- Home

- »

- IT Services & Applications

- »

-

Healthcare Education Market Size, Industry Report, 2033GVR Report cover

![Healthcare Education Market Size, Share & Trends Report]()

Healthcare Education Market (2025 - 2033) Size, Share & Trends Analysis Report By Providers (Continuing Medical Education Providers, Educational Platforms, Learning Management Systems, Universities & Academic Centers), By Application, By Delivery Mode, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-317-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Education Market Summary

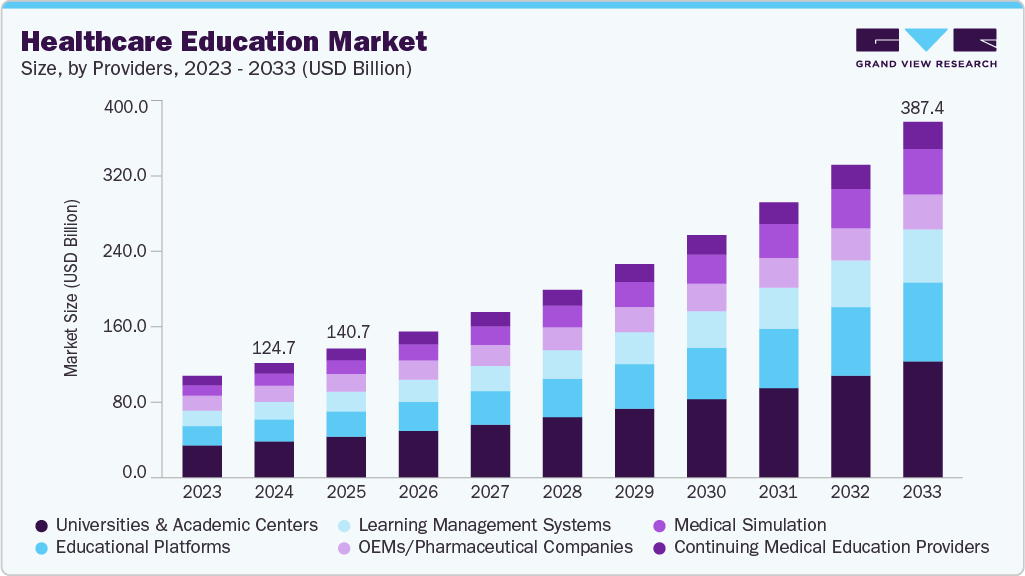

The global healthcare education market size was valued at USD 124.71 billion in 2024 and is projected to reach USD 387.40 billion by 2033, growing at a CAGR of 13.5% from 2025 to 2033. The industry is driven by technological advancements such as e-learning, AI, and VR, which offer flexible and immersive learning experiences.

