- Home

- »

- Clinical Diagnostics

- »

-

Middle East Imaging Biomarkers Market Size Report, 2033GVR Report cover

![Middle East Imaging Biomarkers Market Size, Share & Trends Report]()

Middle East Imaging Biomarkers Market (2025 - 2033) Size, Share & Trends Analysis Report By Biomarkers (Molecular/Nuclear Biomarkers), By Imaging Technology, By Application, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-798-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

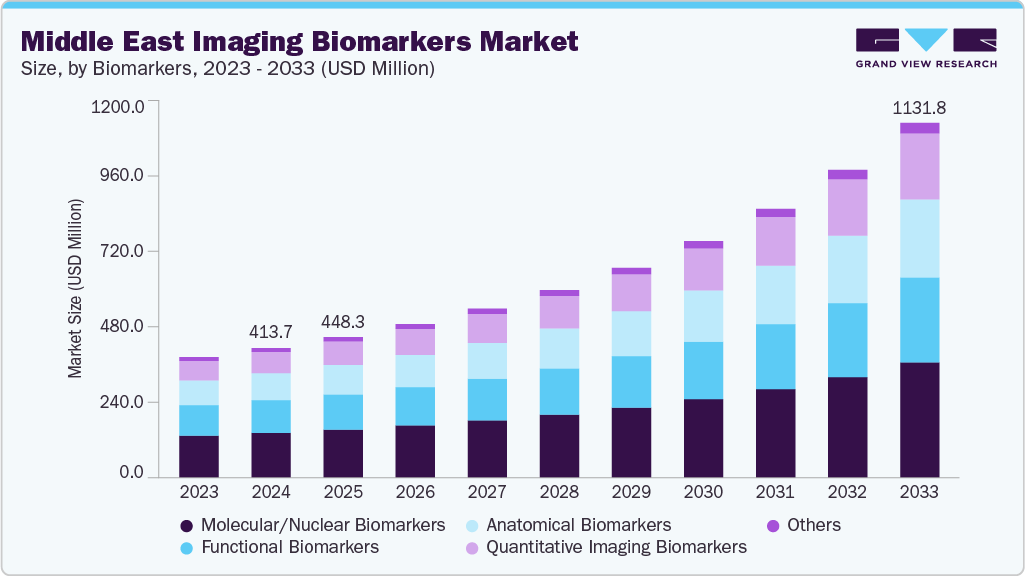

The Middle East imaging biomarkers market size was estimated at USD 413.74 million in 2024 and is projected to reach USD 1,131.80 million by 2033, growing at a CAGR of 12.27% from 2025 to 2033. The expansion of advanced imaging infrastructure (MRI, PET/CT) and the greater adoption of biomarker-driven clinical pathways are shifting care from empiric to data-driven approaches.

This structural shift-driven by national healthcare strategies, increased public and private healthcare spending, and programs aimed at attracting clinical trials-creates a growing addressable market for imaging biomarkers used in oncology, neurology, and cardiology.

The growing prevalence of chronic and lifestyle-related diseases is one of the most significant drivers of the Middle East imaging biomarkers industry. The region has seen a rapid rise in cancer, cardiovascular, and neurological disorders due to aging populations, sedentary lifestyles, and dietary changes. According to WHO data, noncommunicable diseases account for over 70% of total deaths in GCC countries, increasing the need for early detection and precise diagnosis. Imaging biomarkers-used in PET, MRI, and CT modalities-play a vital role in identifying disease progression at the molecular levels. This surge in chronic disease prevalence has, therefore, heightened demand for advanced imaging technologies that rely on biomarker data for early and accurate diagnosis.

Increasing healthcare expenditure and infrastructure development are also accelerating market growth. Countries such as Saudi Arabia, the UAE, and Qatar are investing heavily in advanced diagnostic centers, imaging equipment, and hospital modernization as part of their national health transformation programs. For example, Saudi Arabia’s Vision 2030 allocates substantial funds to expand digital and diagnostic healthcare capabilities, while the UAE continues to position itself as a regional hub for precision medicine and advanced diagnostics. This sustained increase in healthcare spending-estimated to grow at over 7% annually across the GCC-enhances accessibility to imaging biomarker technologies and fuels adoption across both public and private sectors.

