- Home

- »

- Alcohol & Tobacco

- »

-

Wine Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Wine Market Size, Share & Trends Report]()

Wine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Table Wine, Dessert Wine, And Sparkling Wine), By Distribution Channel (On-Trade And Off-Trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-353-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wine Market Summary

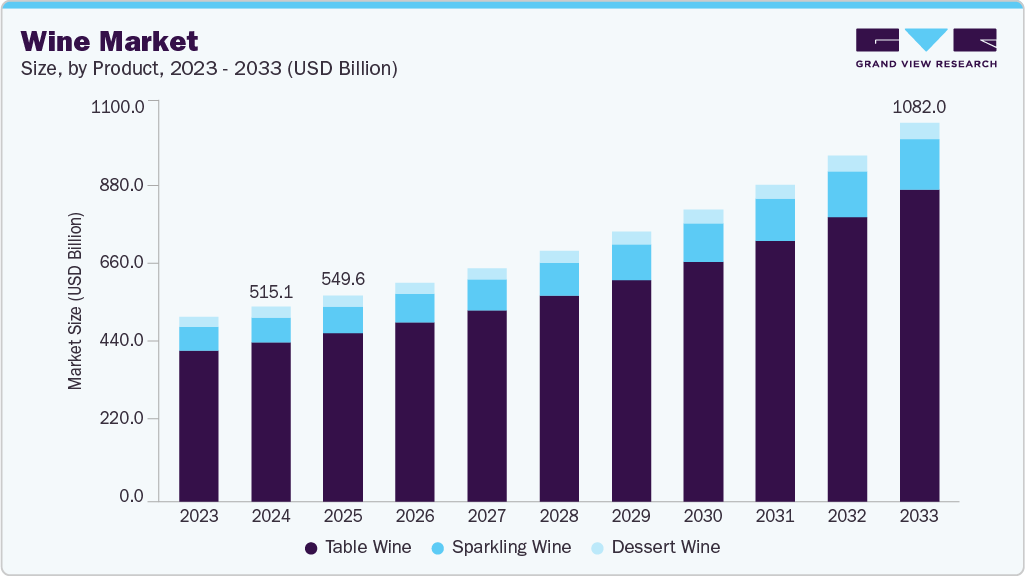

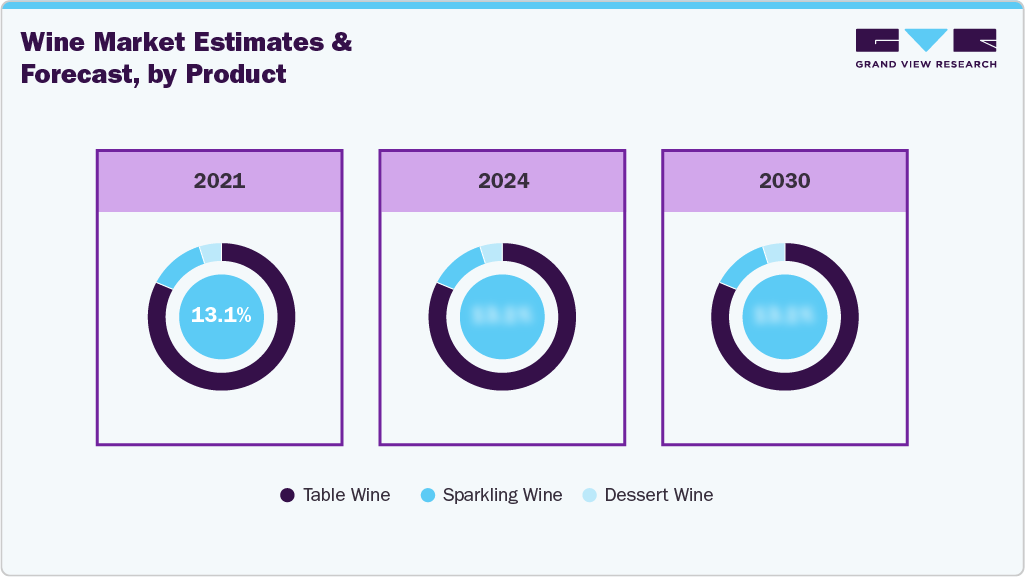

The global wine market size was estimated at USD 515.13 billion in 2024 and is projected to reach USD 1,082.05 billion by 2033, growing at a CAGR of 8.8% from 2025 to 2033. The market growth is attributed to the increasing popularity of premium and super-premium wines, particularly among younger consumers in emerging markets.

