- Home

- »

- Beauty & Personal Care

- »

-

South Africa Anti-aging Products Market Size Report, 2033GVR Report cover

![South Africa Anti-aging Products Market Size, Share & Trends Report]()

South Africa Anti-aging Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Facial Serums, Moisturizers, Eye Care Products, Facial Masks & Peels), By Distribution Channel (Supermarkets & Hypermarkets), And Segment Forecasts

- Report ID: GVR-4-68040-690-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

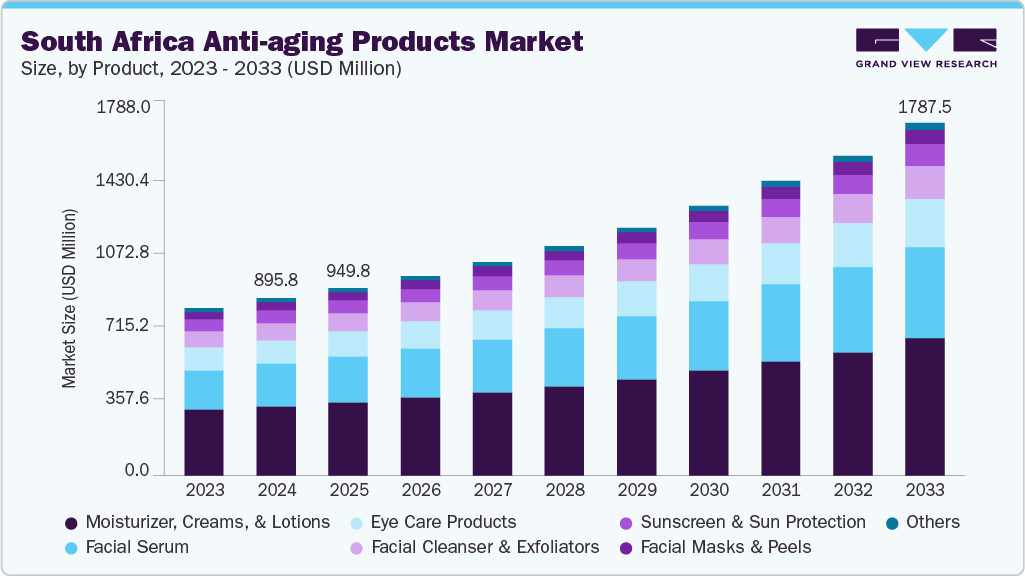

The South Africa anti-aging products market size was estimated at USD 895.8 million in 2024 and is projected to reach USD 1787.5 million by 2030, growing at a CAGR of 8.2% from 2025 to 2033. Increasing exposure to UV radiation, urban pollution, and stress-related skin damage has made consumers more aware of premature aging and the importance of early skincare intervention.

There is also a noticeable shift in beauty standards, with a growing number of South Africans embracing skincare not just for aesthetic improvement but as part of a broader self-care and wellness routine. Social media platforms have played a central role in this change, with influencers and dermatology content creators popularizing routines that include serums, retinols, and SPF-based moisturizers as essential for preserving skin's youthfulness.

Consumer preferences are also evolving in favor of products that are both effective and aligned with local identity. As highlighted in Vogue Business, homegrown brands like SKOON, Suki Suki Naturals, and Litchi & Titch are launching anti-aging formulations that integrate natural African ingredients such as baobab, marula, and rooibos. These offerings are tailored to suit a range of melanin-rich skin tones and are designed with South Africa’s climate in mind. At the same time, international brands are customizing their product lines to meet regional skincare needs, reflecting a dual movement of localization and scientific innovation within the market.

Retail distribution has also adapted to meet rising demand. Traditional retail chains such as Woolworths and Clicks continue to be dominant touchpoints for anti-aging products, offering curated skincare aisles and occasional brand-led educational campaigns. However, the growth of digital commerce is accelerating significantly. According to Reuters, Takealot, South Africa’s leading e-commerce platform, has expanded its skincare category while also piloting township-based fulfillment services. These efforts aim to close access gaps in underserved areas and tap into a wider consumer base that is becoming increasingly digitally engaged.

In support of this e-commerce expansion, Reuters also reported that Amazon has opened a seller onboarding hub in Cape Town to encourage local participation and diversify its product range, including skincare. With greater access to both international and locally developed brands, coupled with rising consumer interest in clean ingredients and high-efficacy formulations, South Africa’ anti-aging skincare market is poised for sustained growth. This momentum is driven not just by vanity but by a broader cultural shift that views skincare as a form of personal investment and self-expression.