Key Market Trends & Insights

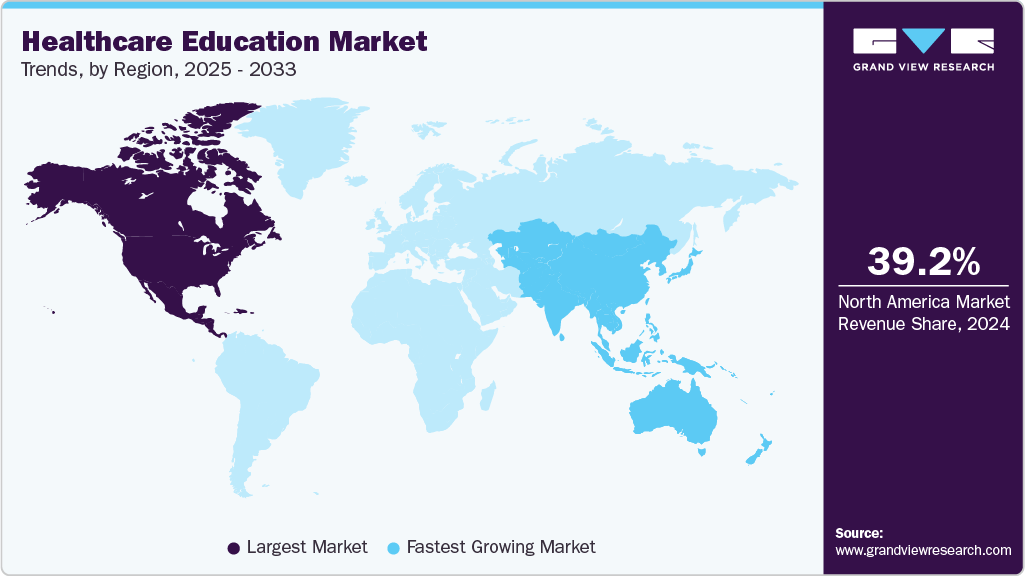

- North America dominated the global healthcare education market with the largest revenue share of 39.2% in 2024.

- The healthcare education market in the U.S. led the North America market and held the largest revenue share in 2024.

- By providers, universities and academic centers led the market, holding the largest revenue share of 31.9% in 2024.

- By application, the radiology segment held the dominant position in the market.

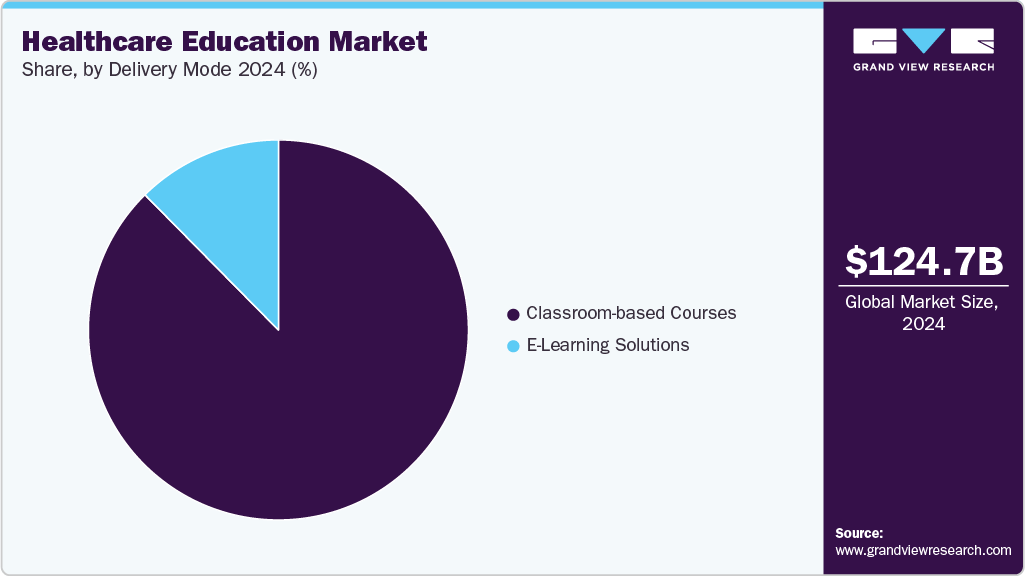

- By delivery mode, the classroom-based courses segment held the dominant position in the market.

- By end use, students held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 124.71 Billion

- 2033 Projected Market Size: USD 387.40 Billion

- CAGR (2025-2033): 13.5%

- North America: Largest Market in 2024

- Asia Pacific: Fastest-Growing Market

The increasing demand for healthcare professionals due to an aging population and the need for pandemic preparedness, along with government and institutional support through policy initiatives and funding, is enhancing educational infrastructure and standardization.Increased awareness and emphasis on public health have led to the expansion of public health programs and initiatives to address global health challenges such as pandemics and non-communicable diseases. The rise of interdisciplinary and integrated curricula, which adopt a holistic approach to healthcare education by integrating various fields such as medicine, nursing, pharmacy, and allied health sciences, has significantly contributed to the market growth. Regulatory requirements and the pursuit of professional growth have fueled the expansion of Continuing Medical Education (CME) and Continuing Professional Development (CPD) programs, ensuring that healthcare professionals maintain their licenses and stay updated with the latest advancements.

