- Home

- »

- Biotechnology

- »

-

Stem Cell Culture Media Market Size, Industry Report, 2033GVR Report cover

![Stem Cell Culture Media Market Size, Share & Trends Report]()

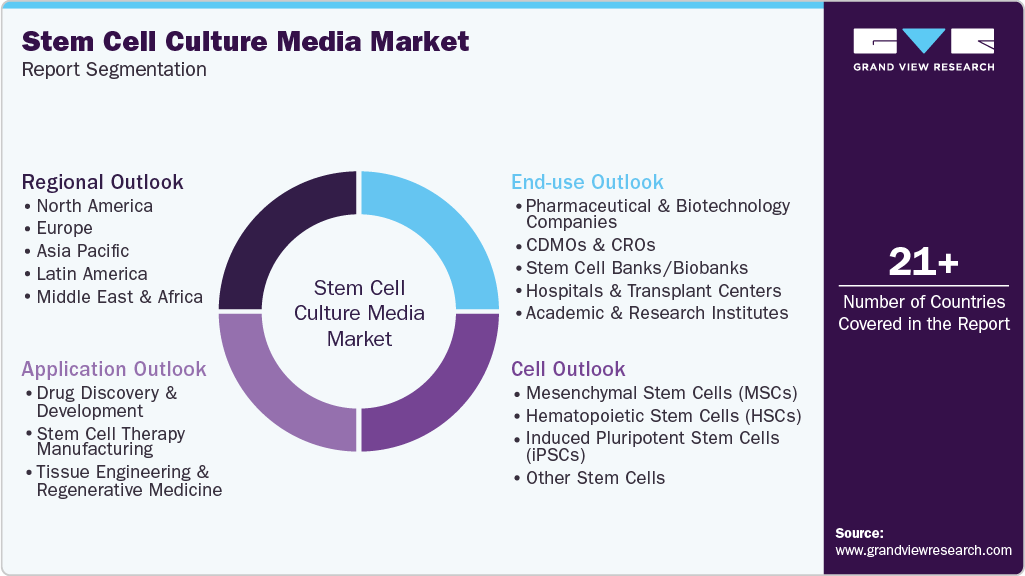

Stem Cell Culture Media Market (2025 - 2033) Size, Share & Trends Analysis Report By Cell (Hematopoietic Stem Cells, Mesenchymal Stem Cells), By Application (Drug Discovery & Development, Stem Cell Therapy Manufacturing), By End-use (Stem Cell Banks/Biobanks, CDMOs & CROs), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-821-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stem Cell Culture Media Market Summary