Key Market Trends & Insights

- By region, Europe led the wine market with a share of 44.9% in 2024.

- By product, table wine led the market and accounted for a share of 81.8% in 2024.

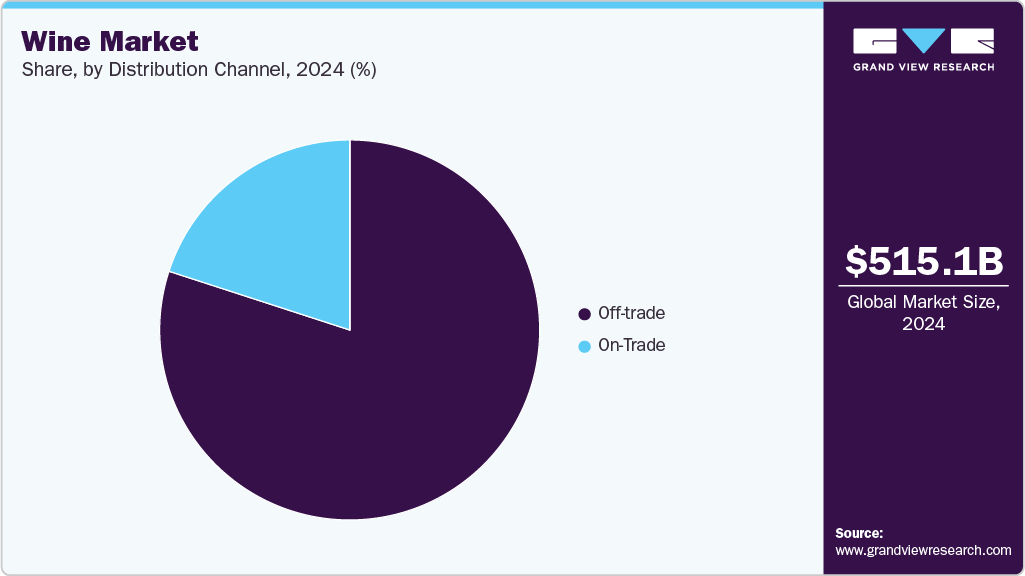

- By distribution channel, the off-trade segment led the market and accounted for a share of 77.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 515.13 Billion

- 2033 Projected Market Size: USD 1,082.05 Billion

- CAGR (2025-2033): 8.8%

- Europe: Largest market in 2024

These consumers are seeking higher-quality, more sophisticated wines and are willing to pay a premium for them. Another significant trend is the growing demand for sustainable and organically produced wines, reflecting a broader consumer focus on environmental consciousness and health. Rosé wine continues its upward trajectory, driven by its refreshing character and versatility, making it a popular choice across various occasions. Furthermore, e-commerce and online wine subscriptions are rapidly expanding, creating new avenues for wine producers to reach consumers directly and personalize their offerings.The expanding middle class in emerging economies, particularly in the Asia-Pacific, is contributing significantly to increased wine consumption. Rising disposable incomes allow more people to explore and enjoy wine as a lifestyle choice. Increased tourism and globalization also play a role, exposing individuals to different wine cultures and varieties. In addition, the perception of wine as a sophisticated and health-conscious beverage is fueling its demand, particularly when consumed in moderation. Finally, strategic marketing and promotional efforts by wine producers, focusing on education and storytelling, are effectively attracting new consumers and solidifying the loyalty of existing ones.

Emerging markets, particularly in Asia Pacific, are also contributing to the growth of the wine industry. Countries such as China, India, and South Korea are seeing increased wine consumption due to rising disposable incomes, urbanization, and greater exposure to Western drinking habits. At the same time, sustainability and environmental consciousness are shaping purchasing decisions, leading to a higher demand for organic, natural, and sustainably produced wines. Wineries adopting eco-friendly practices, such as organic farming, recyclable packaging, and renewable energy use, are gaining favor among environmentally conscious consumers.

