- Home

- »

- Electronic Devices

- »

-

Wireless Audio Devices Market Size, Industry Report, 2033GVR Report cover

![Wireless Audio Devices Market Size, Share, & Trend Report]()

Wireless Audio Devices Market (2025 - 2033) Size, Share, & Trend Analysis By Product (Earphone, Headphone), By Functionality, By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-117-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wireless Audio DevicesMarket Summary

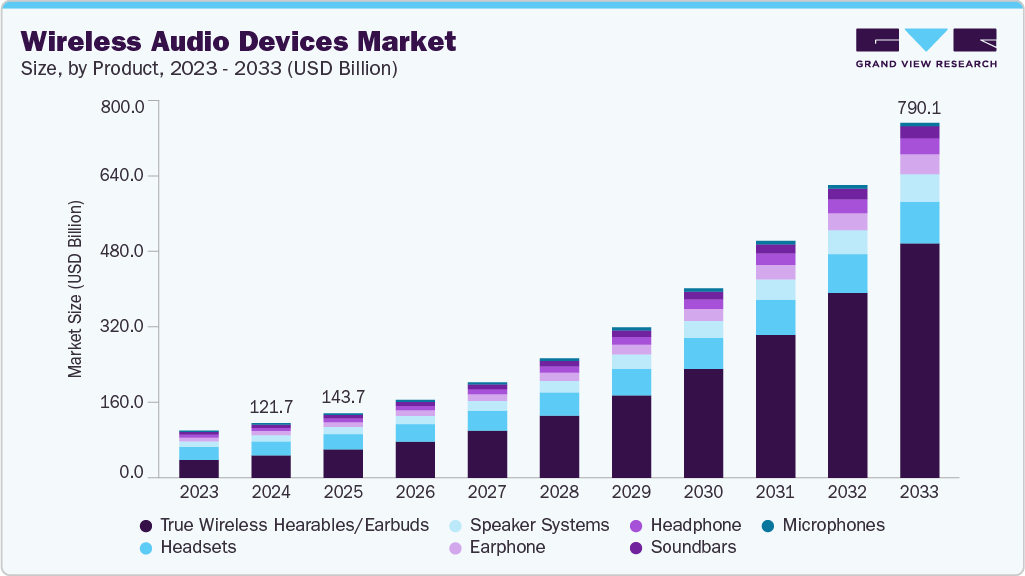

The global wireless audio devices market size was estimated at USD 121.67 billion in 2024 and is projected to reach USD 790.05 billion by 2033, growing at a CAGR of 23.7% from 2025 to 2033, due to the rising demand for portable and convenient audio solutions, the rapid adoption of audio streaming services, and the explosive growth of mobile and online gaming. Advancements in Bluetooth technology, active noise cancellation, and battery efficiency enhance product performance, while increased integration with smart devices and voice assistants improves usability.

Key Market Trends & Insights

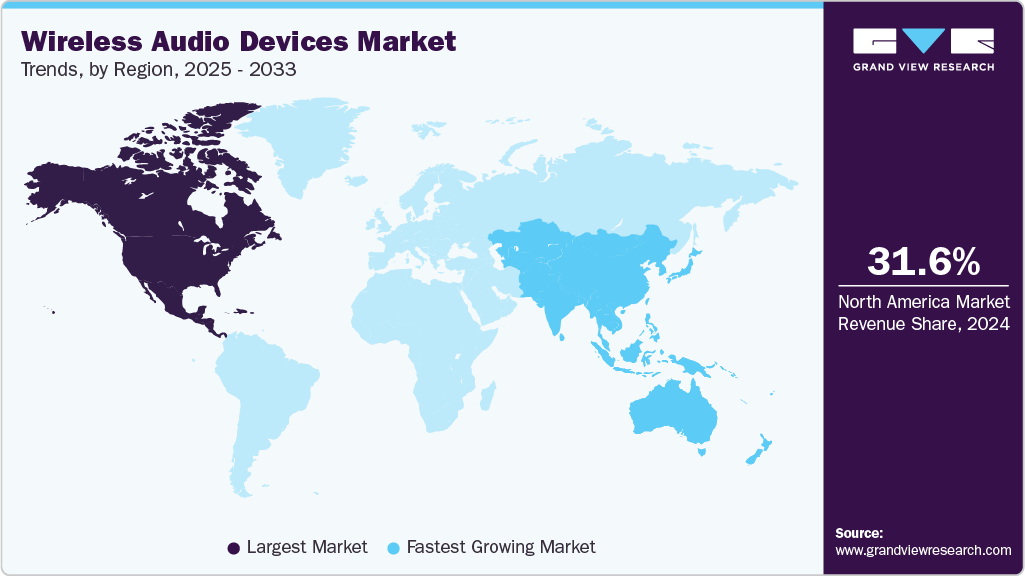

- North America dominated the global wireless audio devices market with the largest revenue share of 31.6% in 2024.

