- Home

- »

- HVAC & Construction

- »

-

Zero Turn Mower Market Size & Share, Industry Report, 2033GVR Report cover

![Zero Turn Mower Market Size, Share & Trends Report]()

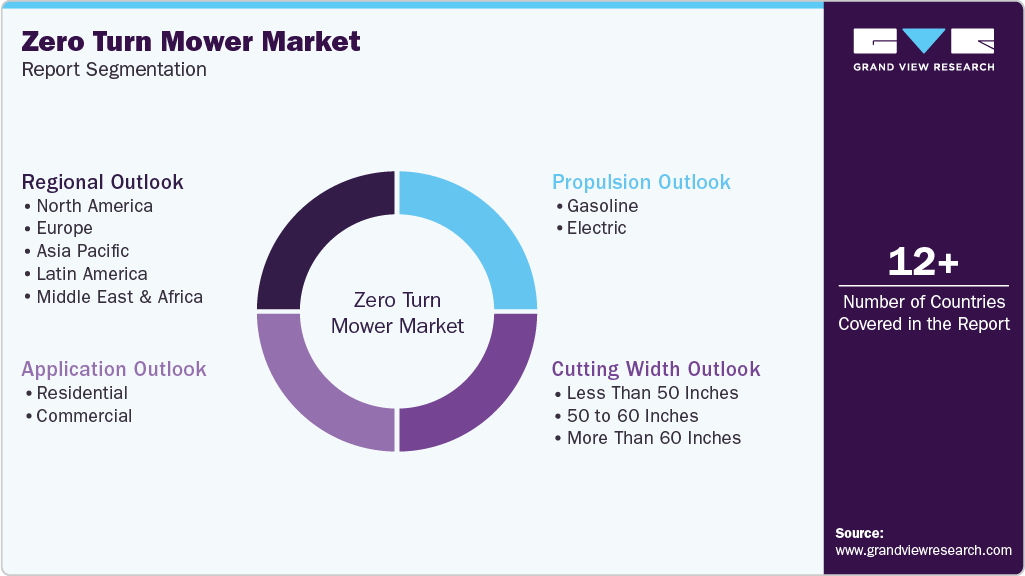

Zero Turn Mower Market (2025 - 2033) Size, Share & Trends Analysis Report By Propulsion (Gasoline, Electric), By Cutting Width (Less than 50 inches, 50 to 60 inches, More than 60 inches), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-551-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Zero Turn Mower Market Summary

