- Home

- »

- Animal Health

- »

-

Veterinary X-ray Market Size & Share, Industry Report, 2033GVR Report cover

![Veterinary X-ray Market Size, Share & Trends Report]()

Veterinary X-ray Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Equipment, Accessories, PACS), By Animal, By Technology, By Type (Digital, Analog), By Portability, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-724-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary X-ray Market Summary

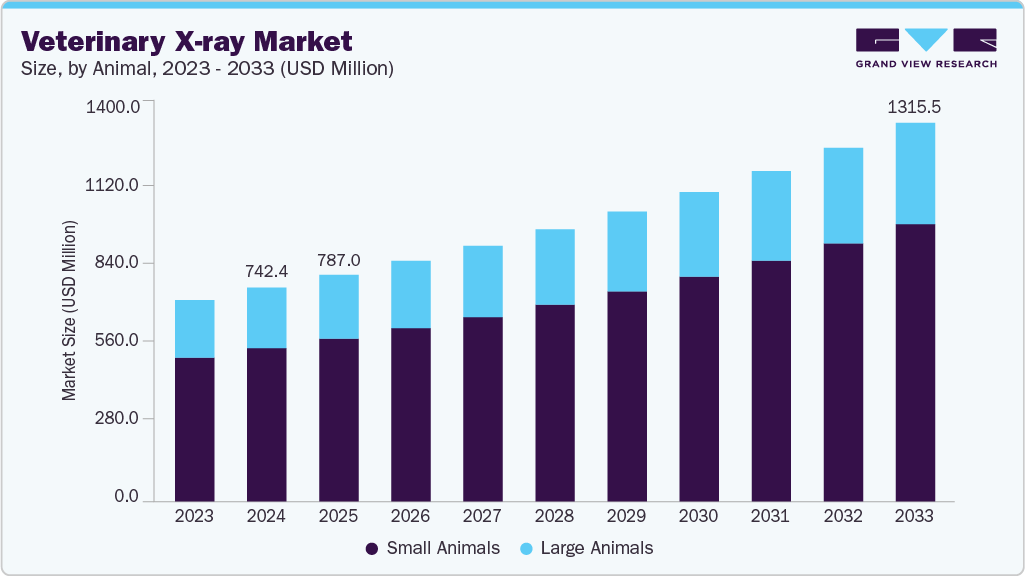

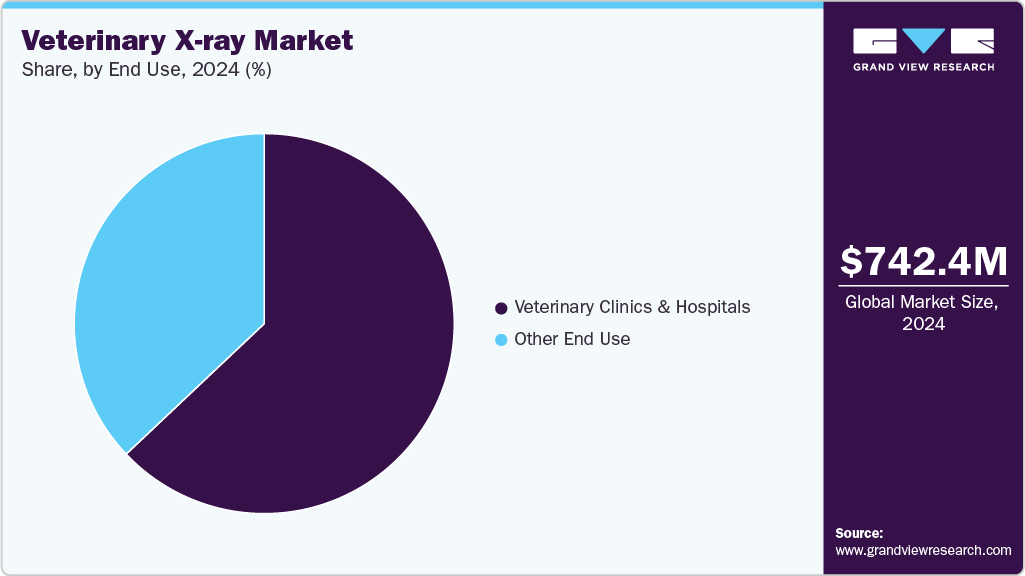

The global veterinary X-ray market size was estimated at USD 742.4 million in 2024 and is projected to reach USD 1,315.5 million by 2033, growing at a CAGR of 6.63% from 2025 to 2033. Increasing prevalence of zoonotic diseases, rising demand for imaging devices, rapid technological advancements, and a supportive regulatory environment are some of the factors driving market growth.