- The wireless audio devices market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, true wireless hearables/earbuds led the market and held the largest revenue share of 41.2% in 2024.

- By technology, the bluetooth segment held the dominant position in the market and accounted for the largest revenue share in 2024.

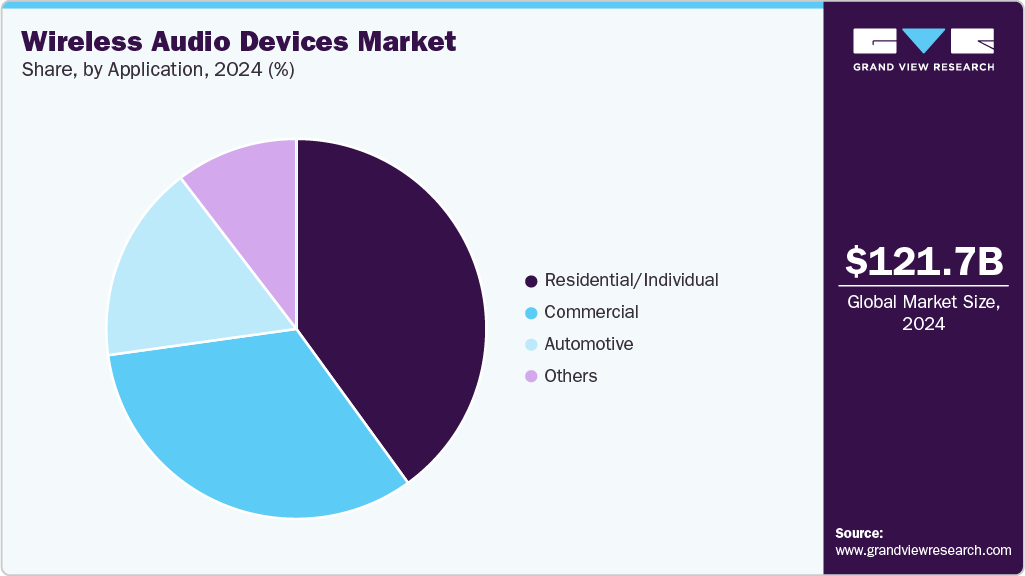

- By application, the residential/individual segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 121.67 Billion

- 2033 Projected Market Size: USD 790.05 Billion

- CAGR (2025-2033): 23.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the growing popularity of remote work and hybrid lifestyles boosts the need for high-quality wireless audio products for communication and productivity.The increased penetration of smartphone users due to the rising trend of binge-watching is expected to drive the market growth. The addition of features, such as low-power audio codecs, voice-activation technology, and Bluetooth technology, among others in smartphones enables consumers to use them for several applications. Smartphones have been the constant providers of information and entertainment post the pandemic. The growing use of smartphones as a means of communication, entertainment, and online activities such as social networking, video gaming, and surfing the web has fueled the demand for wireless audio devices such as TWS earbuds, headphones, and headsets.

The wireless audio devices industry is undergoing rapid technological transformation driven by advancements in connectivity, AI integration, and immersive sound experiences. The shift to Bluetooth 5.3 and LE Audio is improving audio quality, power efficiency, and enabling features such as Auracast, which allows one source to broadcast audio to multiple receivers simultaneously. For instance, in January 2025, JBL introduced the Tour ONE M3, an addition to its over-ear headphone lineup, featuring cutting-edge audio innovations and seamless connectivity. The standout feature is the debut of the JBL SMART Tx audio transmitter, enabling lossless audio and Hi-Res Bluetooth streaming. Equipped with True Adaptive Noise Cancelling 2.0, the Tour ONE M3 is engineered to deliver an immersive and personalized sound experience.

The wireless audio devices industry is increasingly shaped by evolving regulatory frameworks focused on spectrum usage, product safety, and environmental sustainability. Markets such as the U.S. and the European Union have introduced stringent RF (radio frequency) and EMC (electromagnetic compatibility) standards. In the U.S., the FCC regulates Bluetooth and wireless devices under Part 15, while in the EU, compliance with the Radio Equipment Directive (RED) is mandatory.

Product Insights

The true wireless hearables/earbuds segment led the market with the largest revenue share of 41.2% in 2024, driven by increasing adoption of smartphones without traditional 3.5mm headphone jacks, which has accelerated the shift toward wireless audio solutions. Major smartphone manufacturers, including Apple and Samsung, have phased out wired headphone ports, compelling consumers to opt for wireless alternatives like TWS earbuds. Moreover, advancements in Bluetooth technology, such as Bluetooth 5.0 and newer versions, have improved connectivity, battery efficiency, and audio quality, making TWS earbuds more reliable and appealing to consumers.