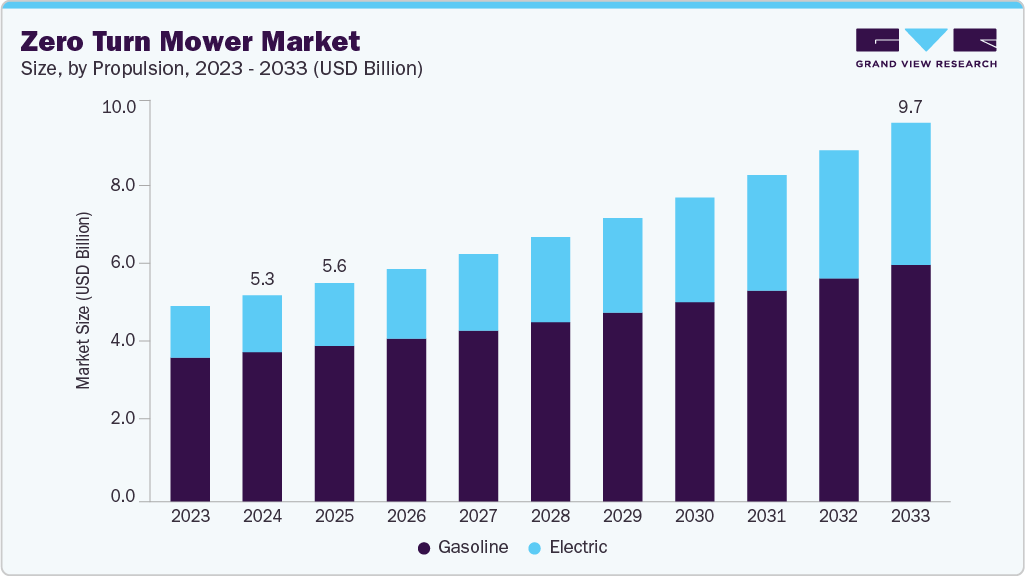

The global zero turn mower market size was estimated at USD 5.28 billion in 2024, and is projected to reach USD 9.70 billion by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The expansion of the commercial landscaping industry, which encompasses a wide range of services including grounds maintenance, turf management, and ornamental horticulture for commercial clients such as golf courses, public parks, municipalities, universities, and corporate campuses fuels growth of the market.

Key Market Trends & Insights

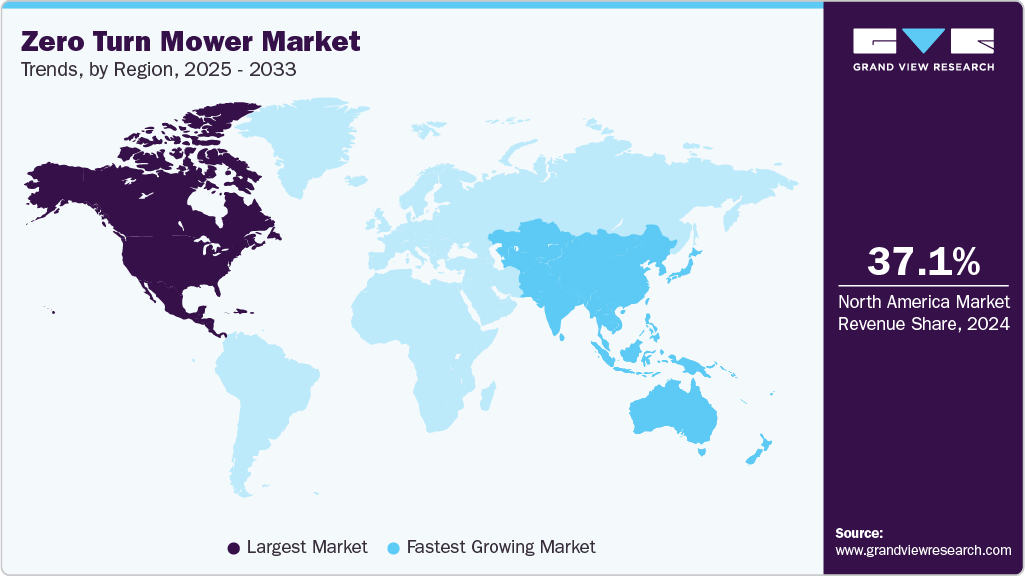

- North America zero turn mower market accounted for a 37.1% share of the overall market in 2024.

- The zero turn mower industry in the U.S. held a dominant position in 2024.

- By cutting width, the 50 to 60 inches segment held the largest market share of 55.0% in 2024.