Key Market Trends & Insights

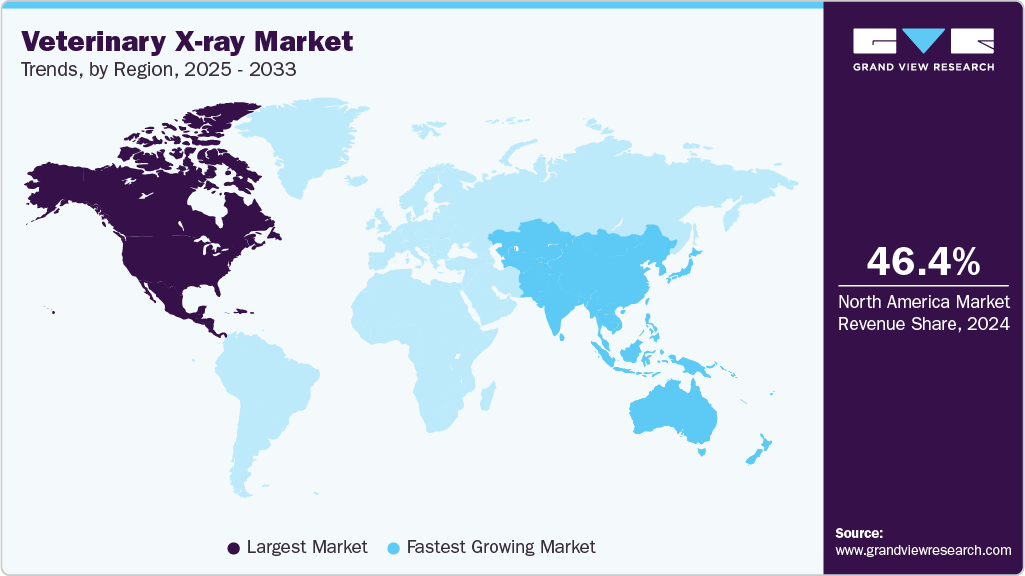

- The North America veterinary X-ray market held the largest revenue share of 46.36% in 2024.

- The U.S. dominated North America with the largest revenue share in 2024.

- By animal, the small animals segment held the largest market share of 71.68% in 2024.

- By solution, the equipment segment held the largest market share in 2024.

- By technology, the computed radiography segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 742.4 Million

- 2033 Projected Market Size: USD 1,315.5 Million

- CAGR (2025-2033): 6.63%

- North America: Largest Revenue Share Market in 2024

- Asia Pacific: Fastest Growing in the Market

The growing prevalence of zoonotic diseases, such as rabies, leptospirosis, and avian influenza, has created a heightened demand for early diagnosis and monitoring in animals. According to a CDC report from April 2025, zoonotic diseases are widespread globally, including in the U.S., with more than 60% of known infectious diseases in humans originating from animals. Additionally, 75% of recently emerging human infectious diseases are linked to animal sources. Thus, animal clinics and hospitals rely on imaging tools, such as X-ray systems, to detect infections, assess internal organ damage, and monitor disease progression. As a result, the need for advanced diagnostic technologies has intensified, driving investments in radiography.Additionally, animal practitioners have recognized the value of imaging devices for accurate diagnosis, treatment planning, and monitoring recovery in animals. As demand for faster, more reliable, and non-invasive diagnostic methods grows, animal hospitals and clinics are prioritizing the acquisition of X-ray systems. Research in medical imaging systems is also boosting market growth. For instance, in September 2022, the world’s largest animal hospital chains, Mars and IVC Evidensia, adopted AI to interpret X-rays amid a radiologist shortage. Trials in North America and Europe allowed rapid analysis of radiographs, supporting rather than replacing specialists. This shift marked a significant step toward AI integration in veterinary diagnostics. The surge in demand for imaging devices is fueled by manufacturers developing advanced, high-resolution systems to cater to the evolving needs of veterinary diagnostics.

Moreover, ongoing technological innovations in animal imaging, such as digital radiography, portable X-ray units, and improved imaging software, have made X-ray systems more efficient, accurate, and user-friendly. For instance, in May 2024, SK Telecom, in collaboration with ATX Medical Solutions, launched its AI-powered veterinary X-ray service, X Caliber, in Australia. This service enables the rapid cloud-based analysis of dog and cat X-rays with an accuracy rate of 86-94%. These advancements reduce procedure time, enhance diagnostic clarity, and enable real-time monitoring, making imaging a vital tool in animal care. As a result, clinics and hospitals are increasingly upgrading to advanced X-ray systems to utilize these benefits. Thus, technological progress in imaging directly drives the adoption of veterinary X-ray devices, as practitioners seek state-of-the-art solutions to enhance diagnostic capabilities and streamline clinical workflows.

