDS-so images and rich metadata flow seamlessly into EHRs and downstream analytics. Cloud migration and hybrid storage models are reducing the total cost of ownership while improving scalability, disaster recovery, and cyber-resilience, which is a board-level concern after high-profile ransomware events. Long-term retention and tightening data-governance rules (auditability, privacy, data residency) favor vendor neutral archive (VNAs) over application-tied archives.

Recent innovations and strategic initiatives from leading healthcare IT companies further propel the adoption of VNAs. For instance, in February 2024, Fujifilm's Synapse VNA was named best in KLAS for the fifth consecutive year, recognizing its interoperability and customer satisfaction excellence. Similarly, in March 2024, GE HealthCare announced a collaboration with Tribun Health to advance Vendor Neutral Archive by integrating Vendor Neutral Archive data into GE's Edison VNA platform. This partnership aims to enhance interoperability and provide clinicians with a more comprehensive view of patient data.

Building on these advancements, the VNA market is witnessing a shift towards greater cloud integration, focusing on enhancing scalability, security, and real-time data access. The growing emphasis on interoperability enables healthcare organizations to seamlessly manage and share imaging data across different systems, improving collaboration and efficiency. As healthcare providers adopt more flexible and integrated solutions, VNAs play a critical role in supporting precision medicine, enhancing clinical decision-making, and streamlining workflows across various healthcare settings.

Increasing Role of AI in Vendor Neutral Archive Market

The role of Artificial Intelligence (AI) in the Vendor Neutral Archive (VNA) market is rapidly increasing as healthcare providers seek more efficient ways to manage and analyze the vast amounts of imaging and clinical data they store. AI technologies such as machine learning and deep learning are being integrated into VNAs to automate data categorization, improve image analysis, and assist in clinical decision-making. AI-powered tools can automatically tag, classify, and organize medical images, making it easier for clinicians to access relevant data quickly and accurately. This integration enhances workflow efficiency and supports better patient outcomes by enabling healthcare professionals to make more informed, data-driven decisions in real time.

AI's application within VNAs is extending beyond simple data management. Applying AI algorithms to large sets of imaging data stored in a VNA allows for advanced functionalities such as predictive analytics, anomaly detection, and early diagnosis of conditions such as cancer or neurological diseases. By analyzing historical imaging data, AI can help identify patterns and trends that may not be immediately visible to the human eye. As a result, healthcare providers are increasingly adopting AI-enhanced VNAs to support personalized medicine, improve diagnostic accuracy, and streamline the healthcare delivery process. This shift is expected to significantly transform how imaging data is stored, managed, and utilized in clinical settings, further driving the growth of the VNA market.

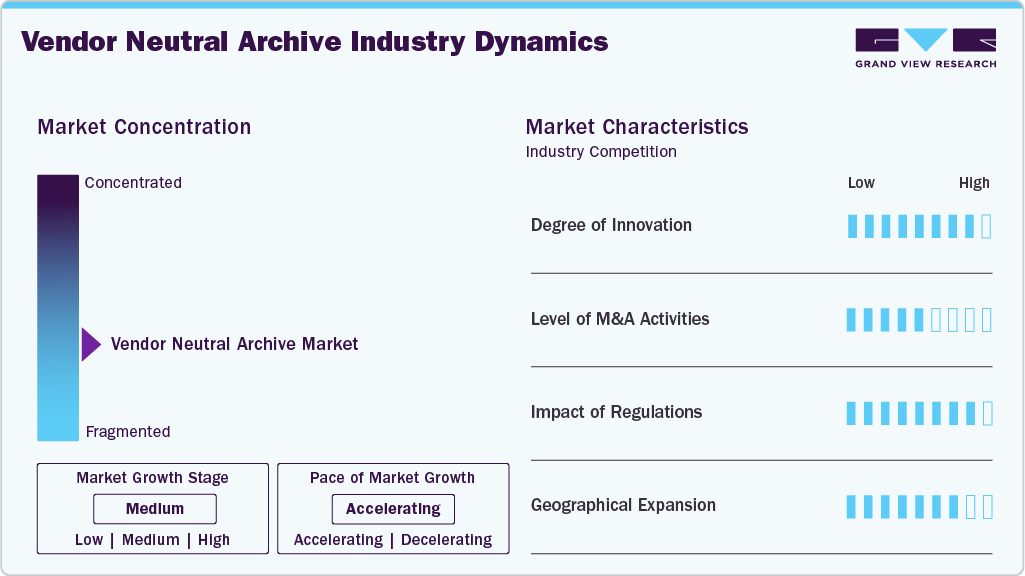

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the vendor neutral market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, moderate growth was observed in regional expansion.