Another strong growth driver is the increasing focus on research and development, particularly in biopharmaceuticals and clinical imaging studies. The Middle East has become increasingly active in global clinical trials, with many now incorporating imaging biomarkers to assess drug efficacy and safety. The expansion of biotechnology incubators and partnerships between local universities and international pharmaceutical companies is also fostering innovation. For instance, Saudi Arabia and the UAE have established biomedical research clusters dedicated to oncology and neurology imaging, which significantly contribute to the use of imaging biomarkers. This growing R&D intensity not only drives new biomarker discovery but also supports technology transfer and clinical validation across the region.

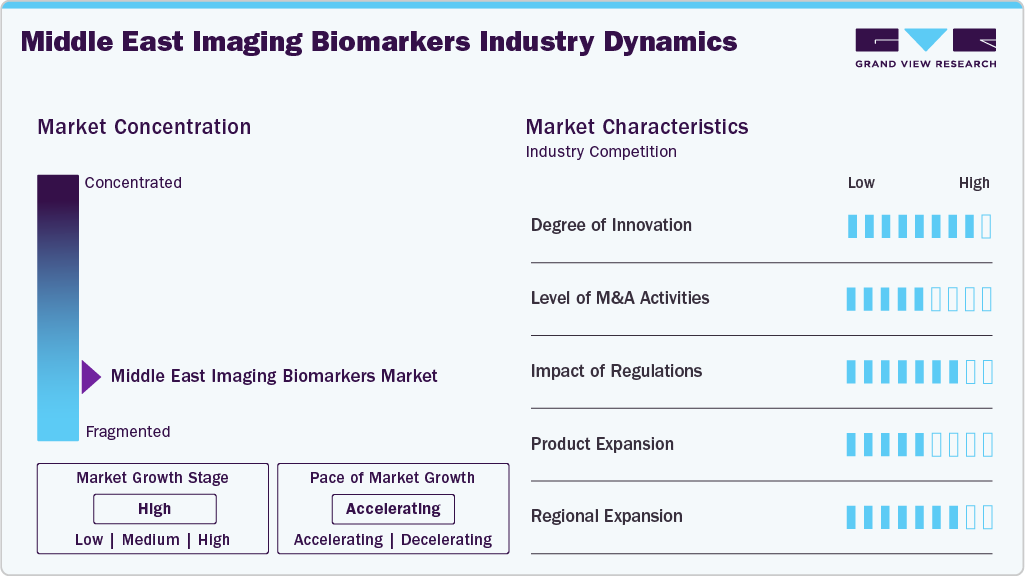

Market Concentration & Characteristics

The high degree of innovation in the Middle East imaging biomarkers industry, driven by advancements in imaging technologies, artificial intelligence (AI), and data analytics. These innovations enable the development of more precise and non-invasive diagnostic tools, facilitating early disease detection and the creation of personalized treatment plans.

The merger and acquisition is critical in the Middle East imaging biomarkers industry in promoting innovation, market penetration, and the development of products. Academic institutions, research laboratories, and manufacturers can collaborate to develop innovative solutions and enhancements in imaging biomarker technologies.

Regulations play a crucial role in shaping the Middle East imaging biomarkers industry by ensuring quality, safety, and standardization of diagnostic procedures. Governments are aligning with international standards, such as ISO and FDA/EMA guidelines, to expedite approvals for imaging agents and AI-based tools. Streamlined regulatory frameworks enhance market confidence, attract global collaborations, and accelerate the adoption of advanced imaging technologies across the region.

Product expansion in the Middle East imaging biomarkers industry involves the introduction of new imaging modalities, biomarkers, and diagnostic platforms to address a broader range of medical conditions and improve diagnostic accuracy. Companies are increasingly focusing on developing multiplex biomarker imaging technologies that enable the simultaneous detection of multiple biomarkers, thereby enhancing the comprehensiveness of diagnostic assessments.