There has been an increase in preference for sparkling wines. American wine preferences reflect a strong inclination toward smoother and fruitier wines, which suggests a widespread appreciation for balanced and approachable flavors. Semi-sweet and sweet wines also enjoy notable popularity, indicating a preference for wines with a touch of sweetness that appeal to a broad audience. Meanwhile, dry and savory wines maintain a steady following, likely catering to those who appreciate more structured and complex profiles. Tannic wines, which have a bold and intense character, appear to have a more niche appeal. These preferences highlight the diverse palates of American consumers and the evolving trends shaping the wine market.

Innovation in wine varieties and packaging formats is further driving demand. The market has seen a rise in sparkling wines, fruit-infused wines, and alternative packaging options such as canned wine, boxed wine, and single-serve bottles. This diversification appeals to a broader audience, making wine consumption more convenient and adaptable to different lifestyles. Wine tourism has also become a major growth driver, with destinations such as France, Italy, Spain, the U.S., and Australia attracting visitors eager for immersive vineyard experiences. These experiences not only boost local economies but also encourage global wine sales as travelers bring back their newly discovered favorites.

Consumer Insights

Over the years, the global vineyard landscape has undergone significant evolution, driven by increasing demand for wine across various regions. As wine consumption continues to rise, particularly in emerging markets, vineyard expansion has become necessary to meet the growing demand. Many countries with a deep-rooted winemaking tradition, such as France, Italy, and Spain, continue to dominate the global vineyard area. Meanwhile, regions such as the United States, Argentina, Australia, and China have also expanded their vineyard plantations to cater to both domestic and international markets. Some of the world's most renowned vineyards include Château Margaux in France, Bodega Catena Zapata in Argentina, Penfolds Magill Estate in Australia, and Napa Valley's Opus One in the U.S. These vineyards, known for their high-quality production, reflect the ongoing expansion and adaptation of the global wine industry to evolving consumer preferences and market trends.

Wine has recently gained traction and is one of the fastest-growing beverages in the market, especially in the U.S. and the UK. With the rapid expansion of social media, winemakers are continuously adopting and integrating social media to market wines. The wine market is transforming owing to technological innovations. However, consumers between the ages of 18 and 27 prefer beer over wine, owing to which winemakers are using social media to increase their market presence and audience. Tourism and travel have also led to an increase in demand for locally manufactured wines. Chile and Italy are very well known for their wines and consumers travel to these countries for their food and wines. Another trend is the adoption of canned wine, which has been on the market for the past five years.

Europe is the most established wine market, with most of Europe’s wine production concentrated in the southern part of the region, where consumers prefer local wine over foreign wine. However, countries such as the UK, the Netherlands, Austria, Germany, and Belgium can offer significant growth opportunities for the wine market. These countries have insufficient domestic wine production, and the consumers are more open to foreign wines. The Eastern European wine market is relatively small, but wine consumption in this part of the region is increasing and also providing further growth opportunities for wine producers. This is expected to drive market growth in Europe in the coming years. However, European wine consumption has been experiencing a decline over the past few years. This trend is influenced by factors such as changing consumer preferences, economic conditions, and health awareness. Major wine-consuming countries such as France, Italy, and Germany have seen decreases in per capita consumption. Despite this, there is a growing interest in premium and sustainable wines, which has helped maintain some stability in the market.

