- Home

- »

- Beauty & Personal Care

- »

-

Middle East & Africa Perfume Market, Industry Report, 2030GVR Report cover

![Middle East & Africa Perfume Market Size, Share & Trends Report]()

Middle East & Africa Perfume Market (And Segment Forecasts 2025 - 2030) Size, Share & Trends Analysis Report By Product (Mass, Premium), By End-use (Men, Women), By Distribution Channel (Offline, Online), By Country

- Report ID: GVR-4-68040-813-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East & Africa Perfume Market Summary

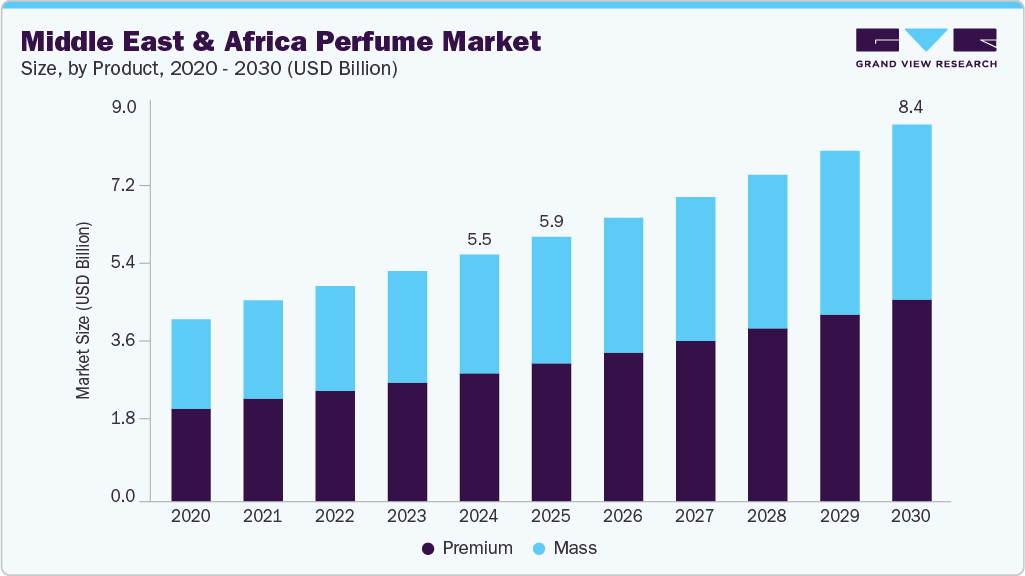

The Middle East & Africa perfume market size was estimated at USD 5.49 billion in 2024 and is projected to reach USD 8.39 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. An increasing focus on personal grooming and a rising consumer inclination toward premium and unique fragrances are driving market expansion.

Key Market Trends & Insights

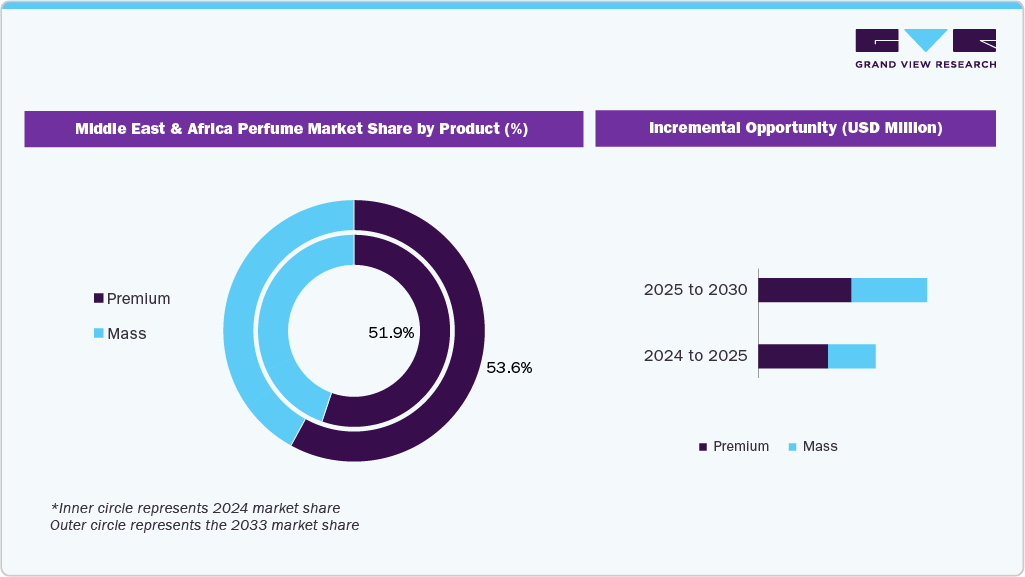

- By products, the premium segment held the largest revenue share of 51.9% in 2024.