Additionally, the shift toward patient-centered care and personalized medicine requires training that emphasizes communication skills, and patient engagement. The growth of online and hybrid educational models has made healthcare education more accessible and flexible, catering to diverse learning needs. The emergence of new medical specialties and the focus on advanced certifications are driving the demand for specialized educational programs. Collaboration with the healthcare industry ensures that curricula are aligned with current standards and technological advancements, while improvements in educational technology, such as AI-powered tutoring systems and interactive e-books, have enhanced the quality and effectiveness of healthcare education. Simulation-based learning provides realistic, hands-on training, further preparing healthcare professionals for complex clinical scenarios.

Growing industry specific applications are also propelling market growth. In automotive, healthcare education supports advanced driver-assistance systems (ADAS), predictive maintenance, and autonomous navigation. In healthcare, it enables medical imaging, diagnostics, and personalized monitoring solutions, while in industrial settings, it drives predictive analytics, process optimization, and defect detection. Consumer electronics further contribute to adoption, with smart assistants, AR/VR, and connected devices becoming mainstream. As organizations prioritize efficiency, personalization, and automation, the healthcare education market is witnessing strong momentum, supported by rising government initiatives, digital transformation efforts, and expanding 5G infrastructure, which collectively create a favorable environment for accelerated deployment.

The global healthcare education system is also driven by rising healthcare expenditure, increasing investments in medical training infrastructure, and the growing adoption of competency-based education models that emphasize practical skills alongside theoretical knowledge. Expanding private sector participation and partnerships with leading medical institutions are accelerating innovation in curricula and delivery formats. The rising prevalence of chronic diseases, coupled with the demand for skilled professionals in specialized areas such as geriatrics, oncology, and mental health, is fostering growth in advanced healthcare education programs. Moreover, the integration of digital platforms with big data and analytics allows for personalized learning pathways, improving learner outcomes and efficiency. Collectively, these factors are shaping a more adaptive, scalable, and globally relevant healthcare education ecosystem.

Providers Insights

The universities and academic centers segment dominated the market with a share of over 31.9% in 2024. The segment's growth is attributed to its established reputation for academic excellence and credibility, drawing in students and professionals seeking top-tier educational programs. Offering a comprehensive curriculum, they uphold stringent accreditation standards, ensuring program quality and growing confidence among students and employers. Additionally, serving as hubs for research and innovation, these institutions foster collaboration with industry partners, driving advancements in medical science and enriching the educational experience.

The medical simulation segment is expected to register the highest CAGR over the forecast period due to continuous advancements in simulation technology. Innovations such as VR, AR, and haptic feedback systems are enhancing realism and effectiveness, leading to better learning outcomes. Simulations offer hands-on experience in a safe environment, bridging classroom learning with real-world practice and improving clinical competency. They also contribute to patient safety by allowing learners to practice procedures and teamwork without risk. Simulations promote collaboration among healthcare disciplines, aiding in CPD and competency assessment while facilitating interprofessional education. Despite initial investment costs, simulations offer long-term savings and scalability, making them a cost-effective training solution for healthcare education.

Application Insights

The radiology segment accounted for the largest revenue share in 2024, emphasizing its essential role in modern healthcare for diagnostic imaging and treatment planning across various medical specialties. With increasing demand for radiology services, there's a need for well-trained professionals proficient in interpreting medical images and utilizing advanced imaging technologies. Technological advancements in imaging, such as AI-enhanced imaging and molecular imaging, drive the evolution of radiology education to ensure students are equipped with the latest techniques and tools. Radiology education directly impacts patient care by training professionals to accurately interpret images, diagnose diseases, and guide treatment decisions, making radiologists and radiologic technologists essential members of multidisciplinary care teams.

The cardiology segment is positioned for substantial growth due to the increasing prevalence of cardiovascular diseases globally. With advancements in cardiovascular medicine and technology, healthcare professionals require up-to-date skills to manage complex cases. Specialization in various cardiology subspecialties, emphasis on prevention, and a multidisciplinary approach emphasize the need for cardiovascular care. Integration of digital health and telemedicine further enhances accessibility and patient engagement. Thus, educational programs focus on evidence-based practices, research, and innovation to equip healthcare professionals with the necessary expertise to address the growing challenges in cardiovascular health effectively.

