- Home

- »

- Alcohol & Tobacco

- »

-

North America Cigar And Cigarillos Market Size Report, 2033GVR Report cover

![North America Cigar And Cigarillos Market Size, Share & Trends Report]()

North America Cigar And Cigarillos Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mass, Premium), By Flavor (Flavored, Unflavored), By Distribution Channel (Offline, Online), By Country (U.S., Canada, Mexico), And Segment Forecasts

- Report ID: GVR-4-68040-730-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Cigar And Cigarillos Market Summary

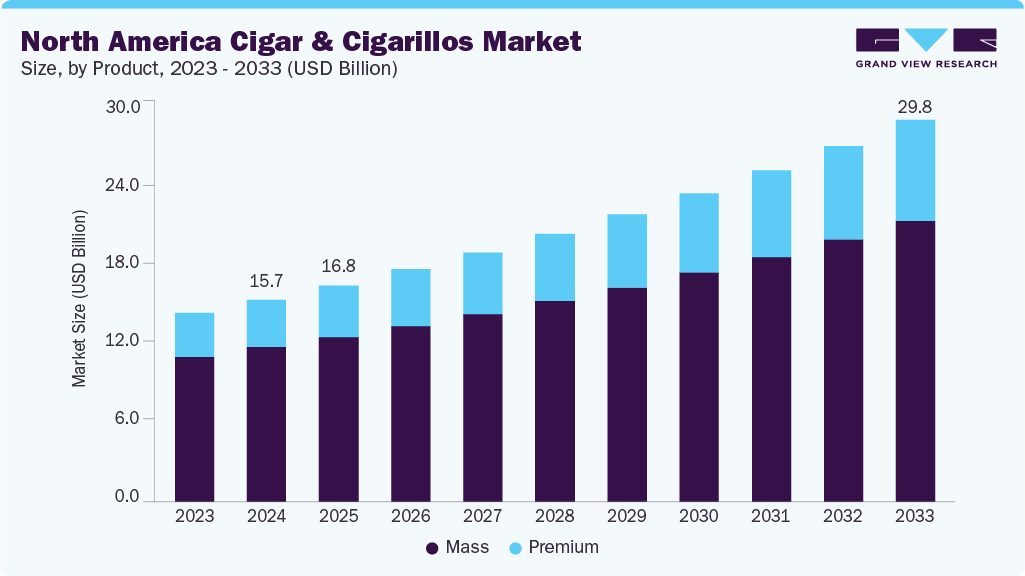

The North America cigar and cigarillos market size was estimated at USD 15.72 billion in 2024 and is projected to reach USD 29.78 billion by 2033, growing at a CAGR of 7.4% from 2025 to 2033. Rising disposable incomes and lifestyle aspirations, strong cigar culture and social acceptance, premiumization trend, flavor innovation and youth appeal, and retail expansion and e-commerce growth are some of the factors driving the market.

Key Market Trends & Insights

- By product, mass cigars and cigarillos led the market and accounted for a share of 76.5% in 2024.