The degree of innovation in the industry is high driven by propelled by advancements such as the integration of cloud-based platforms, AI-driven data analytics, and advanced imaging management tools that enhance data accessibility, automate workflows, and improve diagnostic capabilities. These innovations are enabling healthcare organizations to centralize and securely store vast amounts of clinical data while enhancing the speed and accuracy of clinical decision-making. For instance, simplirad an India based cloud-based radiology software company offers AI-based vendor neutral archive that enables healthcare organizations to store and share medical imaging data seamlessly, while enhancing scalability and reducing IT costs.

The level of merger & acquisition in the industry is moderate driven by the industry's rapid growth and the need for companies to enhance their technological capabilities and market reach. For instance, in October 2024, GE Healthcare partnered with Tribun Health to integrate Tribun’s digital pathology Health Suite with GE’s Edison Datalogue VNA, enabling unified storage of pathology and imaging data, AI-assisted pathology, and clinician collaboration for improved oncology workflows.

The impact of regulations on the market is high. The market is governed by several stringent regulations designed to shape how solutions are developed, deployed, and managed across healthcare systems. Compliance with data protection laws such as HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR (General Data Protection Regulation) in Europe is critical, as VNAs handle sensitive patient data across various platforms.

Geographical expansion in the Vendor Neutral Archive (VNA) market is being driven by both mature and emerging opportunities. In developed regions such as North America and Europe, VNA vendors are consolidating their presence through strategic partnerships with large healthcare networks, expanding managed service offerings, and aligning with national interoperability initiatives. These markets are highly competitive, so companies are differentiating by offering advanced capabilities such as cloud-native VNAs, AI integration for image indexing, and cybersecurity resilience, while simultaneously acquiring regional PACS or imaging IT providers to increase market penetration.

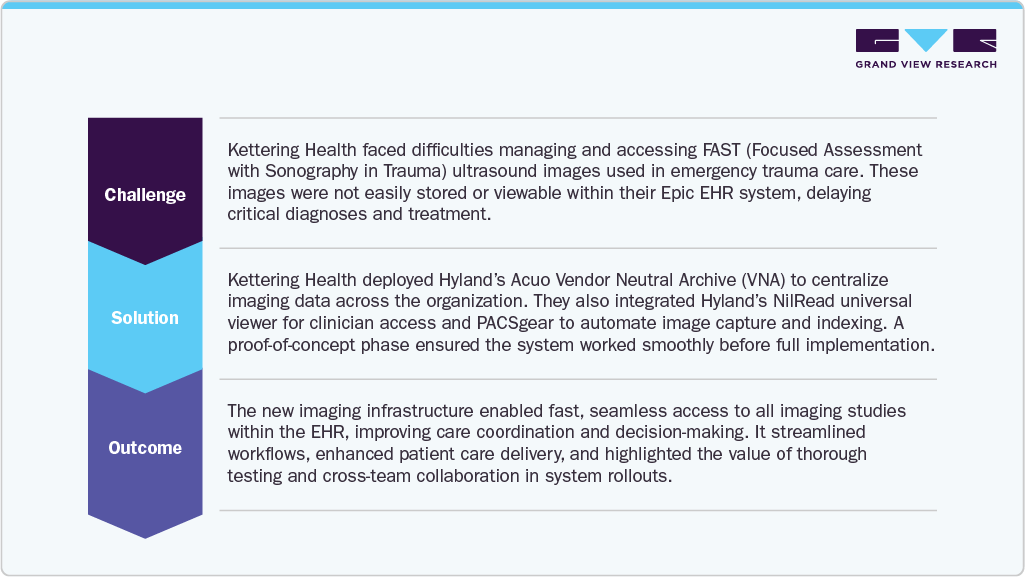

Case Study:

Kettering Health improved trauma care by centralizing and streamlining access to imaging data using Hyland’s VNA and viewing solutions. This enhanced clinical workflows, enabling faster, more informed decision-making.

Imaging Modalities Insights

The radiology segment held the largest share of 47.67% in 2024 and is expected to grow rapidly during the forecast period. Radiology departments generate the highest volume of imaging data, including CT, MRI, X-ray, and ultrasound scans, which require extensive storage and easy access across multiple systems and locations. VNAs were initially adopted to manage and unify radiology images from different PACS vendors, enabling interoperability, long-term storage, and streamlined workflows, contributing to the segment’s large share.