Regional expansion in the Middle East imaging biomarkers industry is driven by growing healthcare investments and cross-border collaborations among GCC countries. Nations such as Saudi Arabia, the UAE, and Qatar are establishing advanced diagnostic hubs and research partnerships. This regional integration enhances technology transfer, clinical trial activity, and access to imaging biomarkers, strengthening the region’s position in precision diagnostics.

Biomarkers Insights

The molecular and nuclear biomarkers segment led the market with the largest revenue share of 34.63% in 2024, reflecting the region’s growing focus on advanced diagnostic imaging. These biomarkers play a crucial role in molecular imaging modalities, such as PET and SPECT, enabling the precise visualization of disease mechanisms at the cellular level. Rapid technological advancements and increased investment in nuclear medicine facilities across countries like Saudi Arabia, the UAE, and Qatar have enhanced the sensitivity and specificity of these biomarkers. Consequently, molecular and nuclear imaging are becoming integral to early disease detection, personalized treatment planning, and improved patient outcomes.

The quantitative imaging biomarkers (QIBs) segment is expected to grow at the fastest CAGR during the forecast period, driven by the growing demand for precise and reproducible imaging data in clinical practice. QIBs enable objective assessment of disease progression and treatment response, supporting personalized healthcare strategies. Regional healthcare providers and research institutions are increasingly adopting advanced imaging analytics platforms to enhance diagnostic accuracy and optimize clinical decision-making. innovations, such as Quibim’s QP-Insights platform, launched in February 2024, are influencing Middle Eastern adoption by integrating imaging and multi-omics data to accelerate drug discovery and precision medicine initiatives.

Imaging Technology Insights

The CT imaging segment accounted for the largest market revenue share in 2024, due to its widespread clinical use and advanced diagnostic capabilities. CT imaging enables the detailed visualization of anatomical structures in cross-section, supporting accurate diagnosis and treatment planning. Continuous advancements, such as the development of mobile CT systems, have significantly improved accessibility and patient care across hospitals and emergency units in the region. For instance, similar innovations are being introduced in GCC healthcare systems to enhance bedside imaging and streamline diagnostic workflows. In addition, the integration of CT imaging with biomarker-based diagnostic approaches, particularly in neurological disorders like Alzheimer’s disease, is transforming clinical pathways toward earlier and more precise detection.

The PET imaging segment is projected to witness at the fastest CAGR over the forecast period, driven by technological advancements and expanding applications in oncology and neurology. PET imaging facilitates the visualization of metabolic processes and molecular activity, supporting biomarker-based disease monitoring. Regional investments in nuclear medicine and PET infrastructure, along with collaborations for Alzheimer’s and cancer research, are accelerating its adoption. The growing use of combined blood-based biomarkers and PET imaging, as demonstrated in international studies such as Bio-Hermes, is influencing Middle Eastern clinical practices by improving diagnostic accuracy, reducing screening failures, and strengthening precision medicine initiatives.

Application Insights

The diagnostics segment led the market with the largest revenue share of 30.83% in 2024, driven by innovations that enhance early disease detection and clinical decision-making. Non-invasive imaging biomarkers enable the precise visualization and quantification of biological processes, aiding in the accurate diagnosis of diseases across oncology, neurology, and cardiovascular medicine. Regional healthcare systems, particularly in Saudi Arabia and the UAE, are integrating AI-driven imaging tools to improve diagnostic accuracy and efficiency.

The drug discovery and development segment is projected to register at the fastest CAGR during the forecast period, supported by the growing use of imaging biomarkers in translational research. Imaging biomarkers provide valuable insights into disease mechanisms and treatment efficacy, facilitating the identification of new therapeutic targets and the optimization of clinical trials. Middle Eastern research institutions and pharmaceutical partners are increasingly adopting imaging-based biomarkers for the evaluation and validation of drugs. initiatives, such as InterVenn Biosciences’ collaboration with the Biomarker Consortium and the WIN Consortium, serve as models inspiring similar regional partnerships. These strategic alliances and R&D investments are strengthening the region’s biomedical innovation ecosystem and accelerating the adoption of imaging biomarkers in the drug development process.