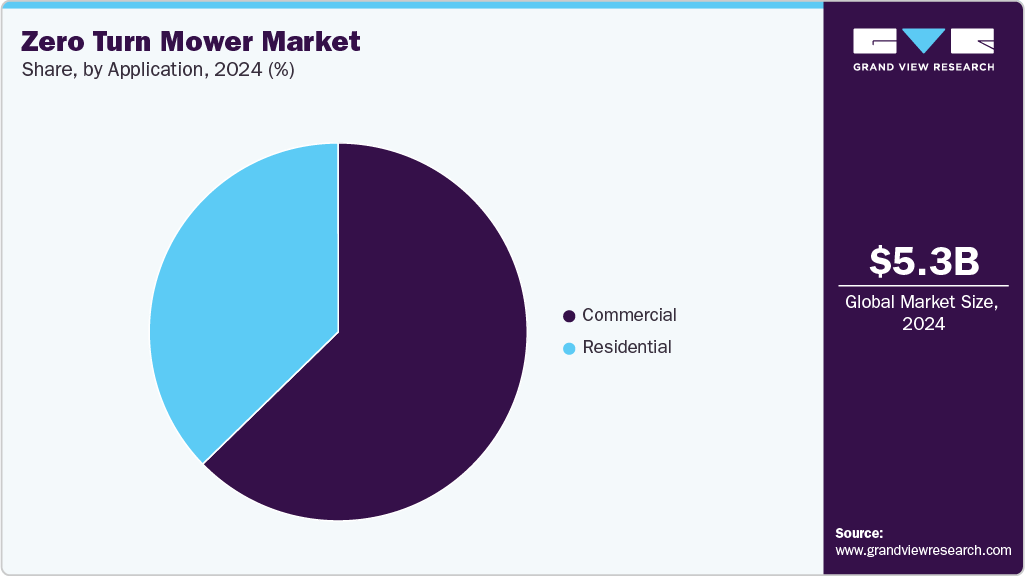

- By application, the commercial segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.28 Billion

- 2033 Projected Market Size: USD 9.70 Billion

- CAGR (2025-2033): 7.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest market

The commercial landscaping sector is experiencing steady growth driven by rising urbanization, increasing investments in green infrastructure, and greater emphasis on aesthetic and functional outdoor spaces. This trend is particularly visible in the surge of golf course investments, public park revitalizations, and expanded groundskeeping contracts in institutional and hospitality settings. The golf course segment, a key customer base for zero turn mowers, is seeing a resurgence in capital spending and infrastructure modernization. As of the end of 2023, there were approximately 15,963 golf courses across 13,963 facilities in the U.S., according to the National Golf Foundation (NGF). This accounts for nearly 42% of the global golf course supply and reinforces the country’s pivotal role in driving demand for commercial turf maintenance equipment. The scale and frequency of maintenance required for these expansive landscapes make zero turn mowers indispensable, particularly due to their maneuverability, productivity, and operator comfort.

The global demand for zero turn mowers is rising as end users prioritize efficiency, speed, and precision in lawn care and landscape maintenance. Unlike traditional lawn tractors, zero turn mowers offer faster cutting times, sharper maneuverability, and the ability to handle complex mowing patterns with minimal operator effort. These advantages have made ZTMs a preferred solution for commercial landscapers, municipalities, facility managers, and large estate owners looking to improve operational output and reduce job completion times.

High upfront costs and maintenance complexity remain a key challenge in the adoption of autonomous zero-turn mowers. While ZTMs are known for their speed, cutting efficiency, and superior maneuverability, their cost structure can discourage price-sensitive buyers, particularly small landscaping businesses and residential prosumers.Entry-level residential ZTMs with 34 to 42-inch cutting decks typically range from USD 3,300 to USD 4,000. Mid-range commercial units, offering 48 to 60-inch fabricated decks and higher horsepower engines, are usually priced between USD 4,000 and USD 5,500. In contrast, premium electric or autonomous ZTMs such as the John Deere Z380R with a 54-inch deck are priced around USD 8,999, while heavy-duty commercial fleets with 60 to 70-inch decks and advanced hydrostatic drive systems can exceed USD 10,000.

Propulsion Insights

The gasoline segment accounted for the largest share of 72.5% in 2024. Gasoline powered zero turn mowers offer various advantages, making them a popular choice for homeowners and lawncare enthusiasts. Gasoline fuel is readily available at most gas stations, eliminating the need for additional fuel storage or specialized facilities. This accessibility makes gasoline-powered mowers a convenient choice for end users with smaller lawns or those without direct access to other engine fuel.

The electric segment is expected to grow at the fastest CAGR during the forecast period. Electric zero turn mowers are witnessing rapid growth driven by environmental regulations, increasing fuel prices, noise restrictions, and consumer preference for sustainable landscaping solutions. With zero emissions during operation, these mowers are especially attractive to eco-conscious consumers and municipalities. Improvements in lithium-ion battery technology have led to enhanced runtime, power output, and charging speed, thereby driving demand for electric zero turn mowers.

Cutting Width Insights

The 50 to 60 inches segment held the largest market share of 55.0% in 2024. Zero-turn mowers with a 50 to 60-inch cutting width are becoming increasingly popular, as they provide an ideal balance of efficiency and versatility for residential and light commercial applications. These mowers are well-suited for medium to large lawns, allowing users to cover more ground without sacrificing maneuverability. Homeowners with larger properties and landscaping professionals alike favor this size due to its productivity and ability to navigate around trees, garden beds, and other obstacles effectively.