Furthermore, the changing regulatory landscape for animal health care is a key factor influencing the veterinary X-ray industry. Enhanced regulations concerning diagnostic precision, radiation safety, and uniform imaging procedures are encouraging animal practices to implement advanced X-ray technologies that meet these standards. According to the USFDA's April 2025 report, the FDA is responsible for animal-use devices but does not require pre-market approval, registration, or post-market reporting. Manufacturers are responsible for ensuring that their devices are safe, effective, and correctly labeled, making compliance with regulations a key obligation of the manufacturer. Regulatory requirements frequently require digital imaging, cloud storage solutions, and accurate reporting, prompting clinics to transition from traditional X-ray machines to AI-enhanced or high-resolution systems. Thus, these regulations are accelerating market growth by increasing demand for modern, compliant animal imaging solutions globally.

Recent Developments in Veterinary Diagnostic Imaging

Modality / Technology

Major Developments

Applications in Veterinary Medicine

Additional Notes

Ultrasound

Regional/localized scans (A/TFAST, single-organ scans), peripatetic services, AR-enabled 3D visualization

Trauma assessment, organ-specific imaging, surgical planning, and client education

Remote training, upskilling staff, interactive 3D visualization, VR cardiac assessments

Computed Tomography (CT)

Multidetector CT, Cone beam CT for dental/exotic imaging, 3D reconstructions

Orthopedic planning, dental procedures, exotic animal imaging

Integration with VR for implant design, teaching, and client communication

Positron Emission Tomography (PET-CT)

Combines CT anatomy with functional biomarker info

Tumor detection, metabolic activity assessment

Growing use in veterinary research and clinical practice, limited by cost in some regions

Radiomics

Quantitative extraction from medical images, pattern analysis

Diagnosis and monitoring of conditions like bronchomalacia in dogs

AI-assisted CT image analysis enhances detection and staging

Artificial Intelligence (AI)

Automated image labeling, orientation correction, and image quality optimization

General imaging workflow enhancement, improved accuracy, and efficiency

Rapidly evolving; applicable across multiple modalities

Interventional Radiology

Minimally invasive procedures using imaging guidance

Chemoembolization, stent placement

One of the fastest-growing areas in veterinary medicine

Contrast Agents

New MRI and ultrasound contrast agents

Enhanced anatomical and functional imaging

MRI agents with reduced potency, ultrasound bubbles with extended persistence

3D Ultrasound Elastography

Measures tissue stiffness under compression/shear

Detection of tumors, fibrosis, and liver disease assessment

Non-invasive, functional assessment of soft tissue pathology

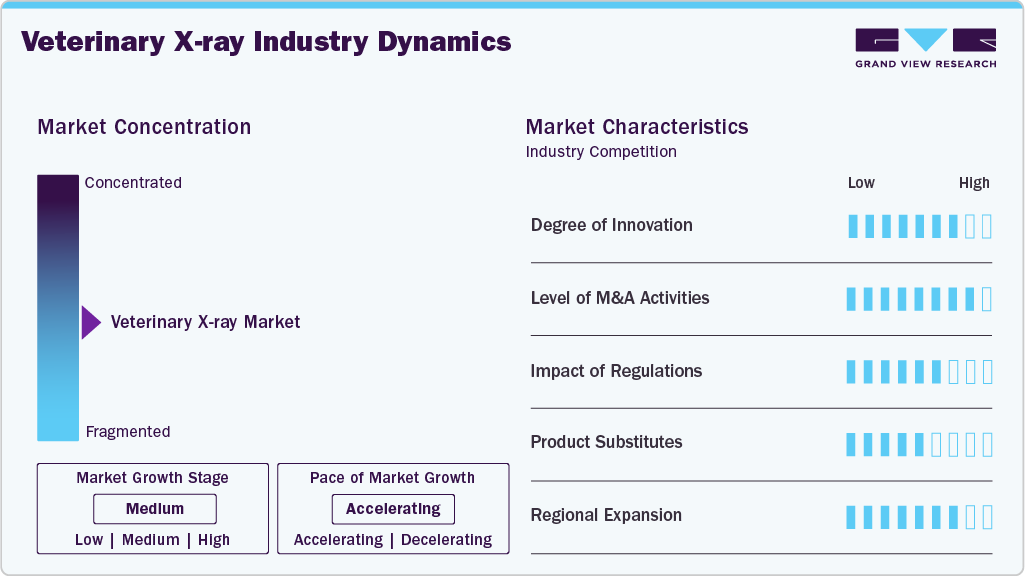

Market Concentration & Characteristics

The veterinary X-ray market is moderately concentrated, dominated by key players, such as IDEXX, Sound Technologies, and Carestream. These companies leverage advanced imaging technologies, robust distribution networks, and strategic partnerships, creating high entry barriers for smaller competitors while driving innovation and shaping global market standards.