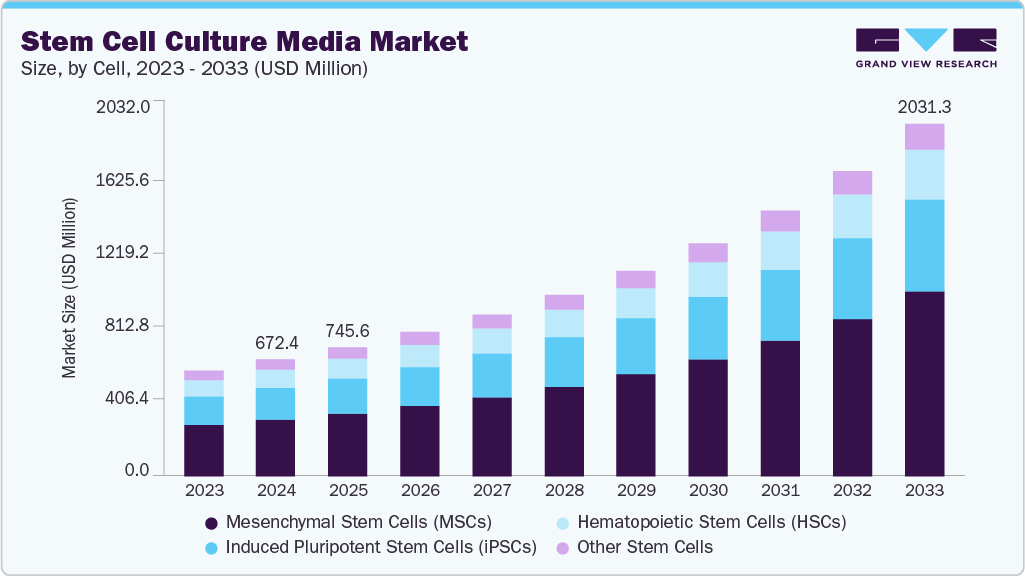

The global stem cell culture media market size was estimated at USD 672.4 million in 2024 and is projected to reach USD 2,031.3 million by 2033, growing at a CAGR of 13.35% from 2025 to 2033, driven by rising adoption of regenerative therapies, expanding stem-cell-based research, and increasing investments in cell therapy development.

Key Market Trends & Insights

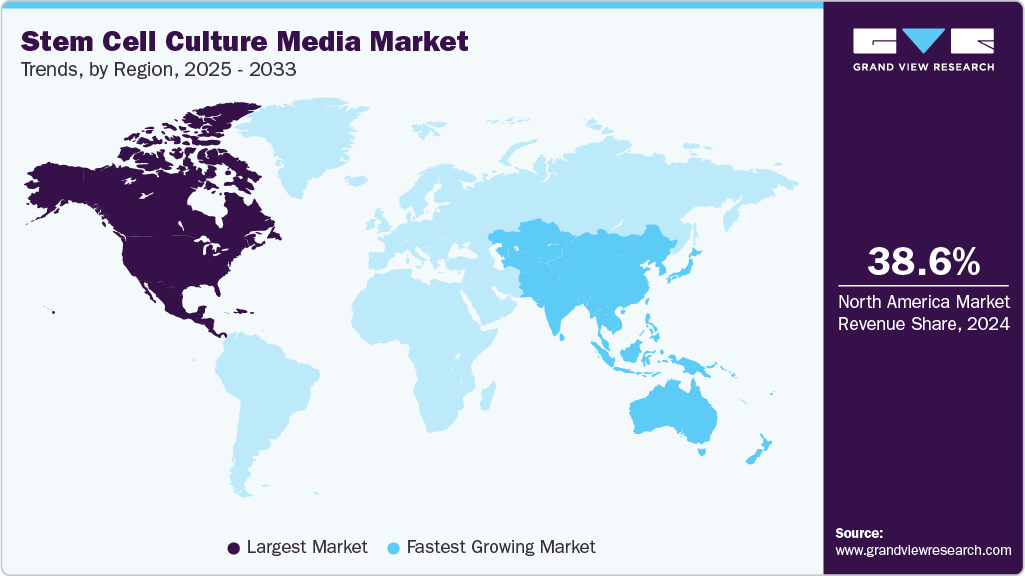

- The North America market for stem cell culture media held the largest share of 38.57% of the global market in 2024.

- The stem cell culture media industry in the U.S. is expected to grow significantly over the forecast period.

- By cell, the Mesenchymal Stem Cells (MSCs) segment held the largest market share of 48.56% in 2024.

- By application, the drug discovery & development segment held the largest market share of 49.15% in 2024.