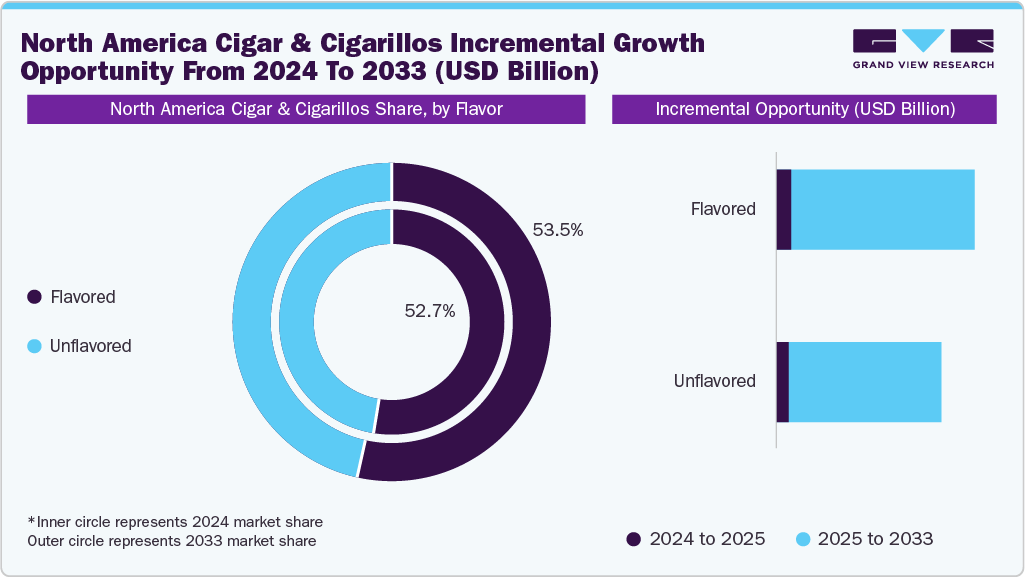

- By flavor, flavored cigars and cigarillos led the market and accounted for a share of 52.7% in 2024.

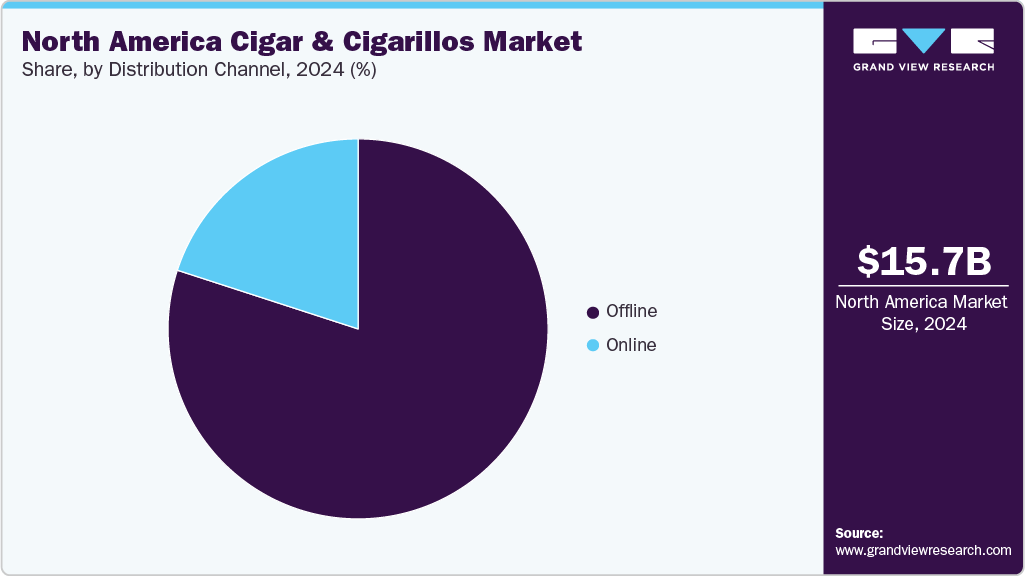

- By distribution channel, sales of cigars and cigarillos through offline distribution channels held the largest revenue share of around 80.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.72 Billion

- 2033 Projected Market Size: USD 29.78 Billion

- CAGR (2025-2033): 7.4%

Increasing disposable incomes across North America have fueled consumer spending on leisure and luxury products, including cigars and cigarillos. Smoking premium cigars has become a status symbol for affluent groups, often associated with celebrations, networking, and high-end lifestyles. This aspirational demand, combined with rising urbanization, has supported market growth. Middle-income groups are also contributing, as they seek affordable indulgence through flavored cigarillos. Overall, higher purchasing power continues to drive consistent demand, strengthening mass-market and premium product segments across the region.Moreover, the region has a long-established cigar culture, deeply tied to tradition, social gatherings, and celebratory occasions. Cigar lounges, clubs, and events have reinforced the association of cigars with leisure and networking, making them a socially accepted indulgence. Premium cigars are often considered part of a sophisticated lifestyle, while mass cigars remain accessible for casual users. This ingrained cultural acceptance and widespread availability sustain steady consumption across demographics. The combination of heritage, social value, and lifestyle appeal strongly drives the market’s long-term stability.