The veterinary X-ray industry is witnessing significant innovation, with advancements in AI-assisted imaging, 3D imaging, digital radiography, and portable X-ray devices. Manufacturers are integrating cloud-based data storage, mobile accessibility, and enhanced diagnostic algorithms, improving accuracy and workflow efficiency. For instance, in January 2024, SignalPET launched SignalSTAT, an AI-powered veterinary X-ray solution that offers 24/7 rapid interpretation within 45 minutes, combining expert oversight with affordability.

Mergers and acquisitions are reshaping the market as key players consolidate to expand technological capabilities, geographic presence, and distribution networks. For instance, in October 2025, OR Technology Group acquired Ireland’s VetEquip Ltd., expanding its European presence, strengthening veterinary equipment and service offerings, and advancing its strategy to become a global leader in instant diagnostic imaging solutions.

Regulatory frameworks significantly influence the veterinary X-ray market. Guidelines on diagnostic accuracy, radiation safety, and imaging standards compel clinics to adopt compliant, high-quality X-ray systems. Pre-market approvals are not mandatory; however, manufacturers must ensure that devices are safe, properly labeled, and effective. These regulations drive demand for advanced, certified, and technologically reliable imaging solutions, promoting market growth.

Alternative diagnostic tools, such as ultrasound, MRI, CT scans, and handheld imaging devices, act as substitutes for traditional X-ray systems. Although these methods offer additional diagnostic insights, X-rays remain crucial due to their affordability, quick results, and user-friendliness. The existence of alternatives pushes manufacturers to be creative, leading to the development of hybrid solutions that combine various imaging features to maintain their market presence.

Regional expansion, such as in North America and Europe, is driven by advanced infrastructure. In contrast, emerging regions such as the Asia Pacific and Latin America offer growth potential due to rising pet ownership, increasing awareness, and investments in modern veterinary clinics. For instance, in January 2023, SignalPET expanded into Asia, starting with Singapore, and launched an R&D center in Israel, partnering with SAGE Healthcare to deliver AI-powered point-of-care radiology solutions across animal clinics globally.

Animal Insights

The small animals segment dominated the market, with the largest revenue share of 71.68% in 2024, and is projected to grow at the fastest CAGR over the forecast period. The segment’s growth is driven by the increasing prevalence of pet ownership and the rising demand for preventive and diagnostic healthcare. According to the American Pet Products Association (APPA) National Pet Owners Survey, it was reported that 94 million U.S. households own at least one pet. Additionally, animal clinics and hospitals prioritize advanced imaging solutions for pets, enabling the early detection of conditions such as fractures, tumors, and internal organ abnormalities.

The large animal segment, comprising cattle and other livestock, is the second-fastest-growing segment in the market, driven by increasing demand for livestock health management, rising awareness of early disease detection, and the adoption of advanced imaging technologies. Veterinary professionals are increasingly acquiring advanced X-ray systems, portable imaging technologies, and digital tools to effectively assess musculoskeletal, orthopedic, and internal health issues in large animals. Furthermore, regulations governing animal health and productivity in the agricultural sector are driving this adoption even more.

Solution Insights

The equipment segment held the largest share of the veterinary X-ray industry in 2024, driven by the growing adoption of advanced diagnostic technologies in animal practices. This segment encompasses digital radiography systems, portable X-ray units, and AI-integrated imaging devices, all designed to deliver high-quality diagnostic results quickly and accurately. In addition, animal clinics and hospitals are increasingly investing in modern X-ray equipment to enhance workflow, ensure better patient outcomes, and comply with evolving diagnostic standards across companion and livestock care.

The PACS segment is estimated to grow at the fastest CAGR over the time period. The increasing adoption of digital workflows and cloud-based data management solutions drives the segment’s growth. PACS enables veterinarians to securely store, retrieve, and share high-resolution X-ray images, improving diagnostic efficiency and collaboration among specialists. The system’s integration with AI tools and digital radiography enhances image analysis accuracy while reducing turnaround times. Moreover, growing demand for telemedicine, remote consultations, and seamless access to diagnostic data across multiple locations further accelerates its adoption.