The pathology segment is expected to grow at fastest CAGR during the forecst period due to increased adoption of vendor neutral archive solutions, including whole slide imaging, which generates large data files that need strong storage and management. The growing use of AI-based diagnostic tools in pathology, rising cancer diagnostics workload, and the move toward integrated and remote pathology workflows are motivating healthcare providers to adopt VNAs for efficient, interoperable storage and access to pathology images across departments and locations. For instance, in February 2025, The National Pathology Imaging Co-operative (NPIC) launched an open-source, publicly accessible register of 26 AI-based Vendor Neutral Archive tools that detail their regulatory status, clinical validation, and performance to promote transparency and informed implementation in clinical practice.

Deployment Mode Insights

The cloud-based segment had the largest market share of 45.86% in 2024 due to its benefits in scalability, cost savings, and remote access, which are becoming increasingly vital as imaging data volumes grow. Healthcare providers are adopting cloud VNAs to cut on-premise infrastructure costs, enable disaster recovery, and facilitate multi-site data sharing and interoperability, fueling rapid growth in this segment compared to traditional on-premise solutions.

The on-premise segment held a significant share of the market. Most healthcare providers have traditionally preferred storing sensitive imaging data within their own data centers for better control, security, and compliance with data protection laws. Large hospitals and imaging centers have existing IT systems to support on-premise VNAs, ensuring smooth integration with their PACS and HIS systems while keeping direct control over data access and storage.

Component Insights

Software segment had the largest market share in 2024. VNAs are primarily purchased as software solutions for data storage, management, and integration across imaging modalities and sites. Healthcare providers invest significantly in VNA software to consolidate imaging data from multiple PACS and ensure interoperability, while services such as installation, maintenance, and support contribute a smaller share. For instance, in March 2025, GE HealthCare recently advanced its cloud strategy by unveiling its new imaging platform, GE HealthCare Imaging Cloud, built on Amazon Web Services (AWS), to integrate data seamlessly across systems and improve accessibility and workflow efficiency, highlighting the continued focus on software-led VNA solutions.

The services segment is projected to grow at the fastest CAGR over the forecast period, as hospitals and imaging centers rely on managed services, cloud migration support, and consulting for implementation and regulatory compliance. The growing complexity of integrating VNA systems with existing IT infrastructure, coupled with a shift toward cloud-based deployment, is fueling demand for specialized services, making this the most rapidly expanding segment..

End Use Insights

Hospitals segment held the largest share in 2024 due to the massive volumes of imaging data they generate across multiple departments and specialties, requiring centralized storage, interoperability, and easy access for clinical workflows and patient care. Large hospitals also have the financial and IT resources to implement VNA solutions that integrate data from various PACS and support enterprise imaging strategies. For instance, in April 2025, an Australian private hospital chose Sectra’s enterprise imaging solution to streamline workflows across radiology, breast imaging, and cardiology, enhancing operational efficiency and patient outcomes. This highlights hospitals’ growing focus on integrated imaging platforms.

The Diagnostic Imaging Centers segment is expected to experience the fastest growth rate from 2025 to 2033, due to increasing demand for outpatient imaging services, higher imaging volumes, and the need to efficiently integrate data across multiple sites and modalities. As these centers expand and adopt advanced imaging technologies, implementing VNA solutions becomes crucial for cost-effective data storage, interoperability with hospital systems, and seamless image sharing with referring physicians, fueling rapid growth in this segment.

Application Insights

The clinical segment dominated the market in 2024, driven by the rising adoption of advanced imaging modalities, increasing data volumes from radiology, cardiology, and pathology, and the shift toward enterprise-wide imaging platforms to improve interoperability. Healthcare providers are increasingly investing in VNAs to streamline diagnostic workflows, enable cross-department image sharing, and meet compliance with regulatory standards such as HIPAA and GDPR.

The non-clinical segment is emerging as the fastest-growing category, fueled by the rise of administrative and operational healthcare data. Hospitals and payers are leveraging VNAs for storage and management of insurance claims, patient records, billing information, and research datasets. Growth is further supported by the demand for analytics-driven decision-making, cost reduction through cloud-based deployment, and integration of AI for real-time insights.

Regional Insights

North America vendor neutral archive market dominated the overall market in 2024 with a share of 38.29%, driven by advanced healthcare infrastructure, high imaging volumes, and strong regulatory support for interoperability and data sharing. Increasing adoption of enterprise imaging strategies and electronic health records (EHRs) fuels demand for centralized, vendor-neutral solutions that streamline access across multiple specialties and facilities. Furthermore, the presence of key market players such as Hyland, GE Healthcare, and Philips is contributing to the growth of the VNA market in the region.