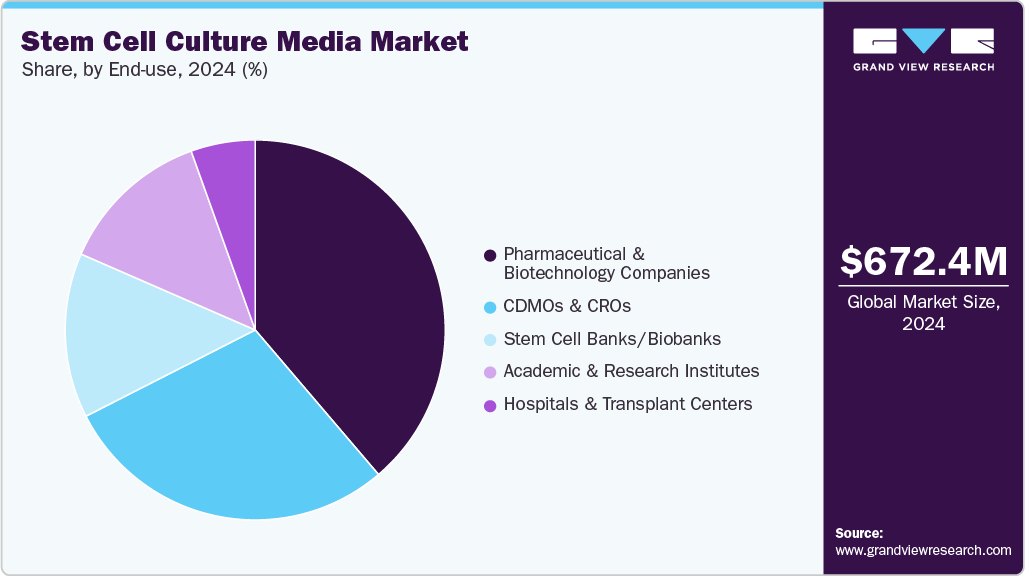

- Based on end-use, the pharmaceutical & biotechnology companies segment held the largest market share of 38.76% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 672.4 Million

- 2033 Projected Market Size: USD 2,031.3 Million

- CAGR (2025-2033): 13.35%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing Adoption of Regenerative Medicine

The rising adoption of regenerative medicine is a major driver of demand for stem cell culture media, as stem-cell-based therapies require high-quality, clinically compliant formulations for cell expansion and manufacturing. The growing prevalence of neurodegenerative, cardiovascular, orthopedic, and autoimmune disorders is driving research into MSCs, ESCs, iPSCs, and HSCs, prompting academic institutions, biotech companies, and hospitals to rely increasingly on specialized serum-free, xeno-free, and chemically defined media that ensure safety, consistency, and regulatory compliance.

iPSC lines created to study neurodegenerative diseases.

Disease

Phenotype

Cell

PD

Increased α-synuclein

Dopaminergic neurons

PD

50% GCase activity,3× α-synuclein, reduced dopamine synthesis/release

Midbrain dopaminergic neurons

AD

Increased amyloid β42 secretion

Neurons

AD

Increased Aβ42, Aβ38, and total/phosphorylated tau

Neurons

AD

Increased Aβ42 production and Aβ42/40 ratio

Cortical neurons

AD

Aβ1-42 aggregates

Neurons

AD

Higher amyloid-β, phospho-tau (Thr231), active GSK-3β

Neurons

AD

Abnormal tau expression, tau hyperphosphorylation, multiple phenotypes

Neurons

AD

Loss of synaptic proteins, altered Aβ42/Aβ40 ratio, protein aggregation, tau phosphorylation changes