Portability Insights

The fixed segment held the largest share of the veterinary X-ray market in 2024, driven by their superior image quality, stability, and suitability for high-volume animal hospitals and diagnostic centers. These systems are ideal for comprehensive imaging of small and large animals, offering advanced features such as higher power output, larger imaging fields, and integration with digital radiography and PACS systems.

The mobile segment is expected to witness the fastest growth over the forecast period, driven by the increasing demand for flexibility, portability, and on-site diagnostic capabilities. Mobile X-ray units enable veterinarians to perform imaging directly at farms, stables, or remote clinics, reducing animal stress and improving care efficiency. These systems are particularly beneficial for large animal practices, equine care, and emergency services requiring immediate diagnostics. In addition, technological advancements in lightweight design, battery performance, and wireless digital imaging have enhanced portability without compromising image quality. For instance, the Adaptix 3D Veterinary Imaging System delivers affordable, low-dose 3D imaging using Digital Tomosynthesis, providing cross-sectional views and enhanced diagnostic confidence without requiring a dedicated CT room or high operational costs.

Technology Insights

Computed radiography (CR) represented the largest segment in 2024, due to its cost-effectiveness, reliability, and ease of integration into existing clinical workflows. CR systems use reusable imaging plates and scanners to produce high-quality digital images, offering a practical balance between traditional film and advanced digital radiography. Their affordability and compatibility with existing X-ray infrastructure make them particularly attractive for small and mid-sized clinics. Furthermore, technological innovations are driving market growth. For instance, in November 2024, Fujifilm Healthcare Americas unveiled advanced imaging systems at the Radiological Society of North America (RSNA) Conference, including AI-powered MRI, next-generation ultrasound, digital radiography suites, and a compact fluoroscopy C-arm, all of which emphasize innovation, efficiency, and improved diagnostic workflows.

The direct (Capture) radiography (DR) is the fastest-growing segment in the veterinary X-ray market over the forecast period, owing to its superior image quality, instant image acquisition, and workflow efficiency. This technology eliminates the need for intermediate processing, allowing veterinarians to view and analyze images immediately,a capability not possible with computed radiography. Additionally, it enhances diagnostic precision and reduces patient stress by facilitating faster and more efficient procedures. Thus, growing demand for advanced, AI-compatible imaging systems and digital transformation across clinics further accelerates DR adoption.

Application Insights

The orthopedics and trauma segment accounted for the largest share of the veterinary X-ray industry in 2024, driven by the rising incidence of fractures, joint disorders, and musculoskeletal injuries in companion and large animals. X-ray imaging remains the gold standard for diagnosing bone fractures, arthritis, hip dysplasia, and post-surgical evaluations. The market is also witnessing growth in product launches and approvals. For instance, in November 2025, Adaptix received FDA 510(k) clearance for its Ortho350, a compact, mobile, low-dose 3D Digital Tomosynthesis system delivering fast, affordable orthopedic imaging for extremities, enhancing diagnostic accuracy and workflow efficiency.

The dentistry segment is expected to witness the fastest growth over the forecast period, driven by increasing awareness of the importance of oral health in relation to overall animal well-being. Dental diseases such as periodontal issues, tooth fractures, and infections are common in pets, necessitating accurate diagnostic imaging. Veterinary dental X-ray systems enable detailed visualization of tooth roots, bone structures, and hidden pathologies, improving treatment outcomes. For instance, in October 2025, Adaptix highlighted its VetSA3D system, which enables rapid 3D imaging of dental, orthopedic, and exotic conditions in under 30 seconds, thereby enhancing diagnostic accuracy, workflow efficiency, and space utilization in veterinary practices.

Type Insights

The digital segment dominated the market, accounting for the largest revenue share in 2024, and is expected to witness the fastest growth over the forecast period. This growth can be attributed to its high image quality, efficiency, and seamless integration with modern veterinary workflows. Digital radiography (DR) systems provide immediate image acquisition, reduced radiation exposure, and easy storage and sharing via PACS or cloud-based platforms, making them ideal for both small and large animal practices. In addition, increasing adoption of AI-assisted diagnostic tools, mobile digital units, and all-in-one digital X-ray suites further strengthens this segment.