The more than 60 inches segment is expected to grow at the fastest CAGR during the forecast period. Zero-turn mowers with cutting widths exceeding 60 inches are primarily designed for large commercial and municipal applications, where speed and efficiency are critical. These mowers reduce mowing time significantly, making them ideal for sports fields, parks, estates, and other expansive green areas. Landscaping businesses are scaling, and contract-based maintenance is expanding across public and private sectors, driving increased demand for zero-turn mowers with cutting width more than 60-inches.

Application Insights

The commercial segment dominated the market in 2024. The growth of the segment is driven by increased demand from landscaping service providers, municipalities, schools, golf courses, and large estates. These buyers prioritize productivity, durability, and low total cost of ownership, making high-capacity, heavy-duty mowers a preferred choice. The growing trend toward outsourcing landscaping maintenance across commercial properties and institutions further fuels demand for high-performance zero-turn models.

The residential segment is projected to grow at a significant CAGR of 6.3% over the forecast period. The residential segment is experiencing rapid growth, driven by rising homeownership rates, increasing interest in DIY lawn maintenance, and growing awareness of landscaping aesthetics. Homeowners are opting for zero-turn mowers due to their ease of use, faster mowing times, and superior maneuverability compared to traditional riding mowers. In addition, affordability and product financing options are making zero-turn mowers more accessible to the average homeowner.

Regional Insights

The North America zero turn mower market held a significant share of 37.1% in 2024. The increasing need for efficient and time-saving lawn care solutions is driving the growth of the turn mower market in North America. These mowers offer superior maneuverability and faster mowing speeds compared to traditional mowers, making them highly preferred for both residential and commercial applications.

U.S. Zero Turn Mower Market Trends

The U.S. zero turn mower market held a dominant position in 2024 due to theexpanding landscaping services industry across the U.S.Commercial lawn care companies are increasingly relying on zero turn mowers to meet the rising demand for the maintenance of public parks, golf courses, and commercial properties. Public parks and golf courses require zero turn mowers capable of covering large areas efficiently in a single pass.

Europe Zero Turn Mower Market Trends

The Europe zero turn mower industry was identified as a lucrative region in 2024. Technological innovations and a growing emphasis on sustainability are fueling the growth of the zero turn mower market in Europe. As European countries strengthen their environmental regulations and push for greener technologies, there is increasing demand for low-emission and energy-efficient landscaping equipment.

The UK zero turn mower market is expected to grow rapidly in the coming years. The expansion of green acreage and public spaces is driving growth of the zero turn mower market in the UK With increasing investments in the development and maintenance of urban parks, golf courses, sports fields, and public gardens, there is growing demand for efficient lawn care solutions.

The Germany zero turn mower industry held a substantial market share in 2024. Rising residential lawn care demand is driving the growth of the zero turn mower market in Germany. As more people move to suburban areas and prioritize the maintenance of private gardens and lawns, the demand for high-performance and time-saving lawn care equipment is increasing.

Asia Pacific Zero Turn Mower Market Trends

The Asia Pacific zero turn mower market is anticipated to grow at a CAGR of 7.8% during the forecast period. Rapid urbanization and infrastructure expansion are major factors driving the growth of the zero turn mower market in the Asia Pacific region. As countries such as China, India, and Southeast Asian nations experience accelerated urban development, there is a significant increase in the construction of residential communities, commercial complexes, parks, and recreational green spaces. These developments demand consistent and efficient landscape maintenance, boosting the need for high-performance mowing equipment such as zero turn mower.

The Japan zero turn mower industry is expected to grow rapidly in the coming years due to the aging population. As a significant portion of the population enters retirement age, tasks like manual lawn maintenance become increasingly difficult. Older homeowners are now turning to user-friendly and low-effort equipment such as zero turn mower that allows them to maintain their outdoor spaces without physical strain.