Hippocampal neurons

AD

Abnormal astrocyte markers, reduced heterogeneity, astroglial atrophy

Neurons & astrocytes

AD

Increased β-amyloid, altered cytokines, dysregulated Ca2+

Astrocytes

AD

Impaired phagocytosis/migration/metabolism; increased cytokine secretion

Microglia-like cells

AD

Aβ plaques and phosphorylated tau aggregates

3D-differentiated neuronal cells

AD

Amyloid aggregation, hyperphosphorylated tau, endosome abnormalities

Brain organoids

ALS

Cytosolic aggregates, shorter neurites

Motor neurons

ALS

TDP-43 aggregation

Motor neurons

ALS

Altered membrane excitability genes; reduced firing capacity

Motor neurons

ALS

Oxidative stress, mitochondrial dysfunction, ER stress

Motor neurons

ALS

Elevated spike rates, depolarization block

Motor neurons

ALS

Increased SOD1, altered autophagy via astrocytes

Astrocytes

ALS

Motor neuron death

Oligodendrocytes

MS

Demonstrated myelination in oligodendrocyte-neuron coculture

Oligodendrocytes

MS

Principal source of myelinating oligodendrocytes

OPCs

MS

Reduced Ki67, decreased SOX2+ pool, altered neuronal/oligodendrocyte markers

Brain organoids

HD

Distinct microarray profile, altered electrophysiology & metabolism

Neural cells

HD

Impaired rosette formation, mitochondrial deficits

Forebrain neurons

HD

Mutant huntingtin aggregation, lysosome changes, aging-related neuronal death

GABAergic medium spiny neurons

HD

Subtle phenotype changes incl. cell turnover and immune adhesion

Brain microvascular endothelial-like cells

Source: International Journal of Molecular Science, Secondary Research, Grand View Research

Stem cells, especially MSCs, ESCs, and iPSCs, are increasingly used to model chronic diseases in vitro, enabling more accurate drug screening and a deeper understanding of disease mechanisms, which broadens the use of stem cell culture media. Growing public and private investment in regenerative medicine to address rising healthcare burdens is further accelerating demand for high-quality, chemically defined, xeno-free, and GMP-grade media to support clinical and commercial manufacturing. Together, demographic pressures, scientific progress, and unmet medical needs continue to strengthen the global stem cell culture media industry.

Shift Toward Chemically Defined & Xeno-Free Media

A major factor propelling the market is the growing trend toward chemically defined and xeno-free stem cell culture media, which is bolstered by heightened regulatory scrutiny and the demand for cell culture systems that are safer, more reliable, and reproducible. Because serum- or animal-derived ingredients in conventional media pose risks such as immunogenicity, contamination, variability, and ethical concerns, organizations like the FDA and EMA are advocating for the elimination of ingredients of animal origin. Researchers and manufacturers are embracing defined, serum-free formulations that provide more control over cell growth and differentiation, while satisfying international regulatory requirements for fully characterized, compliant inputs, as stem cell applications move closer to clinical-grade therapies.

The transition to chemically defined and xeno-free media is also making it possible to scale up production of stem-cell-based products in a way that complies with GMP. Consistent and repeatable media performance is crucial for ensuring therapeutic quality and regulatory approval as businesses transition from small-scale R&D to large-scale clinical bioprocessing. The demand for reliable, standardized media that are tailored for clinical workflows is further increased by the use of automated bioreactors, 3D culture systems, and organoid platforms. The demand for xeno-free, chemically defined formulations is therefore rising sharply as a result of biopharmaceutical companies, CDMOs, and research institutions making significant investments in advanced media solutions.