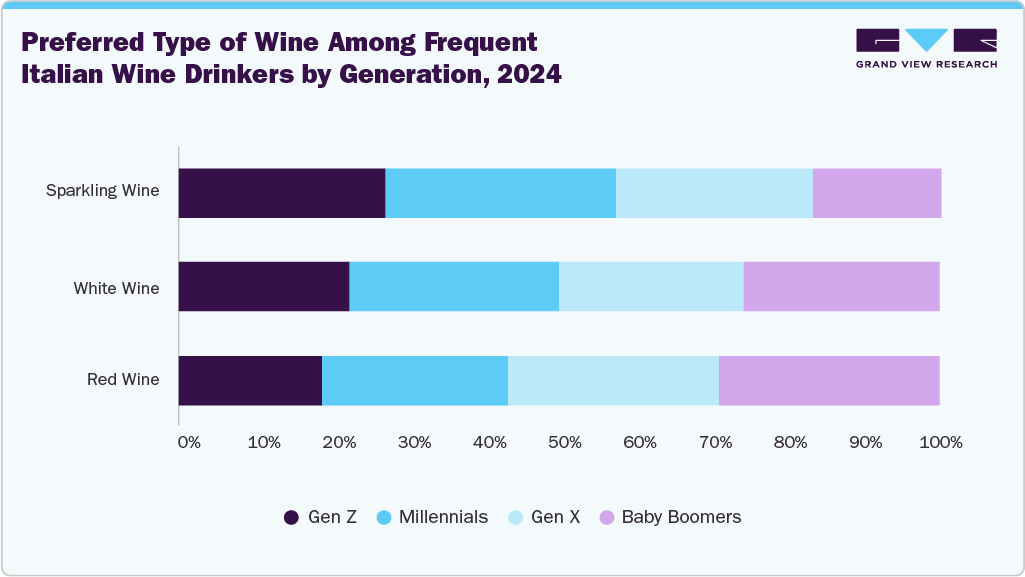

As per the report published by Amfori in 2020, Italy is one of the world’s most ancient winemaking countries. The country boasts an enormous wealth of expertise, diversity (more than 2,000 varieties and vintages of grapes), and some of the finest wines in the entire world.There is a preference for different types of wine among frequent Italian wine drinkers that varies across generations, reflecting distinct tastes and consumption habits. Younger generations, especially Gen Z and Millennials, favor sparkling wines for social occasions, while Millennials and Gen X show strong interest in white wine for its versatility. Red wine remains a classic choice, particularly among Baby Boomers, who appreciate its depth and tradition. These preferences reflect the evolving wine culture in Italy, blending heritage with modern trends.

Product Insights

Table wine segment held the largest market share of more than 81.8% in 2024. The market for table wine is increasing due to rising consumer preference for casual and affordable wine options for everyday consumption. Growing wine culture, particularly among millennials and young adults, along with increased social drinking occasions, has driven demand. Moreover, the expansion of online wine retail, improved accessibility, and the popularity of food and wine pairings have contributed to market growth. The trend toward organic and sustainably produced wines is also attracting health-conscious consumers, further fueling demand.

The sparkling wine segment is projected to register the fastest CAGR of 9.1% from 2025 to 2033. The market for sparkling wine is increasing due to rising consumer preference for celebratory and casual drinking occasions. Growing demand for premium and diverse sparkling wine varieties, including Prosecco, Champagne, and Cava, has expanded the market. Additionally, younger consumers are embracing sparkling wine for its refreshing taste and lower alcohol content. The rise of e-commerce and direct-to-consumer sales has further boosted accessibility, while the trend toward food pairings and mixology has increased its appeal in the hospitality sector.

Distribution Channel Insights

The off-trade segment led the market in 2024 and accounted for the largest revenue share of 77.9%. The off-trade distribution channel of wine includes retail outlets, supermarkets, and hypermarkets. With the ongoing pandemic, the off-trade distribution channel of wine has seen more growth as compared to the on-trade channel. The lockdown propelled the demand for off-trade sales of wine.The U.S. off-trade spirits market experienced a decline in sales, with a 4.7% drop in the year leading up to November 2023, according to data from the Wine & Spirits Wholesalers of America (WSWA) via their SipSource tool. This decline followed an uptick in sales during October, indicating some volatility in consumer purchasing patterns. The downturn in spirits sales was part of a broader trend, with wine sales experiencing an even sharper decline of 8.7% over the same period.

The on-trade delivery channel is expected to account for the fastest CAGR of 9.7% from 2025 to 2033. The on-trade distribution channel includes outlets such as clubs, hotels, bars, restaurants, and coffee shops. The COVID-19 pandemic drastically affected the growth of this segment, owing to the shutting down of these aforementioned outlets and international tourism came to a standstill caused by the strict lockdown measures across the world. According to a report from mixer producer Fentimans, the first lockdown in the UK led to a loss of USD 14.5 billion in on-trade drinks sales in six months. Nevertheless, by category, wine in the UK was least exposed to on-trade closures as over 85% of wine consumption is at home, as per an article by IWSR Drinks Market Analysis.