Consumer Insights & Surveys

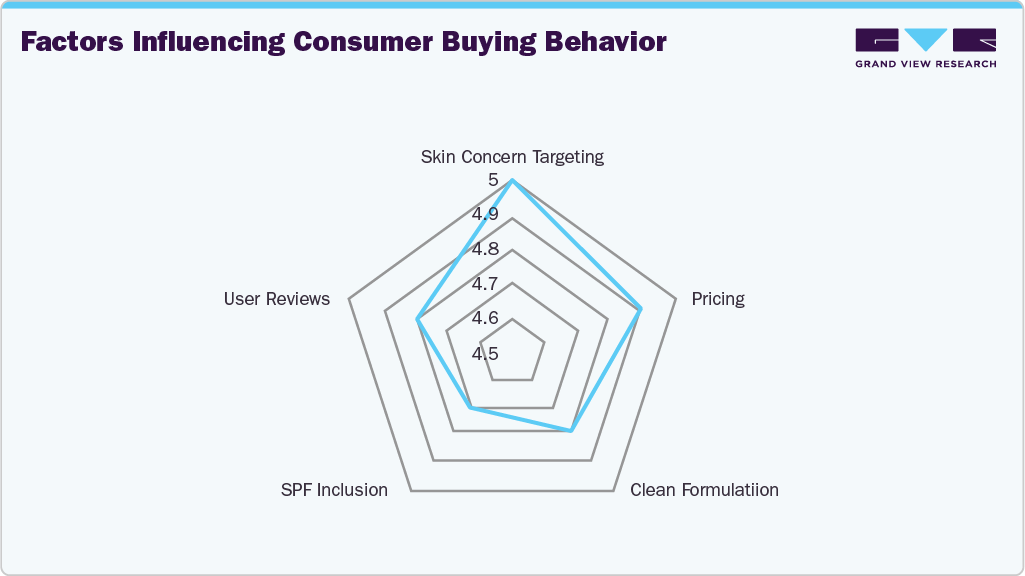

South African consumers are becoming increasingly proactive about skin aging, shifting their focus toward prevention rather than correction. This trend is especially prominent among consumers in their late 20s to early 40s, who are incorporating SPF, antioxidant serums, and hydration-boosting products into their daily routines. Rather than relying on heavy corrective creams, they prefer lightweight formulations that can deliver visible results over time. There is also growing demand for hybrid or multi-functional products that address hydration, firmness, and discoloration in one solution, reflecting a desire for both efficiency and efficacy.

In parallel, there has been a notable change in how aging is perceived. Instead of promoting age reversal, brands are reframing their positioning to align with themes of confidence, skin health, and graceful aging. Influencer-led content and social media platforms are playing a major role in normalizing fine lines and encouraging long-term care. Consumers are seeking authenticity from brands, moving away from unrealistic claims and photo shopped imagery. This change in tone is resonating with both younger and older demographics, particularly in metropolitan regions where access to international skincare education and premium products is more prevalent.

Transparency in formulation is a key factor driving consumer decisions in the South African anti-aging industry. Shoppers are increasingly knowledgeable about ingredients and are seeking clear information about what a product contains and how it works. They pay close attention to active ingredients such as retinol, vitamin C, niacinamide, and peptides, and are more likely to trust brands that disclose concentration levels and offer clinical substantiation. This demand for ingredient clarity has pushed both local and global brands to improve their labeling, communication, and digital education efforts to stay competitive in a more discerning market.

Another major influence is the relevance of products to local climate and skin tone. Given South Africa’s wide range of weather conditions and diverse population, consumers prefer formulations that are non-comedogenic, lightweight, and effective on melanin-rich skin. Hyperpigmentation, uneven tone, and sun-related skin issues are especially common concerns. As a result, brands that tailor their products for African skin, particularly those using locally sourced botanicals or region-specific solutions, tend to perform better in the market. This localized approach is increasingly seen as a sign of authenticity and effectiveness, and is influencing consumer loyalty and purchasing behavior.

Product Insights

The moisturizer, creams, & lotions segment led the market with the largest revenue share of 39.21% in 2024. These products are perceived as daily-use staples, offering hydration, skin barrier reinforcement, and visible smoothing effects, which align well with consumer expectations for low-effort, high-impact solutions. Their adaptability across skin types and concerns makes them an inclusive category, appealing to both younger consumers seeking early preventative care and mature users targeting visible signs of aging.