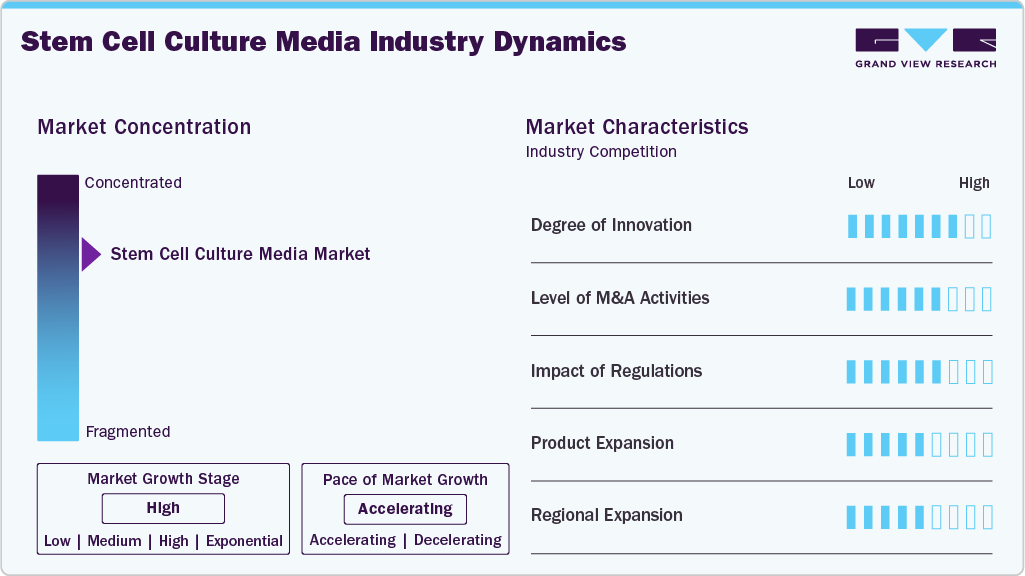

Market Concentration & Characteristics

The degree of innovation in the stem cell culture media industry is high, driven by advances in stem cell biology and the need for safer, more consistent culture systems. Companies are rapidly developing chemically defined, xeno-free, and serum-free formulations, as well as media tailored for specific stem cells and differentiation pathways.

The level of M&A activities in the stem cell culture media industry is moderate, as companies primarily seek targeted acquisitions to broaden their specialized media portfolios, improve their GMP manufacturing capabilities, and fortify their positions in regenerative medicine. While large mergers are limited, strategic deals continue as firms seek technologies that support advanced stem cell research and cell therapy development.

Regulatory requirements drive demand for GMP-compliant, xeno-free, and well-characterized stem cell media, ensuring safety and consistency. While compliance increases development costs, it also promotes innovation in standardized, scalable media for both research and therapeutic use.

Companies in the stem cell culture media industry are actively expanding their portfolios by developing specialized, chemically defined, and xeno-free media for different stem cells and applications. This enables wider adoption across research, clinical, and commercial settings. It includes formulations for iPSCs, MSCs, ESCs, HSCs, and lineage-specific differentiation, as well as media optimized for 3D cultures, organoids, and bioreactors.

Companies in the market are expanding into emerging markets, such as the Asia-Pacific and Latin America, to tap into growing research activities and the adoption of regenerative medicine. Establishing local subsidiaries, collaborating with research institutions, and creating distribution networks are examples of expansion strategies that enable a broader market reach and expedite the delivery of specialized media to meet local demand.

Cell Insights

The Mesenchymal Stem Cells (MSCs) segment accounted for the largest market share of 48.56% in 2024 and is expected to witness the fastest CAGR during the forecast period, driven by increasing applications in regenerative medicine, tissue engineering, and immunotherapy research. The segment has strong growth potential in both academic and commercial sectors due to growing demand for personalized therapies, improvements in scalable MSC expansion technologies, and an increase in clinical trial investments.

The iPSCs segment is rapidly growing in the market, driven by adoption in disease modeling, drug discovery, and regenerative medicine. Advances in reprogramming, differentiation technologies, and demand for patient-specific therapies are fueling market growth.

Application Insights

The drug discovery & development segment accounted for the largest market share of 49.15% in 2024, primarily due to the growing use of stem cell culture media in high-throughput screening, preclinical testing, and development of targeted therapies.

The stem cell therapy manufacturing segment is anticipated to witness the fastest CAGR over the forecast period, driven by the rising demand for large-scale production of clinical-grade stem cells, increasing cell therapy approvals, and advancements in automated expansion and bioprocessing technologies. Growing investments by biopharmaceutical companies and CMOs to meet global regenerative medicine needs are further supporting the segment’s rapid growth during the forecast period.

End-use Insights

The pharmaceutical & biotechnology companies segment dominated the industry in 2024, accounting for a revenue share of 38.76% and is expected to grow at the fastest CAGR over the forecast period. This dominance is driven by their extensive R&D activities, large-scale adoption of stem cell technologies, and investments in innovative therapies. The segment continues to benefit from collaborations, strategic partnerships, and the increasing demand for high-quality culture media to support drug discovery, regenerative medicine, and clinical applications.

The CDMOs & CROs segment is expected to register a significant CAGR from 2025 to 2033, due to the increasing outsourcing of stem cell research, the growing need for specialized manufacturing services, and expanding partnerships with pharmaceutical and biotechnology firms to speed up drug development and cell therapy production.