End Use Insights

The students segment accounted for the largest revenue share in 2024, owing to the high demand for healthcare education fueled by the industry's growth. Aspiring healthcare professionals seek quality education and training with diverse educational pathways available, including undergraduate, professional, and postgraduate programs; thus, institutions cater to students' interests and career aspirations. Admissions to healthcare programs are competitive, emphasizing the value placed on education for securing future opportunities. Additionally, lifelong learning and continuing education are essential for healthcare professionals to maintain their license, certification, and competency throughout their careers, with institutions offering various programs to meet their ongoing educational needs.

The non-physician segment is poised for significant growth as non-physician healthcare professionals, including nurses, physician assistants, and pharmacists, take on increasingly vital roles in healthcare delivery. With expanding responsibilities and scope of practice, these practitioners are filling essential gaps in care delivery, particularly in areas facing workforce shortages. Emphasis on interprofessional education, advanced practice training, and specialization prepares non-physician practitioners to meet the evolving healthcare needs of diverse patient populations, with a focus on population health, preventive care, and specialized expertise in high-demand areas.

Delivery Mode Insights

The classroom-based courses segment dominated the market in 2024, due to its advantages in providing hands-on learning experiences, interpersonal interaction, and clinical simulation. These courses foster practical skills development, interpersonal communication, and teamwork essential for healthcare professionals. In classroom courses, simulation-based training and skills labs create a supportive learning environment. Instructors offer personalized instruction and real-time feedback. Peer-to-peer interaction promotes collaborative learning and community engagement, while contextual learning enhances awareness and patient-centered care delivery.

The e-learning solutions segment is poised for significant growth, as it offers healthcare professionals and students accessibility, flexibility, and diverse learning resources. Learners benefit from self-paced education, interactive modules, and personalized learning pathways, fostering engagement and knowledge retention. With scalability and adaptability, e-learning reaches a wide audience globally, catering to individual needs and proficiency levels. Leveraging technological innovations such as AI, VR, and mobile apps, e-learning platforms provide immersive learning experiences and facilitate continuous professional development. Compliance with industry standards and accreditation criteria ensures the integrity and quality of educational content, enhancing learners' career prospects and credibility in the healthcare sector.

Regional Insights

North America dominated the global healthcare education industry with a revenue share of 39.2% in 2024, driven by its advanced healthcare infrastructure and high investment in education and training. The region's top-tier hospitals, medical schools, and research institutions create a clinical training environment with access to cutting-edge technology and diverse patient populations. Significant funding from both the public and private sectors supports a wide range of educational initiatives, making healthcare education more accessible. Additionally, the strong emphasis on continuing medical education (CME) ensures that healthcare professionals maintain licensure and stay updated with medical advancements, further driving the market's growth.

U.S. Healthcare Education Market Trends

The healthcare education industry in the U.S. is expected to grow significantly. The growth is attributed to the presence of renowned institutions such as Harvard Medical School, Johns Hopkins University, and The University of Pennsylvania. These leading schools draw students from around the world, significantly boosting market revenue and reinforcing the country's reputation as a center for high-quality healthcare education.

Europe Healthcare Education Market Trends

The healthcare education industry in Europe is expected to grow significantly over the forecast period. Healthcare education is gaining traction in Europe as the region's aging population is driving the need for a larger, well-trained healthcare workforce to address age-related health issues and chronic diseases. European institutions are incorporating advanced technologies such as VR, AR, and simulation-based training to enhance learning and clinical preparedness.

Asia Pacific Healthcare Education Market Trends

The healthcare education industry in the Asia Pacific region is anticipated to witness the fastest CAGR over the forecast period. Governments across the region, including China, India, and Japan, are prioritizing healthcare education through initiatives like "Healthy China 2030" and the National Health Policy in India. With more than half of the world's population residing in the region, there's a significant demand for healthcare services, leading to the expansion of medical and nursing schools. Countries such as Singapore and Australia are renowned for their high-quality healthcare education programs.