Regional Insights

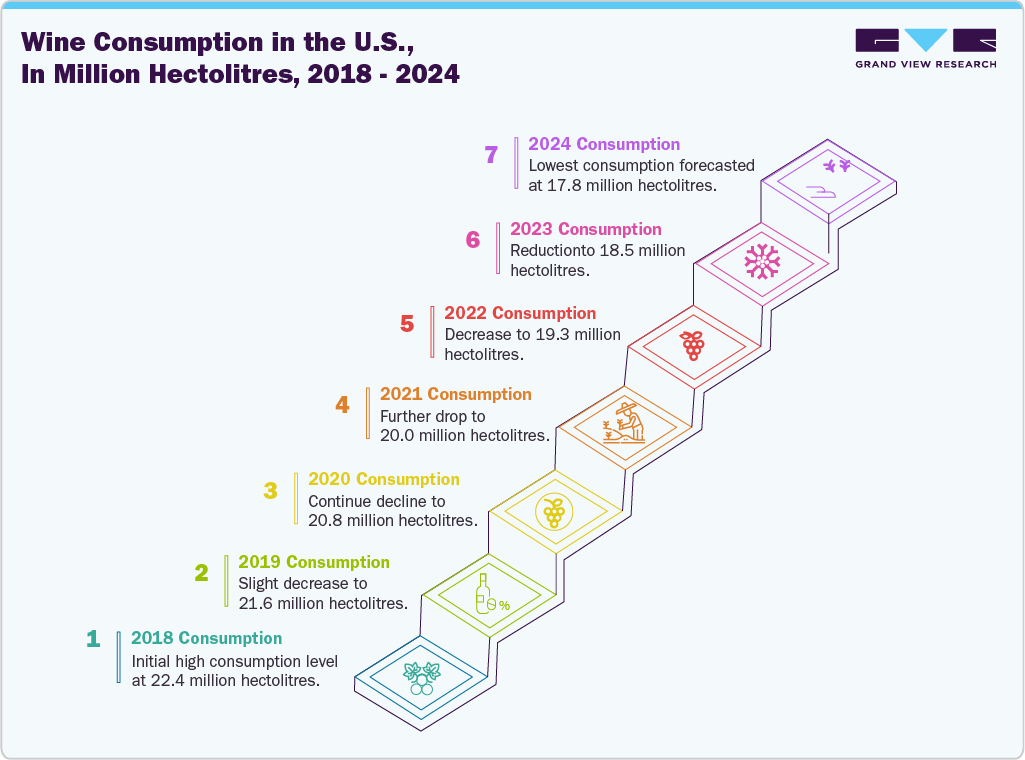

The North America wine market is expected to grow at a CAGR of 8.9% from 2025 to 2033. The wine market in the Americas has exhibited a diverse range of trends. In the U.S., per capita wine consumption has declined, decreasing from a peak of 3.16 gallons in 2021 to 2.68 gallons in 2023, marking a 15% reduction. This decline is partly attributed to changing preferences among younger generations, with Gen Z reducing alcohol spending by 15% in January 2025 compared to 2023. Conversely, Mexico has experienced a significant increase in wine consumption, with domestic wine's market share rising from 10% to 34% over the past two decades. In addition, between 2021 and 2023, white wine consumption in Mexico grew from 16% to 18%, reflecting a growing appreciation for wine among Mexican consumers.

U.S. Wine Market Trends

The winemarket in the U.S. is expected to grow at a CAGR of 8.8% from 2025 to 2033. Wine sales have surged across the U.S. owing to innovation in its flavor, color, and packaging. Beyond the classic wines, niche markets and emerging wine regions are gaining prominence. Regions such as the Willamette Valley, located in Oregon, the Finger Lakes, located in New York, Santa Rita Hills, located in California, and the Columbia Valley are carving out niches with their distinct offerings. Indigenous grape varieties, innovative winemaking techniques, and unique terroirs are captivating adventurous palates.