Regional Insights

North America stem cell culture media industry dominated the global market for the largest revenue share of 38.57% in 2024, due to strong R&D investments, sophisticated healthcare infrastructure, and high public awareness. In May 2022, SQZ Biotechnologies in the U.S. collaborated with STEMCELL Technologies to co-develop a Research-Use-Only microfluidic intracellular delivery system, reflecting growing demand for advanced stem cell culture media to support preclinical research.

U.SStem Cell Culture Media Market Trends

The U.S. stem cell culture media industry has witnessed significant growth due to increasing adoption of stem-cell-based research, regenerative therapies, and personalized medicine. Demand is particularly high for chemically defined, serum-free, and feeder-free media for MSCs, ESCs, and iPSCs.

Europe Stem Cell Culture Media Market Trends

Europe’s stem cell culture media industry is expanding steadily, with the help of a robust regulatory environment, public-private research partnerships, and targeted funding from the European Union. The region emphasizes xeno-free and GMP-compliant media, which are critical for clinical trials and commercial cell therapy production.

The UK stem cell culture media industry is growing due to robust R&D in stem cell research, government support for regenerative medicine, and strong healthcare infrastructure.

Germany’s stem cell culture media industry benefits from a strong biotech R&D landscape and government initiatives such as “Industrie 4.0” and regenerative medicine grants. These efforts support both domestic innovation and foreign investments, expanding the availability of advanced stem cell media.

Asia Pacific Stem Cell Culture Media Market Trends

The Asia Pacific stem cell culture media industry is projected to expand at the fastest CAGR of 15.32% over the forecast period. This growth is driven by rising investments in regenerative medicine, increasing prevalence of chronic diseases, and expanding academic and industrial research related to cell and gene therapy. For instance, in February 2025, Miltenyi Biotec launched India’s first cell and gene therapy CoE in Hyderabad, enhancing regional capabilities and reflecting the rising demand for advanced stem cell culture media in clinical and research applications.

China stem cell culture media industry is emerging as a key market, fueled by government investment, a growing biotech startup ecosystem, and large-scale stem cell research programs. In May 2022, FUJIFILM Irvine Scientific completed its Bioprocessing Innovation and Collaboration Center in Suzhou, China, enhancing local support for cell culture media optimization amid rising demand in regenerative medicine and advanced therapies.

Japan’s stem cell culture media industry is expanding rapidly, driven by advancements in regenerative medicine, tissue engineering, and stem cell therapies. Strong research infrastructure and government support continue to enhance innovation and global competitiveness.

MEA Stem Cell Culture Media Market Trends

The Middle East & Africa stem cell culture media industry is growing rapidly, driven by rising healthcare investments, chronic disease prevalence, and vaccine self-sufficiency initiatives. Regional partnerships and training programs are strengthening biomanufacturing capabilities and local expertise.

Kuwait stem cell culture media industry is in the early stages of market development, with growing investments in healthcare modernization, regenerative medicine, and partnerships with international research organizations. The government’s initiatives to build a knowledge-based biotech sector are expected to boost adoption of advanced stem cell media in research and clinical applications.