U.S Vendor Neutral Archive Market Trends

VNA market in the U.S. is driven by advanced healthcare infrastructure and high imaging utilization. According to Harvard Health Publishing as of 2021, more than 800 million of CT scans are performed in the U.S. This volume highlights the immense need for efficient storage, management, and retrieval of imaging data. Such a high number of imaging procedures generates vast amounts of data that healthcare providers must securely archive and make accessible across multiple care settings, which propels the growth of the VNA market.

Europe Vendor Neutral Archive Market Trends

VNA market in Europe is experiencing steady growth, driven by increasing adoption of digital health solutions, growing imaging volumes, and the rising need for interoperable systems across national health services. One of the key trends fueling market growth is the strong regulatory focus on data protection and patient privacy, exemplified by the General Data Protection Regulation (GDPR), which mandates secure handling, archiving, and access to medical data. VNAs are seen as enablers of compliance, offering audit trails, data governance features, and secure access management.

VNAmarket in UK is expected to witness significant growth opportunities over the coming years. The growth is attributed to the increasing need for interoperable imaging storage solutions across NHS trusts and private hospitals. A shift towards cloud-based and hybrid VNAs for greater scalability and cost efficiency, integration with PACS and EHR systems to streamline workflows, and rising demand for enterprise imaging strategies that consolidate data from multiple modalities and sites. Additionally, the focus on AI-enabled imaging analysis and national digital health initiatives is further driving the adoption of advanced VNA solutions in the country.

Germany vendor neutral archive market is driven by the country’s strong focus on healthcare digitization and interoperability standards. Hospitals and imaging centers are increasingly adopting enterprise VNA solutions to unify imaging data across departments and locations, improving clinical workflows and data access. There is also a rising trend toward cloud-based VNAs for flexible storage and disaster recovery, along with the integration of AI tools for advanced imaging analysis. For instance , a national survey by Springer Nature in May 2025 reported a 48% increase in PET imaging volume in Germany from 2017 to 2021, highlighting the growing imaging data load that requires robust and interoperable storage solutions like VNAs to efficiently handle oncology and theranostic imaging data.

Asia Pacific Vendor Neutral Archive Market Trends

Vendor Neutral Archive market in Asia Pacific is experiencing robust traction driven by extensive healthcare digitization and infrastructure upgrades across major countries such as China, India, Japan, South Korea, and Australia. Healthcare providers are actively deploying cloud-based and hybrid VNA solutions to support telehealth, disaster recovery, and scalable image storage. Integration with PACS, EHR systems, and emerging AI-driven imaging analytics is becoming common, further fueling adoption.

VNAmarket in Japan is gaining momentum due to the country’s focus on healthcare digital transformation and strong imaging infrastructure. Providers across hospital networks are increasingly adopting cloud and hybrid VNA deployments to improve scalability and interoperability. Leading Japanese players like Fujifilm and Canon are expanding their enterprise imaging platforms in major hospital groups, reflecting the market’s dynamic and modernization-driven path.

China vendor neutral archive market is experiencing strong growth driven by rising imaging volumes and rapid digitization of healthcare infrastructure. Hospitals and diagnostic centers are increasingly adopting cloud-based and hybrid VNAs to enhance scalability and interoperability. This trend is further accelerated by the country’s quick integration of AI into healthcare. For example, China’s first AI hospital, launched in May 2025, can diagnose over 10,000 patients in just a few days. This underscores the need for robust VNAs to efficiently store, manage, and integrate large imaging datasets for AI training, diagnostics, and clinical workflows. As AI-powered care models expand, the demand for scalable, intelligent VNA solutions that support high-volume, multi-site, and AI-enhanced imaging workflows is expected to grow across the country.

Latin America Vendor Neutral Archive Market Trends

Vendor Neutral Archive Market in Latin America is growing steadily as healthcare providers seek to modernize imaging storage and management systems amid rising diagnostic imaging volumes. Countries like Mexico are increasingly adopting enterprise and cloud-based VNAs to improve interoperability, centralize imaging data across hospital networks, and support telemedicine initiatives. However, budget constraints and uneven IT infrastructure remain challenges in some regions.

Middle East And Africa Vendor Neutral Archive Market Trends

Vendor Neutral Archive market in Middle East and Africa is experiencing steady growth driven by increased healthcare digitization efforts, especially in countries like Saudi Arabia and the UAE, where hospitals are adopting enterprise and cloud-based VNAs to centralize imaging data and support national health IT strategies. The focus is on improving interoperability across hospital networks, integrating PACS and EHR systems, and enabling efficient telemedicine services.