The analog segment is expected to witness the second-fastest growth during the forecast period, particularly in cost-sensitive clinics and emerging regions. These systems are valued for their affordability, simplicity, and reliability, offering a practical solution for basic diagnostic imaging that requires minimal infrastructure investment. Analog X-rays are essential for practices that require low maintenance, minimal training, and established workflow compatibility. Moreover, animal clinics in rural or developing areas often prefer analog systems due to limited access to digital infrastructure or high upfront costs.

End Use Insights

The veterinary clinics and hospitals represented the largest segment in 2024 and is also expected to grow at the fastest CAGR over the period. The segment’s growth is driven by increasing pet ownership, rising demand for preventive and diagnostic care, and the need for advanced imaging solutions. These facilities require reliable X-ray systems for routine diagnostics, orthopedic assessments, dental imaging, and emergency care. In addition, adoption of digital radiography, mobile X-ray units, and PACS-integrated solutions enhances workflow efficiency, diagnostic accuracy, and patient throughput. Clinics and hospitals are investing in modern imaging infrastructure to improve service quality, comply with evolving standards, and meet client expectations.

The other end-use segment, comprising rescue centers, reference laboratories, academic institutions, and research facilities, is the fastest-growing in the veterinary X-ray market. Rising demand for specialized imaging in wildlife rehabilitation, laboratory diagnostics, and veterinary education is driving the adoption of advanced X-ray systems. Additionally, portable and mobile digital X-ray units, combined with AI-assisted interpretation and cloud-based image management, facilitate flexible and efficient workflows across diverse locations. Furthermore, academic and research institutions increasingly leverage imaging for training, case studies, and experimental research, whereas rescue centers require rapid diagnostics for emergency care.

Regional Insights

North America dominated the veterinary X-ray market with the largest revenue share of 46.36% in 2024, driven by the rising pet ownership, increased spending on companion animal healthcare, and growing demand for advanced diagnostic imaging in clinics and hospitals. The market is witnessing innovations such as digital radiography, portable X-ray systems, and AI-based imaging that enhance diagnostic accuracy and workflow efficiency.

Regulatory oversight by bodies such as the FDA and Health Canada ensures the safety and quality compliance of equipment. According to the USFDA report of March 2025, the FDA defined animal devices broadly, including instruments such as X-ray equipment, but does not require pre-market approval, registration, or post-market reporting for animal-only devices. Manufacturers would be responsible for safety, effectiveness, and labeling, allowing veterinary X-ray companies flexibility in product deployment while ensuring compliance with basic safety standards.

U.S. Veterinary X-ray Market Trends

The U.S. veterinary X-ray industry accounted for the highest share of North America in 2024, owing to increased spending on companion animal healthcare, upgradation of technologies in clinics and hospitals, and growth of specialties (orthopedics, trauma, dental, and oncology) in veterinary practice. The equipment is marketed by major vendors, such as IDEXX, which primarily focus on small animals rather than large animals. Some of the advancements, such as those for May 2025, include the installation of a linear accelerator and photon-counting CT scanner at Cornell University Hospital for Animals, which emits X-ray photons to advance diagnostic and therapeutic precision in animal care.

The Canada Veterinary X-ray market is expected to grow at a significant CAGR during the forecast period. The region is undergoing transformation due to the rising demand for advanced diagnostics in companion and large-animal care, as well as the increasing adoption of digital radiography and portable imaging systems. The shift from analog to digital and integration with PACS software enhances workflow efficiency and diagnostic accuracy. The regulations for X-rays are established by Health Canada’s Radiation Emitting Devices (RED) regulations, which ensure safety, proper labeling, and compliance with national radiation standards.

Europe Veterinary X-ray Market Trends

The Europe veterinary X-ray industry is expanding rapidly, supported by technology upgrades and digital conversion, rising animal-welfare standards and regulations, and growing demand for advanced imaging. Unlike human medical devices, which are regulated under the EU MDR 2017/745, veterinary devices currently lack a dedicated European regulatory framework, creating variability and compliance challenges across member states. Moreover, equipment suppliers (often human-imaging OEMs) are entering the veterinary segment through partnerships or dedicated veterinary channels. For instance, in September 2024, Veterio Clinic in Warsaw installed advanced imaging systems from United Imaging, becoming Central Europe’s first veterinary facility to adopt advanced diagnostic technology, setting new standards in animal healthcare.