Europe Wine Market Trends

The Europe wine market accounted for a revenue share of 44.9% of the global revenue in 2024. Europe is the most established wine market, with several countries, such as Portugal, Italy, and France, having the highest per capita wine consumption per year.EU member states consumed 107 million hectoliters of wine in 2023, accounting for 48% of global wine consumption. This figure represents a marginal decrease of 1.8% compared to 2022 and is more than 5% below the ten-year average. Countries such as Germany and the UK are the biggest importers of wine, where wine production is much lower than its consumption.

The wine market in France is expected to develop at the fastest CAGR of 8.4% during the projected period. A large majority of French wine consumers also associate wine with values of tradition and sophistication, and consume a familiar drink. Increasingly, consumers also associate wine with relaxing occasions and see the drink as refreshing. These factors are expected to create an optimistic outlook for the France wine market in the upcoming years. Wine tourism in France is currently experiencing considerable growth. An increasing number of wine tourism enthusiasts are exploring the rich wine-growing heritage of France, traveling through outstanding landscapes, learning about the timeless know-how safeguarded by passionate winegrowers, and enjoying a host of new tastes.

Asia Pacific Wine Market Trends

The wine market in Asia Pacific is expected to grow at the fastest CAGR of 10.5% from 2025 to 2033. Asia Pacific is the third-largest market for wine consumption in terms of volume, driven primarily by China, Japan, and South Korea. The region offers significant potential due to its large customer base, rising disposable incomes, and favorable climatic conditions for wine cultivation, especially in China. Non-grape wine is experiencing wide penetration in all major markets of Asia Pacific. The popularity of wine is growing among female consumers in Asia Pacific. According to the U.S. Bureau of Labor Statistics, as of January 2021, slightly more than 4.3 million Asian women were employed. The growing number of women in the workforce and the resultant higher discretionary spending are contributing to the rising demand for premium wine.

India wine market is projected to grow at a CAGR of 14.7% over the forecast period. The large young population, increasing urbanization, and the perception of wine as a ‘status symbol are factors expected to drive the market in India. The growing acceptance and preference for wine among the upper and middle classes is also providing a boost to the market.The largest exporters of wine to India are Australia, Spain, France, and Italy, which together contribute to almost 75% of the country’s wine imports. Secondary exporters include Chile, South Africa, and Argentina. The European Union previously supplied over half of India’s wine imports, but over the past two years, Australia has surpassed Europe through more competitive prices and lower logistical costs.

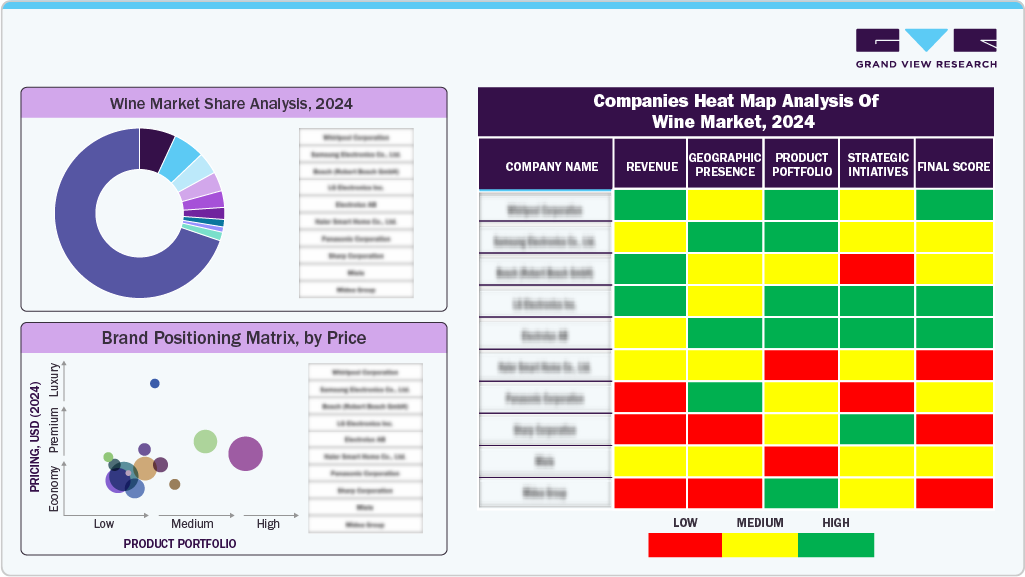

Key Wine Company Insights

The market is fragmented, with several global and regional competitors present. These companies are investing heavily in acquisitions and promotions to grow their client base and brand loyalty. Furthermore, these firms are leveraging emerging technologies such as blockchain and artificial intelligence to improve consumer experience and streamline supply chain activities.