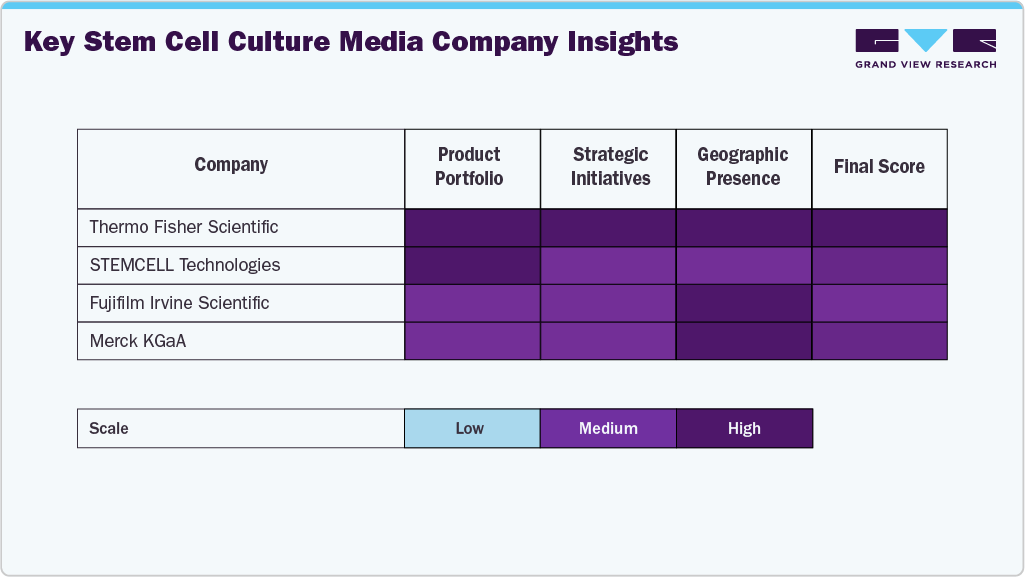

Key Stem Cell Culture Media Company Insights

Leading companies such as Thermo Fisher Scientific, STEMCELL Technologies, Fujifilm Irvine Scientific, Merck KGaA, and Sartorius AG have maintained significant market share by offering high-quality, chemically defined, and GMP-compliant media for various stem cells, including MSCs, iPSCs, ESCs, and HSCs. These firms leverage advanced media formulations, broad application coverage, and extensive global distribution networks to serve both research and clinical markets.

Innovative, lineage-specific, and feeder-free media solutions are being offered by businesses such as Lonza, Miltenyi Biotec, Danaher (Cytiva), REPROCELL USA Inc., Takara Bio Inc., and PromoCell in order to satisfy the increasing needs of academic research institutes, pharmaceutical companies, and developers of regenerative medicine.

The stem cell culture media industry is driven by M&A, strategic alliances, and innovations in chemically defined, xeno-free media, with companies integrating science and customer solutions, gaining a competitive edge.

Key Stem Cell Culture Media Companies:

The following are the leading companies in the stem cell culture media market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher ScientificSTEMCELL Technologies

- Fujifilm Irvine Scientific

- Merck KGaA

- Sartorius AG

- Lonza

- Miltenyi Biotec

- Danaher (Cytiva)

- REPROCELL USA Inc.

- Takara Bio Inc.

- PromoCell

Recent Developments

-

In May 2025, NextCell Pharma in Sweden entered a strategic collaboration with FUJIFILM Irvine Scientific, combining MSC products with optimized culture media and cryopreservation solutions to support stem cell therapy research.

-

In January 2025, Terumo Blood and Cell Technologies in the U.S. collaborated with FUJIFILM Irvine Scientific to accelerate T cell expansion using PRIME-XV® T Cell Expansion Media, supporting scalable cell therapy manufacturing and research.

-

In January 2025, FUJIFILM Irvine Scientific in the U.S. sold its Medical Media Business Unit to Astorg, enabling strategic focus on life sciences and supporting growth in cell culture and therapeutic markets.

Stem Cell Culture Media Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 745.6 million

Revenue forecast in 2033

USD 2,031.3 million

Growth rate

CAGR of 13.35% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cell, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific; STEMCELL Technologies; Fujifilm Irvine Scientific; Merck KGaA; Sartorius AG; Lonza; Miltenyi Biotec; Danaher (Cytiva); REPROCELL USA Inc.; Takara Bio Inc.; PromoCell

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stem Cell Culture Media Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global stem cell culture media market report based on cell, application, end-use, and region:

-

Cell Outlook (Revenue, USD Million, 2021 - 2033)

-

Mesenchymal Stem Cells (MSCs)

-

Hematopoietic Stem Cells (HSCs)

-

Induced Pluripotent Stem Cells (iPSCs)

-

Other Stem Cells

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery & Development

-

Stem Cell Therapy Manufacturing

-

Tissue Engineering & Regenerative Medicine

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

CDMOs & CROs

-

Stem Cell Banks / Biobanks

-

Hospitals & Transplant Centers

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.