The veterinary X-ray market in the UK is expected to grow significantly over the forecast period. The market is expanding rapidly due to an increasing network of referral hospitals and a growing demand for high-resolution digital imaging to support advanced diagnostics. Increasing focus on animal welfare and early disease detection has boosted investments in portable and 3D imaging systems. In addition, in October 2025, Adaptix Ltd demonstrated its VetSA3D system, a compact 3D X-ray solution enabling rapid, high-quality dental, orthopaedic, and exotic imaging in under 30 seconds, enhancing diagnostic accuracy, workflow efficiency, and clinic affordability. The market is led by players such as Siemens Healthineers, IMV Imaging, FUJIFILM, and Adaptix, with emerging innovations, including helium-free MRI and compact 3D X-ray solutions, transforming workflows.

The Germany veterinary X-ray market held a significant revenue share in 2024. The market is expanding rapidly, supported by a shift from analog to digital radiography and a growing demand for portable X-ray systems, which are accelerating diagnostics in both companion and large-animal care. The X-ray devices are governed by Germany’s Radiation Protection Act (Strahlenschutzgesetz) and EU directives, ensuring strict compliance in equipment use, operator safety, and facility licensing. In addition, innovations are driving the market growth. For instance, in February 2025, GIERTH X-Ray installed its combiVet S system, featuring the HF 400M and CANON CXDI-702C digital detector, at Grüne Aue small animal practice, thereby enhancing diagnostic efficiency.

Asia Pacific Veterinary X-ray Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's market is expanding due to factors such as the growth of livestock industries and increasing awareness of animal healthcare. Countries such as Japan, Australia, and South Korea enforce strict radiation and device safety standards, whereas emerging markets often have less formal oversight, requiring companies to navigate diverse compliance requirements. The market is rapidly evolving, driven by digital innovation and AI integration. For instance, in June 2024, SK Telecom launched its AI-powered X Caliber veterinary X-ray service in Australia, enabling rapid 15-second image analysis, cloud storage, mobile access, and easy upgrades, advancing diagnostic efficiency in companion animal care.

The veterinary X-ray market in Japan held a significant revenue share in 2024 and is witnessing new growth opportunities due to rising expenditures on companion animal healthcare and a growing emphasis on early disease detection. Adoption of digital radiography, portable X-ray units, and AI-assisted imaging systems enhances diagnostic accuracy and workflow efficiency in both small- and large-animal practices. Additionally, the Japanese Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceuticals and Medical Devices Agency (PMDA) ensure strict compliance with radiation safety standards, device registration requirements, and quality standards.

The market for veterinary X-ray in India is expected to witness growth, driven by the expansion of the livestock and dairy sectors, increasing veterinary awareness, and the growing adoption of portable and digital radiography systems for both companion and large animals. Some of the advancements highlighted the demand for on-site diagnostics and emergency care. For instance, in March 2025, mobile X-ray solutions of Samast Mahajan’s fully equipped animal ambulances. The Central Drugs Standard Control Organization (CDSCO) and the Atomic Energy Regulatory Board (AERB) ensure safety and compliance for radiation-emitting devices, including veterinary x-ray devices.

Latin America Veterinary X-ray Market Trends

The Latin America veterinary X-ray industry is poised by rising disposable income and pet care spending, technological awareness and training, and government initiatives in animal health. The region is advancing due to the adoption of digital radiography, portable X-ray units, and AI-assisted imaging, particularly in Brazil, Mexico, and Argentina, where veterinary infrastructure is growing. Some of the players, such as IDEXX, Canon Medical, FUJIFILM, and Siemens Healthineers providing cost-effective, portable, and service-supported imaging solutions for both companion and large-animal practices.

The Brazil Veterinary X-ray market is gaining momentum, driven by government livestock health programs, technological adoption and training, and rising veterinary specialty and referral clinics. For instance, in April 2025, Mindray highlighted its Device+IT+AI ecosystem in Brazil, integrating smart diagnostic tools, AI-assisted imaging, and hospital-wide connectivity to enhance efficiency, accuracy, and data-driven veterinary and medical care.

Middle East & Africa Veterinary X-ray Market Trends

The Middle East and Africa (MEA) veterinary X-ray industry is witnessing growth, driven by rising pet ownership, increasing demand for preventive animal healthcare, and expanding veterinary infrastructure in urban centers. The adoption of digital radiography, portable X-ray units, and AI-assisted imaging solutions is accelerating, particularly in countries such as the UAE, Saudi Arabia, South Africa, and Egypt. In addition, regulatory frameworks vary widely across the region, with some countries enforcing stringent radiation safety and device registration requirements. In contrast, others have less formal oversight, requiring companies to navigate diverse compliance landscapes.