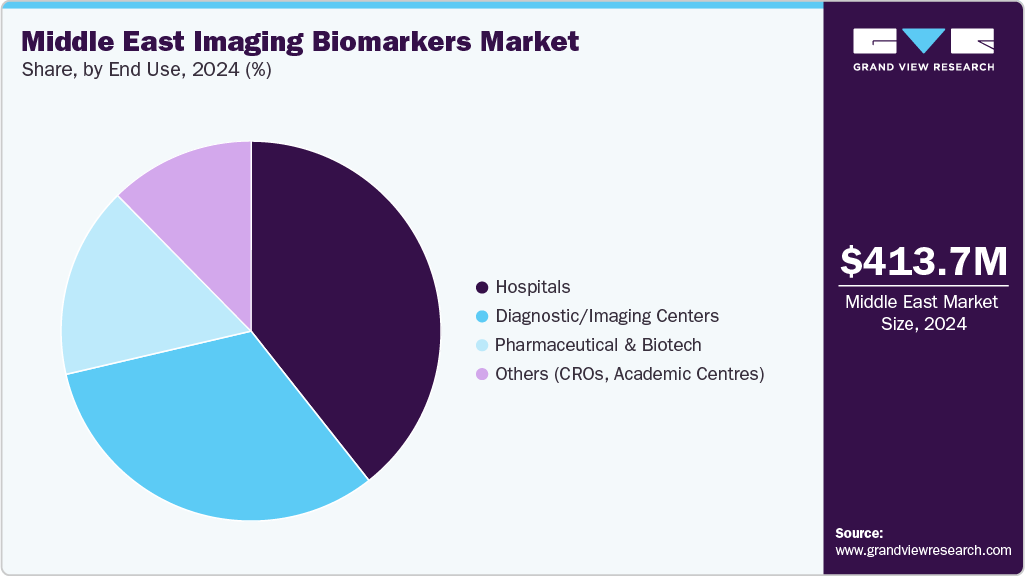

End Use Insights

The hospital segment led the market with the largest revenue share of 39.37% in 2024. Hospitals across the region are rapidly adopting advanced imaging technologies to enhance patient outcomes, improve diagnostic precision, and optimize clinical workflows. Major healthcare institutions in countries such as Saudi Arabia, the UAE, and Qatar are integrating cutting-edge imaging solutions, including ultrasound, CT, MRI, and PET systems, into their routine medical practices. companies such as GE Healthcare are expanding their presence through advanced imaging and diagnostic drug products, reflecting the growing emphasis on technology integration and comprehensive patient care within hospital settings across the Middle East.

The diagnostic and imaging centers segment is expected to register at the fastest CAGR during the forecast period, supported by the rising demand for specialized and accessible diagnostic services. These centers are increasingly investing in next-generation imaging platforms and biomarker-based diagnostic tools to deliver high-quality, non-invasive testing. Their ability to offer focused, cost-efficient, and timely imaging services is attracting both patients and research collaborations. As healthcare delivery becomes more decentralized, the rapid growth of diagnostic centers across the region is set to play a pivotal role in expanding access to advanced imaging biomarker technologies.

Country Insights

Saudi Arabia Imaging Biomarkers Market Trends

The imaging biomarkers market in Saudi Arabia accounted for the largest market revenue share of 22.26% in 2024, due to the government’s Vision 2030 initiative, which emphasizes healthcare innovation and digital transformation. Expanding hospital infrastructure, coupled with strong investment in advanced diagnostic imaging such as PET and MRI, is driving adoption. The country’s rising prevalence of cancer, cardiovascular, and neurological diseases has accelerated demand for early diagnostic biomarkers. In addition, research collaborations with global biotech firms are enhancing the integration of molecular and quantitative imaging biomarkers in clinical practice.

UAE Imaging Biomarkers Market Trends

The UAE imaging biomarkers market was identified as a lucrative country in market. The UAE is emerging as a leader in the field of imaging biomarkers, supported by its robust healthcare infrastructure, technological advancements, and precision medicine initiatives. The government’s focus on AI-driven healthcare and smart diagnostics is fostering rapid growth in imaging biomarker applications for oncology and neurology. Strong public-private partnerships, such as those within Dubai Health and Abu Dhabi’s research hubs, are facilitating early disease detection and personalized treatment strategies. The growth of medical tourism and the adoption of digital health platforms further support market expansion.