The China zero turn mower market held a substantial market share in 2024. The increasing adoption of smart and robotic technology is driving the growth of the zero-turn mower market in China. With the country's strong focus on automation and digitalization, there is rising demand for technologically advanced lawn maintenance equipment. Smart zero-turn mowers equipped with GPS, remote monitoring, autonomous navigation, and connectivity features are gaining popularity among both commercial landscapers and tech-savvy homeowners.

Key Zero Turn Mower Company Insights

Some of the key companies in the zero turn mower market includes Altoz, Deere & Company, Husqvarna Group, KUBOTA Corporation., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Altoz is an outdoor power equipment company known for designing and manufacturing tracked and wheeled zero-turn mowers. The company’s zero-turn mowers combine striking design with high-performance functionality, delivering the cut quality, durability, and operator comfort essential for achieving professional-grade results. Engineered with precision and built for reliability, Altoz mowers are thoughtfully designed to meet the demands of both performance and productivity. The company’s zero turn mowers offer superior performance, exceptional comfort, and dependability.

-

Kubota Corporation is a Japan‑based diversified industrial manufacturer founded in 1890 in Osaka. The company specializes in agricultural machinery (such as tractors, combine harvesters, rice transplanters, and engines), construction and utilities equipment, and water and environmental infrastructure (including pipes, valves, pumps, and treatment systems). Kubota’s equipment is designed, produced, and distributed globally through manufacturing facilities in Japan, the U.S., Germany, China, Thailand, France, and others, serving markets in over 120 countries.

Key Zero Turn Mower Companies:

The following are the leading companies in the zero turn mower market. These companies collectively hold the largest market share and dictate industry trends.

- Altoz

- ARIENS

- BigDog Mower Co.

- Briggs & Stratton

- Deere & Company

- Husqvarna Group

- KUBOTA Corporation.

- MTD Products Inc.

- Robert Bosh GmbH

- SPARTAN MOWERS

Recent Developments

-

In January 2025, KUBOTA Corporation introduced a Smart Autonomous Zero-Turn Mower at CES 2025, aimed at residential applications. This mower uses cooperative technology that allows multiple units to operate together, enabling efficient execution of larger tasks while using smaller machines.

-

In October 2024, Deere & Company expanded its residential zero turn mower lineup with the launch of the Z380R Electric ZTrak Zero-Turn Mower. The Z380R features a larger 54-inch cutting deck for increased mowing capacity and coverage. Designed for extended performance, it is equipped with dual batteries that provide a longer runtime, capable of mowing up to 3.5 acres, depending on operating conditions.

Zero Turn Mower Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.59 billion

Revenue forecast in 2033

USD 9.70 billion

Growth rate

CAGR of 7.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report cutting width

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Propulsion, cutting width, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Altoz; ARIENS; BigDog Mower Co.; Briggs & Stratton; Deere & Company; Husqvarna Group; KUBOTA Corporation.; MTD Products Inc.; Robert Bosh GmbH; SPARTAN MOWERS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Zero Turn Mower Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global zero turn mower market report based on propulsion, cutting width, application, and region.

-

Propulsion Outlook (Revenue, USD Million, 2021 - 2033)

-

Gasoline

-

Electric

-

-

Cutting Width Outlook (Revenue, USD Million, 2021 - 2033)

-

Less Than 50 inches

-

50 to 60 inches

-

More than 60 inches

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the zero turn mower market include Altoz; ARIENS; BigDog Mower Co.; Briggs & Stratton; Deere & Company; Husqvarna Group; KUBOTA Corporation.; MTD Products Inc.; Robert Bosh GmbH; and SPARTAN MOWERS.

b. Key factors that are driving the market growth include rising number of commercial spaces with large size lawns, growing demand for landscaping services, and increasing interest of homeowners in gardening activities.

b. The global zero turn mower market size was estimated at USD 5.28 billion in 2024 and is expected to reach USD 5.59 billion in 2025.

b. The global zero turn mower market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2033 to reach USD 9.70 billion by 2033.

b. North America dominated the zero turn mower market with a share of over 37% in 2024. This is attributable to a rise in the number of landscaping activities and the number of golf courses in the region

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.