South Africa veterinary X-ray market held the largest revenue shareand is expanding, fueled by increasing livestock and equine healthcare needs, as well as the rising demand for advanced diagnostics. The adoption of digital radiography, portable X-ray systems, and AI-assisted imaging enhances diagnostic accuracy, workflow efficiency, and mobile services, particularly in rural and farm-based settings. Regulatory oversight is governed by the South African Health Products Regulatory Authority (SAHPRA) and the National Department of Health, which enforce device registration, radiation safety, and quality standards.

The veterinary X-ray market in Saudi Arabia is expected to grow, driven by a focus on preventive care and early diagnosis, as well as the expansion of specialty clinics and hospitals in the country. The adoption of digital radiography, portable X-ray units, and artificial intelligence imaging enhances diagnostic accuracy, workflow efficiency, and mobile services, particularly in urban and farm-based settings.

Key Veterinary X-ray Company Insights

Key players in the market include IDEXX Laboratories, Canon Medical, FUJIFILM, Siemens Healthineers, Mindray, Adaptix, and DRGEM. Market share is dominated by global leaders offering digital, portable, and AI-assisted solutions. At the same time, regional vendors capture niche segments with cost-effective, service-supported imaging systems for companion and large-animal practices. For instance, in May 2024, SK Telecom launched its AI-powered X Caliber veterinary X-ray service in Australia and Indonesia, enabling 15-second cloud-based analysis with high sensitivity, enhancing diagnostic speed, accuracy, and accessibility for companion animals.

Key Veterinary X-ray Companies:

The following are the leading companies in the veterinary X-ray market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories, Inc.

- Mars, Inc.

- Narang Medical Ltd.

- FUJIFILM Holdings Corporation

- Carestream Health

- Mindray Bio-Medical Electronics Co., Ltd.

- Midmark Corporation

- Canon Medical Systems Corporation

- Agfa-Gevaert Group

- SEDECAL

Recent Developments

-

In November 2025,Goa’s Sonsoddo veterinary hospital will launch X-ray and sonography services, enhancing animal diagnostics and healthcare access in South Goa, addressing regional service gaps, and supporting preventive veterinary care.

-

In March 2024,IMV Imaging and Asto CT formed a strategic partnership to integrate ultrasound, X-ray, CT, and MRI solutions, enhancing veterinary imaging for small animals, equines, and farm animals globally.

-

In June 2024, Adaptix partnered with Televere Systems to launch its 3D Small Animal Imaging System in the U.S., offering advanced dental, orthopedic, and exotic imaging, improving diagnostic precision and practice efficiency.

Veterinary X-ray Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 787.0 million

Revenue forecast in 2033

USD 1,315.5 million

Growth rate

CAGR of 6.63% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, solution, technology, type, portability, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

IDEXX Laboratories, Inc.; Mars, Inc.; Narang Medical Ltd.; FUJIFILM Holdings Corporation; Carestream Health; Mindray Bio-Medical Electronics Co., Ltd.; Midmark Corporation; Canon Medical Systems Corporation; Agfa-Gevaert Group; SEDECAL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary X-ray Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Veterinary X-ray market report based on solution, portability, technology, type, application, end use, and region:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Animals

-

Large Animals

-

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Accessories/ Consumables

-

PACS

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct (Capture) Radiography

-

Computed Radiography

-

Film-based Radiography

-

-

Portability Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed

-

Mobile

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Digital

-

Analog

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Orthopedics and Trauma

-

Respiratory

-

Gastrointestinal

-

Dentistry

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Clinics & Hospitals

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary X-ray market size was estimated at USD 742.4 million in 2024 and is expected to reach USD 787.0 million in 2025.

b. The global veterinary X-ray market is expected to grow at a compound annual growth rate of 6.63% from 2025 to 2033 to reach USD 1,315.5 million by 2033.

b. North America dominated the veterinary X-ray market with a share of 46.36% in 2024. This is attributable to growing pet ownership, implementing strategic initiatives by the key manufacturers, and the increasing disease burden in animals.

b. Some key players operating in the veterinary X-ray market include IDEXX Laboratories, Inc.; Mars, Inc.; Narang Medical Ltd.; FUJIFILM Holdings Corporation; Carestream Health; Mindray Bio-Medical Electronics Co., Ltd.; Midmark Corporation; Canon Medical Systems Corporation; Agfa-Gevaert Group; SEDECAL

b. Key factors that are driving the veterinary X-ray market growth include the Increasing prevalence of zoonotic diseases, rising demand for imaging devices, rapid technological advancements, and a supportive regulatory environment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.