In addition, brands have capitalized on this demand by infusing traditional moisturizing formats with advanced actives such as retinol and hyaluronic acid, enhancing product functionality while maintaining user familiarity. The category’s strong presence across mass retail, pharmacy chains, and e-commerce platforms has further amplified its reach and repeat purchase behavior, reinforcing its sustained commercial performance.

The facial serum segment is projected to grow at the fastest CAGR of 9.1% from 2025 to 2033 in South Africa anti-aging products industry. Serums are increasingly favored for their concentrated formulations, fast absorption, and ability to address specific concerns such as fine lines, uneven texture, and hyperpigmentation. This demand is being driven by a more informed and ingredient-conscious consumer base, particularly among urban and digitally engaged demographics. As skincare routines become more personalized, consumers are incorporating serums alongside moisturizers to achieve layered, results-oriented care. The rise of science-backed beauty content on social media, combined with broader availability through online and premium retail channels, has further accelerated product awareness.

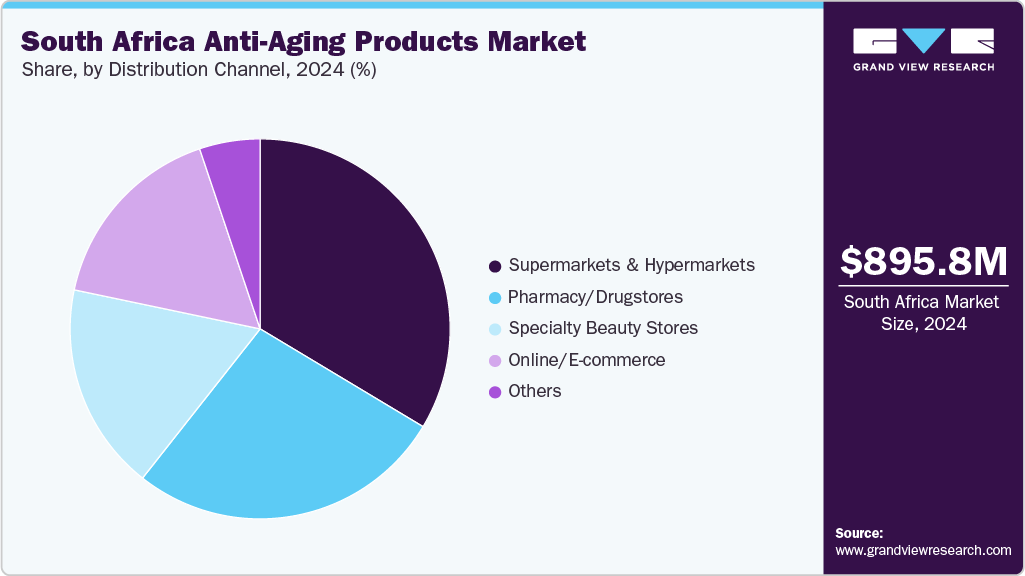

Distribution Channel Insights

The supermarkets and hypermarkets segment led the market with the largest revenue share of 33.60% in 2024. These outlets offer the convenience of one-stop shopping, allowing customers to purchase skincare essentials alongside other household items. Their strong physical presence in both urban centers and suburban areas ensures broad consumer reach, while frequent promotional campaigns, in-store displays, and product sampling encourage impulse purchases and brand discovery. Furthermore, well-known brands strategically position their anti-aging lines in these retail environments to attract a price-sensitive yet quality-conscious demographic, reinforcing supermarkets and hypermarkets as key distribution channels in the country’s skincare landscape.

The online/e-commerce segment is expected to grow at the fastest CAGR of 10.1% from 2025 to 2033. As more consumers seek convenience, product variety, and access to international and niche brands, online platforms offer a compelling alternative to traditional retail. Enhanced digital payment systems, faster delivery services, and mobile-optimized shopping experiences have made online skincare shopping more seamless and trustworthy. In addition, social media and influencer marketing continue to influence buyer decisions, encouraging trial of newly launched or trending anti-aging formulations. The availability of consumer reviews, detailed product information, and personalized recommendations further strengthens online engagement, positioning digital retail as a key growth engine in South Africa’s evolving skincare market.