Key Healthcare Education Companies Insights

Key players operating in the healthcare education market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some key companies in the healthcare education industry are Siemens Healthcare GmbH and General Electric Company.

-

Siemens Healthcare GmbH is a key player in healthcare education due to its strong integration of training with advanced medical technologies such as imaging, diagnostics, and laboratory systems. Its extensive simulation-based education programs and digital training platforms make it a key player driving innovation in healthcare education worldwide.

-

General Electric Company provides comprehensive clinical education services, including on-site, online, and simulation-based training. Leveraging its leadership in medical imaging, diagnostics, and monitoring equipment, the company provides highly specialized education programs that enhance practitioner skills and ensure alignment with cutting-edge healthcare technologies.

Key Healthcare Education Companies:

The following are the leading companies in the healthcare education market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric Company

- Siemens Healthcare GmbH

- Medtronic

- FUJIFILM Holdings Corporation

- Elsevier B.V.

- Oracle

- SAP SE

- Koninklijke Philips N.V.

- Stryker

- Coursera Inc.

Recent Developments

-

In July 2025, the National Institute of Pharmaceutical Education and Research (NIPER), Guwahati, India, introduced a one-year postgraduate diploma in medical devices for the academic year 2025-26. The course combines technical topics such as AI, biomaterials, and imaging with hands-on work in regulatory, lab & pre-clinical settings.

-

In February 2025, Education Management Solutions, LLC, a healthcare simulation management solutions provider, partnered with Lumeto Inc., a computer & software services provider, to offer the InvolveXR platform across North America, integrating VR-based simulations and AI tools into healthcare training & management. This collaboration is aimed at improving training outcomes using immersive, technology-driven methods.

-

In January 2025, a consortium of 12 European universities launched the Sustainable Healthcare with Digital Health Data Competence (Susa) project under the EU Digital Europe programme. The initiative focuses on enhancing digital skills among healthcare professionals, offering bachelor’s and master’s programs alongside lifelong learning modules to strengthen data-driven, sustainable healthcare practices.

Healthcare Education Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 140.67 billion

Revenue forecast in 2033

USD 387.40 billion

Growth rate

CAGR of 13.5% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Providers, application, delivery mode, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

General Electric Company; Siemens Healthcare GmbH; Medtronic; FUJIFILM Holdings Corporation; Elsevier B.V.; Oracle; SAP SE; Koninklijke Philips N.V.; Stryker; Coursera Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Education Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthcare education market report based on providers, application, delivery mode, end use, and region.

-

Providers Outlook (Revenue, USD Billion, 2021 - 2033)

-

Continuing Medical Education Providers

-

Educational Platforms

-

Learning Management Systems

-

Universities and Academic Centers

-

OEMs/Pharmaceutical Companies

-

Medical Simulation

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Academic Education

-

Cardiology

-

Radiology

-

Neurology

-

Pediatrics

-

Internal Medicine

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Classroom-based Courses

-

E-Learning Solutions

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Students

-

Physicians

-

Non-Physicians

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthcare education market size was estimated at USD 124.71 billion in 2024 and is expected to reach USD 140.67 billion in 2025.

b. The global healthcare education market is expected to grow at a compound annual growth rate of 13.5% from 2025 to 2033 to reach USD 387.40 billion by 2030.

b. North America dominated the market in 2024, accounting for over 39.0% share of the global revenue, driven by its advanced healthcare infrastructure and high investment in education and training. The region's top-tier hospitals, medical schools, and research institutions create a clinical training environment with access to cutting-edge technology and diverse patient populations.

b. Some key players operating in the healthcare education market include General Electric Company; Siemens Healthcare GmbH; Medtronic; FUJIFILM Holdings Corporation; Elsevier B.V.; Oracle; SAP SE; Koninklijke Philips N.V.; Stryker; and Coursera Inc.

b. Key factors driving the growth of the healthcare education market include the increasing adoption of digital learning and the growing demand for training due to continuous advancements in medical technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.