Key Vendor Neutral Archive Company Insights

The market players are undertaking strategies such as acquisitions, new product launches, joint ventures and agreements, and expansion in other regions to increase their market outreach.

Key Vendor Neutral Archive Companies:

The following are the leading companies in the vendor neutral archive market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Siemens Healthineers International AG

- FUJIFILM Corporation

- Koninklijke Philips N.V.,

- IBM Watson Health (Merative)

- Hyland Healthcare

- Sectra AB

- Agfa HealthCare

- Carestream Health

- BridgeHead Software

- Canon Medical Systems

- Novarad

- Dell Technologies

- Change Healthcare

- Dicom Systems, Inc.

- Intelerad

- RamSoft

Recent Developments

-

In November 2023, Intelerad has partnered with one of Michigan’s largest health systems in a USD 50 million multi-year deal to deploy its IntelePACS, Clario SmartWorklist, cloud-enabled VNA, and image exchange solutions across 22 hospitals and 300+ facilities, enhancing imaging workflows for over 11,500 providers.

“We are humbled to have the opportunity to help one of America’s leading health systems transform healthcare in America’s tenth largest state. We are committed to continuing to invest in and innovate our enterprise imaging solutions to empower our partners to improve outcomes for hundreds of thousands of patients.”

- Morris Panner, president, Intelerad

-

In November 2023, InsiteOne acquired BRIT Systems, integrating its RIS/PACS/VNA platform into their portfolio. This move enhances InsiteOne’s multi-tenant enterprise imaging capabilities.

“We are excited to join InsiteOne, as we share a similar passion to provide world class solutions and exceptional customer support.”

-Kyle Boyd, VP BRIT Systems.

-

In October 2022 RamSoft launched OmegaAI cloud-native Imaging EMR that consolidates VNA, PACS, RIS, zero-footprint viewing, patient portals, BI tools, and FHIR-based interoperability into a single SaaS platform.

“Some radiologists are still skeptical that cloud-native radiology software accessed via a web browser on a standard Internet connection can allow them to review and analyze medical images from multiple modalities with the same ease as traditional on-premises radiology software.”

- Siva Ramanathan, RamSoft’s Chief Technology Officer.

-

In October 2021, Carestream partnered with Gaslini Institute of Italy to offer 24/7 pediatric telemedicine across MSC Cruises’ fleet, using Carestream’s cloud-based Vue VNA platform and zero-footprint viewer for remote imaging consultations and specialist support.

Vendor Neutral Archive Market Report Scope

Report Attribute

Details

Market Sized in 2025

USD 3.26 billion

Revenue forecast in 2033

USD 8.89 billion

Growth rate

CAGR of 13.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR in % from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Imaging modalities, deployment mode, component, end use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

GE HealthCare; Siemens Healthineers International AG; FUJIFILM Corporation; Koninklijke Philips N.V.; IBM Watson Health (Merative); Hyland Healthcare; Sectra AB; Agfa HealthCare; Carestream Health; BridgeHead Software; Canon Medical Systems; Novarad; Dell Technologies; Change Healthcare; Dicom Systems, Inc.; Intelerad; RamSoft

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vendor Neutral Archive Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the vendor neutral archive market based on imaging modalities, deployment mode, component, end use, application, and region:

-

Imaging Modalites Outlook (Revenue, USD Million, 2021 - 2033)

-

Radiology

-

Cardiology

-

Pathology

-

Endoscopy

-

Mammography

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premise

-

Cloud-based

-

Hybrid

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Imaging

-

Non-clinical Data Management

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vendor neutral archive market size was valued at USD 2.94 billion in 2024 and is expected to reach 3.26 billion in 2025

b. The global vendor neutral archive market is expected to grow at a compound annual growth rate of 13.3% from 2025 to 2033 to reach USD 8.89 billion by 2033.

b. North America dominated global vendor neutral archive (VNA) market in 2024 with a share of 38.29%. This growth is driven by advanced healthcare infrastructure, high imaging volumes, and strong regulatory support for interoperability and data sharing.

b. Some key players operating in the global VNA market include GE HealthCare, Siemens Healthineers International AG, FUJIFILM Corporation, Koninklijke Philips N.V., IBM Watson Health (Merative), Hyland Healthcare, Sectra AB, Agfa HealthCare, Carestream Health, BridgeHead Software, Canon Medical Systems, Novarad, Dell Technologies, Change Healthcare, Dicom Systems, Inc., Intelerad, and RamSoft

b. Key factors that are driving the market growth include increasing imaging volumes across multi-ology workflows (radiology, cardiology, pathology, ophthalmology) and the need to consolidate silos created by legacy PACS during M&A.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.