The “Survey of Premium Versus Large Manufactured Cigars Use in U.S. Consumers", published on the National Library of Medicine in 2023, examines the smoking behaviors, purchasing habits, and health risk perceptions of users of premium cigars (PC) and large manufactured cigars (LMC) in the U.S. Through an Internet questionnaire, the study analyzed responses from 188 participants, revealing that most users were aged 30-69, with higher income levels among PC users who preferred purchasing from online retailers or specialty shops, while LMC users favored convenience stores.

The findings indicated 82% smoked at home, with many relighting unfinished cigars. Both groups recognized the health risks associated with cigar smoking, showing no significant differences in their perceptions of addiction, cancer, or heart disease risks. The study underscores the need for clearer definitions and regulations in the tobacco market, as it challenges the belief that premium cigars carry less health risk compared to large, manufactured cigars.

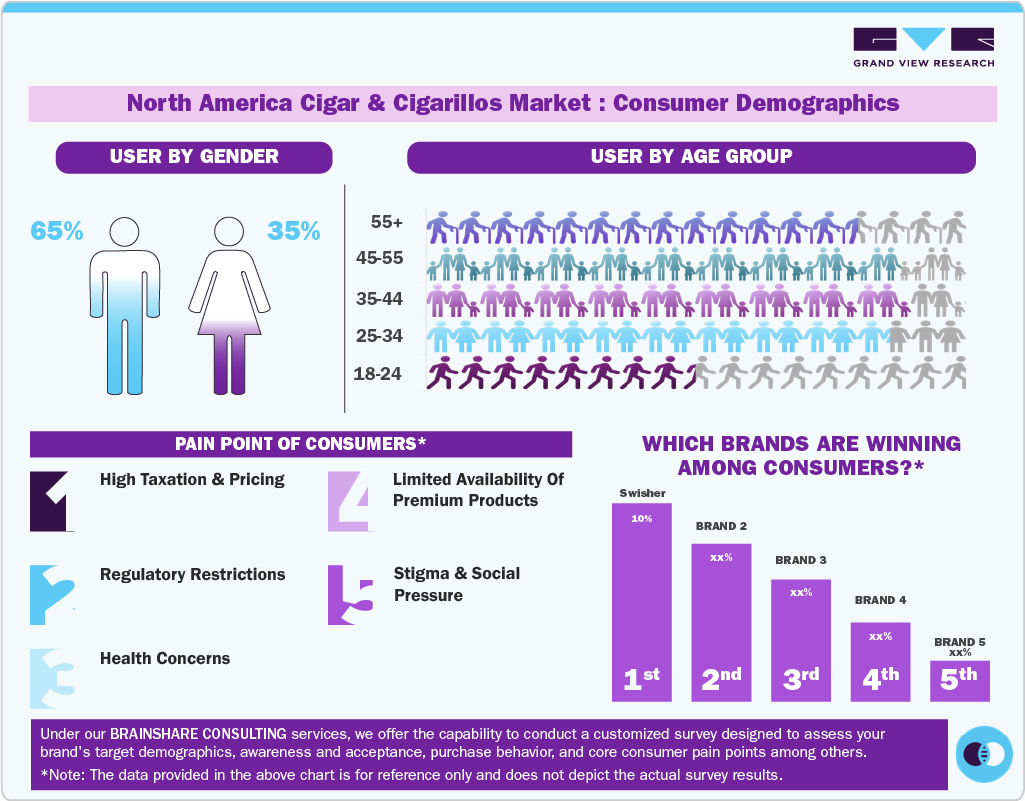

Consumer Insights for North America Cigar And Cigarillos

Consumers in North America demonstrate diverse cigar and cigarillo consumption preferences, influenced by demographics, lifestyle choices, and cultural associations. Premium cigars are primarily purchased by older, affluent consumers who value craftsmanship, exclusivity, and tradition, often linking smoking with leisure, networking, or special occasions. Younger demographics, however, lean toward affordable flavored cigarillos, attracted by variety, convenience, and experimentation. Flavors such as fruit, mint, and chocolate have gained traction, making them popular among new users. Accessibility through supermarkets, convenience stores, and online platforms ensures widespread availability. The market reflects a dual consumer base: luxury-driven premium buyers and price-sensitive flavored product users.