The headphone segment is anticipated to grow at the fastest CAGR during the forecast period. Technological innovations have converted wireless headphones from basic audio accessories to complex electronics. Bluetooth technological advancements and new audio codecs have opened the path for smooth wireless audio transmission with low latency and excellent sound quality. This technical advancement has eliminated the constraints of traditional wired headphones, providing users with unprecedented flexibility of mobility.

Technology Insights

The bluetooth segment accounted for the largest market revenue share in 2024, driven by the widespread adoption of Bluetooth 5.0 and new versions such as Bluetooth 5.2 and 5.3, which have significantly improved data transfer speeds, range, and stability, making wireless audio devices more reliable than ever. These enhancements enable seamless connectivity for earbuds, headphones, and speakers, reducing latency and improving synchronization, which are critical for gaming, video streaming, and high-fidelity music playback

The bluetooth + wi-fi segment is expected to grow at the fastest CAGR during the forecast period. The declining cost of chipsets and the increasing availability of dual-radio SoCs (System on Chips) are making it easier and more affordable for manufacturers to incorporate both Bluetooth and Wi-Fi functionality into audio devices. At the same time, advances in power efficiency, antenna design, and automatic connectivity switching are improving the user experience.

Functionality Insights

The smart devices segment accounted for the largest market revenue share in 2024, fueled by the proliferation of AI-powered voice assistants, such as Siri, Google Assistant, and Alexa, which have transformed wireless earbuds and headphones into intelligent, voice-controlled hubs. Users now expect seamless integration with smart ecosystems, enabling hands-free commands for music, calls, navigation, and smart home control. This functionality has shifted wireless audio devices from mere accessories to essential tools for connected living, driving adoption across demographics.

The non-smart devices segment is expected to grow at the fastest CAGR during the forecast period, driven by a several factors emphasizing the ongoing attraction of simplicity, dependability, and different customer demands. These non-smart devices serve consumers seeking easy audio solutions without the complications of integrated features in a world dominated by sophisticated technologies.

Application Insights

The residential/individual segment accounted for the largest market revenue share in 2024, driven by the affordability and accessibility, which have expanded the market’s reach, with budget-friendly options from brands making wireless audio devices attainable for a broader audience. As competition intensifies, manufacturers are incorporating premium features, such as ANC and water resistance, into mid-range products, democratizing high-quality audio experience. Coupled with holiday sales, subscription-based models, and trade-in programs, these strategies accelerate residential adoption.

The automotive segment is expected to grow at the fastest CAGR over the forecast period. a convergence of factors that redefine in-car entertainment and connectivity. With the increasing number of connected vehicles, wireless audio devices provide a seamless way to elevate the driving experience. Bluetooth, Wi-Fi, and other wireless technologies enable users to stream music, podcasts, and navigation instructions directly to their vehicles' audio systems.

Regional Insights

North America dominated the global wireless audio devices market with the largest revenue share of 31.6% in 2024, driven bythe region’s deep integration of smart technologies, rising demand for premium audio experiences, and the widespread adoption of true wireless stereo (TWS) devices across consumer, professional, and enterprise segments. With the rise of hybrid work models, content creation, and fitness-focused lifestyles, consumers are increasingly turning to wireless earbuds, headphones, and portable speakers. These devices are favored for features like active noise cancellation, voice assistant integration, and smooth multi-device connectivity.

U.S. Wireless Audio Devices Market Trends

The wireless audio devices market in the U.S. accounted for the largest market revenue share in North America in 2024, owing to the changing consumer preferences that emphasize convenience, premium sound quality, and seamless device integration. In addition, with the growing adoption of hybrid work, remote learning, and fitness tracking, U.S. consumers are increasingly drawn to wireless earbuds, headphones, and speakers that offer smart assistant compatibility, adaptive audio features, and enhanced connectivity.

Europe Wireless Audio Devices Market Trends

The wireless audio devices market in Europe is anticipated to register at a considerable CAGR from 2025 to 2033. Europe's market benefits from rising demand for eco-friendly and sustainable tech products. Consumers in the region are increasingly preferring audio devices with energy-efficient features, recyclable materials, and longer battery life, influenced by regulatory initiatives and green consumerism.

The UK wireless audio devices market is expected to grow at a rapid CAGR during the forecast period, owing to the rising popularity of voice-controlled smart assistants like Alexa and Google Assistant, integrated into wireless speakers and headphones. The growth of online learning and virtual meetings has also contributed to increasing demand for wireless headsets with noise-canceling features.