Key South Africa Anti-aging Products Company Insights

The South Africa anti-aging products industry is characterized by a diverse blend of established international names and emerging local brands, each striving to meet evolving consumer expectations and skincare goals. In response to a more informed and ingredient-conscious audience, companies are investing in advanced formulations that offer scientifically supported actives and multifunctional performance. Efforts are being made to broaden product lines that cater to a wide range of skin tones, environmental conditions, and age-specific concerns unique to the South African consumer base. Moreover, brands are placing greater emphasis on transparency, clean formulations, and precision-targeted solutions, strategies that are increasingly essential for maintaining relevance and competitive strength in this dynamic and maturing market.

-

Coty Inc. is a global beauty company headquartered in New York, specializing in cosmetics, skincare, and fragrances. Established in 1904, Coty manages a diverse portfolio of brands across prestige and mass segments. In the skincare and anti-aging category, the company offers products under brands like Lancaster and Philosophy. Lancaster’s anti-aging range features products like the 365 Skin Repair Serum, which supports skin regeneration and radiance, while Philosophy’s Anti-Wrinkle Miracle Worker line targets fine lines, uneven tone, and dehydration using peptides and vitamin C-based formulations.

-

Beiersdorf AG is a global skincare company based in Germany that is recognized for its expertise in dermatological and personal care products. Established in 1882, the company owns well-known brands such as Nivea, Eucerin, and La Prairie, catering to various skincare needs, including anti-aging solutions. Beiersdorf offers products that reduce wrinkles, boost skin elasticity, and promote hydration.

Key South Africa Anti-aging Products Companies:

- The Estée Lauder Companies Inc.

- Beiersdorf AG

- L'Oréal S.A.

- Caudalie

- Avène Thermal Water

- Nuxe

- NAOS Group (Bioderma)

- Shiseido Company, Limited

- Coty Inc.

- Kenvue Brands LLC

Recent Developments

-

In February 2025, Eucerin launched a new anti-aging serum, collaborating with brand ambassador Basetsana Kumalo to highlight its benefits for mature skin. Similarly, local brand Standard Beauty offers a range of anti-aging skincare products, emphasizing affordability and effectiveness. These product launches reflect the dynamic nature of South Africa's skincare industry, catering to consumers' evolving preferences for effective anti-aging solutions.

-

In August 2023, Supergoop! Expanded its presence in Australia and the Middle East after success in Southeast Asia and Europe. The brand, which first entered the Asian market through Sephora in 2017, has gained popularity for its innovative sun care products. Following its launch in China via Tmall Global in 2020, Supergoop! Recently entered European Sephora stores and is now focusing on further international growth. Founder Holly Thaggard emphasized the brand's commitment to sun care that caters to different skin types, climates, and lifestyles. Their best-seller, Unseen Sunscreen SPF40, exemplifies this with added skincare benefits.

South Africa Anti-aging Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 949.8 million

Revenue forecast in 2033

USD 1,787.5 million

Growth rate

CAGR of 8.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

South Africa

Key companies profiled

The Estée Lauder Companies Inc.; Beiersdorf AG; L'Oréal S.A.; Caudalie; Avène Thermal Water; Nuxe; NAOS Group (Bioderma); Shiseido Company, Limited; Coty Inc.; Kenvue Brands LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South Africa Anti-aging Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the South Africa anti-aging products market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Facial Serum

-

Moisturizer, Creams, & Lotions

-

Eye Care Products

-

Facial Cleanser & Exfoliators

-

Facial Masks & Peels

-

Sunscreen & Sun Protection

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Pharmacy/Drugstores

-

Specialty Beauty Stores

-

Online/E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The South Africa anti-aging products market was estimated at USD 895.8 million in 2024 and is expected to reach USD 949.8 million in 2025.

b. The South Africa anti-aging products market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2033 to reach USD 1,787.5 million by 2033.

b. Moisturizer, Creams, & Lotions accounted for the revenue share of about 39.21% of South Africa anti-aging products industry in 2024, rising skin aging concerns, particularly among individuals aged 36–45, are driving increased demand for anti-aging products. Factors such as high UV exposure, urban pollution, and growing skincare awareness further fuel this trend.

b. Some of the key players in the South Africa anti-aging products market The Estée Lauder Companies Inc.; Beiersdorf AG; L'Oréal S.A.; Caudalie; Avène Thermal Water; Nuxe; NAOS Group (Bioderma); Shiseido Company, Limited; Coty Inc.; Kenvue Brands LLC

b. In South Africa, the demand for anti-aging products is growing due to rising awareness of skin health and the effects of prolonged sun exposure. Consumers are turning to products that combine sun protection with anti-aging benefits tailored to diverse skin tones.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.