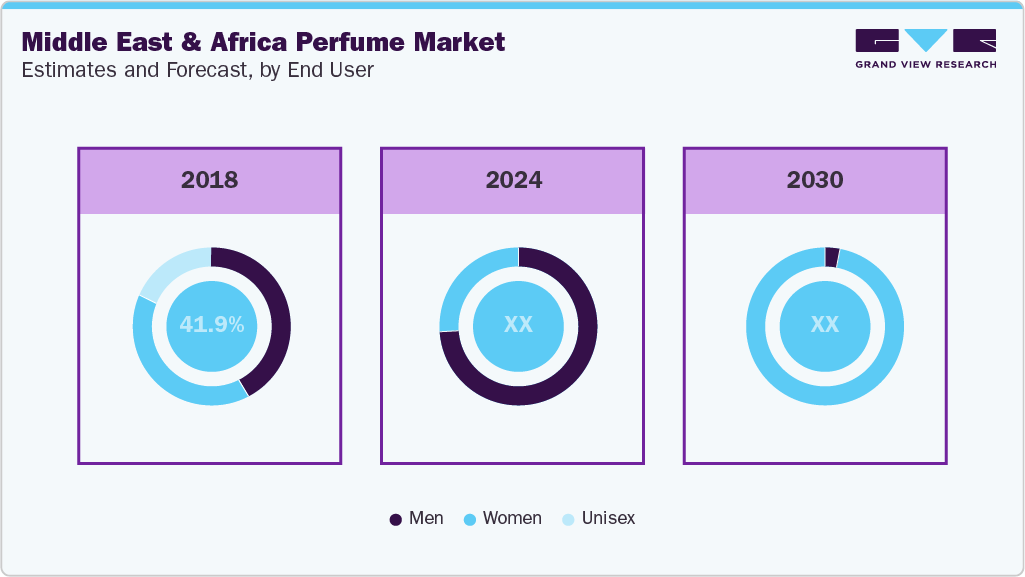

- By end use, the men segment accounted for the largest share of 44.1% in 2024.

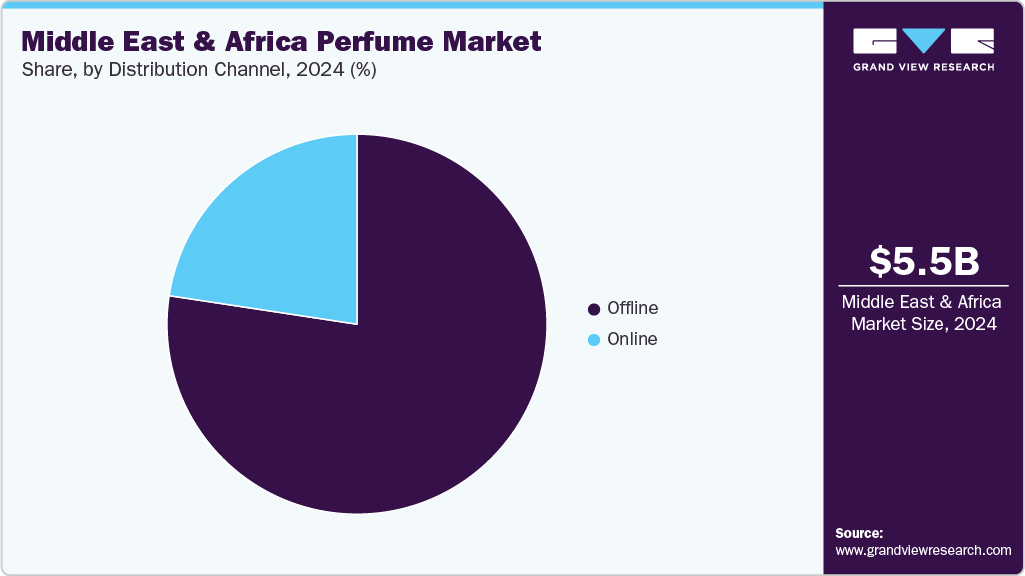

- By distribution channel, offline segment dominated the perfume market, with a share of 77.4% in 2024.

- By country, the UAE is expected to register the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 5.49 Billion

- 2030 Projected Market Size: USD 8.39 Billion

- CAGR (2025-2030): 7.3%

The perfume market in the Middle East and Africa is undergoing a significant transformation, driven by a blend of luxury, artisanal craftsmanship, and modern innovation. Companies such as Eurofragance highlight the region’s rich olfactive heritage with formats including mukhallats, attars, and bakhoor, while also integrating modern “French-Middle Eastern” styles that blend woody oud with fresh fruits and spices. Shifting consumer preferences toward high-end and distinctive scents are leading to a surge in demand for exotic, high-quality fragrances and personalized formats, contributing to the premiumization of the market. The market growth is also supported by increasing disposable incomes, expanding retail and online channels, and a growing affinity for lifestyle and identity-driven products.

Product Insights

The premium segment in the Middle East & Africa perfume market accounted for the largest revenue share of 51.9% in 2024 and is expected to record the fastest CAGR over the forecast period. The growth is attributed to the increasing demand for luxury scent experiences, exclusivity, and cultural authenticity. Consumers in the region increasingly seek personalized and limited-edition fragrances that blend traditional olfactory notes with modern elegance. Leading brands are introducing immersive experiences and artisanal collections, enhancing brand storytelling and emotional connection. For instance, My Perfumes, a perfume house based in the UAE, debuted its viral Arabiyat Sugar collection at Beautyworld Middle East 2025, featuring 15 gourmet-inspired fragrances that combine craftsmanship and contemporary flair.