The wireless audio devices market in Germany accounted for the largest market revenue share in Europe in 2024, due to a strong audiophile culture and demand for high-fidelity audio equipment. Consumers prioritize sound quality and are willing to invest in premium headphones and speakers that offer superior acoustics and ergonomic design.

Asia Pacific Wireless Audio Devices Market Trends

The wireless audio devices market in the Asia Pacific is projected to grow at the fastest CAGR over the forecast period, due to a tech-savvy youth population and expanding smartphone penetration. Affordable wireless audio products from regional brands and the popularity of mobile gaming and video streaming contribute significantly to market expansion.

The Japan wireless audio devices market is expected to grow at a rapid CAGR during the forecast period, driven by demand for compact, minimalist audio solutions that cater to space-constrained urban living. Innovations in wearable audio tech and integration with domestic consumer electronics drive adoption of wireless earbuds and neckband-style devices.

The wireless audio devices market in China held a substantial market share in 2024, due to its strong manufacturing ecosystem and rapid innovation cycle. E-commerce platforms and local brands are accelerating market penetration through aggressive pricing, frequent product refreshes, and influencer-driven marketing campaigns targeting young consumers.

Key Wireless Audio Devices Company Insights

Key players operating in the wireless audio devices industry are Apple Inc., SAMSUNG, Sony Corporation, Bose Corporation, and Sennheiser electronic GmbH & Co. KG. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Bose Corporation extended its collaboration with global superstar LISA, unveiling the limited-edition Bose × LISA Ultra Open Earbuds. Designed as both a fashion statement and advanced audio wearable, the earbuds deliver immersive sound while keeping users connected to their surroundings. To mark the launch, Bose and LISA are introducing a special pop-up experience curated by the artist, along with an exclusive opportunity for fans to meet her later this year.

-

In January 2025, Samsung announced its latest Q-series soundbars HW-Q990F and HW-QS700F showcasing advanced hardware and AI-driven features aimed at transforming home entertainment. These flagship models deliver immersive, high-quality sound designed to provide a premium audio experience across movies, music, and gaming.

-

In September 2024, Apple Inc. announced its latest AirPods lineup, introducing the redesigned AirPods 4 with an open-ear design and two versions, one with Active Noise Cancellation (ANC). The AirPods Pro 2 will soon feature an industry-first all-in-one hearing health suite, including Loud Sound Reduction, a Hearing Test, and a Hearing Aid function.

Key Wireless Audio Devices Companies:

The following are the leading companies in the wireless audio devices market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Bose Corporation

- GN Store Nord A/S (Jabra)

- HARMAN International

- Logitech (Jaybird)

- SAMSUNG

- Skullcandy.com

- Sennheiser electronic GmbH & Co. KG

- Sony Corporation

- Xiaomi

Wireless Audio Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 143.70 billion

Revenue forecast in 2033

USD 790.05 billion

Growth rate

CAGR of 23.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, technology, functionality, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Apple Inc.; Bose Corporation; GN Store Nord A/S (Jabra); HARMAN International; Logitech (Jaybird); SAMSUNG; Skullcandy.com; Sennheiser electronic GmbH & Co. KG; Sony Corporation; Xiaomi

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wireless Audio Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global wireless audio devices market report based on product, technology, functionality, application, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Earphone

-

Headphone

-

True Wireless Hearables/Earbuds

-

Speaker Systems

-

Soundbars

-

Headsets

-

Microphones

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Bluetooth

-

Wi-Fi

-

Bluetooth + Wi-Fi

-

Airplay

-

Others

-

-

Functionality Outlook (Revenue, USD Billion, 2021 - 2033)

-

Smart Devices

-

Non-smart Devices

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential/Individual

-

Commercial

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wireless audio devices market size was estimated at 121.67 billion in 2024 and is expected to reach USD 143.70 billion in 2025.

b. The global wireless audio devices market is expected to grow at a compound annual growth rate of 23.7% from 2025 to 2033 to reach USD 790.05 billion by 203.

b. The true wireless hearables/earbuds segment dominated the market and accounted for the revenue share of 41.2% in 2024, driven by increasing adoption of smartphones without traditional 3.5mm headphone jacks, which has accelerated the shift toward wireless audio solutions.

b. Key players in the wireless audio devices industry include Apple Inc., Bose Corporation, GN Store Nord A/S (Jabra), HARMAN International, Logitech (Jaybird), SAMSUNG, Skullcandy.com, Sennheiser electronic GmbH & Co. KG, Sony Corporation, Xiaomi

b. Key factors driving the market's growth include the rising demand for portable and convenient audio solutions, the rapid adoption of audio streaming services, and the explosive growth of mobile and online gaming. Advancements in Bluetooth technology, active noise cancellation, and battery efficiency enhance product performance, while increased integration with smart devices and voice assistants improves usability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.