Consumer behavior in the region is also shaped by health awareness, regulation, and lifestyle trends. While anti-smoking campaigns and taxation influence purchasing decisions, many loyal consumers perceive cigars as a social indulgence rather than a daily habit, allowing them to remain committed buyers. Millennials and Gen Z consumers, despite health-conscious attitudes, explore cigars and cigarillos in social contexts, particularly flavored products offering novelty. Meanwhile, premium cigar users often seek personalized experiences in lounges and through subscription services. Online channels are increasingly important, with consumers valuing convenience, privacy, and product variety. This evolving landscape highlights segmentation between occasional luxury smokers and trend-driven younger audiences.

Product Insights

Mass cigars and cigarillos accounted for the largest revenue share of 76.5% in 2024. This growth is primarily driven by their affordability, wide availability, and popularity among younger consumers seeking flavored and convenient smoking options. Machine-made cigars, particularly those offered by leading brands such as Swisher, John Middleton, and Swedish Match, continue to attract a broad customer base through strong retail penetration. Their cost-effectiveness and variety ensure consistent demand, making them the backbone of the regional cigar and cigarillos industry.

Premium cigar and cigarillos is the fastest-growing segment, expected to grow at a CAGR of 8.8% from 2025 to 2033. The growth is fueled by rising consumer preference for luxury, artisanal, and hand-rolled tobacco products that offer exclusivity and superior craftsmanship. Premium cigars are increasingly associated with status, leisure, and social occasions, attracting affluent consumers and enthusiasts. The rise of cigar lounges, specialty retail outlets, and online subscription models further supports demand, positioning premium products as a high-value growth driver within the North America cigar and cigarillos market.

Flavor Insights

Flavored cigars and cigarillos held the largest revenue share of 52.7% in 2024 and are expected to grow at the fastest CAGR over the forecast period from 2025 to 2033. The revenue share underscores their strong appeal among younger and trend-driven consumers in North America. Popular flavors such as fruit, mint, vanilla, and chocolate continue to attract new users, making flavored products a key entry point for occasional and social smokers. Their affordability, wide availability in convenience stores, and strong presence across online platforms have further strengthened their market position. Despite increasing regulatory restrictions on flavored tobacco, demand remains resilient, driven by consumer preference for variety, novelty, and enhanced smoking experiences, ensuring sustained growth within this product category.

Unflavored cigars and cigarillos are expected to grow at a CAGR of 7.2% from 2025 to 2033, driven by increasing demand for traditional tobacco experiences among mature and premium consumers. Unflavored products are often associated with authenticity, craftsmanship, and a pure smoking experience, making them particularly appealing in the premium cigar category. Affluent buyers and long-time cigar enthusiasts prefer these offerings for their rich taste profiles and heritage value. As premiumization trends continue, unflavored cigars are set to capture significant growth, balancing the market alongside flavored products despite rising regulatory challenges.

Distribution Channel Insights

Sales of cigars and cigarillos through offline distribution channels held the largest revenue share of around 80.0% in 2024. This huge revenue reflects the dominance of traditional retail formats in North America. Convenience stores, supermarkets, hypermarkets, and specialty tobacco shops remain the preferred purchase points, offering immediate product access and diverse options. Offline channels also benefit from impulse buying behavior, particularly for mass-market and flavored cigarillos. While online sales are steadily rising, offline outlets command consumer trust, brand visibility, and a wide geographic reach, ensuring their stronghold as the primary sales channel in the regional market.

Sales of cigars and cigarillos through online mode are expected to grow at a CAGR of 8.8% from 2025 to 2033, driven by rising consumer preference for convenience, privacy, and product variety. Online platforms offer broader access to mass-market and premium products, including exclusive blends and subscription-based services tailored to enthusiasts. E-commerce enables brands to engage directly with consumers through targeted promotions and digital marketing strategies. As younger demographics increasingly adopt online shopping, this channel is set to play a crucial role in expanding reach and reshaping purchasing behavior within the North American market.