Mass is a lucrative product segment, driven by increasing urbanization, expanding middle-class populations, and rising awareness of affordable luxury. Consumers are seeking long-lasting, high-quality fragrances at accessible price points, encouraging manufacturers to innovate with cost-effective formulations and attractive packaging. Regional and international brands are strengthening their presence through supermarkets, convenience stores, and online platforms to ensure enhanced product accessibility. Strategic marketing, celebrity endorsements, and value-driven product differentiation further boost market penetration. As affordability and variety remain key purchase drivers, the mass perfume segment continues to capture a significant share of the regional fragrance market.

End Use Insights

The men's segment accounted for the largest share of 44.1% in 2024 and is expected to record the fastest CAGR over the forecast period, driven by cultural traditions, modern trends, and increasing focus among men on personal hygiene and grooming. Brands are increasingly capitalizing on this trend by introducing masculine formulations that blend regional olfactive DNA with global luxury cues. Rising male grooming awareness, higher disposable income, and the growing importance of fragrance as a style statement are further fueling the growth of this segment.

The women's segment is estimated to grow over the forecast period, driven by rising female purchasing power, evolving beauty preferences, and a growing inclination toward identity-driven fragrances. Regional and international brands are increasingly curating collections, celebrating femininity, empowerment, and cultural heritage. For instance, in August 2025, “Niswah” by Ahmed Al Maghribi Perfumes was introduced on Emirati Women’s Day to honor women’s elegance and individuality. The fragrance embodies a blend of oriental floral and woody notes, reflecting sophistication and timeless grace.

Distribution Channel Insights

The offline segment accounted for the largest share, 77.4%, in 2024, supported by consumers' strong preference for personalized, sensory-driven retail experiences. Physical stores and boutique outlets allow customers to test, customize, and directly engage with fragrances, a crucial factor in a culture that values olfactory depth and craftsmanship.

The online distribution channel segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by increasing digital adoption, e-commerce penetration, and social media influence. Customers are increasingly using online platforms due to convenience, product diversity, and exposure to international fragrance brands. Retailers and manufacturers are augmenting digital experiences through influencer partnerships and targeted marketing campaigns. Competitive pricing, easy delivery options, and customer reviews strengthen consumer trust in online fragrance purchases.

Country Insights

UAE Perfume Market Trends

The UAE perfume market is evolving, with technology reshaping consumer experience and driving growth. Market players utilize digital tools, including AI and machine learning, to analyze consumers' purchasing habits, lifestyle data, and environmental conditions, enabling the delivery of highly tailored fragrances. Brands also leverage innovations such as virtual reality and 3D-printed bottles to create engaging, customized fragrance journeys.

Key Middle East & Africa Perfume Company Insights

Leading companies in the Middle East and Africa perfume market focus on developing fragrances that blend regional authenticity with modern sophistication, catering to consumers' diverse preferences and cultural nuances across the region.

Key Middle East & Africa Perfume Companies:

The following are the leading companies in the Middle East & Africa perfume market. These companies collectively hold the largest market share and dictate industry trends.

- NCHANEL

- Coty Inc.

- LVMH

- The Estée Lauder Companies

Recent Developments

- In September 2025, the founders of African Botanics launched their new luxury fragrance brand Osmé. The brand debuted with three initial fragrances, namely Obsidian, Piryte, and Turmali, inspired by natural elements and crafted for a premium DTC and retail rollout.

Middle East & Africa Perfume Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.89 billion

Revenue forecast in 2030

USD 8.39 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, country

Country Scope

UAE

Key companies profiled

CHANEL; Coty Inc.; LVMH; The Estée Lauder Companies

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East & Africa Perfume Market Report Segmentation

This report forecasts revenue growth at the region & country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Middle East & Africa perfume market report based on product, end use, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Unisex

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UAE

-

Frequently Asked Questions About This Report

b. The Middle East & Africa perfume market size was estimated at USD 5.49 billion in 2024 and is expected to reach USD 5.89 billion in 2025.

b. The Middle East & Africa perfume market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 8.39 billion by 2030.

b. The premium segment in the Middle East & Africa perfume market accounted for the largest revenue share of 51.9% in 2024 and is expected to record the fastest CAGR over the forecast period, driven by growing demand for luxury scent experiences, exclusivity, and cultural authenticity.

b. Some key players operating in the Middle East & Africa perfume market include CHANEL, Coty Inc., LVMH, The Estée Lauder Companies, among others.

b. The perfume market in the Middle East and Africa is undergoing a significant transformation, driven by a blend of luxury, artisanal craftsmanship, and modern innovation. Companies such as Eurofragance highlight the region’s rich olfactive heritage with formats including mukhallats, attars, and bakhoor, while also integrating modern “French-Middle Eastern” styles that blend woody oud with fresh fruits and spices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.