Key Wine Companies:

The following are the leading companies in the wine market. These companies collectively hold the largest Market share and dictate industry trends.

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- The Wine Group

- Treasury Wine Estates

- Concha Y Toro

- Castel Freres

- Accolade Wines

- Pernod Ricard

- Asahi Group Holdings, Ltd

- Beijing Yanjing Beer Group Co.

Recent Developments

-

In January 2025, Alliance Wine launched its first comprehensive Burgundy En Primeur campaign, integrating wines from the newly acquired H2Vin portfolio. This campaign features nearly 350 wines from over 30 top Burgundy producers, showcasing the combined strength and depth of the two businesses. The campaign is part of a broader trend in the wine trade, with other companies such as Thorman Hunt and Flint Wines also launching their own primeur offerings around the same time.

-

In June 2024, Searcys, Great Britain's oldest caterer, launched a new English Sparkling Wine. The new vintage was harvested in 2016, bottled in 2017, and aged on lees for over six and a half years. Produced by Surrey's Greyfriars vineyard, it features vibrant apple and citrus flavors with toasty aromas.

-

In May 2023, Sixty Vines, a restaurant known for its wine-on-tap experience, partnered with Ridge Vineyards to bring the winery’s iconic wines to taps across the U.S. This collaboration marks Ridge Vineyards’ first venture into wine-on-tap service, making their premium wines more accessible and sustainable by reducing bottle waste. The partnership aligns with growing consumer demand for high-quality, eco-friendly wine experiences while enhancing Sixty Vines' commitment to sustainability and innovation in wine service.

-

In June 2023, London-based, female-led wine startup NICE announced the launch of its first canned sparkling white wine. This 10% ABV Spanish Airén from La Mancha offers dry, crisp, and sparkling notes packaged in a 200ml can. The product joins NICE's existing lineup of canned wines, including Sauvignon Blanc, Pale Rosé, and Malbec. The introduction responds to the growing consumer demand for convenient, high-quality sparkling wines, with miniature cans experiencing a 17% year-on-year growth compared to 8% for miniature bottles.

Wine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 549.64 billion

Revenue forecast in 2033

USD 1,082.05 billion

Growth rate

CAGR of 8.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Brazil; Argentina; and South Africa

Key companies profiled

E. & J. Gallo Winery; Constellation Brands, Inc.; The Wine Group; Treasury Wine Estates; Concha Y Toro; Castel Freres; Accolade Wines; Pernod Ricard; Asahi Group Holdings, Ltd; Beijing Yanjing Beer Group Co.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Wine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global wine market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Table Wine

-

Dessert Wine

-

Sparkling Wine

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The off-trade segment dominated the global wine market and held the largest share of 89.0% in 2024.

b. Europe dominated the wine market with a share of 44.90% in 2024. Disposable income and tourism levels significantly influence wine consumption, particularly in key markets like France, Italy, and the U.K. Demographic shifts, such as the aging population, also play a role, as older consumers tend to have higher wine consumption rates. Furthermore, advancements in e-commerce and online wine retailers have increased accessibility and convenience, expanding the market reach to new consumer segments.

b. The global wine market was estimated at USD 515.13 billion in 2024 and is expected to reach USD 549.65 billion in 2025.

b. The global wine market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2033 to reach USD 1,082.05 billion by 2033.

b. Some of the key market players in the wine market are E. & J. Gallo Winery; Constellation Brands, Inc.; The Wine Group; Treasury Wine Estates; Concha Y Toro; Castel Freres; Accolade Wines; Pernod Ricard; Asahi Group Holdings, Ltd; Beijing Yanjing Beer Group Co.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.