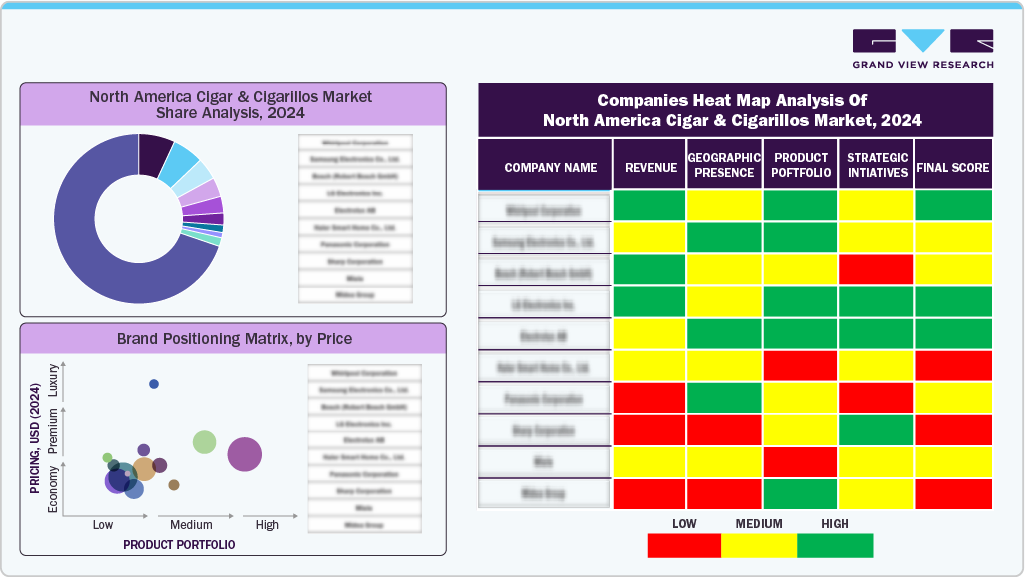

Key North America Cigar And Cigarillos Company Insights

Key players operating in the North America cigar and cigarillos market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key North America Cigar And Cigarillos Companies:

- Swisher

- John Middleton, Inc.

- J.C. Newman Cigar Company

- Arturo Fuente

- Oliva Cigar Co.

- Forged Cigar Co, Inc.

- Alec Bradley

- Rocky Patel Premium Cigars, INC.

- General Cigar Company Inc.

- Altadis U.S.A.

Recent Developments

-

In January 2025, Scandinavian Tobacco Group UK launched its Signature Action Mix cigarillos, featuring dual capsules that combine berry and mint flavors. The rollout focused on retail activation, targeting over 10,000 convenience stores with branded merchandising, wholesale promotions, and trade marketing support to drive adoption.

-

In April 2023, Rocky’s Cigars launched the premium cigar brand in Goa, unveiling it at Badmaash Café in Vagator. The event marked the brand’s entry into the Indian market, spotlighting its journey from Patel's upbringing in Mumbai to California and his rise to prominence in the premium cigar industry.

North America Cigar And Cigarillos Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.86 billion

Revenue Forecast in 2033

USD 29.78 billion

Growth rate

CAGR of 7.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Swisher; John Middleton, Inc.; J.C. Newman Cigar Company; Arturo Fuente; Oliva Cigar Co.; Forged Cigar Co, Inc.; Alec Bradley; Rocky Patel Premium Cigars, INC.; General Cigar Company Inc.; Altadis U.S.A.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Cigar And Cigarillos Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the North America cigar and cigarillos market report based on product, flavor, distribution channel, and country:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Mass

-

Premium

-

-

Flavor Outlook (Revenue, USD Billion, 2021 - 2033)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Online

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America cigar and cigarillos market size was estimated at USD 15.72 billion in 2024 and is expected to reach USD 16.8 billion in 2025.

b. The North America cigar and cigarillos market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2033 to reach USD 29.78 billion by 2033.

b. Mass cigar and cigarillos accounted for the largest revenue share of 76.5% in 2024. This growth is primarily driven by their affordability, wide availability, and popularity among younger consumers seeking flavored and convenient smoking options.

b. Some key players operating in the North America cigar and cigarillos market include Swisher; John Middleton, Inc.; J.C. Newman Cigar Company; Arturo Fuente; Oliva Cigar Co.; Forged Cigar Co, Inc.; Alec Bradley; Rocky Patel Premium Cigars, INC.; General Cigar Company Inc.; and Altadis U.S.A.

b. Rising disposable incomes and lifestyle aspirations, strong cigar culture and social acceptance, premiumization trend, flavor innovation and youth appeal, and retail expansion and e-commerce growth are some of the factors driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.