Kuwait Imaging Biomarkers Market Trends

The imaging biomarkers market in Kuwait is advancing due to increased government spending on healthcare modernization and the development of diagnostic technology. The Ministry of Health’s focus on upgrading imaging departments and integrating molecular imaging systems into hospitals is fostering growth. Rising awareness of personalized medicine and the early diagnosis of non-communicable diseases, especially cancer and diabetes, is further propelling demand. Collaborative projects with regional and international research institutions are also helping Kuwait strengthen its biomedical and diagnostic imaging capabilities.

Oman Imaging Biomarkers Market Trends

The Oman imaging biomarkers market is gaining momentum as part of the country’s national health transformation plans. Investments in modern hospitals, imaging facilities, and workforce training are improving diagnostic accuracy and accessibility. The growing burden of chronic diseases such as cancer and neurological disorders is encouraging the adoption of biomarker-based imaging for early detection. The government’s efforts to digitalize healthcare systems and partner with international medical technology firms are also driving innovation in diagnostic imaging.

Key Middle East Imaging Biomarkers Company Insights

The market players operating in the Middle East imaging biomarkers industry are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Middle East Imaging Biomarkers Companies:

- GE HealthCare

- FUJIFILM Holdings Corporation

- Siemens Healthineers AG

- Lunit Inc.

- Median Technologies

- BioClinica Inc.

- ICON plc

- Bracco

- Philips Healthcare

Recent Development

-

In October 2025, Alamar Biosciences launched the NULISAqpcr BD-pTau217 Assay, a breakthrough in non-invasive, brain-specific biomarker detection for Alzheimer's disease research. This assay precisely detects brain-derived phosphorylated tau 217 (pTau217) in blood or serum using only 10 µL of biological sample. The assay's direct measurement of CNS-derived pTau217 without the need for cerebrospinal fluid (CSF) collection or PET imaging removes existing barriers to widespread adoption in population-based studies or longitudinal clinical trials.

-

In February 2024, Life Molecular Imaging (LMI) entered into a strategic partnership with Oryx Isotopes Industrial Company (Oryx) to establish the production and distribution of Florbetaben (18F) in Saudi Arabia and neighboring countries. This collaboration aims to strengthen the regional availability of this advanced radiotracer, supporting Amyloid-PET imaging for the detection of Alzheimer ’s-related biomarkers and enhancing molecular imaging capabilities across the Middle East and North Africa (MENA) region.

-

In February 2024, United Imaging, a global leader in medical technology, forged key partnerships with several healthcare and technology organizations during Arab Health 2024. Among these collaborations, Prepaire Labs, a biotechnology company advancing drug discovery and personalized medicine, joined forces with United Imaging to utilize its cutting-edge innovation, the world’s first total-body PET/CT system, uEXPLORER, to enhance disease understanding and accelerate precision healthcare solutions.

Middle East Imaging Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 448.31 million

Revenue forecast in 2033

USD 1,131.80 million

Growth rate

CAGR of 12.27% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Biomarkers, imaging technology,application, end use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

GE HealthCare; FUJIFILM Holdings Corporation; Siemens Healthineers AG; Lunit Inc.; Median Technologies; BioClinica Inc.; ICON plc; Bracco; Philips Healthcare

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Imaging Biomarkers Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the Middle East imaging biomarkers market report based on biomarkers, imaging technology, application, end use, and country:

-

Biomarkers Outlook (Revenue, USD Million, 2021 - 2033)

-

Anatomical biomarkers

-

Functional biomarkers

-

Molecular/Nuclear Biomarkers

-

Quantitative Imaging Biomarkers

-

Others

-

-

Imaging Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

MRI

-

CT

-

PET

-

SPECT

-

Ultrasound

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostics

-

Drug Discovery & Development

-

Personalized Medicine

-

Disease Risk Assessment

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic/imaging centers

-

Pharmaceutical and Biotech Companies

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.